Macro Theme:

Key dates ahead:

- 12/10: FOMC

- 12/10: ORCL ER

- 12/11: AVGO ER

- 12/12: PPI

- 12/16: NFP

- 12/17 VIX Exp

- 12/18: CPI (confirmed)

- 12/19: OPEX

SG Summary:

Update 12/9: FOMC 12/10 + ORCL ER 12/10 + AVOG ER 12/11 make this week the directional trigger into end-of-year. We lean to the bullish side, as the benign passing of events may allow SPX to rally, with 7,000 the major upside target. To express this view, we are evaluating trades like 12/19 call flies (more speculative), or 12/31 call flies (less speculative):

- 12/19 SPX call fly 7,000 x 7,100 x 7,200 marked at $9.2

- 12/31 7,000 x 7,100 x 7,200 marked at $13.5

We may look to pair this off with a downside hedge like:

- 12/17 exp VIX call spreads: 43 cents

Additionally, at any time should SPX break our Risk Pivot (currently <6,800), we would likely look to be directionally short of stocks.

Key SG levels for the SPX are:

- Resistance: 6,900, 6,925, 6,950

- Pivot: 6,790 (bearish <, bullish >)

- Support: 6,850, 6,820, 6,800, 6,725

Founder’s Note:

Futures are flat, with JOLTS data out at 8:30AM ET.

Support is at 6,825, and 6,800. Resistance 6,850, 6,900. The 0DTE straddle is $29/42 bps i.e. low.

Today is being priced as another low vol session, and we think that will be relatively true. Its relative because yesterday we saw the market have a sharp, large move relative to the 0DTE straddle (just as we saw in the session before, and the session before that, and…).

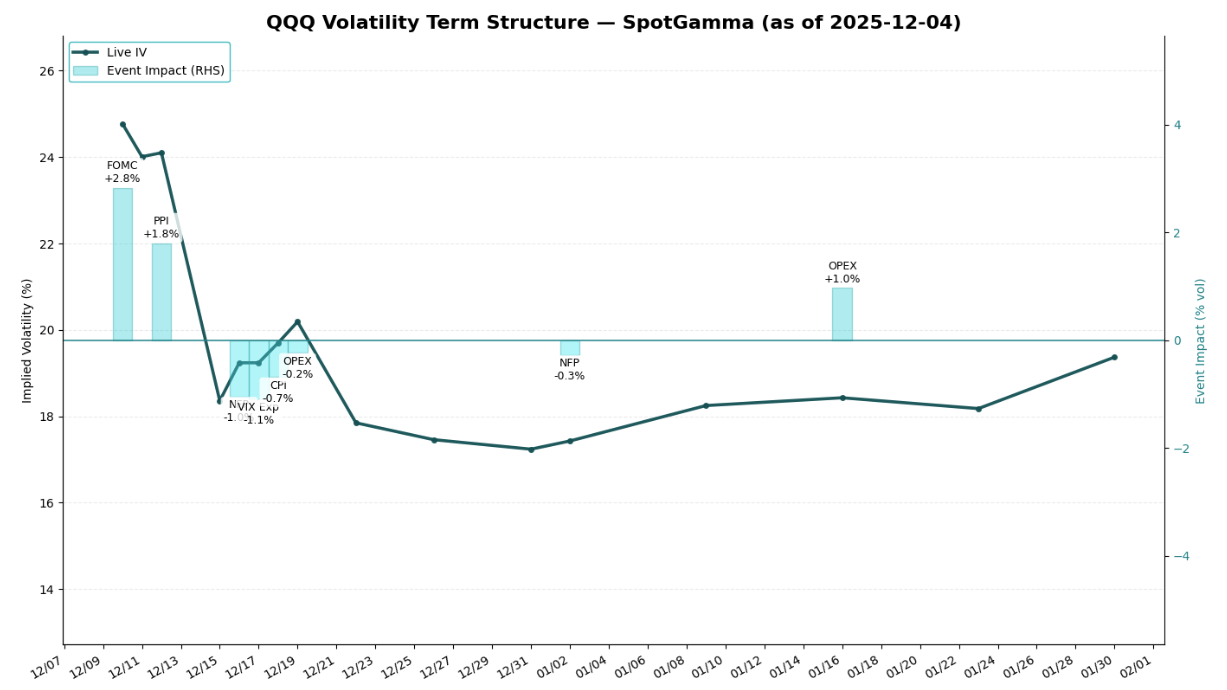

FOMC is the last thing preventing traders from packing it up for the year, and our models show ~3 vol points associated with this event (QQQ, below & SPY is similar event vol). That 3 points of event vol (blue bars) is in the context of SPX IV that is pretty fairly priced. 1-month realized vol (RV) is 14%, and 5-day RV has been stable at 5%. SPX ATM IV’s for expirations past this week are all in the 12-14% range. ~13% 1-month IV vs 1-month RV at 14%…seems even.

Should FOMC pass without issue we imagine that DEC vol gets smacked, and we start to see ~10% IV’s into end-of-year. That would be a lift to stocks, with 7,000 SPX the huge OI level into EOY. The downside path is open to at least 6,700, we think FOMC-induced anxiety could spark a quick move into the 6,6xx’s…

But wait, there’s another part to this picture.

Trump threw an NVDA/China deal onto markets yesterday, which resulted in a sharp 2.6% pop yesterday, which then faded (apparently China doesn’t want our chips). That also explains the total lack-of-bid to NVDA calls, as the name remains in the bottom left of Compass, sharply trailing the other mag names (yellow box, bottom right). The concentration of these Mag names implies some correlation is afoot, and suggests a bullish lean to the stocks that have been driving markets all year (all decade?).

