Macro Theme:

Key dates ahead:

- 2/18: VIX Exp

- 2/20: OPEX

- 2/25: NVDA ER

SG Summary:

Update 2/17: We are on high alert that Wed VIX expiration – Friday’s OPEX opens a window of weakness that may finally allow SPX vols to match the high vols seen in single stocks. A break of SPX <6,800 is our “high risk” signal.

2/13: A break <6,800 implies we visit the 6,600s as downside put positions drive short hedging. Low CPI may kick-save things, with a positive market response having a clear path back to 6,900. Ultimately we think upside is only worth a day trade at this point, as rallies likely remain unstable. If the SPX gets into the 6,600s it’s likely vol premium gets rich enough for vol sellers to step up, which could offer support.

Key SG levels for the SPX are:

- Resistance: 6,900

- Pivot: 6,900 (bearish <, bullish >) updated 2/10

- Support: 6,800, 6,700, 6,650

Founder’s Note:

Futures are +40bps, with VIX Exp at 9:30AM ET.

Anyone trading equity futures around the cash open, be on watch for large unusual swings related to the expiry.

This AM rally does not throw us off of the idea that the SPX is vulnerable to a larger directional move now that VIX Exp is upon us. The first order here is that we’re looking for an increase in SPX volatility as we enter the expiration window. This is a 1-2% move in either direction, with resistance at 7k. Our “wash out” downside area remains in the 6,600s.

Our sense is for lower, given the dispersion (high volatility in single stocks vs low index vol). We think this stuff usually has to resolve with a vol spike, but to be honest the idea that stocks bounce and quiet down is a viable path. Given this, we will remain neutral of stocks while SPX is >6,800, and look to lean long with SPX >6,900. A break of <6,800 is a signal to press shorts.

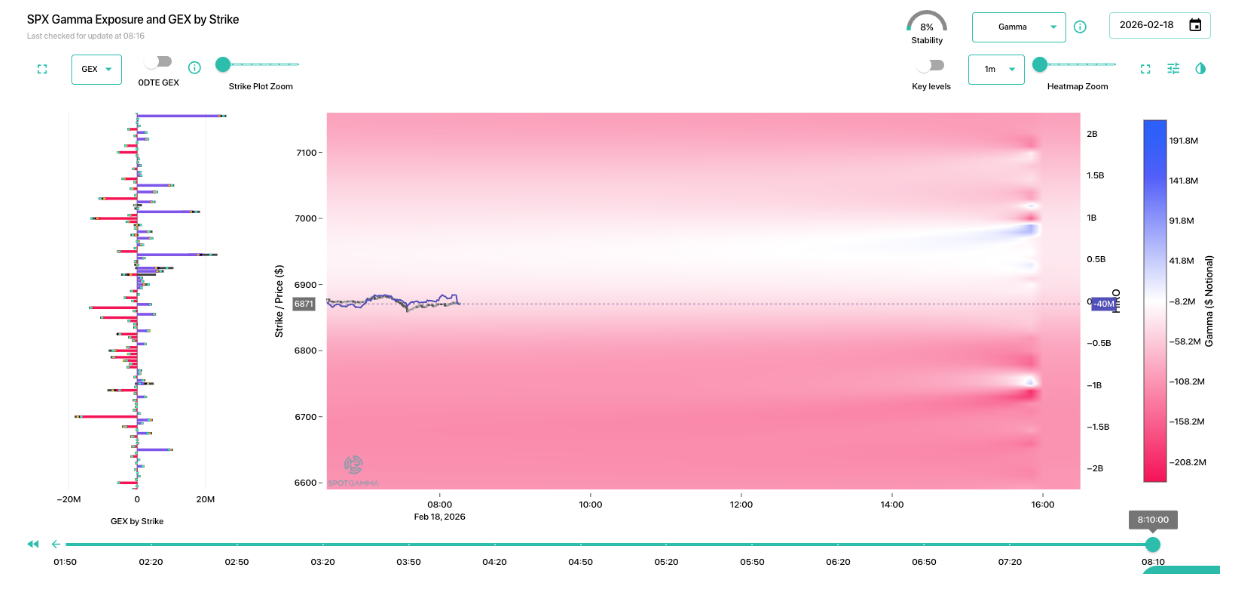

From a gamma perspective – its all negative. This is shown via the red TRACE map, and this supports the call for an increase in index vol.

