Macro Theme:

Key dates ahead:

- 11/27: Thanksgiving

- 11/28: Early Close

- 12/5: PCE/NFP

- 12/10: CPI/FOMC

- 12/15: ORCL ER

- 12/17 VIX Exp

- 12/19: OPEX

SG Summary:

Update 11/25: 11/24 (below) views are still in place, but we have updated our Risk Pivot to 6,680 from 6,600.

11/24: We want to lean long of stocks with SPX >6,600 as we believe put option decay into a holiday week will be a dominant tailwind for stocks. 6,700-6,750 is our upside target into Wednesday night. Should SPX break <6,600 we would close short term swing longs, and watch for a test of 6,500. Our longer term “wash out” downside level remains 6,350. Note: even in a risk-off scenario we still hold a core Dec 1×2 call spread per 11/21 note.

11/21: Yesterday’s break of 6,700 opened the downside plunge which occurs into todays OPEX + a weekend. Puts are now expensive, which in the absence of a catalyst, can drive an equity bounce. Given that we are looking to enter SPY/QQQ 1×2 call flies for early December as a way to play/cover a right tail move. 6,500 is initial support, with 6,350 still our “wash out” level. Meaningful upside resistance is 6,700, which is our new Risk Pivot level.

Key SG levels for the SPX are:

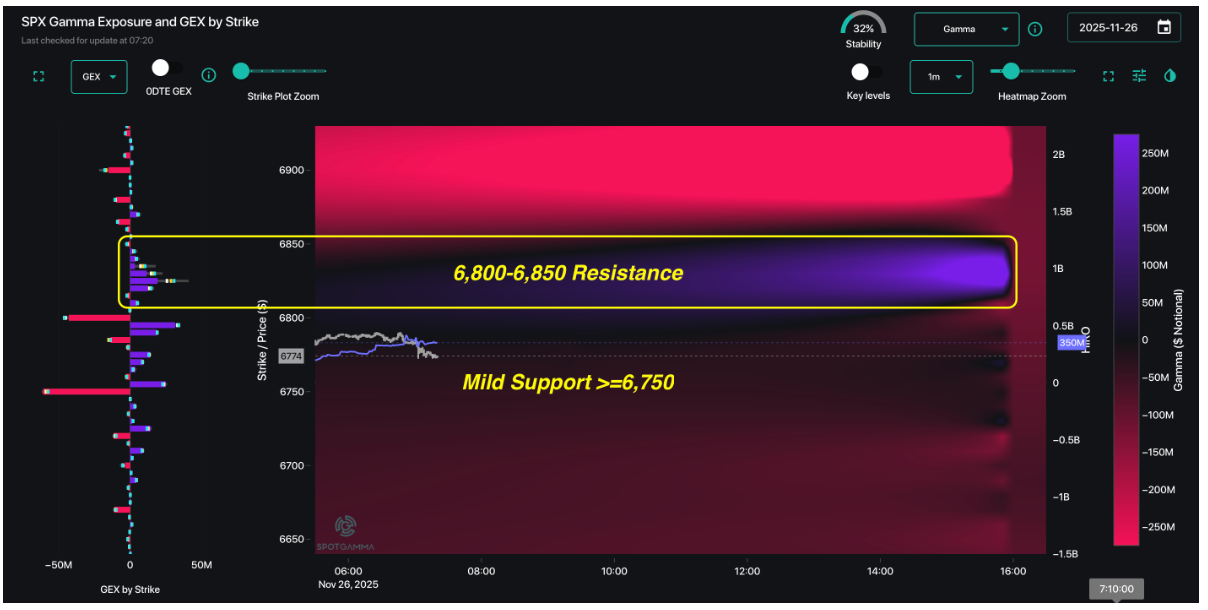

- Resistance: 6,800, 6,825, 6,850 (note how upside resistance levels are compacting vs recent sessions)

- Pivot: 6,700 (bearish <, bullish >)

- Support: 6,775, 6750, 6,700

Founder’s Note:

Futures are up 10 bps, with Jobless Claims & GDP at 8:30 AM ET.

The overnight highs in ES futures toughed implied levels of just under 6,800, which was our topping level into today. As the SPX nears this level, we are seeing the first signs of major positive gamma (TRACE purple). This suggests call sellers are stepping up in 6,800-6,850 area. Given that, a bit of upside drift into the 6,850 area for today into Friday makes sense. This pinning into 6,800-6,850 is our favored scenario into Friday as volatility likely continues its contraction over the holiday.

