Macro Theme:

Short Term SPX Resistance: 4,400 Call Wall

Short Term SPX Support: 4,300

SPX Risk Pivot Level: 4,300

Major SPX Range High/Resistance: 4,400

Major SPX Range Low/Support: 4,000

‣ Barring a major CPI miss, one has to favor a final Christmas rally out of late Nov and into the December Expiration. Assuming that the CPI is in line, we’d anticipate the equity market high being Wednesday AM 11/15, with consolidation happening into & around 11/17th (Equity OPEX). This would clear the way for a final, year end rally. 4,500 is our current upside target in that scenario, and that would adjust based on call positioning.

*updated 11/9

Founder’s Note:

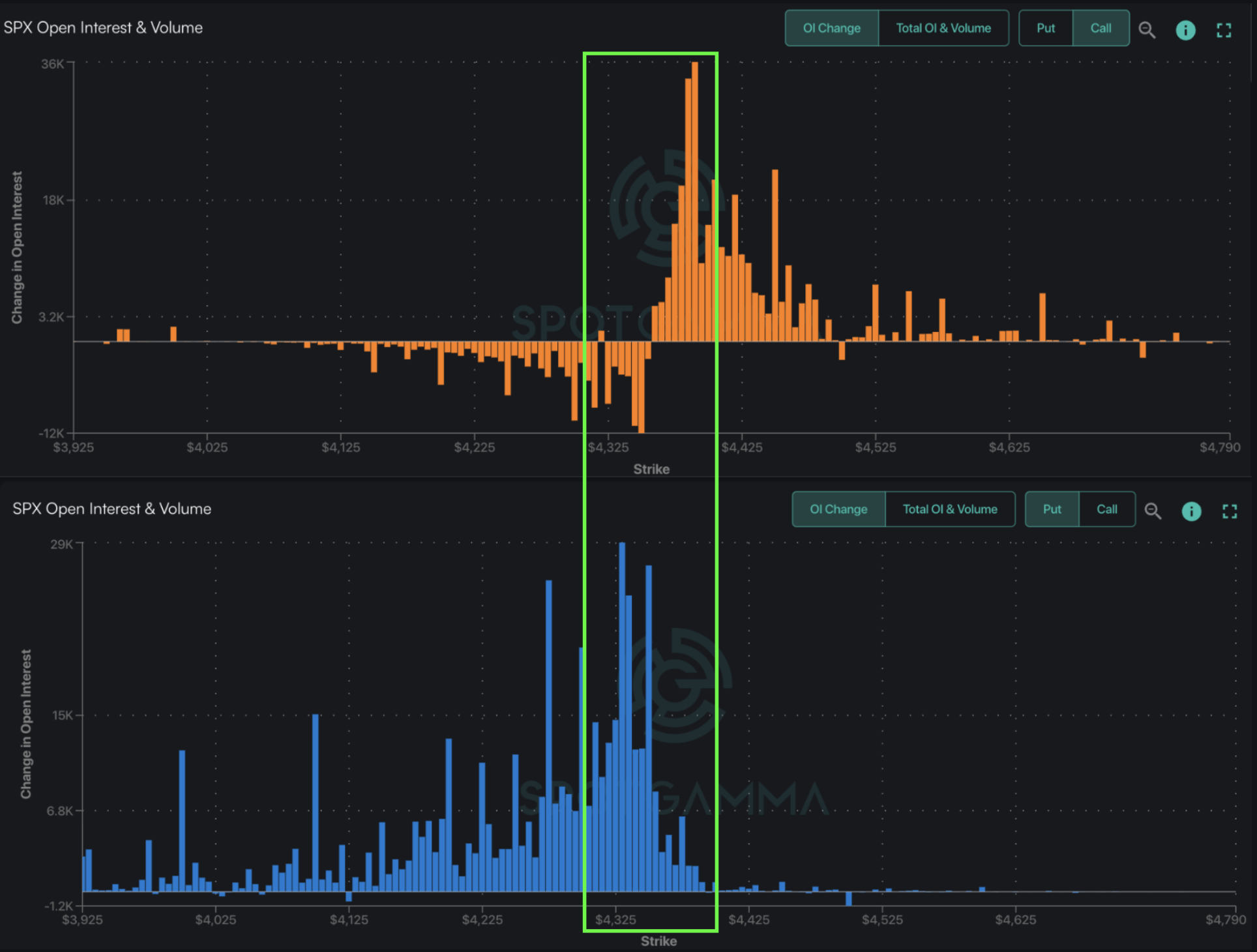

ES Futures are flat at 4,358. Key SG levels for the SPX are:

- Support: 4,330, 4,324, 4,308 & 4,300

- Resistance: 4,350, 4,360, 4,374, 4400

- 1 Day Implied Range: 0.66%

In the QQQ resistance is at 370, 372.5 & 375. Support is at 365.

Yesterdays intraday SPX move, at 1.03%, was larger than our anticipated move of 0.67%, but that is not something we think repeats again today.

As has been widely discussed, it was a nasty Treasury auction that yesterday provoked a sharp equity move lower, with Powell capping off the move one hour later. We highlight these events again this morning, as to put them in a bit more context. Below is a chart of the auction tail which shows that it was the largest 30Y tail on record. This essentially informs us that the results of the 30Y auction missed expectations by a record amount. This resulted in higher rates across the board, which pressured equity vol higher. We’d note this morning that rates have eased, with the 10Y off 5bps to 4.6%.

It also reinforces that Treasury auctions are “must watch” with the next auction on 11/13 (note you can see the upcoming auctions via the “Events Calendar” on our dashboard, using the “Low Impact” setting).

We’d offer that the market reaction to yesterdays events was muted due to supply of dealer gamma, which may have absorbed a lot of the selling. That positioning is shown in the SPY plot two images below, with very large gamma bars staggered from 430 on up to 440 (and also SPX 4,300 to 4,400). Therefore all that happened yesterday was an adjustment from the high end of our SPX range, to the middle.

Further, supportive positioning should remain either in through Tuesday and/or while the SPY/SPX is > 430/4,300. Because we model tight daily trading ranges (SG 1 Day Implied Move), we do not think a break of 4,300 is in the cards for today. However, below 430 SPY/4,300 SPX there are predominantly put positions which can be associated with higher market volatility.

0 comentarios