Macro Theme:

Key dates ahead:

- 12/10: FOMC

- 12/15: ORCL ER

- 12/16: NFP

- 12/17 VIX Exp

- 12/18: CPI (confirmed)

- 12/19: OPEX

SG Summary:

Update 12/8: We are eyeing 7,000 as the major upside level post-FOMC, with 6,700 the prime downside level. A full update will be provided by Wed AM 12/10.

12/5: We are more cautious of markets to start the week of 12/1 due to a deluge of upcoming data, culminating on 12/5 with PCE+NFP. This caution has us more positioned for chop and/or mild downside vs looking for major equity upside. Given this, we move our Risk Pivot up to 6,775 with eyes on 6,700 as more material support. Into 12/5 and FOMC on 12/10 we anticipate an opportunity for resumption of the upside trend, and while that is what we anticipate we’ll look for positive gamma into those events to give us the green light.

Key SG levels for the SPX are:

- Resistance: 6,900, 6,925, 6,950

- Pivot: 6,790 (bearish <, bullish >)

- Support: 6,850, 6,820, 6,800, 6,725

Founder’s Note:

Futures are +10bps with no major data on the tape.

Key Levels for today are 6,900 resistance, and support at 6,850, 6,820 and 6,800. Today’s straddle is just 37bps, so watch out for shake outs.

The big resistance is at 6,950, which has is up a bit from Friday’s 6,725 largest positive gamma. However, this is driven primarily by rolling short dated positions. Its similar to the downside, where we now see some light positive gamma at 6,750 (up from 6,700). This matters, because if you are doing post-FOMC planning, you need to know where the sticky positive gamma is located. For today & tomorrow we’d expect 0DTE traders to come back in at these highlighted levels to sell options, which produces local positive gamma (i.e. gamma tied to specific strikes). However, positive gamma which is only supplied by 0DTE is inherently unstable. So, while we feel alright about market stability today to FOMC (Wed), we are treading a bit lightly post-FOMC.

Whats the worry about post FOMC? Well, there is no positive post-FOMC gamma – at least currently.

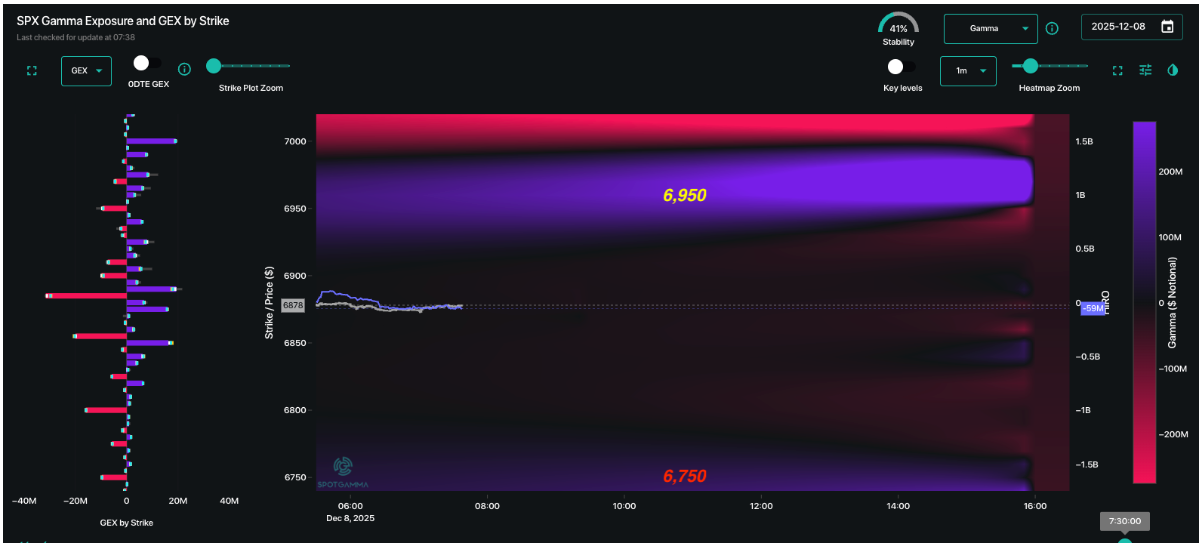

You see this via SPX GEX in EquityHub, wherein the all expiration GEX shows some decent positive gamma around current SPX prices, and peaking into 6,950, which coincides with the bright blue area of TRACE, above.

