Macro Theme:

Short Term SPX Resistance: 4,900

Short Term SPX Support: 4,850

SPX Risk Pivot Level: 4,800

Major SPX Range High/Resistance: 5,000 Call Wall

Major SPX Range Low/Support: 4,800

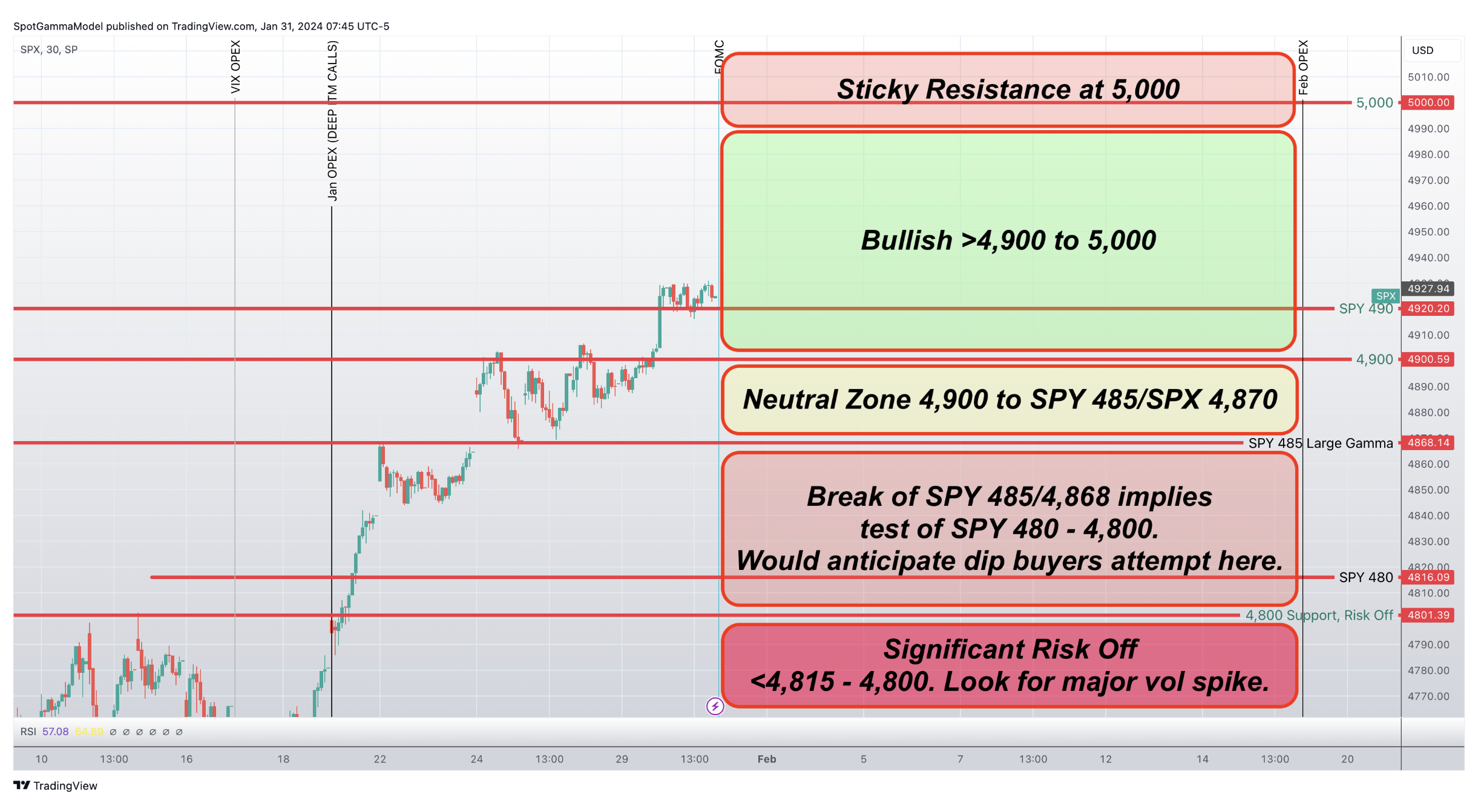

‣ We look for a sharp directional move post-FOMC & into 2/16 expiration, with 5,000 the key upside strike. Major downside “risk-off” occurs on a break of 4,800, which is our first major support.*

*updated 2/1

Founder’s Note:

ES Futures are up 40bps to 4,890. NQ futures are up 60bps to 17,343.