To the downside there is some light positive gamma, and we’d anticipate that being more meaningful after this AM data passes. Ultimately, for today, we would remain “intraday” long with SPX >6,750, with our longer term Risk Off signal at 6,700. <6,700 we would close out longs, and look to be neutral and/or short.

What about vol? As we talked about yesterday AM the right tail (OTM puts) were still bid, with the VIX holding 20. What we see under the hood is that SPX fixed strike vols are 1-2 vol points under Friday’s levels, but actually a bit higher than yesterday’s close (SPX grid below this AM IV – y’days close). The AM data clearing likely allows a final crushing of today’s & Friday’s IV, which is enough to prop markets up, but a full longer term vol crush may now be out of possibilities.

CORE PCE that was due out at 10AM ET today has been pushed to 12/5, which coincides with the next NFP. That jacks up IV for next week.

Below we’ve got our event volatility plot, and you can see the elevated term structure for major data. Note that just some of the upcoming data is a labeled, but the blue bars show us how much extra vol is injected into the overall IV due to all events (many data points are overlapping on the plot and not listed). For example, the NFP/PCE (first blue bar) on 12/5 is currently creating ~1.1 vol points.

The overall point here is that the event vol cant release until at least after the data points roll off, but next weeks data gives way to FOMC/PPI on 12/10 + ORCL earnings and then big VIX Exp + OPEX. If vol can’t release more – well that is a removal of a key tailwind for stocks. This is why we are going to be less constructively bullish after Friday.

Lastly a quick update on the new most important stock in the world: GOOGL. There is now a lot of positive gamma in the 310-335 area with the GOOGL GEX line peaking at ~$110mm. A week ago peak positive gamma for GOOGL was ~$46mm – and so this is a lot. Given this, 330 may be where the near term upside resistance lines are drawn, with plenty of implied support down into 310 (i.e. we’re operating with the idea that dips are bought while GOOGL >310).

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

|

/ESZ25 |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$6781.26 |

$6765 |

$675 |

$25018 |

$608 |

$2465 |

$245 |

|

SG Gamma Index™: |

|

2.506 |

0.028 |

|

|

|

|

|

SG Implied 1-Day Move: |

|

0.68% |

0.68% |

|

|

|

|

|

SG Implied 5-Day Move: |

|

1.47% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

|

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

|

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$6746.26 |

$6730 |

$673 |

$24850 |

$607 |

$2450 |

$241 |

|

Absolute Gamma Strike: |

$7016.26 |

$7000 |

$670 |

$24500 |

$600 |

$2450 |

$240 |

|

Call Wall: |

$6816.26 |

$6800 |

$680 |

$23950 |

$610 |

$2485 |

$250 |

|

Put Wall: |

$6516.26 |

$6500 |

$660 |

$24600 |

$590 |

$2450 |

$235 |

|

Zero Gamma Level: |

$6692.26 |

$6676 |

$673 |

$24582 |

$607 |

$2460 |

$245 |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [7000, 6800, 6000, 6700] |

|

SPY Levels: [670, 675, 680, 640] |

|

NDX Levels: [24500, 25000, 25500, 25200] |

|

QQQ Levels: [600, 610, 615, 590] |

|

SPX Combos: [(7097,94.03), (7077,76.88), (7050,90.59), (7023,79.42), (7016,81.86), (7003,99.56), (6976,82.12), (6969,80.81), (6949,95.64), (6928,90.05), (6915,72.05), (6908,75.56), (6901,98.73), (6888,70.29), (6881,84.11), (6874,85.78), (6867,91.69), (6847,98.87), (6840,90.64), (6834,92.84), (6827,98.85), (6820,90.50), (6813,98.44), (6806,89.56), (6800,99.84), (6793,99.07), (6786,91.11), (6779,89.09), (6773,94.85), (6766,73.49), (6759,74.97), (6752,98.06), (6725,81.97), (6719,83.96), (6698,82.27), (6678,76.45), (6671,71.36), (6651,85.32), (6637,67.39), (6624,70.96), (6617,80.76), (6597,78.65), (6563,67.83), (6549,82.66), (6522,74.07), (6516,74.01), (6502,95.10), (6468,82.19), (6448,77.92)] |

|

SPY Combos: [698.24, 678.17, 673.49, 688.21] |

|

NDX Combos: [24243, 24643, 25068, 24043] |

|

QQQ Combos: [590.16, 599.84, 584.71, 582.89] |

0 comentarios