Macro Theme:

Key dates ahead:

- 12/24: Xmas Eve 1/2 Day

- 12/25: Xmas

SG Summary:

Update 12/18: Risk Pivot holds at 6,800 – if that level is recovered then we think it’s a signal of our previously discussed “Xmas rally”. Above 6,800 we would look to add 12/31 6,900 area call spreads/flies. Sub 6,800 the favor remains with downside, and quite frankly there is no material positive gamma below. Further, with vol also low we are hesitant to lower the Risk Pivot (vs if there was a big fat vol risk premium & some positive gamma). For downside plays, we like Feb and/or March options which avoid a heavy time decay from the upcoming holiday period. Plus those >=60 day puts are fairly priced since put skew has been muted on this recent drawdown.

Update: 12/16: The SPX tested and held 6,800. Given this, we’ve re-adjusted the Risk Pivot to 6,790. We continue to favor holding a cheap 7k area Call Fly into end of year (>=7k strike IV’s are still 9%), as we think this window of 12/16 to 12/26 is favorable for bulls. That being said, should SPX break the Risk Pivot, we will look to enter short trades.

12/9: FOMC 12/10 + ORCL ER 12/10 + AVGO ER 12/11 make this week the directional trigger into end-of-year. We lean to the bullish side, as the benign passing of events may allow SPX to rally, with 7,000 the major upside target. To express this view, we are evaluating trades like 12/19 call flies (more speculative), or 12/31 call flies (less speculative):

12/19 SPX call fly 7,000 x 7,100 x 7,200 marked at $9.212/31 7,000 x 7,100 x 7,200 marked at $13.5

We may look to pair this off with a downside hedge like:

12/17 exp VIX call spreads: 43 cents

Key SG levels for the SPX are:

- Resistance: 6,900, 7,000

- Pivot: 6,790 (bearish <, bullish >) UPDATED 12/16

- Support: 6,850, 6,800

Founder’s Note:

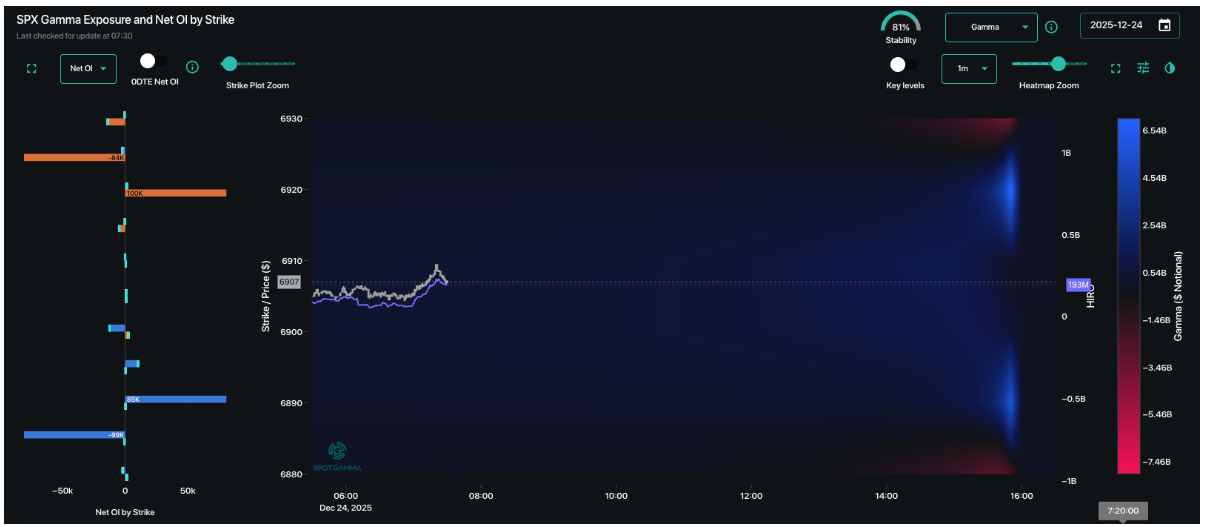

Merry Christmas to those that celebrate. ES held a 10bps band overnight – which we speculate could be some type of record-low. Why so tight into today’s early close session (1PM ET)?

Thanks to this fascinating setup:

Captain Condor has today a massive 90k 0DTE Condor – this is double the size of the largest we’ve ever seen. The trade printed last night for lowly $1.45, meaning Captain & his crew have $31.95mm at risk for today’s shortened holiday session. Not only that, the spread is at 6,920/6,925 x 6,990/6,985 – so those center strikes are only 30 handles/43bps wide. That has to be uncomfortable.

