Macro Theme:

Key dates ahead:

- 12/16: NFP

- 12/17 VIX Exp

- 12/18: CPI

- 12/19: OPEX

- 12/24: Xmas Eve 1/2 Day

- 12/25: Xmas

SG Summary:

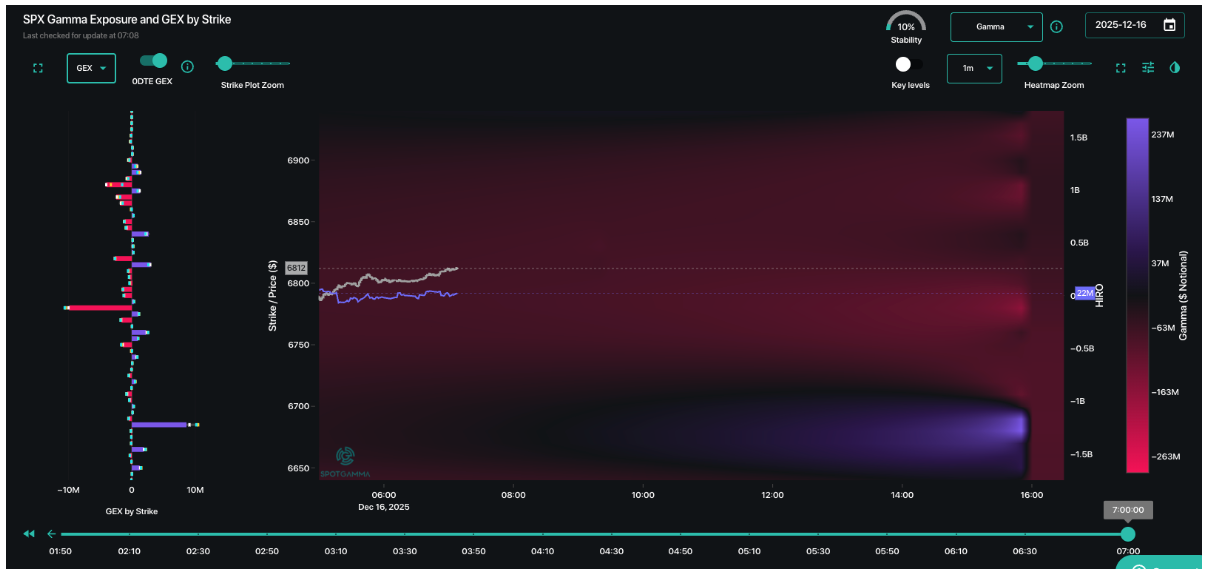

Update: 12/16: The SPX tested and held 6,800. Given this, we’ve re-adjusted the Risk Pivot to 6,790. We continue to favor holding a cheap 7k area Call Fly into end of year (>=7k strike IV’s are still 9%), as we think this window of 12/16 to 12/26 is favorable for bulls. That being said, should SPX break the Risk Pivot, we will look to enter short trades.

12/15: Should SPX 6,840 break, we will be looking to add short positions via January put spreads.

12/9: FOMC 12/10 + ORCL ER 12/10 + AVGO ER 12/11 make this week the directional trigger into end-of-year. We lean to the bullish side, as the benign passing of events may allow SPX to rally, with 7,000 the major upside target. To express this view, we are evaluating trades like 12/19 call flies (more speculative), or 12/31 call flies (less speculative):

- 12/19 SPX call fly 7,000 x 7,100 x 7,200 marked at $9.2

- 12/31 7,000 x 7,100 x 7,200 marked at $13.5

We may look to pair this off with a downside hedge like:

- 12/17 exp VIX call spreads: 43 cents

Additionally, at any time should SPX break our Risk Pivot (currently <6,800), we would likely look to be directionally short of stocks.

Key SG levels for the SPX are:

- Resistance: 6,900, 7,000

- Pivot: 6,790 (bearish <, bullish >) UPDATED 12/16

- Support: 6,800, 6,700

Founder’s Note:

Futures are off 10 bps ahead of 8:30AM NFP.

TLDR: We’re looking for a >∓1% move today, which is a unique call because the market is only pricing in 60bps. 6,900 is resistance for today, with first support at 6,800. On this point, the Risk Pivot has been re-rolled back down to 6,800, after we raised it to 6,840 yesterday. Eyeing end-of-year if we at any point break below 6,800 we look for a test of 6,700. To the upside, we still think there is a path to 7k, and we hold very cheap 12/31 call flies to play that upside wing.

Our caution yesterday was that <6,840 the market would flip to selling, and that was mildly true in that the SPX immediately slid to 6,800, but did hold then level until the overnight hours. ES did probe implied SPX 6,800 level, but subsequently rallied 50bps to SPX implied ~6815.

The 14k non-0DTE puts at 6,800 that we highlighted yesterday also remain in place (offering negative gamma to 6,700), which means that the 6,800 level is still vulnerable, but the truth is it’s also pure negative gamma (red on the map) on up to 7k. That suggests big movement, and (or however?) the SPX 0DTE straddle is pricing in on $41/60bps of movement (ref 6,815). How traders digest NFP is likely the short term trigger, but we have seasonality to dance with, too (see below).

60bps/40 handles of movement feels…insidiously low given that the SPX has not had an intraday swing of less that 58 handles since last Wed (FOMC). Ironically, while there have been big swings, the SPX is nearly flat to the pre-FOMC levels (making 5-day realized vol 0, LOL). Given the negative gamma mapped above, and the NFP data point, we don’t think today is the day that the SPX pins. Plus, VIX Expiration is tomorrow, which has produced turning points several times in recent months.

