Macro Theme:

Key dates ahead:

- 2/26: Jobless Claims, INTU, CRWV ER

- 2/27: Core PPI

SG Summary:

Update 2/20: We’ve moved our Risk Pivot to 6,800. This is because of the strong stats from 2/20 AM Note, which all point to a bullish bounce next week. We quite frankly feel like something nefarious is afoot, but feelings aren’t valid. Sub 6,800 we will very quickly flip to neutral and/or bearish of stocks.

2/17: We are on high alert that Wed VIX expiration – Friday’s OPEX opens a window of weakness that may finally allow SPX vols to match the high vols seen in single stocks. A break of SPX <6,800 is our “high risk” signal.

Key SG levels for the SPX are:

- Resistance: 6,950, 7,000

- Pivot: 6,900 (bearish <, bullish >) NEW Updated 2/26

- Support: 6,890, 6,800

Founder’s Note:

Futures are flat, with NVDA up 50bps after earnings last night.

CRM: -3%

ZM: -3%

Risk Pivot raised to 6,900 from 6,800.

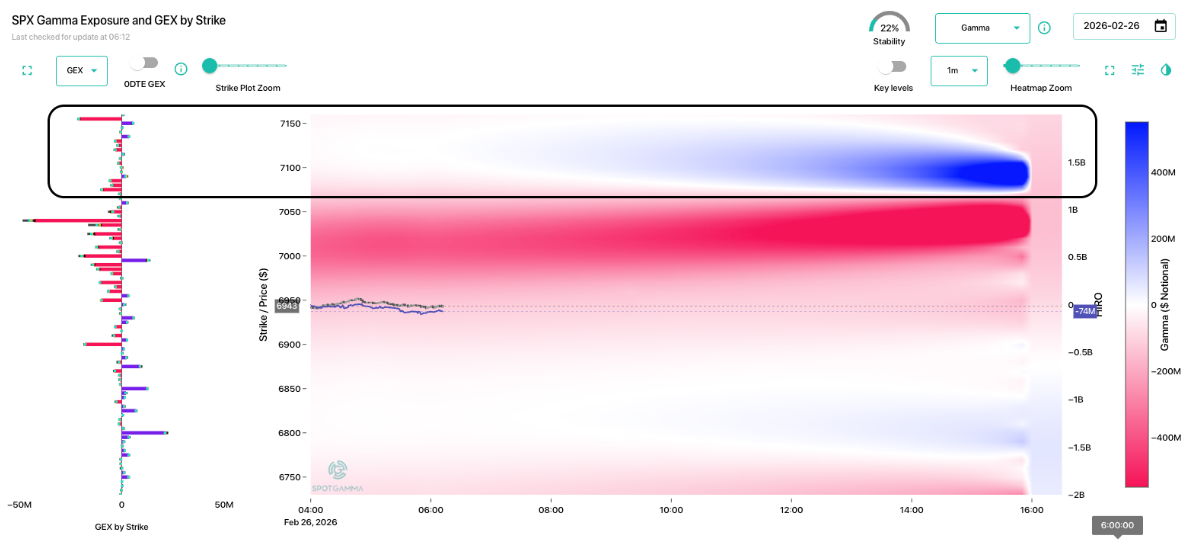

The big development in options land is the removal of positive gamma that has been persistent in the 6,950 to 7,000 strike zone. The only positive gamma now present is up near ~7,100, and even that is pretty mild. Further we see a chunky 20k OI negative gamma strikes – these are 0DTE long buyside bets (MM short). The implication is that there is no lid on this SPX at the moment, but we’d imagine that any upside test of 7k is met with call shorting.

To the downside it’s negative gamma down into 6,800, but we’d note that we haven’t seen much positive gamma below for some time.

Overall this looks pretty bullish, and as long as SPX is >6,900 we won’t argue against that.

Looking at the volatility space, we see vols lightening up, which backs the bullish sentiment. Below is 3/27 exp skew from Monday (gray) vs today (teal), and you can see a decent 1 vol point decline. That’s not going to show up on the morning news, but its a sign that bulls have a tailwind.

We pointed out on X yesterday that the “most viral blog post of all time” may have marked a major low in software stocks. We of course are not CMTs, but this has been “support” for the IGV (software ETF) over the last year (red line). It would just be an amazing thing for everyone to freak out about something at the absolute low – that hasn’t happened before…has it?

