Macro Theme:

Key dates ahead:

- 11/28: Early Close (1PM ET)

- 12/5: PCE/NFP

- 12/10: CPI/FOMC

- 12/15: ORCL ER

- 12/17 VIX Exp

- 12/19: OPEX

SG Summary:

Update 11/28: With Thanksgiving weekend arriving we see the “Easy Money” made from volatility crushing likely over, as trades turn to econ data for the week of Dec 1, then FOMC into 12/10. We will still maintain a net long position while the SPX is >6,750, which is our new risk-off Pivot level, we do however want to be more cautious given our primarily catalyst is behind us (rich puts ->IV decline i.e. “Vanna Rally”).

11/25: 11/24 (below) views are still in place, but we have updated our Risk Pivot to 6,680 from 6,600.

11/24: We want to lean long of stocks with SPX >6,600 as we believe put option decay into a holiday week will be a dominant tailwind for stocks. 6,700-6,750 is our upside target into Wednesday night. Should SPX break <6,600 we would close short term swing longs, and watch for a test of 6,500. Our longer term “wash out” downside level remains 6,350. Note: even in a risk-off scenario we still hold a core Dec 1×2 call spread per 11/21 note.

Key SG levels for the SPX are:

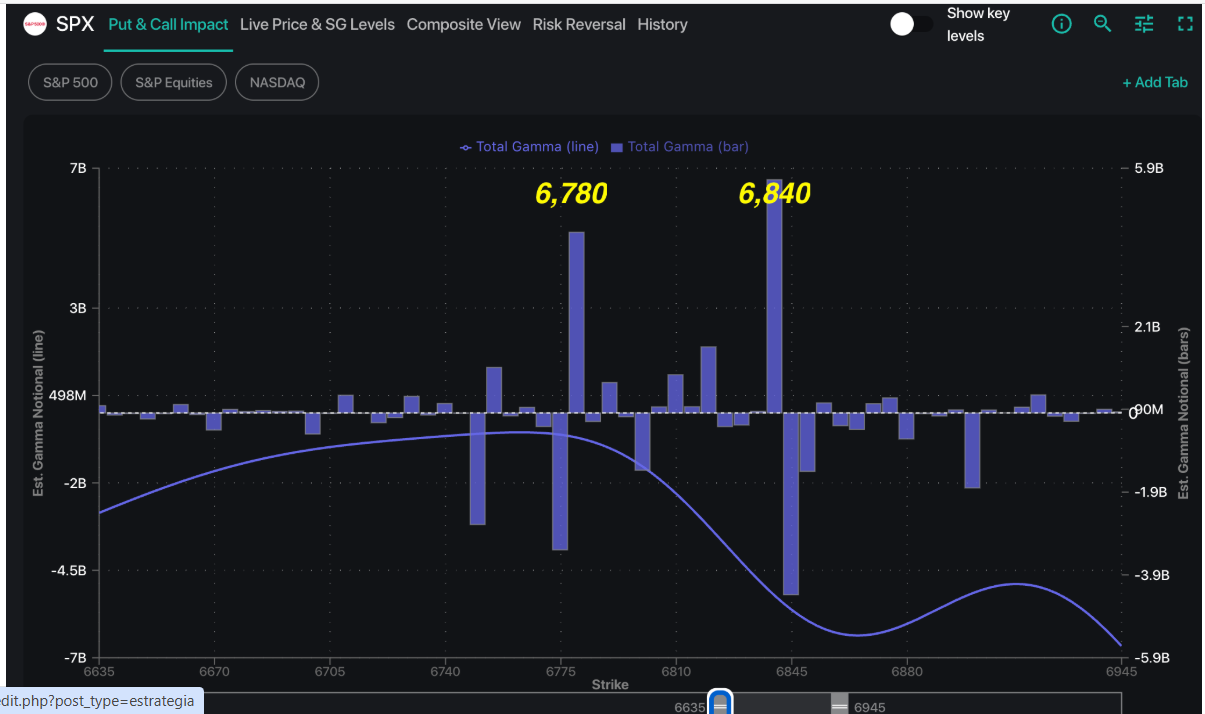

- Resistance: 6,840, 6,850, 6,900

- Pivot: 6,750 (bearish <, bullish >)

- Support: 6,800, 6,780, 6750, 6,700

Founder’s Note:

We hope everyone had a great Thanksgiving!

