Macro Theme:

Key dates ahead:

- 12/5: PCE (confirmed)

- 12/10: FOMC

- 12/15: ORCL ER

- 12/16: NFP

- 12/17 VIX Exp

- 12/18: CPI (confirmed)

- 12/19: OPEX

SG Summary:

Update 12/5: We are more cautious of markets to start the week of 12/1 due to a deluge of upcoming data, culminating on 12/5 with PCE+NFP. This caution has us more positioned for chop and/or mild downside vs looking for major equity upside. Given this, we move our Risk Pivot up to 6,775 with eyes on 6,700 as more material support. Into 12/5 and FOMC on 12/10 we anticipate an opportunity for resumption of the upside trend, and while that is what we anticipate we’ll look for positive gamma into those events to give us the green light.

Key SG levels for the SPX are:

- Resistance: 6,900

- Pivot: 6,790 (bearish <, bullish >)

- Support: 6,850, 6,820, 6,800, 6,725

Founder’s Note:

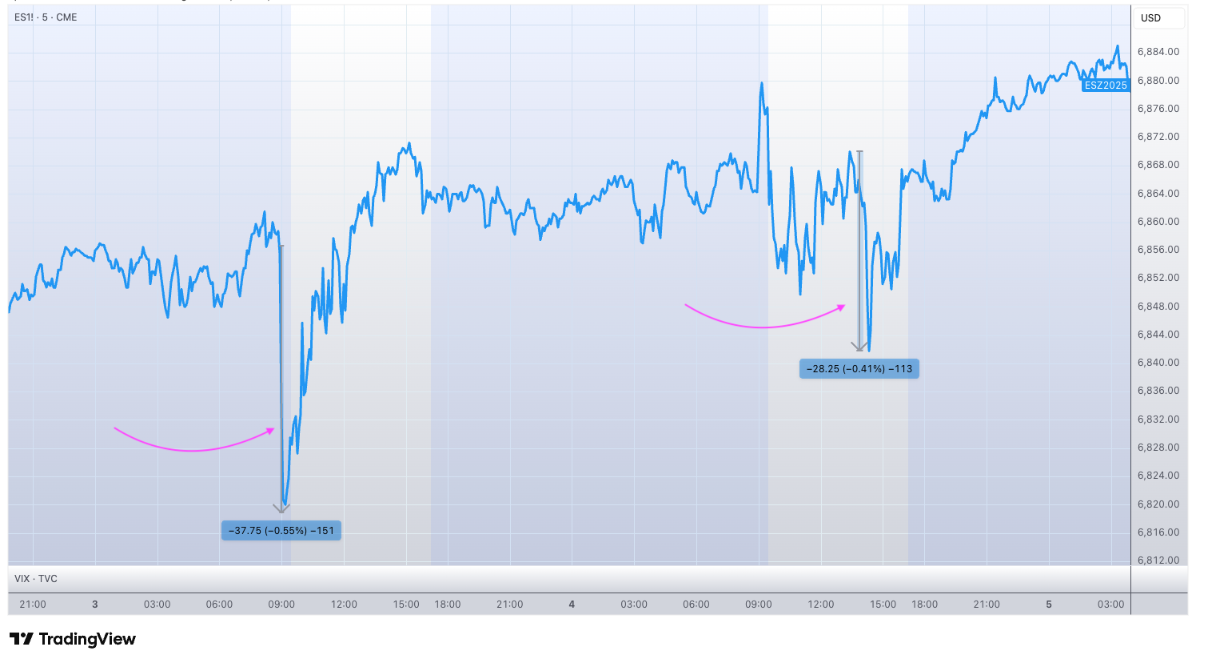

Futures are up 15bps ahead of PCE at 10AM ET.

Today’s levels:

Support: 6,850, 6,820, 6,800

Resistance: 6,900

On the PCE topic, the 0DTE straddle is just $29.3/42bps (ref 6,865) which is quite low. This infers traders are not terribly focused on this mornings report, which could be simply because its September’s delayed reading. Ultimately if it passes without issue it likely brings a mild event-vol contraction which aids in buoying stocks. PCE gives way to a weekend, too, which is generally a vol-depressant.