Key SG levels for the SPX are:

- Support: 4,850, 4,817, 4,800

- Resistance: 4,868, 4,900, 4,920

- 1 Day Implied Range: 0.83%

For QQQ:

- Support: 415, 410

- Resistance: 422, 425

Call Wall

IWM:

- Support: 190

- Resistance: 196, 200

Call Wall

Earnings: ‣ Thursday, Feb 01 (PM): AMZN, AAPL, and META

TLDR: We are unchanged from the map we laid out yesterday. Equity sellers came out, but volatility buyers did not. This suggests the reflexive stock dip buyers/equity vol sellers are now taking a shot. For today, 4,900 area is overhead resistance, with SPY 480 major support. Looking ahead, if we break 4,800 then the vol buyers likely step up, leading to a jump in equity downside. Conversely, a close over 4,900 re-engages the bulls, with 5,000 the major overhead target. Huge tech earnings tonight + NFP tomorrow should force a larger directional break into Feb OPEX.

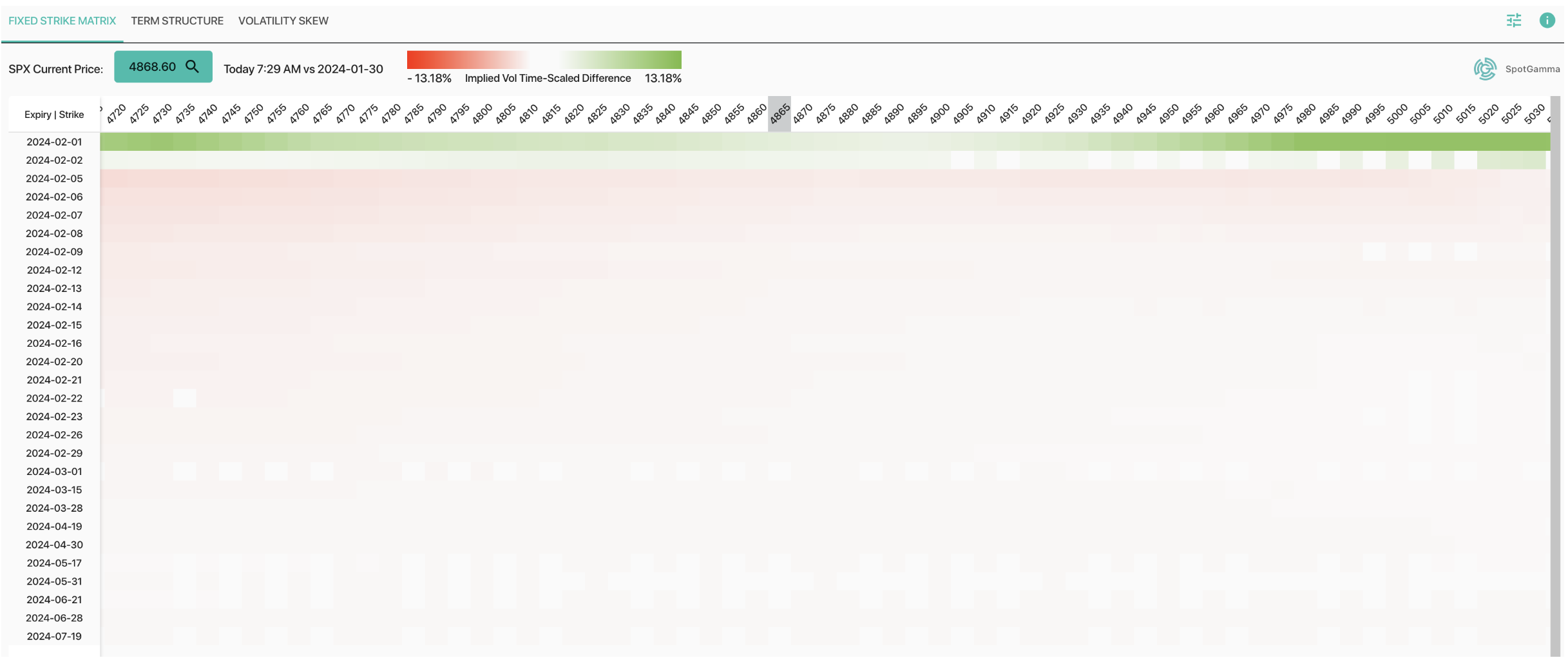

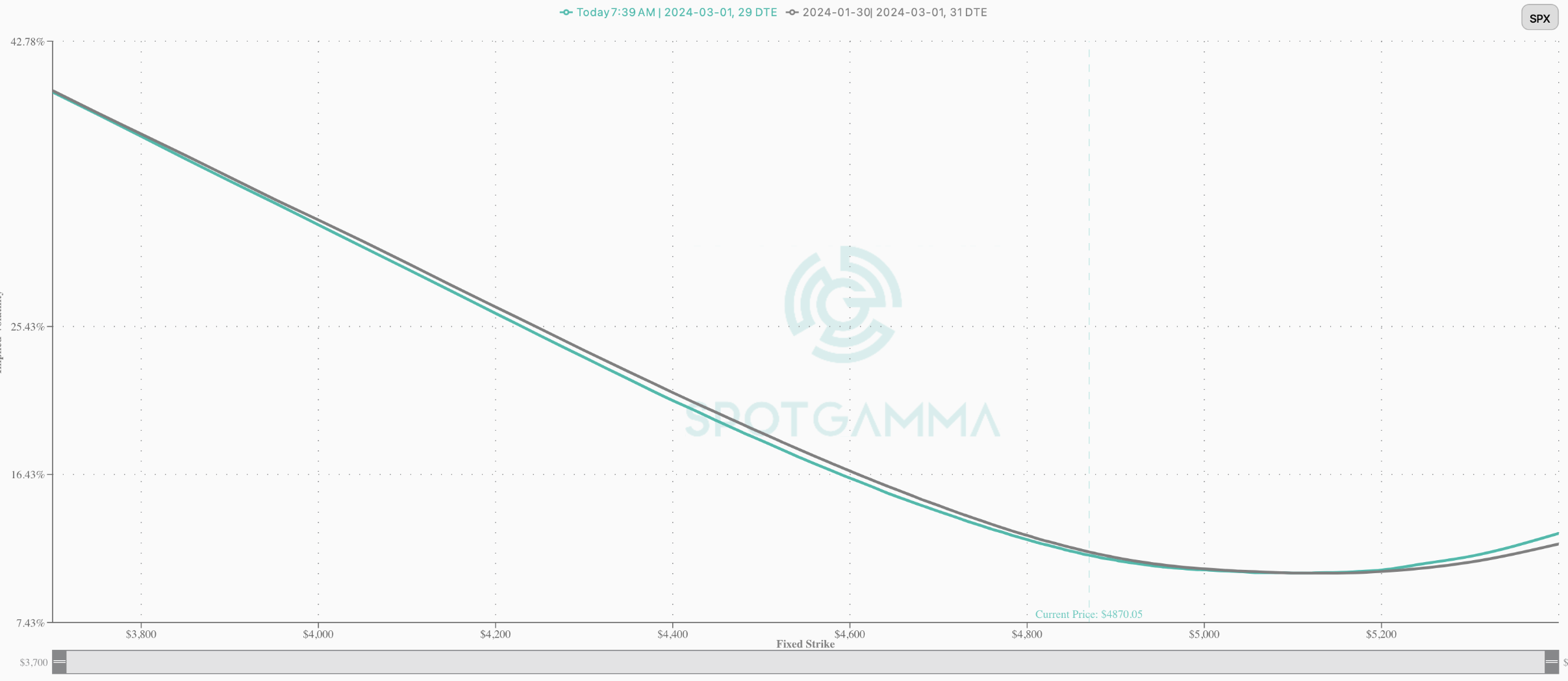

Yesterday brought some sharp weakness to equities, but by and large options implied volatility did not move. As evidence of this, we show fixed strike volatility for this morning compared to the close of trading on 1/30, when the SPX was up above 4,900. As you can see, for all expirations past this week the matrix is a shade of red which informs us that IV is down. What you would expect to see are shades of green, particularly for downside strikes, as traders buy put options for downside protection. This lack of volatility bid removes a key driver of equity downside.