If you look at the software vols, we obviously still see some very high IV Ranks, but those should come down today now that some earnings have passed. We’d argue lower IVs in this space generate a bullish tailwind, and we also see some movement from left (put-heavy) to right, towards calls. IGV doesn’t have the most consistent vol surface, but you can see the 3-day history via the Compass line.

On this topic we made a point of calling out the CRM ultra-high IV play into earnings yesterday, and it may be worth playing similar short volatility trades in INTU (+80 IV Rank, 7.8% est move). CRWV has a 14% implied ER move, but the IV Rank there is only 50. Here is a rough framework for looking at these trades.

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

|

/ESH26 |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$6958.27 |

$6946 |

$693 |

$25329 |

$616 |

$2663 |

$264 |

|

SG Gamma Index™: |

|

2.241 |

-0.242 |

|

|

|

|

|

SG Implied 1-Day Move: |

|

0.62% |

0.62% |

|

|

|

|

|

SG Implied 5-Day Move: |

|

1.47% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

|

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

|

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$6907.27 |

$6895 |

$692 |

$25010 |

$616 |

$2640 |

$264 |

|

Absolute Gamma Strike: |

$7012.27 |

$7000 |

$690 |

$25075 |

$620 |

$2700 |

$265 |

|

Call Wall: |

$7012.27 |

$7000 |

$700 |

$25075 |

$625 |

$2700 |

$270 |

|

Put Wall: |

$6812.27 |

$6800 |

$690 |

$24000 |

$600 |

$2550 |

$257 |

|

Zero Gamma Level: |

$6917.27 |

$6905 |

$691 |

$24887 |

$615 |

$2657 |

$268 |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [7000, 6900, 6950, 6000] |

|

SPY Levels: [690, 700, 685, 695] |

|

NDX Levels: [25075, 26000, 25000, 25500] |

|

QQQ Levels: [620, 610, 600, 625] |

|

SPX Combos: [(7273,74.10), (7252,90.99), (7224,76.01), (7203,97.40), (7196,71.09), (7175,72.97), (7168,71.30), (7155,92.69), (7148,96.30), (7127,88.43), (7113,80.20), (7099,98.87), (7092,80.84), (7078,95.39), (7071,74.90), (7064,74.27), (7057,93.84), (7050,99.42), (7043,98.45), (7036,94.81), (7029,95.59), (7023,99.25), (7016,96.12), (7009,98.16), (7002,99.86), (6995,94.27), (6988,97.78), (6981,88.23), (6974,96.57), (6967,95.77), (6960,78.74), (6953,96.78), (6918,87.38), (6891,71.31), (6884,66.41), (6877,92.74), (6863,86.49), (6849,88.41), (6842,83.42), (6835,69.40), (6828,91.08), (6814,87.02), (6807,74.79), (6800,97.50), (6793,83.30), (6772,89.98), (6766,89.58), (6759,74.17), (6752,89.68), (6738,76.08), (6724,81.45), (6717,85.09), (6703,97.09), (6675,66.94), (6661,76.46), (6647,87.27), (6627,77.82), (6613,77.58)] |

|

SPY Combos: [678.41, 668.1, 707.97, 713.47] |

|

NDX Combos: [24645, 25076, 25684, 24240] |

|

QQQ Combos: [599.97, 610.3, 590.24, 579.91] |

|

|

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Gamma Tilt: |

1.225 |

0.800 |

1.506 |

0.932 |

0.987 |

0.610 |

|

Gamma Notional (MM): |

$640.179M |

‑$532.203M |

$12.035M |

‑$34.798M |

$773.273K |

‑$489.003M |

|

25 Delta Risk Reversal: |

-0.068 |

-0.064 |

-0.081 |

-0.076 |

-0.061 |

-0.057 |

|

Call Volume: |

852.326K |

1.057M |

10.88K |

837.881K |

15.607K |

226.248K |

|

Put Volume: |

966.991K |

2.39M |

10.778K |

992.378K |

25.042K |

519.132K |

|

Call Open Interest: |

7.882M |

5.046M |

64.401K |

3.559M |

242.997K |

2.762M |

|

Put Open Interest: |

12.348M |

10.894M |

92.224K |

5.822M |

423.126K |

6.807M |

0 comentarios