Macro Theme:

Key dates ahead:

- 12/24: Xmas Eve 1/2 Day

- 12/25: Xmas

SG Summary:

Update 12/18: Risk Pivot holds at 6,800 – if that level is recovered then we think its a signal of our hereto over-talked “Xmas rally”. Above 6,800 we would look to add 12/31 6,900 area call spreads/flies. Sub 6,800 the favor remains with downside, and quite frankly there is no material positive gamma below. Further, with vol also low we are hesitant to lower the Risk Pivot (vs if there was a big fat vol risk premium & some positive gamma). For downside plays, we like Feb and/or March options which avoid a heavy time decay from the upcoming holiday period. Plus those >=60 day puts are fairly prices since put skew has been muted on this recent drawdown.

Update: 12/16: The SPX tested and held 6,800. Given this, we’ve re-adjusted the Risk Pivot to 6,790. We continue to favor holding a cheap 7k area Call Fly into end of year (>=7k strike IV’s are still 9%), as we think this window of 12/16 to 12/26 is favorable for bulls. That being said, should SPX break the Risk Pivot, we will look to enter short trades.

12/9: FOMC 12/10 + ORCL ER 12/10 + AVGO ER 12/11 make this week the directional trigger into end-of-year. We lean to the bullish side, as the benign passing of events may allow SPX to rally, with 7,000 the major upside target. To express this view, we are evaluating trades like 12/19 call flies (more speculative), or 12/31 call flies (less speculative):

12/19 SPX call fly 7,000 x 7,100 x 7,200 marked at $9.212/31 7,000 x 7,100 x 7,200 marked at $13.5

We may look to pair this off with a downside hedge like:

12/17 exp VIX call spreads: 43 cents

Key SG levels for the SPX are:

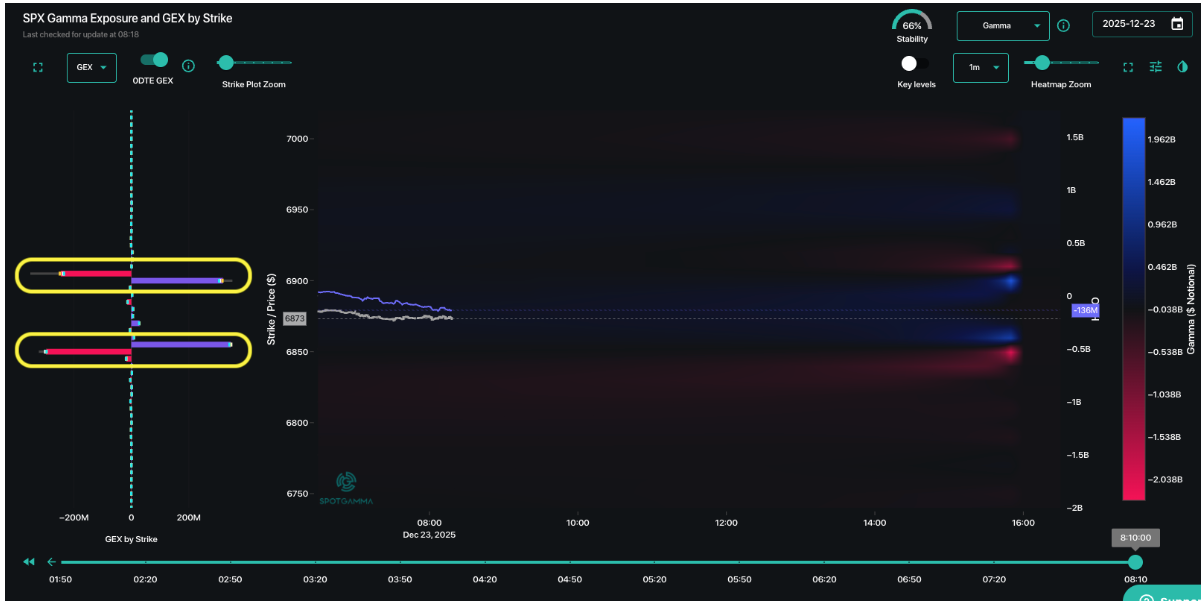

- Resistance: 6,900, 7,000

- Pivot: 6,790 (bearish <, bullish >) UPDATED 12/16

- Support: 6,850, 6,800

Founder’s Note:

Futures are flat with GDP out at 8:30AM ET.

TLDR: We continue to look for positive drift in the SPX, which is up ~2% since OPEX. Another 1-1.5% move places the SPX just under the 7k JPM strike, which would likely be a topping point. To the downside our Risk Pivot remains at 6,800, but we note that there is no material positive gamma < 6,850, and vols are smooshed to their minima. We don’t think that 2 days before Xmas is when violent selling would start, but we will be on watch for downside starting next week.

