Macro Theme:

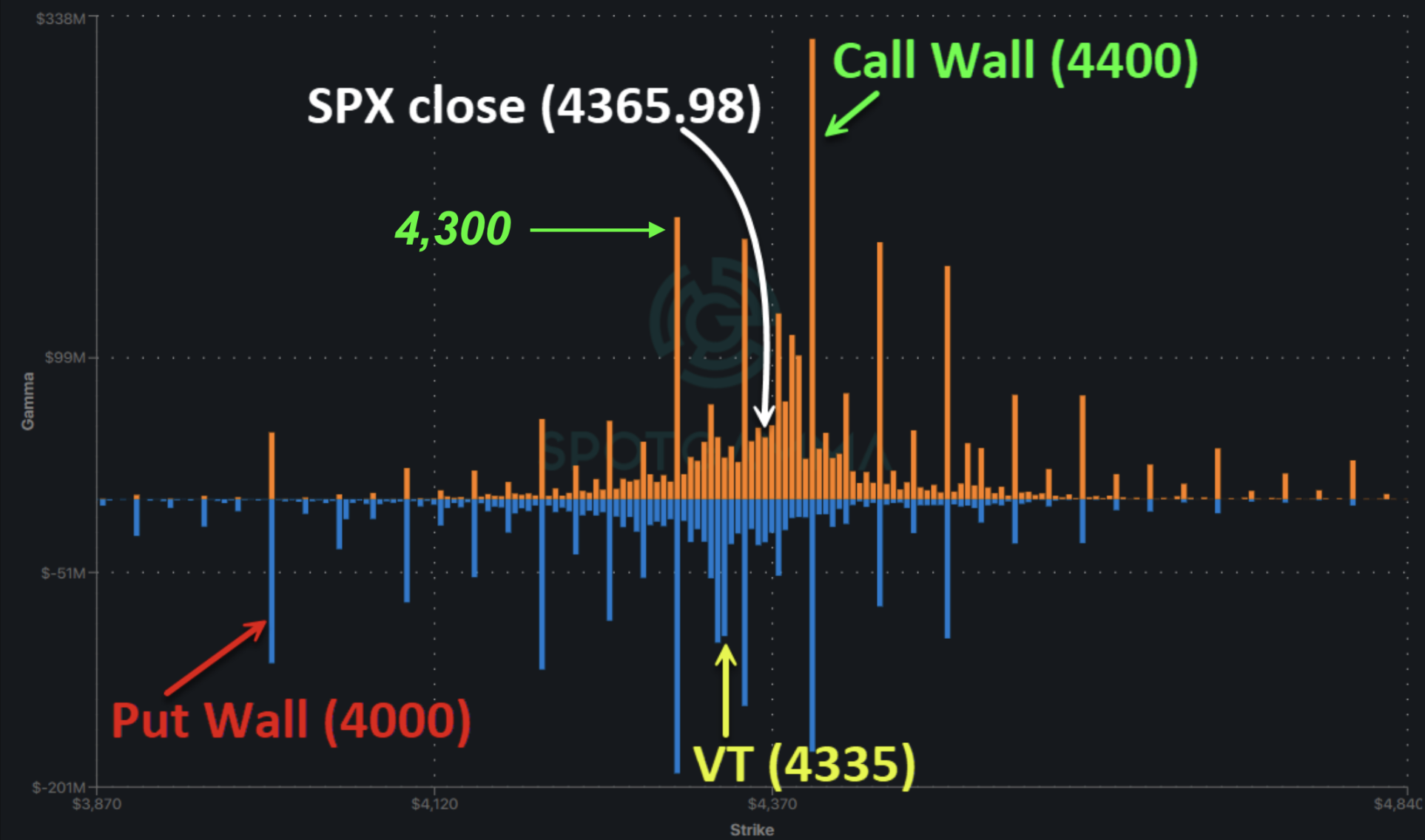

Short Term SPX Resistance: 4,400 Call Wall

Short Term SPX Support: 4,325

SPX Risk Pivot Level: 4,275

Major SPX Range High/Resistance: 4,400

Major SPX Range Low/Support: 4,200

‣ We remain bullish of equities while the SPX is >4,300

‣ We anticipate that the equity market volatility will continue to contract into Nov 17th expiration, and hold that view while SPX holds >4,300

*updated 11/3

Founder’s Note:

ES Futures are flat at 4,377. Key SG levels for the SPX are:

