Macro Theme:

Key dates ahead:

- 2/18: VIX Exp

- 2/20: OPEX

- 2/25: NVDA ER

SG Summary:

Update 2/17: We are on high alert that Wed VIX expiration – Friday’s OPEX opens a window of weakness that may finally allow SPX vols to match the high vols seen in single stocks. A break of SPX <6,800 is our “high risk” signal.

2/13: A break <6,800 implies we visit the 6,600s as downside put positions drive short hedging. Low CPI may kick-save things, with a positive market response having a clear path back to 6,900. Ultimately we think upside is only worth a day trade at this point, as rallies likely remain unstable. If the SPX gets into the 6,600s it’s likely vol premium gets rich enough for vol sellers to step up, which could offer support.

Key SG levels for the SPX are:

- Resistance: 6,900

- Pivot: 6,900 (bearish <, bullish >) updated 2/10

- Support: 6,800, 6,700, 6,650

Founder’s Note:

Futures are -20bps, with no major data releases for today.

Support is at 6,800, and we still are of the view that if that level is breached then 6,600s are on deck. This is because negative gamma increases <6,800, and vol likely spikes. That creates vanna (IV changing delta) + vega “flows”, we quote flows because this stuff is all related. To the upside, resistance remains at the 6,900 area.

Before we dive into a few ideas, we want to relay that we are on high alert that tomorrow’s VIX exp may finally mark a window for SPX volatility “release”. That release could be the re-syncing of SPX vol moving higher to match single stock vol. This was a big topic all of last week (ex: Thu, Fri) and we’ll touch on it here.

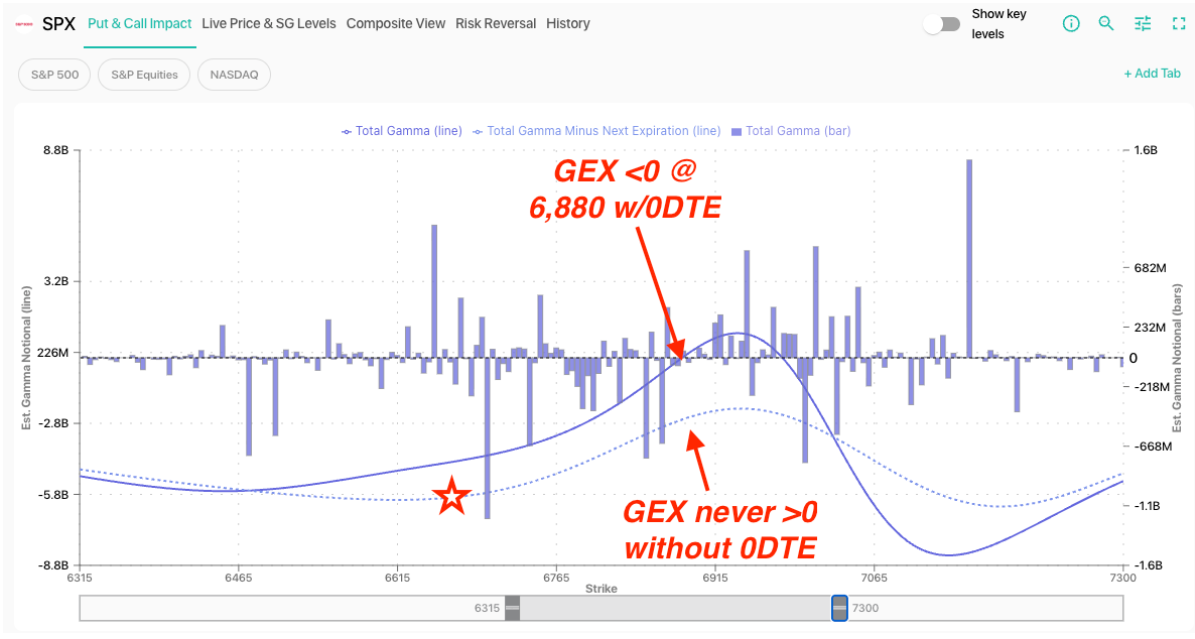

There are a few charts making the rounds which we want to clarify. First are bank charts plotting SPX GEX. If you are looking at a chart of SPX GEX that includes 0/1DTE, and it’s more than 1 day old, its arguably useless. You see that in the plot below, wherein SPX GEX shows as mildly positive >6,880, but when you remove 0DTE and its currently negative gamma over the entire SPX price range (dashed line). What’s our point? These bank charts are stale, and don’t highlight the 0DTE dynamics, which are critical: 0DTE offers transient, local positive gamma that is “here one second, and gone the next”.

