Macro Theme:

Key dates ahead:

- 12/10: FOMC

- 12/10: ORCL ER

- 12/11: AVGO ER

- 12/12: PPI

- 12/16: NFP

- 12/17 VIX Exp

- 12/18: CPI (confirmed)

- 12/19: OPEX

SG Summary:

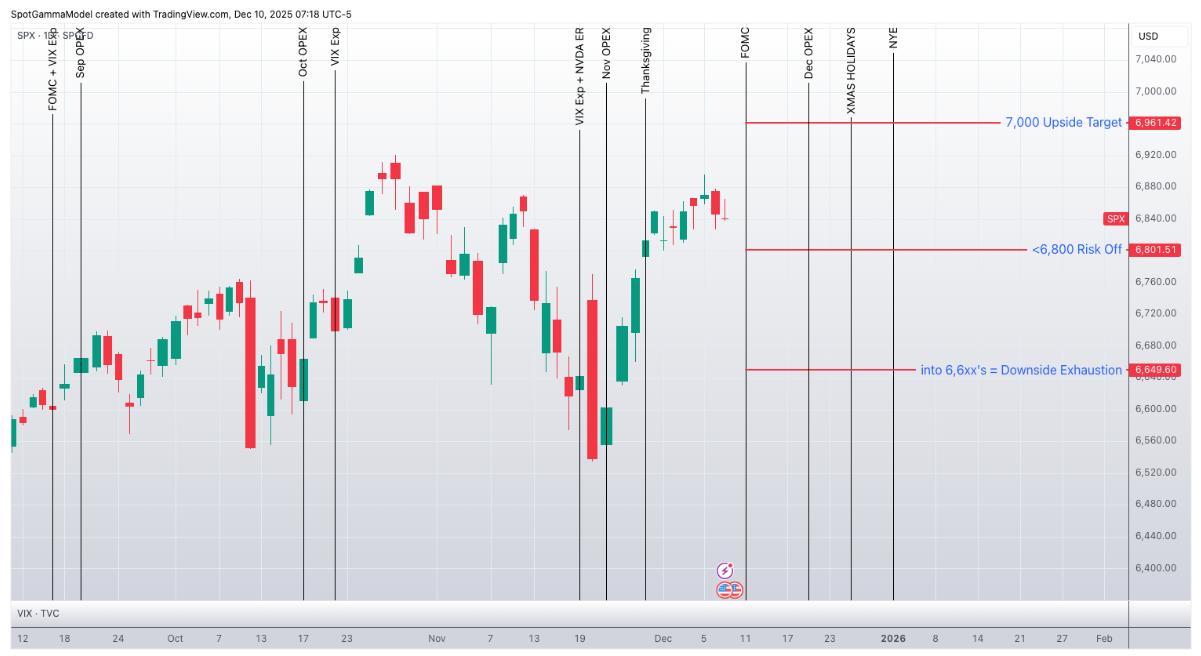

Update 12/9: FOMC 12/10 + ORCL ER 12/10 + AVOG ER 12/11 make this week the directional trigger into end-of-year. We lean to the bullish side, as the benign passing of events may allow SPX to rally, with 7,000 the major upside target. To express this view, we are evaluating trades like 12/19 call flies (more speculative), or 12/31 call flies (less speculative):

- 12/19 SPX call fly 7,000 x 7,100 x 7,200 marked at $9.2

- 12/31 7,000 x 7,100 x 7,200 marked at $13.5

We may look to pair this off with a downside hedge like:

- 12/17 exp VIX call spreads: 43 cents

Additionally, at any time should SPX break our Risk Pivot (currently <6,800), we would likely look to be directionally short of stocks.

Key SG levels for the SPX are:

- Resistance: 6,900, 6,925, 6,950

- Pivot: 6,790 (bearish <, bullish >)

- Support: 6,850, 6,820, 6,800, 6,725

Founder’s Note:

Futures are flat ahead of FOMC at 2PM ET, then ORCL ER at the close.

TLDR: <6,800 we flip to risk off. If SPX holds that level then we maintain a long-stock stance, looking for a test of SPX 7,000 into Dec OPEX (next week). 6,900 is major resistance for today. We’ve distilled everything we see in the options space into 3 simple levels in the chart below. For trade ideas: reference the “Macro Theme” and yesterday’s note.

For us in options land, FOMC is largely above vols. Today’s 0DTE straddle is $46.5/68bps IV 25% (ref 6,835). For those thinking that this FOMC is the most important thing ever, the options market, pricing in just 68bps of range, suggests otherwise.

Our base case is always that FOMCs turn out to be non-events, and vols contract (data supports this). Occasionally, like last year, vol spikes violently. This situation seems a bit unique. SPX term structure is in backwardation (bright teal line), with IV’s past 12/15 around 13%. Pretty normal. Further, you can see that the forward implied vol (FIV) suggests some IV contraction post-FOMC (yellow box) – but not much and this syncs with a fairly tight 68bps 0DTE straddle.

However, FIV is higher than the SPX term structure next week and out into Jan, and that seems tied to the big rolling econ data prints like CPI & NFP. The takeaway from this is that the FOMC is just a step function in the larger path of evaluating forward guidance. You can hear the macro guys post-FOMC saying “we need more data”.

Powell’s guidance could, of course, clear some of this up (in either dovish or hawkish ways), with the point here being that FOMC may not have this “clearing function” out in time. We are watching here for an “end of year trade” vs “start of a new, longer term trend”.

