Macro Theme:

Short Term SPX Resistance: 4,400

Short Term SPX Support: 4,300

SPX Risk Pivot Level: 4,315

Major SPX Range High/Resistance: 4,400

Major SPX Range Low/Support: 4,200

‣ Equity direction is likely to be driven by Wed PPI/FOMC mins + Thursday’s CPI. 4,400 is the short term upside target out of these events*

‣ 4,500 is max upside into Oct OPEX 10/20*

‣ 4,200 is the Oct OPEX downside target if PPI/Fed Mins/CPI datapoints are bearish*

*updated 10/11

Founder’s Note:

ES Futures are flat at 4,395. Key SG levels for the SPX are:

- Support: 4350, 4,300

- Resistance: 4,376, 4,400

- 1 Day Implied Range: 0.79%

Today’s major levels are 4,300 SPX to the downside, and 4,400 to the upside. Our 1 Day Implied move is beginning to shift lower (0.79% from 0.85% late last week), and should continue to do so if the S&P500 holds >=4,300. These lower range forecasts imply lower realized volatility which is supportive of equities. <=4,300 is “risk off”.

Tuesday’s sharp rally was sparked by rate-pause Fed-speak, which led to a move to the noted SPY 435 (SPX 4,360). The US 10 year is now down 30bps to 4.56%, from Friday AM highs of 4.9%. This helps to buoy equity prices, and yesterday’s move started to crack implied vols. Lower IV’s are constructive for equity prices.

Below is the change in ATM IV’s from Monday (gray) to this morning (pink), and as you can see they have shifted ~1pt lower for all expirations past next week. You may also note that there is a mild backwardation, as 0-3DTE IV’s are elevated due to the today’s 8:30AM ET PPI, 2PM ET FOMC Mins, and tomorrows 8:30AM ET CPI (green box). These lower, longer dated IV’s are a signal of pressures easing, and unless these outlined data points come in “hot” then equities are likely to continue higher.

These elevated short term IV’s inform us that a final directional leg may be sparked from out of Thursdays CPI and into next weeks Oct OPEX.

Shown below is the size of OCT OPEX, with puts (blue) and calls (orange) equally weighted. This suggests some neutrality in current positioning, which is likely to shift through these next few datapoints.

Into expiration gamma should begin to concentrate around the

large gamma strikes

noted below. Accordingly, the major target zones into next week appear to be 4,450 – 4,500 SPX to the upside, and 4,250 – 4,200 to the downside. A move to the highlighted strikes (yellow boxes) may be driven by shifting implied vols, which invokes vanna flows. These flows should be material given the elevated volatility premium (ex: VIX 17 vs 1 month SPX RV of ~12).

| SpotGamma Proprietary Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Reference Price: | $4358 | $434 | $15131 | $368 | $1775 | $175 |

| SpotGamma Implied 1-Day Move: | 0.79% | 0.79% |

|

|

|

|

| SpotGamma Implied 5-Day Move: | 2.23% |

|

|

|

|

|

| SpotGamma Volatility Trigger™: | $4340 | $435 | $14850 | $369 | $1805 | $181 |

| Absolute Gamma Strike: | $4400 | $430 | $15250 | $370 | $1850 | $175 |

| SpotGamma Call Wall: | $4400 | $450 | $15250 | $373 | $1850 | $190 |

| SpotGamma Put Wall: | $4200 | $425 | $14000 | $350 | $1700 | $175 |

| Additional Key Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Zero Gamma Level: | $4366 | $437 | $14756 | $370 | $1867 | $185 |

| Gamma Tilt: | 1.014 | 0.759 | 1.576 | 0.901 | 0.582 | 0.470 |

| SpotGamma Gamma Index™: | 0.082 | -0.243 | 0.071 | -0.045 | -0.037 | -0.119 |

| Gamma Notional (MM): | ‑$117.266M | ‑$1.056B | $7.558M | ‑$238.723M | ‑$37.248M | ‑$1.299B |

| 25 Day Risk Reversal: | -0.042 | -0.034 | -0.037 | -0.037 | -0.03 | -0.028 |

| Call Volume: | 689.97K | 1.935M | 10.46K | 1.073M | 19.73K | 436.182K |

| Put Volume: | 1.098M | 3.313M | 12.196K | 1.405M | 31.187K | 775.65K |

| Call Open Interest: | 6.746M | 7.17M | 57.428K | 4.792M | 204.697K | 3.477M |

| Put Open Interest: | 12.825M | 12.829M | 82.328K | 8.607M | 368.805K | 7.02M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [4500, 4450, 4400, 4300] |