Recall, too, that the last 2 sessions have seen violent jumps that mean-reverted. This, as the 0DTE SPX options IV is bottom-basement level. We yesterday discussed how the ultra-low IV causes some short term jump risk as sharp moves can be compounded by 0DTE vol covering. Something to be aware of today if a sharp drop hits on no real news…

Looking at the bigger picture, we continue to mark two key zones on the S&P, which have largely been unchanged this week. 6,925-6.950 to the upside, which is likely major resistance into FOMC, and 6,750-6,700 to the downside. We’re of the view that upside drift likely remains in play into FOMC, it would take a material trigger to invoke a spill to that 6,700 area. On this topic if the SPX breaks <6,790 we would flip to a neutral or short position.

What about the upside?

As we discussed in yesterday’s Q&A, the pre-FOMC upside is really cheap. 7-handle SPX IV’s are about as low as you can get, and thats where >=6,900 strike calls are priced Monday & Tuesday. Given this, we’ve take a few >=6,900 lotto call positions for Monday & Tuesday on the basis of “sometimes you just buy options because they are so cheap”.

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

|

/ESZ25 |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$6867.02 |

$6857 |

$684 |

$25581 |

$622 |

$2531 |

$251 |

|

SG Gamma Index™: |

|

2.396 |

0.070 |

|

|

|

|

|

SG Implied 1-Day Move: |

|

0.60% |

0.60% |

|

|

|

|

|

SG Implied 5-Day Move: |

|

1.73% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

|

$6907.35 |

$689.56 |

|

|

|

|

|

SG Implied 1-Day Move Low: |

|

$6824.95 |

$681.34 |

|

|

|

|

|

SG Volatility Trigger™: |

$6805.02 |

$6795 |

$683 |

$25470 |

$621 |

$2440 |

$249 |

|

Absolute Gamma Strike: |

$7010.02 |

$7000 |

$680 |

$24500 |

$620 |

$2500 |

$250 |

|

Call Wall: |

$7010.02 |

$7000 |

$685 |

$26000 |

$630 |

$2600 |

$260 |

|

Put Wall: |

$6510.02 |

$6500 |

$670 |

$25300 |

$590 |

$2420 |

$240 |

|

Zero Gamma Level: |

$6776.02 |

$6766 |

$678 |

$25135 |

$617 |

$2487 |

$251 |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [7000, 6800, 6700, 6900] |

|

SPY Levels: [680, 685, 670, 700] |

|

NDX Levels: [24500, 25500, 25300, 26000] |

|

QQQ Levels: [620, 630, 625, 600] |

|

SPX Combos: [(7152,87.73), (7125,72.76), (7097,95.67), (7077,84.26), (7049,94.48), (7022,91.98), (7015,87.92), (7001,99.89), (6987,81.60), (6981,69.98), (6974,92.59), (6967,95.61), (6960,84.76), (6953,99.15), (6939,76.35), (6933,88.09), (6926,95.41), (6919,74.18), (6912,95.27), (6905,86.17), (6898,99.79), (6891,88.20), (6885,91.84), (6878,99.46), (6871,88.56), (6864,99.21), (6857,86.15), (6850,97.27), (6816,70.99), (6802,90.20), (6782,77.84), (6775,74.93), (6768,81.53), (6761,77.25), (6747,82.57), (6741,74.34), (6727,85.31), (6713,86.77), (6699,85.86), (6693,68.26), (6651,86.61), (6610,75.36), (6603,76.52), (6549,76.78)] |

|

SPY Combos: [688.68, 698.94, 686.63, 685.26] |

|

NDX Combos: [25863, 25710, 26272, 25991] |

|

QQQ Combos: [629.76, 639.73, 623.52, 634.74] |

0 comentarios