This is particularly true because ORCL & AVGO give some big semi updates tonight & tomorrow. With this in mind, FOMC/ORCL/AVGO being somewhere between non-events (which allows event-vol to contract) and bullish is likely enough to push SPX up into that 7k area by next weeks CPI/NFP/OPEX. And, quite frankly (and despite the FIV), we don’t think CPI/NFP will mean a whole lot to short term moves, anyway (as they normally don’t move markets all that much). Given this setup, we could get a pretty excited move up into 7k, and then we’d think things become more of a grid/pin around that area.

The downside is pretty clear to us: if SPX breaks <6,800, regardless of narrative, then we’d look for a test of 6,700-6,600 area into Friday. VIX in that scenario probably shifts to 25ish.

However, downside moves would feed into not only this upcoming weekend, but next weeks HUGE expirations, and then Xmas & New Years. This suggests to us that a downward spike could be initially quite violent, but then that downside could mean-revert rather quickly. So, long term violent downside is going to be tough at this juncture given the position clearing (OPEX) and time decay/momentum breaks (holidays). Given this, we’d likely look to monetize downside movement & trades rather quickly (price: ~6,700 or time: Friday’s close).

For ORCL ER, there is a big 9% implied earnings move. BuySide traders are positioned in a very clear way: short put (blue) and long call (orange). Remember, we’re showing you the dealer side of those positions in EquityHub, so puts show long and calls, short.

You see this in skew, too, with the put wing off of statistical highs while the calls are bid. We tend to look at fading prominent positions, and so *gun to head* we’d look at call flies or diagonals into earnings – something that plays that call skew cooling off.

As a quick illustration (not trading advice), this is a 1-month 1×2 (broken wing call fly) which trades for 85 cents, and projects positive PNL shortly after earnings should ORCL stay >200 and <240. We like resistance at 250 because positioning declines sharply above that strike.

Another thought on this: we’d wait for closer to the close to put on tonights earnings trades, because FOMC could move the markets, which could throw off strike selection for ORCL earnings plays.

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

|

/ESZ25 |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$6876.93 |

$6870 |

$683 |

$25692 |

$625 |

$2521 |

$251 |

|

SG Gamma Index™: |

|

1.25 |

0.024 |

|

|

|

|

|

SG Implied 1-Day Move: |

|

0.57% |

0.57% |

|

|

|

|

|

SG Implied 5-Day Move: |

|

1.71% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

|

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

|

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$6851.93 |

$6845 |

$683 |

$25490 |

$624 |

$2480 |

$249 |

|

Absolute Gamma Strike: |

$7006.93 |

$7000 |

$680 |

$24500 |

$630 |

$2500 |

$240 |

|

Call Wall: |

$7006.93 |

$7000 |

$700 |

$26000 |

$630 |

$2600 |

$260 |

|

Put Wall: |

$6506.93 |

$6500 |

$670 |

$24000 |

$590 |

$2440 |

$240 |

|

Zero Gamma Level: |

$6785.93 |

$6779 |

$681 |

$25054 |

$619 |

$2496 |

$251 |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [7000, 6900, 6800, 6700] |

|

SPY Levels: [680, 670, 700, 685] |

|

NDX Levels: [24500, 25600, 26000, 25500] |

|

QQQ Levels: [630, 620, 625, 600] |

|

SPX Combos: [(7180,87.72), (7159,76.15), (7131,95.62), (7104,83.44), (7083,95.33), (7063,70.57), (7056,89.20), (7042,92.03), (7028,99.90), (7022,81.56), (7008,95.86), (7001,93.13), (6987,94.47), (6980,98.73), (6967,87.90), (6960,82.44), (6953,98.01), (6946,67.48), (6939,90.39), (6932,99.16), (6918,85.76), (6912,90.61), (6905,83.94), (6898,89.93), (6891,69.64), (6877,91.39), (6864,79.20), (6857,78.94), (6843,84.01), (6836,86.64), (6829,81.50), (6822,86.51), (6809,79.20), (6802,94.04), (6788,81.97), (6781,88.35), (6760,77.99), (6754,76.07), (6747,71.10), (6740,80.76), (6726,91.87), (6706,72.95), (6692,82.08), (6678,89.58), (6637,74.03), (6630,78.63), (6575,77.01), (6541,78.96)] |

|

SPY Combos: [698.68, 689.11, 693.89, 691.16] |

|

NDX Combos: [25898, 26309, 26103, 26026] |

|

QQQ Combos: [629.8, 639.78, 632.92, 628.55] |

|

|

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Gamma Tilt: |

1.116 |

1.023 |

1.554 |

1.103 |

1.105 |

0.913 |

|

Gamma Notional (MM): |

$723.766M |

$219.866M |

$14.831M |

$253.899M |

$4.787M |

‑$89.403M |

|

25 Delta Risk Reversal: |

-0.049 |

0.00 |

-0.051 |

0.00 |

-0.035 |

-0.034 |

|

Call Volume: |

463.853K |

1.04M |

8.443K |

594.086K |

8.068K |

262.055K |

|

Put Volume: |

756.201K |

1.122M |

6.535K |

690.252K |

16.828K |

505.612K |

|

Call Open Interest: |

8.818M |

5.82M |

76.503K |

4.183M |

290.059K |

3.614M |

|

Put Open Interest: |

14.055M |

11.373M |

105.459K |

6.427M |

488.193K |

8.609M |

0 comentarios