- Support: 4,350, 4,337, 4,328 & 4,300

- Resistance: 4,371, 4,376, 4,400

- 1 Day Implied Range: 0.69%

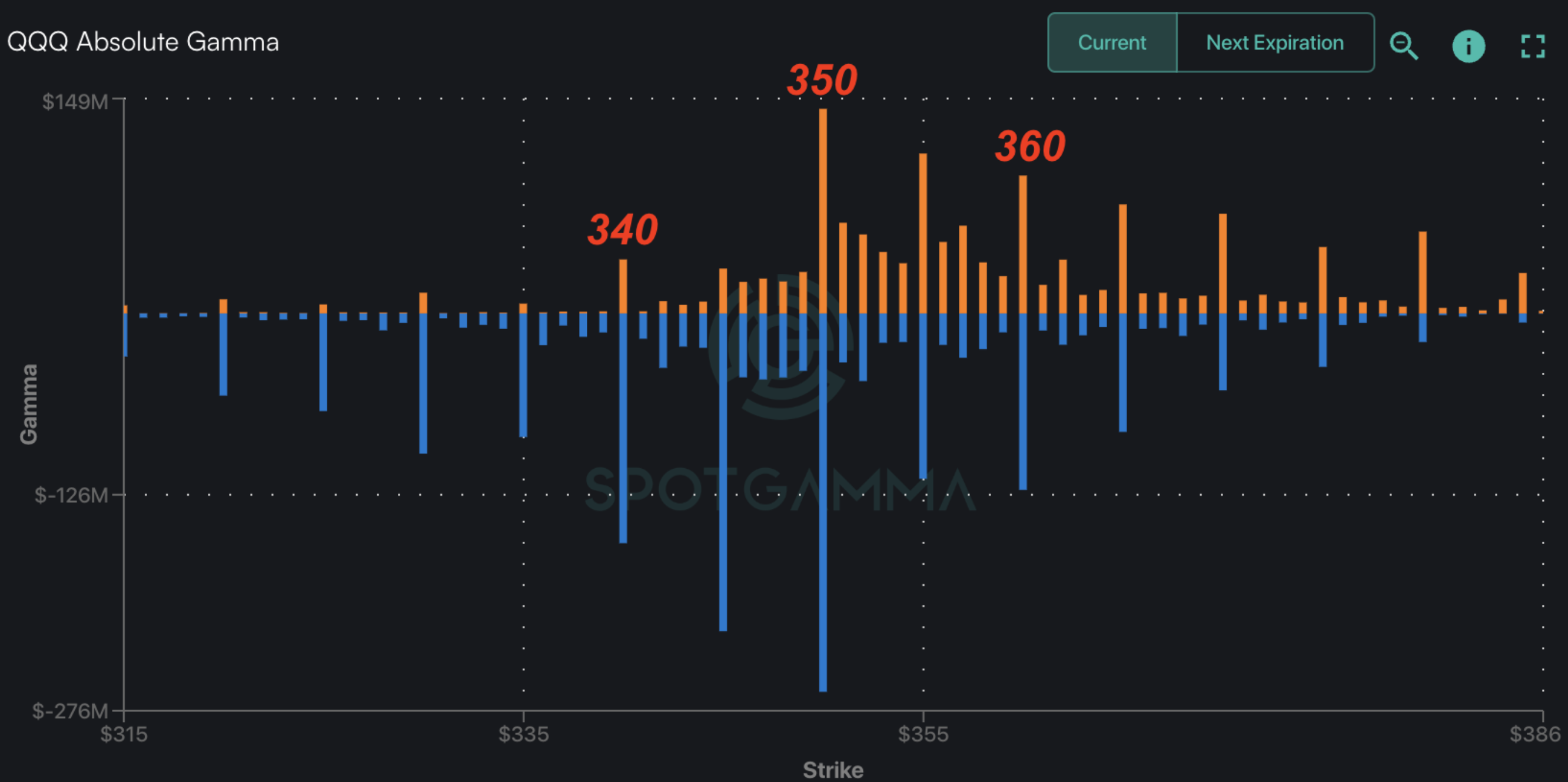

For the QQQ, support is at 365 & 360, with resistance at 369/370 then 380.

Equities stalled yesterday, and we anticipate that to be the case for today. The area that the SPX has stalled around is an area of major, key strikes, as shown in last nights note.