We’ll also be pretty honest here: we had a bullish lean into last week if the SPX held above 6,800, highlighting the cheap ~7k strike area call IV and holiday-induced decay and JPM 12/31 call as a reason for the market to rally. That idea has obviously been whipsawed over the last few days.

Then, we get some downside yesterday as the SPX broke below our new pivot of 6,840, only to pause at 6,800.

So, we have re-adjusted our Risk Pivot to 6,800 from 6,840 because of the fact that the market is insofar holding 6,800, and we now stare down the barrel of a time period that looks very tough to be short in.

1) We have events. Events have vol which likely contracts, which moves equities up: NFP (today), VIX Exp (tomorrow), CPI (Thurs), Massive OPEX (Friday). Obviously data misses moves vol higher, and equities lower.

2) We have holidays: Xmas Eve 1/2 Day (Wed 12/24), Xmas (Thurs 12/25). Lets be honest: who is really working Friday 12/26…

Why does all of this matter?

Look what happened last month, Nov. Granted we went into NOV OPEX with VIX ~20, which gives more energy to markets, but OPEX->Thanksgiving produced a perfect low-to-high. That looks similar to the window we have now.

Also consider last Dec. FOMC, on VIX exp day, sent the SPX -3.5%. The market subsequently bounces on Dec OPEX day, and rallies right into Christmas, stopping just below the 6,050 JPM Call strike, before retracing the final week of the year. The JPM call is currently at 7,000, which is ~2.75% from current SPX levels.

This is the conundrum, both for shorts and longs. Our gut here is long into OPEX and into Christmas, then fade that rally as the seasonality that helps bulls is gone into 2026. That being said, if SPX goes <6,800 we will be forced to ride the short bus, looking for a test of 6,700.

We’re playing this as follows: Currently we are flat, but will flip to short <6,800. We’ve also readjusted upsides to a single, low risk/high reward position: 12/31 call flies which maximize profits on a test of 7k. These calls still have an IV of 9%, which is about as cheap as they get.

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

|

/ESH26 |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$6877.02 |

$6816 |

$680 |

$25067 |

$610 |

$2530 |

$251 |

|

SG Gamma Index™: |

|

0.243 |

-0.05 |

|

|

|

|

|

SG Implied 1-Day Move: |

|

0.47% |

0.47% |

|

|

|

|

|

SG Implied 5-Day Move: |

|

1.48% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

|

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

|

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$6896.02 |

$6835 |

$680 |

$25290 |

$610 |

$2520 |

$249 |

|

Absolute Gamma Strike: |

$7061.02 |

$7000 |

$680 |

$24500 |

$600 |

$2500 |

$250 |

|

Call Wall: |

$7061.02 |

$7000 |

$690 |

$26000 |

$630 |

$2600 |

$260 |

|

Put Wall: |

$6561.02 |

$6500 |

$670 |

$24000 |

$600 |

$2490 |

$240 |

|

Zero Gamma Level: |

$6838.02 |

$6777 |

$679 |

$25003 |

$614 |

$2543 |

$251 |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [7000, 6900, 6800, 6850] |

|

SPY Levels: [680, 685, 670, 690] |

|

NDX Levels: [24500, 25000, 25200, 25500] |

|

QQQ Levels: [600, 620, 610, 615] |

|

SPX Combos: [(7151,83.13), (7123,72.80), (7103,94.15), (7076,70.23), (7048,94.29), (7028,84.70), (7007,88.93), (7001,99.77), (6987,85.37), (6980,78.10), (6973,96.66), (6966,69.05), (6960,79.31), (6953,98.85), (6939,80.44), (6932,82.52), (6926,92.68), (6919,84.54), (6912,92.84), (6898,99.03), (6891,75.17), (6878,91.11), (6871,73.71), (6857,78.27), (6851,97.36), (6837,71.29), (6810,77.79), (6803,69.64), (6782,92.84), (6776,84.92), (6769,87.05), (6762,92.44), (6748,95.22), (6742,78.69), (6728,92.64), (6721,86.16), (6707,90.49), (6701,94.44), (6687,85.68), (6673,79.35), (6660,83.69), (6653,92.87), (6632,69.40), (6612,80.28), (6598,88.88), (6578,68.10), (6551,81.90), (6510,77.32), (6503,94.88)] |

|

SPY Combos: [698.8, 689.26, 694.03, 691.3] |

|

NDX Combos: [24641, 24215, 25042, 24014] |

|

QQQ Combos: [620.98, 600.12, 590.3, 584.78] |

|

|

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Gamma Tilt: |

1.019 |

0.956 |

0.968 |

0.788 |

0.911 |

0.912 |

|

Gamma Notional (MM): |

$60.173M |

$12.223M |

‑$1.957M |

‑$425.774M |

‑$16.027M |

‑$97.96M |

|

25 Delta Risk Reversal: |

-0.049 |

0.00 |

-0.058 |

0.00 |

-0.038 |

-0.033 |

|

Call Volume: |

716.177K |

1.508M |

10.368K |

1.072M |

16.585K |

2.596M |

|

Put Volume: |

894.649K |

2.166M |

10.698K |

1.105M |

26.347K |

389.237K |

|

Call Open Interest: |

9.234M |

6.071M |

78.309K |

4.239M |

299.372K |

3.28M |

|

Put Open Interest: |

14.541M |

11.118M |

109.259K |

6.596M |

515.002K |

8.84M |

0 comentarios