It also highlights one core problem with the Condors martingale strategy: he has to double down after losing, and the whole world knows you’re coming. The result? Dealers drop their prices, given Captain’s strategy a pittance in premium to sell. So he has to bring in his strike range to try and get out of debt.

Second is the convexity of losses, wherein the numbers get big…fast. Lets recap the positions leading to today. These are rough position estimates, which assume he sold spreads for $2 and therefore has $3 of risk (its likely they sold spreads in the $1.5-1.75 range).

12/21: ~8k contracts, -$2.4mm losses

12/22: ~19k, -$5.7mm

12/23: ~45k, -$13.5mm

That’s roughly $21.6mm in losses, before putting on the $31mm in risk today. Yikes!

What does this mean for our trading?

When we did our Captain study earlier this year, our one surprising takeaway was that volatility tends to expand the day after Captain’s large trades (>10k) went out of the market. In this case we have Xmas tomorrow, and only 1 day of trade before the weekend, and so we hesitate to trade on that idea. However…

These vols are about as low as I have ever seen. That’s not hyperbole. For Friday and Monday there are IV’s in the 4%’s!

4!

It makes some sense, given the unreal 90k lot from Captain, plus the holiday + JPM sitting at 7k for 12/31. We just have to buy some options at these IVs, and so we will look to add some lotto straddles or strangles for Friday and/or Monday. We also like entering these trades today just in case Captain’s trade causes some type of disturbance in the force today. We can’t articulate why it would, but the size is unreal, and its a 1/2 session. As a great trader once told us: sometimes you just buy options because they are cheap.

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

| /ESH26 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6961.43 | $6909 | $687 | $25587 | $622 | $2541 | $252 |

| SG Gamma Index™: |

| 6.499 | 0.321 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.73% | 0.73% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.48% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: |

| After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6947.43 | $6895 | $687 | $25020 | $621 | $2525 | $251 |

| Absolute Gamma Strike: | $6972.43 | $6920 | $690 | $25500 | $620 | $2500 | $250 |

| Call Wall: | $6972.43 | $6920 | $690 | $25250 | $625 | $2530 | $260 |

| Put Wall: | $6942.43 | $6890 | $680 | $24900 | $590 | $2500 | $240 |

| Zero Gamma Level: | $6921.43 | $6869 | $681 | $25141 | $621 | $2554 | $251 |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6920, 6925, 7000, 6890] |

| SPY Levels: [690, 687, 688, 689] |

| NDX Levels: [25500, 25600, 25250, 25700] |

| QQQ Levels: [620, 621, 625, 622] |

| SPX Combos: [(7248,89.12), (7200,96.65), (7152,90.50), (7124,77.57), (7103,97.59), (7076,77.02), (7048,97.30), (7034,90.09), (7027,88.44), (7020,78.23), (7013,88.76), (7007,68.37), (7000,99.95), (6993,94.02), (6986,83.45), (6979,98.32), (6972,99.72), (6965,87.90), (6958,99.29), (6951,99.93), (6944,96.62), (6937,99.72), (6931,99.97), (6924,100.00), (6917,100.00), (6910,99.11), (6903,99.28), (6896,99.71), (6889,100.00), (6882,100.00), (6868,75.07), (6861,74.77), (6841,79.85), (6834,92.28), (6827,92.66), (6779,70.33), (6772,77.62), (6751,83.34), (6730,78.66), (6723,82.36), (6702,93.02), (6682,68.00), (6647,83.95), (6626,76.73), (6599,82.97), (6578,74.33)] |

| SPY Combos: [686.84, 687.53, 682.74, 682.05] |

| NDX Combos: [25690, 25588, 25255, 25793] |

| QQQ Combos: [620.39, 621.01, 624.72, 619.77] |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.448 | 1.236 | 1.951 | 1.053 | 0.828 | 0.862 |

| Gamma Notional (MM): | $2.386B | $1.325B | $25.193M | $280.499M | ‑$23.107M | ‑$174.818M |

| 25 Delta Risk Reversal: | -0.036 | 0.00 | -0.045 | 0.00 | 0.00 | 0.00 |

| Call Volume: | 652.005K | 1.304M | 8.05K | 747.469K | 13.218K | 239.022K |

| Put Volume: | 820.535K | 1.786M | 6.792K | 866.746K | 39.159K | 414.427K |

| Call Open Interest: | 7.128M | 5.391M | 55.52K | 3.491M | 193.90K | 2.823M |

| Put Open Interest: | 11.679M | 9.629M | 74.299K | 5.339M | 358.42K | 5.941M |

0 comentarios