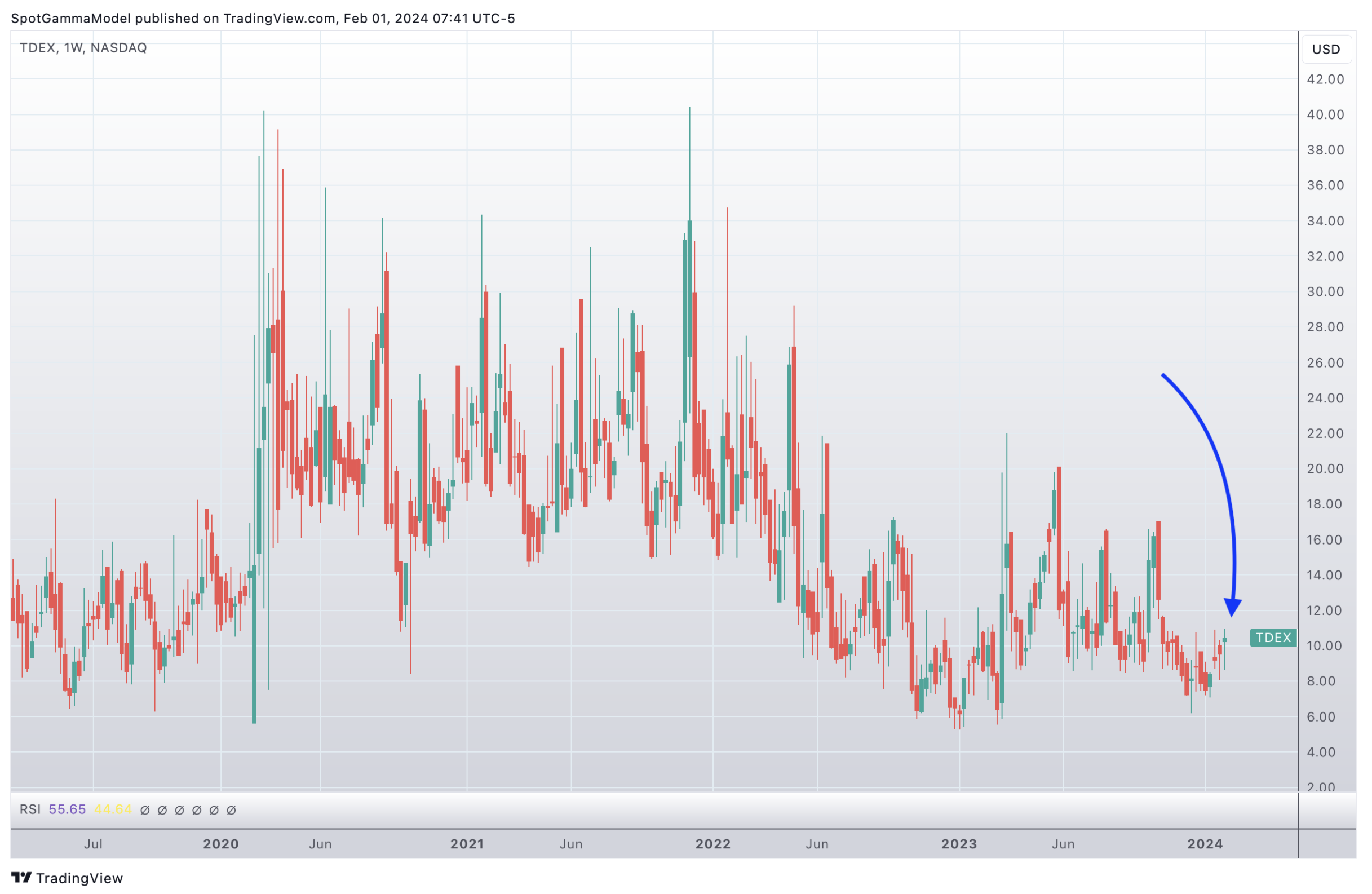

As we pointed out in last nights note, the really wingy strikes did catch a mild bid, and we flagged the jump in the TDEX index, which measures TDEX measures the relative price of 1-month, deep OTM puts (3 STD DEV).