Futures are up 10bps into this shortened trading session – equity markets close at 1pm ET.

Resistance for today is at 6,840, with support at 6,800 & 6,780. Two important dynamics on positioning: the major strikes highlighted today are tied to a 0DTE condor, and second, SPX GEX is currently to shift to a negative footing for Monday across all strikes. This backs our prevailing forecast that the stability injected into this holiday shortened market may be removed into next week. The easy upside money has now been largely made, and we’ll need to rely on clean data & sentiment post-FOMC to trigger a final Santa Clause Rally into 7,000.

There is, however, still a weekend directly in front of us (and its decay), and so we look for positive drift into today’s session with eyes on 6,840 vs 6,780. Going forward, a break <6,750 has us flipping to Risk Off.

We can simplify the volatility measurement by showing the drop in VIX, from ~25 last week to 17.5 today. We also see COR1M (equity correlation index) decline sharply from previous weeks. Neither metric is particularly high or low at this point, with the framing here being “vol was a bit too rich to sustain over the holiday week without a specific catalyst.” Obviously announcements such as the AI Genesis project, and more importantly consensus of a rate cut have improved sentiment – but the next two weeks are data/catalyst heavy which should reduce IV decline. Good data could certainly allow for some further vol contraction into year end, but we need data to clear to release event vol.

Its a similar view in stocks, which went from “max put” to more neutral or mildly bullish in Mag 7’s. Similar to SPX IV/VIX, there is more room for put selling and/or call buying which can help the bulls case. On the flip side, puts are no longer so extreme, which means buying back puts here is easier vs last weeks prices. So, again, this has a bullish tilt to it but traders will likely want to see a bit of data before the final year end chase begins.

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

|

/ESZ25 |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$6826.4 |

$6812 |

$679 |

$25236 |

$614 |

$2486 |

$247 |

|

SG Gamma Index™: |

|

3.904 |

0.172 |

|

|

|

|

|

SG Implied 1-Day Move: |

|

0.67% |

0.67% |

|

|

|

|

|

SG Implied 5-Day Move: |

|

1.47% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

|

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

|

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$6799.4 |

$6785 |

$679 |

$25140 |

$613 |

$2490 |

$240 |

|

Absolute Gamma Strike: |

$7014.4 |

$7000 |

$680 |

$24500 |

$615 |

$2500 |

$250 |

|

Call Wall: |

$6864.4 |

$6850 |

$685 |

$23950 |

$620 |

$2500 |

$250 |

|

Put Wall: |

$6794.4 |

$6780 |

$645 |

$24000 |

$590 |

$2485 |

$235 |

|

Zero Gamma Level: |

$6736.4 |

$6722 |

$678 |

$24796 |

$608 |

$2480 |

$247 |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [7000, 6800, 6000, 6850] |

|

SPY Levels: [680, 670, 685, 700] |

|

NDX Levels: [24500, 25500, 25200, 25000] |

|

QQQ Levels: [615, 620, 600, 610] |

|

SPX Combos: [(7126,72.45), (7099,96.28), (7078,85.08), (7051,93.21), (7024,83.37), (7017,88.44), (7003,99.79), (6976,90.91), (6969,86.30), (6962,68.31), (6949,98.03), (6942,73.57), (6928,80.97), (6922,97.34), (6915,89.15), (6908,92.92), (6901,99.77), (6894,77.65), (6888,92.13), (6881,94.81), (6874,95.55), (6867,98.90), (6860,89.44), (6853,91.58), (6847,99.99), (6840,99.73), (6833,98.22), (6826,89.31), (6819,94.04), (6813,92.57), (6799,99.09), (6792,73.18), (6779,95.01), (6772,94.60), (6758,74.81), (6751,75.50), (6717,74.06), (6697,77.03), (6683,71.83), (6663,71.29), (6649,85.62), (6615,68.16), (6601,67.69), (6547,69.84), (6513,75.10), (6499,93.56)] |

|

SPY Combos: [683.03, 703.42, 682.35, 687.79] |

|

NDX Combos: [25464, 24227, 25893, 25388] |

|

QQQ Combos: [595.27, 605.1, 615.54, 590.35] |

0 comentarios