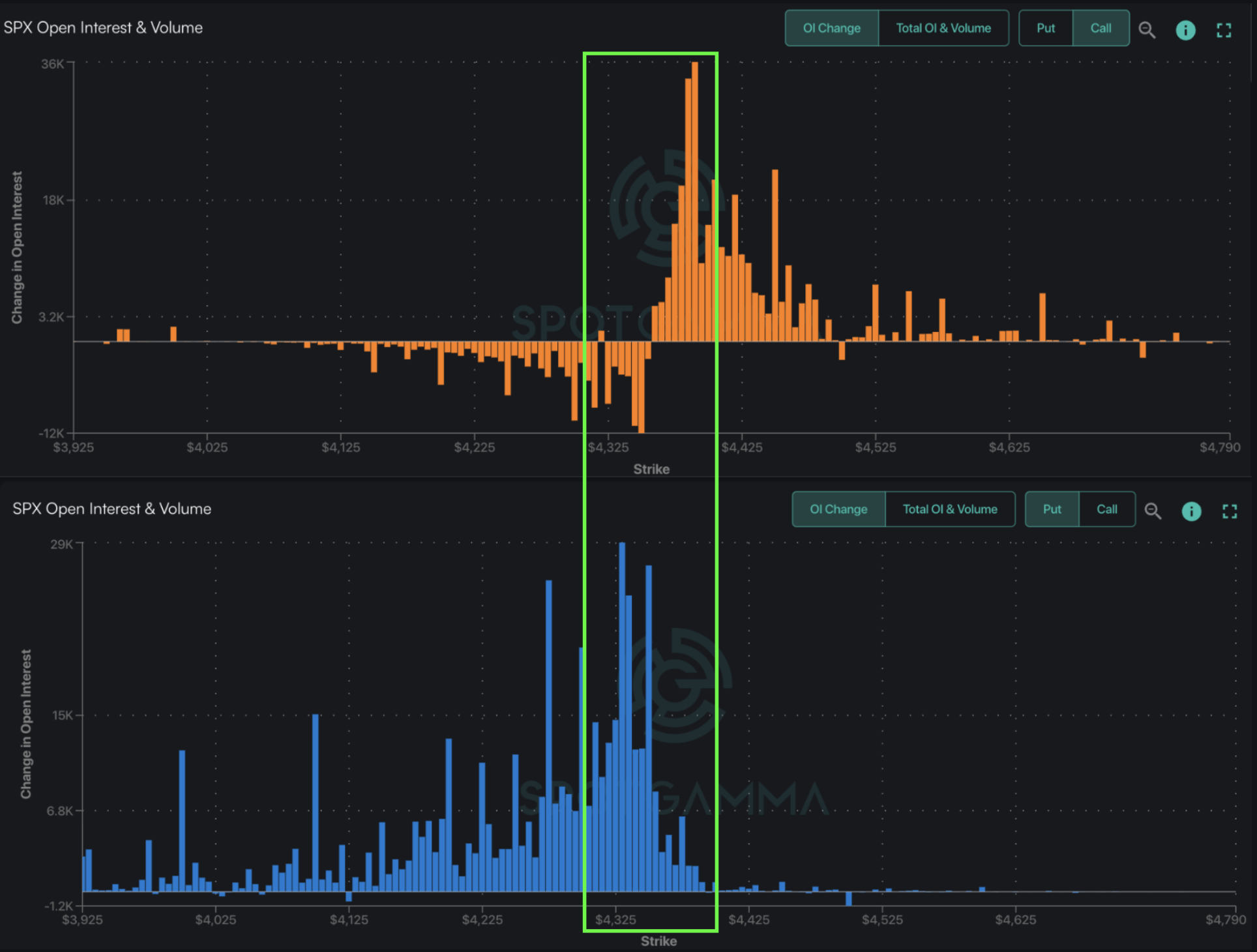

The stalling of the S&P has allowed for traders to add short dated positions at/or around current levels. This can be seen in the change in the 1 day open interest change for SPX calls (top) and puts (bottom). These, we believe, are predominantly traders selling short dated options betting on lower volatility.

On this topic, we’ve noted a decline in upside implied volatility, which suggests traders have started to sell upside calls into the rally. This can be seen in the change in fixed strike volatility over the past week, wherein the zone of red shows a decline in IV for upside strikes. This implies that traders are selling out-of-the-money calls, as lower IV’s infer call supply.

Our map of price action looks like the following:

We think prices hold in the 4,300’s in through tomorrows Powell speech, and into early next week. Should the SPX break above or below this zone, we would consider stocks overbought or oversold, accordingly.

Things then turn to the key window of 11/14 – 11/17 which features CPI, VIX Exp & OPEX. The flows through these key dates should trigger a final directional move into the end-of-year.

0 comentarios