The only thing that is a likely driver today is Captain Condor, who is in with a massive 47k 0DTE position at 6,900/6,905 x 6,855, 6,850. This sets today up to be a “Seek & Destroy” mission, implying that the SPX needs to touch one side that condor. Accordingly, these levels are the big support and resistance for the day. If this trade loses today, Captain has to double down to nearly 100k for tomorrow – the shortened, Xmas Eve session. That would be a fascinating development… and one has to wonder how much Captain and his band of Condors has – can they double from 50k to 100k contracts?

Moving on, we yesterday touched on the move to crush vol into Xmas, and today we see mark the VIX touching 1-year lows of 14.05.Further we see short-dated IV’s in the mid 7’s, which is a clear sign of “maximum crush”. While there isn’t much juice left to squeeze in vol this week, its does set up for vol expansion post-Xmas and into New Years.

Lastly, on single stocks, most are now back to call weighted skews (bottom right of Compass). We note that this is not yet extreme, but it does suggest looking for upside over the next few sessions. In other words, this looks good for the “Santa Rally”, and if it was to move to more of an extreme call weighting, it could be the third leg of a nice short setup for post-Xmas (negative gamma, smashed SPX IV, overweight equity call skews).

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

|

/ESH26 |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$6931.65 |

$6878 |

$684 |

$25461 |

$619 |

$2558 |

$253 |

|

SG Gamma Index™: |

|

3.441 |

0.202 |

|

|

|

|

|

SG Implied 1-Day Move: |

|

0.67% |

0.67% |

|

|

|

|

|

SG Implied 5-Day Move: |

|

1.48% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

|

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

|

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$6908.65 |

$6855 |

$684 |

$25240 |

$618 |

$2520 |

$253 |

|

Absolute Gamma Strike: |

$7053.65 |

$7000 |

$685 |

$25500 |

$620 |

$2500 |

$250 |

|

Call Wall: |

$6953.65 |

$6900 |

$690 |

$25250 |

$620 |

$2600 |

$255 |

|

Put Wall: |

$6908.65 |

$6855 |

$670 |

$24900 |

$590 |

$2500 |

$240 |

|

Zero Gamma Level: |

$6891.65 |

$6838 |

$678 |

$25017 |

$618 |

$2552 |

$253 |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [7000, 6900, 6850, 6905] |

|

SPY Levels: [685, 684, 680, 690] |

|

NDX Levels: [25500, 25250, 25600, 26000] |

|

QQQ Levels: [620, 610, 625, 615] |

|

SPX Combos: [(7202,95.39), (7147,88.52), (7126,71.03), (7099,96.73), (7078,76.73), (7050,96.07), (7030,88.02), (7023,88.62), (7009,78.64), (7002,99.88), (6989,83.12), (6982,96.53), (6975,93.95), (6968,95.13), (6961,88.80), (6954,92.80), (6947,99.76), (6940,96.75), (6934,95.83), (6927,99.85), (6920,98.17), (6913,99.63), (6906,99.99), (6899,100.00), (6892,98.88), (6885,95.43), (6878,95.68), (6858,99.99), (6851,99.98), (6844,82.70), (6837,94.41), (6830,82.24), (6823,93.64), (6782,81.76), (6775,69.46), (6768,77.99), (6748,85.35), (6727,91.79), (6700,92.12), (6679,68.46), (6672,78.07), (6652,86.14), (6631,75.38), (6603,85.28), (6576,69.22), (6548,70.38)] |

|

SPY Combos: [683.31, 696.92, 687.4, 677.19] |

|

NDX Combos: [25513, 25538, 25691, 25487] |

|

QQQ Combos: [620.33, 612.3, 590.08, 614.77] |

|

|

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Gamma Tilt: |

1.332 |

1.176 |

1.666 |

1.049 |

0.950 |

0.930 |

|

Gamma Notional (MM): |

$1.049B |

$794.107M |

$16.684M |

$166.413M |

‑$3.043M |

‑$21.437M |

|

25 Delta Risk Reversal: |

-0.038 |

0.00 |

-0.046 |

0.00 |

0.00 |

0.00 |

|

Call Volume: |

538.29K |

1.40M |

8.764K |

821.899K |

22.137K |

321.603K |

|

Put Volume: |

798.784K |

1.633M |

9.069K |

834.262K |

25.769K |

586.77K |

|

Call Open Interest: |

6.897M |

5.309M |

54.398K |

3.482M |

191.182K |

2.795M |

|

Put Open Interest: |

11.338M |

9.243M |

73.893K |

5.268M |

348.03K |

5.898M |

0 comentarios