These names are all likely to come into focus because on top of FOMC we have ORCL reporting Wed PM, and then AVGO on Thur PM. ORCL may be particularly important (and it has a blistering 9.5% implied earnings move) because it was the darling of the ball in September, with the stock hitting a $345 high. Fast forward to today, the stock is at $215 (eek) and its CDS are the bears prime evidence of how the AI CAPEX story is about to go wrong… You can imagine that if ORCL beats it will add some end-of-year relief, and while there’s only ~3 weeks of 2025 left, much of that is holidays, or holiday-adjacent.

AVGO, which holds a large 3% weighting in the S&P500, has a 6.5% implied move.

So, what are the trades? With index IV’s overall pretty low, our view is there is no need too get fancy. TLDR we like Dec 31 7,000 x 7xxx call spreads or call flies (adjust the upper strike based on your risk/reward), paired off with a few VIX call spreads (discussed below).

If you are the type playing for a dovish surprise (i.e. most speculatively bullish), we like Dec 31 to 1-month IWM calls as they scan as some of the cheapest calls you will find (above, left). SPY, too, show as reasonably priced. 2-3% S&P of upside is our base case into 12/31 (SPX 6,850-7,000).

If you think the FOMC is largely a non event, but we may get a tech boost, then SPY calls/ call spreads are likely better than IWM’s as 35% of SPY is in these AI-related names. SMH/QQQ etc all seem to be carrying somewhat rich IV’s, which we speculate is related to these big tech earnings. Given that, call spreads are likely better in those tech stocks.

For downside, it of course depends on the move you are trying to play. Puts are overall pretty cheap, particularly if you are buying a short-dated tail move down in the 6,700’s, and you can do that with OTM put flies which can give you some decent downside deltas for cheap.

The “Powell breaks things” view may be best expressed with something like DEC 17th VIX 20-30 call spreads, which are currently market at 43 cents. Before you say “VIX 30 sounds crazy”, we present Dec 2024 FOMC move, which saw VIX go from 16-28. We’re not predicting a massive VIX spike out of FOMC, we are simply saying “its a possible path”, and short dated VIX call spreads may be a great risk/reward hedge, particularly if you pair it with an upside equity trade.

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

|

/ESZ25 |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$6878.42 |

$6870 |

$683 |

$25692 |

$624 |

$2521 |

$250 |

|

SG Gamma Index™: |

|

0.917 |

0.033 |

|

|

|

|

|

SG Implied 1-Day Move: |

|

0.58% |

0.58% |

|

|

|

|

|

SG Implied 5-Day Move: |

|

1.71% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

|

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

|

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$6853.42 |

$6845 |

$683 |

$25590 |

$622 |

$2480 |

$249 |

|

Absolute Gamma Strike: |

$7008.42 |

$7000 |

$680 |

$24500 |

$630 |

$2500 |

$240 |

|

Call Wall: |

$7008.42 |

$7000 |

$700 |

$26000 |

$630 |

$2600 |

$260 |

|

Put Wall: |

$6508.42 |

$6500 |

$670 |

$24000 |

$590 |

$2440 |

$240 |

|

Zero Gamma Level: |

$6787.42 |

$6779 |

$677 |

$25243 |

$618 |

$2496 |

$250 |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [7000, 6800, 6900, 6700] |

|

SPY Levels: [680, 685, 670, 700] |

|

NDX Levels: [24500, 25500, 26000, 25800] |

|

QQQ Levels: [630, 620, 625, 600] |

|

SPX Combos: [(7173,87.60), (7145,77.99), (7125,95.45), (7097,83.59), (7077,94.44), (7049,87.18), (7035,91.10), (7022,99.89), (7015,80.43), (7001,94.53), (6994,92.50), (6987,80.50), (6980,90.30), (6973,98.50), (6960,88.81), (6953,84.00), (6946,96.95), (6932,89.70), (6925,99.31), (6918,79.77), (6912,89.66), (6905,91.31), (6898,84.55), (6891,90.70), (6884,72.76), (6877,71.71), (6870,74.82), (6864,72.90), (6857,84.97), (6850,91.08), (6843,70.22), (6836,79.50), (6829,82.36), (6822,80.78), (6815,88.96), (6809,75.17), (6802,85.51), (6795,93.73), (6781,80.75), (6774,87.54), (6760,74.86), (6754,70.08), (6747,79.43), (6740,82.39), (6733,82.31), (6719,92.99), (6712,69.73), (6706,72.80), (6685,81.63), (6671,88.21), (6630,77.45), (6623,75.98), (6575,80.07), (6534,80.23)] |

|

SPY Combos: [698.72, 688.43, 693.92, 691.18] |

|

NDX Combos: [25923, 26334, 26052, 25872] |

|

QQQ Combos: [629.86, 639.87, 634.86, 632.99] |

|

|

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Gamma Tilt: |

1.084 |

1.032 |

1.407 |

1.04 |

1.077 |

0.894 |

|

Gamma Notional (MM): |

$802.96M |

$517.603M |

$16.435M |

$283.529M |

$5.883M |

‑$107.99M |

|

25 Delta Risk Reversal: |

-0.047 |

0.00 |

-0.05 |

0.00 |

-0.036 |

-0.035 |

|

Call Volume: |

645.527K |

1.482M |

9.535K |

816.642K |

13.389K |

225.859K |

|

Put Volume: |

807.147K |

1.386M |

8.296K |

835.79K |

17.87K |

471.114K |

|

Call Open Interest: |

8.768M |

5.788M |

75.658K |

4.175M |

289.366K |

3.557M |

|

Put Open Interest: |

13.881M |

11.33M |

104.721K |

6.338M |

484.171K |

8.544M |

0 comentarios