| SPY Levels: [440, 435, 430, 425] |

| NDX Levels: [15500, 15250, 15100, 15000] |

| QQQ Levels: [375, 370, 365, 360] |

| SPX Combos: [(4550,90.96), (4524,84.55), (4516,90.75), (4502,97.05), (4463,80.53), (4450,98.99), (4428,75.50), (4424,93.63), (4420,80.42), (4415,75.93), (4411,81.61), (4407,78.96), (4402,99.27), (4393,87.23), (4389,80.55), (4385,82.83), (4380,79.17), (4376,96.82), (4341,80.81), (4324,83.25), (4315,86.29), (4302,97.54), (4289,80.17), (4280,85.89), (4276,88.59), (4271,87.98), (4263,83.83), (4250,95.97), (4224,87.44), (4215,83.40), (4202,99.11), (4162,80.09), (4149,91.20)] |

| SPY Combos: [421.01, 441, 445.78, 438.39] |

| NDX Combos: [15253, 14784, 15313, 15601] |

| QQQ Combos: [373.27, 351.9, 361.85, 374.01] |

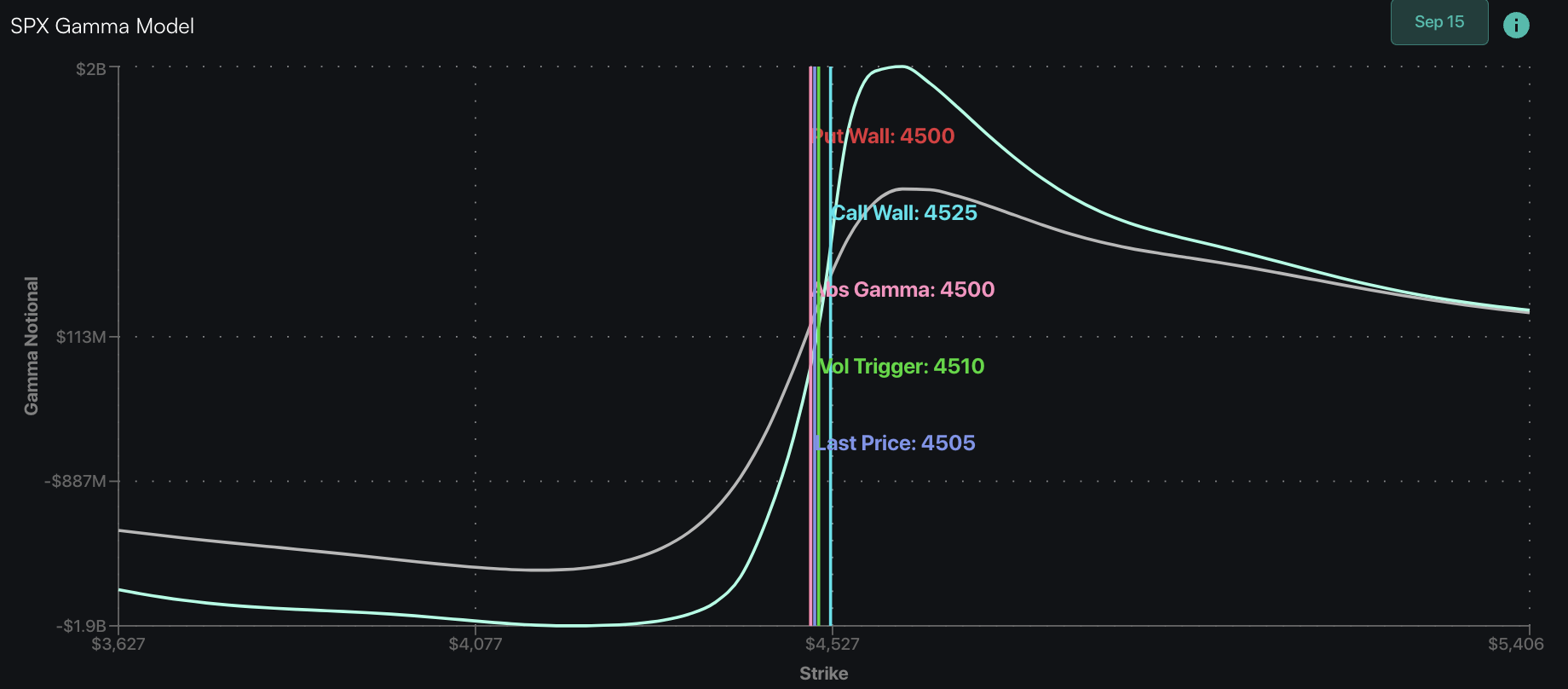

SPX Gamma Model

Strike: $4,499

- Next Expiration: $942,761,935

- Current: $1,038,578,852

View All Indices Charts

0 comentarios