That being said, we continue to like playing short volatility structures in the software names. Here is Compass set to x=Put Skew %, and Y = IV rank. The names at the top right have the highest put skew + IV, and we look at something like CRM with upcoming earnings and what may be a decent opportunity to be in +2 month out short vol structures. CRM reports on 2/25, and so we’d likely wait until a bit closer to earnings to enter such trades. We posit that the software space may have already had the worst of their declines, and may hold up relatively well relative to an SPX decline.

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

| /ESH26 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6858.73 | $6843 | $682 | $24701 | $601 | $2646 | $263 |

| SG Gamma Index™: |

| -1.731 | -0.475 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.68% | 0.68% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.47% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| $6903.58 | $688.67 |

|

|

|

|

| SG Implied 1-Day Move Low: |

| $6810.32 | $679.37 |

|

|

|

|

| SG Volatility Trigger™: | $6915.73 | $6900 | $685 | $24800 | $615 | $2630 | $263 |

| Absolute Gamma Strike: | $7015.73 | $7000 | $690 | $25000 | $600 | $2550 | $260 |

| Call Wall: | $7115.73 | $7100 | $700 | $25550 | $630 | $2680 | $270 |

| Put Wall: | $6815.73 | $6800 | $675 | $24000 | $600 | $2550 | $250 |

| Zero Gamma Level: | $6869.73 | $6854 | $686 | $24825 | $618 | $2660 | $268 |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [7000, 6900, 6800, 6000] |

| SPY Levels: [690, 685, 670, 675] |

| NDX Levels: [25000, 24000, 24500, 25200] |

| QQQ Levels: [600, 610, 620, 590] |

| SPX Combos: [(7158,88.54), (7151,89.95), (7103,96.44), (7076,76.50), (7062,70.39), (7049,93.18), (7042,71.19), (7028,89.91), (7021,82.29), (7014,77.52), (7007,87.65), (7001,93.85), (6994,68.77), (6987,84.89), (6980,66.35), (6973,87.35), (6966,67.11), (6953,90.92), (6946,75.08), (6932,66.89), (6925,72.40), (6912,67.47), (6905,67.73), (6864,70.79), (6850,75.87), (6843,86.19), (6836,67.19), (6830,72.33), (6823,94.32), (6816,83.93), (6802,99.41), (6795,77.10), (6788,84.54), (6782,91.41), (6775,85.03), (6768,95.25), (6761,82.97), (6754,70.66), (6747,95.99), (6741,77.56), (6727,94.20), (6720,78.80), (6713,90.87), (6700,98.43), (6693,81.74), (6686,68.88), (6672,88.84), (6665,79.88), (6658,78.17), (6652,93.62), (6624,81.79), (6617,82.66), (6597,96.85), (6576,76.85), (6563,77.29), (6549,87.35), (6522,72.93), (6515,86.29)] |

| SPY Combos: [678.19, 667.97, 657.74, 672.74] |

| NDX Combos: [24652, 24232, 23837, 24035] |

| QQQ Combos: [600.1, 589.88, 580.25, 585.06] |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.841 | 0.618 | 0.763 | 0.519 | 0.889 | 0.579 |

| Gamma Notional (MM): | ‑$535.915M | ‑$1.274B | ‑$7.146M | ‑$1.096B | ‑$16.464M | ‑$715.345M |

| 25 Delta Risk Reversal: | -0.074 | 0.00 | -0.085 | -0.074 | -0.06 | -0.057 |

| Call Volume: | 674.559K | 1.552M | 10.825K | 963.492K | 14.84K | 194.644K |

| Put Volume: | 993.558K | 2.10M | 10.143K | 1.457M | 34.98K | 594.043K |

| Call Open Interest: | 7.884M | 5.291M | 63.13K | 3.755M | 248.984K | 3.007M |

| Put Open Interest: | 12.774M | 10.926M | 99.896K | 6.164M | 438.674K | 7.80M |

0 comentarios