If you remove 0DTE options (i.e today’s exp), you see the GEX is negative across the board (dashed line). “All of the positive gamma supply in 0DTE options” has been a feature of recent markets, and we flag it here because if you start to position for post-FOMC you can’t count on the currently-positive gamma spots.

We’ll start to dial in downside levels for FOMC as we approach Wednesday, but the upside level is clear: 7,000. Its a massive OI strike (and big round number). Downside is currently open to at least 6,700, but let’s not forget that last year on DEC FOMC Powell delivered a 3% smackdown to SPX. We’re not saying that happens again this year, but this is the type of positioning that can facilitate that. Again, we’ll dig into FOMC positioning tomorrow & Wed as larger FOMC positions come into the market.

Relatedly to the gamma positioning, 0DTE IV’s have been particularly low over the last week (0DTE straddles have been ~40bps). Accordingly, we also saw several “out of nowhere” intraday moves in the ES/SPX (see chart) – all of which have mean reverted. Additionally, on Friday we flagged how cheap the ~6,900 area pre-FOMC IV’s were (<8%).

Interestingly, Friday AM saw a quick 35bps move in <5mins, which immediately gave way to an “out of nowhere” 70bps move to 6,900 – which subsequently fully reverted back to opening levels. Some of you may be saying “50-75bps ain’t that big”, and, generally we’d agree. However, Friday’s 0DTE straddle was 42bps, and so the opening move down of 35 bps, plus 70bps rip to 6,900 (coincidence?), then 56bps drop back to opening levels. So, on an open-to-close basis the SPX move was literally 4bps, and on a close to close basis it was 20 bps (i.e. very low vol and within the 0DTE straddle).

Friday was just like the previous several sessions in that the straddle is realized right near the open (i.e. there is a sudden move near the straddle price). What’s the point? Well, today’s 0DTE straddle is $25.5/37bps, making it the lowest we’ve seen in recent memory.

These cheap-0DTE IV games are likely only in place for today & tomorrow, then FOMC changes both the gamma and IV picture(s).

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

| /ESZ25 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6878.93 | $6870 | $685 | $25692 | $625 | $2521 | $250 |

| SG Gamma Index™: |

| 2.327 | 0.105 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.59% | 0.59% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.71% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: |

| After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6868.93 | $6860 | $684 | $25580 | $624 | $2470 | $249 |

| Absolute Gamma Strike: | $7008.93 | $7000 | $700 | $24500 | $630 | $2500 | $240 |

| Call Wall: | $7008.93 | $7000 | $700 | $26000 | $630 | $2600 | $260 |

| Put Wall: | $6508.93 | $6500 | $660 | $25200 | $590 | $2440 | $240 |

| Zero Gamma Level: | $6787.93 | $6779 | $679 | $25243 | $619 | $2496 | $250 |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [7000, 6800, 6900, 6700] |

| SPY Levels: [700, 680, 685, 670] |

| NDX Levels: [24500, 25500, 25700, 26000] |

| QQQ Levels: [630, 620, 625, 600] |

| SPX Combos: [(7200,95.96), (7152,89.75), (7125,78.29), (7111,69.24), (7097,96.91), (7077,87.52), (7063,69.66), (7049,95.52), (7028,92.66), (7022,69.12), (7015,90.10), (7008,75.78), (7001,99.93), (6987,88.25), (6980,79.13), (6973,95.19), (6967,97.15), (6960,89.36), (6953,99.47), (6946,73.89), (6939,83.07), (6932,94.97), (6925,97.72), (6918,79.07), (6912,96.77), (6905,85.48), (6898,99.75), (6891,95.79), (6884,95.56), (6877,91.17), (6857,91.61), (6843,72.16), (6836,78.91), (6829,75.34), (6822,76.81), (6815,72.75), (6802,88.93), (6774,81.01), (6767,78.15), (6760,76.69), (6747,76.49), (6733,70.85), (6726,74.56), (6712,76.35), (6699,86.33), (6692,70.87), (6651,83.74), (6616,69.14), (6602,70.74), (6547,72.47)] |

| SPY Combos: [698.76, 688.5, 686.44, 685.07] |

| NDX Combos: [25872, 26283, 26077, 26000] |

| QQQ Combos: [629.79, 626.05, 639.76, 632.91] |

0 comentarios