Macro Theme:

Key dates ahead:

- 11/25: Sep Delayed PPI

- 11/27: Thanksgiving

- 11/28: Early Close

- 12/5: NFP

- 12/10: CPI/FOMC

- 12/15: ORCL ER

- 12/17 VIX Exp

- 12/19: OPEX

SG Summary:

Update 11/25: 11/24 (below) views are still in place, but we have updated our Risk Pivot to 6,680 from 6,600.

11/24: We want to lean long of stocks with SPX >6,600 as we believe put option decay into a holiday week will be a dominant tailwind for stocks. 6,700-6,750 is our upside target into Wednesday night. Should SPX break <6,600 we would close short term swing longs, and watch for a test of 6,500. Our longer term “wash out” downside level remains 6,350. Note: even in a risk-off scenario we still hold a core Dec 1×2 call spread per 11/21 note.

11/21: Yesterday’s break of 6,700 opened the downside plunge which occurs into todays OPEX + a weekend. Puts are now expensive, which in the absence of a catalyst, can drive an equity bounce. Given that we are looking to enter SPY/QQQ 1×2 call flies for early December as a way to play/cover a right tail move. 6,500 is initial support, with 6,350 still our “wash out” level. Meaningful upside resistance is 6,700, which is our new Risk Pivot level.

Key SG levels for the SPX are:

- Resistance: 6,700, 6,750

- Pivot: 6,680 (bearish <, bullish >) NEW

- Support: 6,600, 6,500, 6,350 (6,350 is a large put strike zone and a long term support line)

Founder’s Note:

Futures are flat, indicating the SPX will open on 6,700. September PPI 8:30AM ET.

We have now shifted our Risk Pivot from 6,600 to 6,680.

Earnings: AVGO (+2% premarket)

GOOGL: +4% premarket (after +6% y’day), as the world turns to TPU’s…

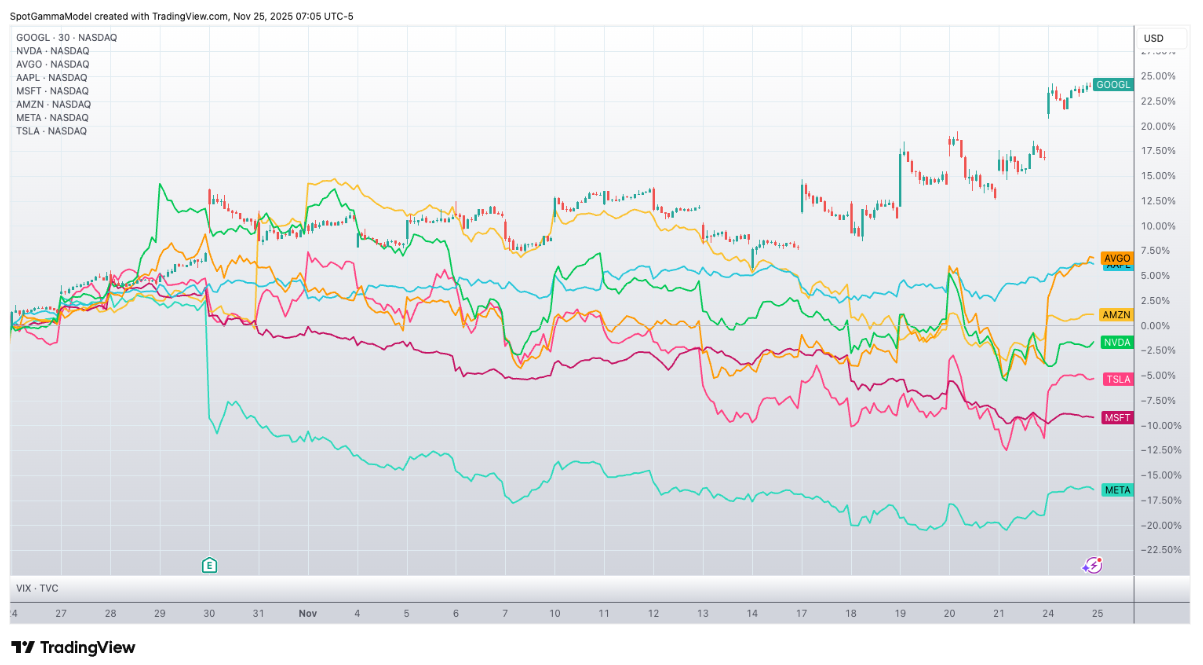

We start with GOOGL, which is triggering a re-ordering of the Mag7’s. You can see 1-month performance vs its peers below, as capital is clearly flushing into GOOGL (and AVGO) and out of MSFT/NVDA (seeming “OPEN AI” names).