One quick note on SPX 0DTE: we mark it as a record 70.5% percent of SPX volume on Thursday, 2/11, and it was +65% the whole week (very high). Makes you think about all those HIRO-seen 0DTE market kick saves (dip-buying)…

Next is this one from Michael Batnick, which has more views than a Kardashian. This chart is a non-options way of showing that single dispersion is high (single stocks are moving a lot) while the SPX does nothing – and this is rare. The data is a derivative (pun intended) of the Nomura chart we posted Thursday, and also linked to the endless correlation (COR1M) conversations we’ve had here over recent weeks. Our point in sharing this is that “the masses” are now on to this idea that something isn’t normal. And, again, we worry that OPEX brings normality…

The last one getting huge attention is the SPX against what we’ve gleaned is an all-stock Put/Call Ratio. The data only goes back to 2024, and it shows that SPX bottoms often coincide with a spike in this PC ratio. That makes sense to us, as big call or put spikes often sync with highs or lows.

The chart then goes on to put a phantom circle under the SPX (far right, top pane), and there is a random line drawn on the PC ratio at ~1.0. Bears love this chart, and it matches the “vibe” of the chart above: “we’re owed a pullback”.

Nitpicks aside, this data is not incorrect: the stock PC ratio is indeed elevated, but pre-2024 this same metric hit 1.2 – 1.3. So it can go a lot higher than it is currently.

In the spirit of committing chart crimes in exchange for engagement, we present that same PC ratio vs the VIX (green). You can see that in the past year we had the tariff crash in April, then some “correlation spasms” in Nov & Oct. The VIX jumped by relatively large amounts during previously elevated levels of PC ratios. The lack of VIX spike here is another way of highlighting the lack of SPX vol, and it highlights the core fear that we have at the moment: that VIX exp allows this vol to release.

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

|

/ESH26 |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$6852.13 |

$6836 |

$681 |

$24732 |

$601 |

$2646 |

$262 |

|

SG Gamma Index™: |

|

-2.885 |

-0.618 |

|

|

|

|

|

SG Implied 1-Day Move: |

|

0.62% |

0.62% |

|

|

|

|

|

SG Implied 5-Day Move: |

|

1.47% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

|

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

|

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$6936.13 |

$6920 |

$685 |

$25000 |

$620 |

$2630 |

$263 |

|

Absolute Gamma Strike: |

$7016.13 |

$7000 |

$690 |

$25000 |

$600 |

$2550 |

$260 |

|

Call Wall: |

$7116.13 |

$7100 |

$700 |

$25550 |

$630 |

$2700 |

$270 |

|

Put Wall: |

$6816.13 |

$6800 |

$675 |

$24000 |

$600 |

$2550 |

$250 |

|

Zero Gamma Level: |

$6915.13 |

$6899 |

$690 |

$24856 |

$619 |

$2660 |

$268 |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [7000, 6900, 6000, 6800] |

|

SPY Levels: [690, 670, 675, 685] |

|

NDX Levels: [25000, 24000, 25550, 24500] |

|

QQQ Levels: [600, 610, 620, 590] |

|

SPX Combos: [(7157,86.68), (7151,89.67), (7123,70.72), (7103,95.84), (7075,71.13), (7048,92.85), (7028,87.28), (7021,86.01), (7007,83.68), (7000,93.54), (6993,72.09), (6973,81.95), (6952,82.34), (6898,84.59), (6870,75.81), (6864,76.71), (6857,70.36), (6850,84.81), (6843,85.19), (6829,73.56), (6822,96.24), (6809,74.02), (6802,99.43), (6788,89.92), (6781,75.84), (6775,81.00), (6768,96.53), (6761,89.26), (6754,66.40), (6747,97.54), (6740,87.21), (6727,93.81), (6720,89.81), (6713,79.84), (6699,98.80), (6693,83.03), (6679,67.22), (6672,94.84), (6658,81.69), (6652,96.46), (6638,80.14), (6624,82.36), (6617,86.16), (6597,97.95), (6576,78.19), (6570,79.52), (6549,91.14), (6522,90.11), (6501,96.34)] |

|

SPY Combos: [677.81, 668.28, 673.05, 675.09] |

|

NDX Combos: [24659, 24238, 23842, 24040] |

|

QQQ Combos: [599.96, 589.75, 580.14, 621.58] |

|

|

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Gamma Tilt: |

0.734 |

0.515 |

0.697 |

0.475 |

0.803 |

0.516 |

|

Gamma Notional (MM): |

‑$657.036M |

‑$1.434B |

‑$6.768M |

‑$1.06B |

‑$17.139M |

‑$749.113M |

|

25 Delta Risk Reversal: |

-0.074 |

-0.061 |

-0.088 |

0.00 |

-0.058 |

0.00 |

|

Call Volume: |

680.677K |

1.556M |

9.119K |

921.911K |

26.924K |

350.03K |

|

Put Volume: |

1.099M |

2.132M |

9.795K |

1.324M |

56.079K |

819.326K |

|

Call Open Interest: |

7.749M |

5.071M |

61.668K |

3.615M |

246.128K |

2.994M |

|

Put Open Interest: |

12.665M |

10.691M |

99.585K |

6.011M |

426.652K |

7.67M |

0 comentarios