The White House also announced “Genesis” AI project, which is not popping all semi/AI names (NVDA -3% pre-market, ORCL -1.5%). We watch this because capital rotation is a better signal than a highly correlated shift out of all stocks.

Turning to SPX gamma, we are now seeing some positive gamma build up at 6,800, and that is now forming as what is likely a top into Friday’s session. 6,750 is the key upside level for today. PPI is likely the key driver for today, assuming that passes without issue then our attention turns to the big gamma strike at 6,570.

The concerning thing here is the lack of positive gamma forming below 6,700….in fact we see no positive gamma. This implies that the downside remains quite fluid, and so much as we want to “set it and forget it” to the upside into Monday, we have to instead keep one eye open if SPX breaks <6,700 and we see billions in negative HIRO values come in. Specifically a break of 6,680 is “Risk Off”.

One of the key drivers we’ve highlighted for a bullish week was the decline in options implied volatility. Before we dive into that, we note today’s 0DTE straddle is $36/57bps (ref 6,700) – hardly a concerned rate of vol.

Below is 12/24 exp SPX skew from Friday’s close (gray) to today, and you can see that the vol is overall lower, except for the extreme left tail.

If you run the same comparison (Friday vs today) in the Fixed Strike grid, you see the same extreme crash-y tail risk puts are flat to higher today vs Friday. This strikes us as interesting, given the lack of positive gamma we see in the TRACE map, it implies that put selling as a positional (i.e. “Im holding these short puts for >1 day”) strategy isn’t in play right now (we did see intraday put selling via HIRO y’day). This is troubling in the sense that put selling is the most bottom-setting order flow we look for.

The takeaway here is that there is still some vol to crush, particularly this weeks IV’s as we head into next weeks data-heavy trading. Following that is FOMC, ORCL earnings and then a huge OPEX. Given this, we still give edge to upside into Friday’s close, but we will be quick to flatten risk out if SPX <6,680.

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

|

/ESZ25 |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$6721.56 |

$6705 |

$668 |

$24873 |

$605 |

$2414 |

$239 |

|

SG Gamma Index™: |

|

0.473 |

-0.133 |

|

|

|

|

|

SG Implied 1-Day Move: |

|

0.66% |

0.66% |

|

|

|

|

|

SG Implied 5-Day Move: |

|

1.47% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

|

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

|

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$6696.56 |

$6680 |

$667 |

$24620 |

$605 |

$2425 |

$240 |

|

Absolute Gamma Strike: |

$6016.56 |

$6000 |

$670 |

$24500 |

$600 |

$2430 |

$240 |

|

Call Wall: |

$7016.56 |

$7000 |

$700 |

$23950 |

$620 |

$2430 |

$250 |

|

Put Wall: |

$6516.56 |

$6500 |

$645 |

$24000 |

$590 |

$2390 |

$225 |

|

Zero Gamma Level: |

$6682.56 |

$6666 |

$667 |

$24440 |

$604 |

$2408 |

$243 |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [6000, 6700, 7000, 6800] |

|

SPY Levels: [670, 640, 660, 675] |

|

NDX Levels: [24500, 25000, 24700, 25500] |

|

QQQ Levels: [600, 610, 615, 590] |

|

SPX Combos: [(7027,75.03), (7020,78.21), (7000,99.11), (6973,85.64), (6953,93.54), (6926,79.53), (6920,68.10), (6900,96.70), (6879,74.80), (6873,84.84), (6853,96.14), (6839,79.90), (6833,68.44), (6826,81.67), (6819,87.04), (6812,86.85), (6799,98.78), (6792,88.26), (6779,86.63), (6772,89.87), (6765,80.17), (6759,80.68), (6752,97.92), (6745,75.67), (6739,88.02), (6725,68.00), (6719,73.58), (6678,72.72), (6672,79.73), (6658,71.88), (6651,89.03), (6638,81.09), (6625,80.44), (6618,84.47), (6598,87.43), (6578,81.20), (6551,88.09), (6537,74.16), (6524,74.97), (6517,84.77), (6497,96.56), (6477,77.12), (6464,80.59), (6450,80.65), (6424,73.76), (6417,79.66), (6397,92.37)] |

|

SPY Combos: [648.53, 678.85, 638.65, 688.74] |

|

NDX Combos: [24252, 24650, 24028, 23954] |

|

QQQ Combos: [584.84, 590.15, 580.12, 583.07] |

0 comentarios