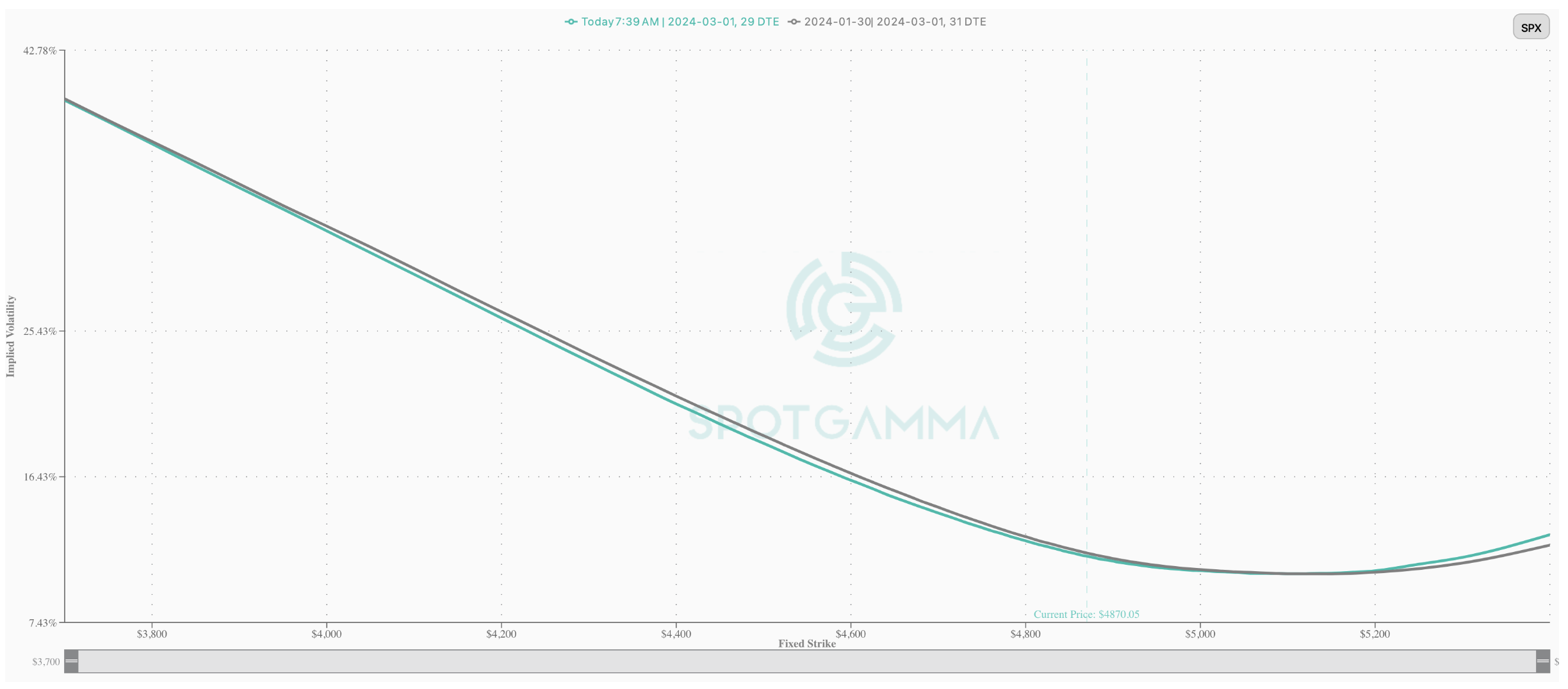

If we zoom in on the 1 month skew, we see that, on a fixed strike basis, IV today (green line) is down from 1/30 (gray line). This is not the volatility bid that bears are looking for, but one would assume that after months of dip-buying/vol selling, that many traders would attempt the same into this weakness.

With that, we continue to follow the map laid out in yesterday’s AM note. Futures are indicating a kick-save back into our neutral zone >SPY 485, but should SPY break back below 485 this AM, we suspect the test of 480 will be completed. We think its unlikely the SPX regains 4,900 today, but should that happen overnight with solid tech earnings then we could see a quick final push to 5,000.

| SpotGamma Proprietary Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Reference Price: | $4845 | $482 | $17137 | $416 | $1947 | $192 |

| SpotGamma Implied 1-Day Move: | 0.83% | 0.83% |

|

|

|

|

| SpotGamma Implied 5-Day Move: | 2.06% |

|

|

|

|

|

| SpotGamma Volatility Trigger™: | $4855 | $486 | $16970 | $422 | $1915 | $196 |

| Absolute Gamma Strike: | $5000 | $480 | $17100 | $415 | $2000 | $190 |

| SpotGamma Call Wall: | $5000 | $495 | $17100 | $424 | $1920 | $200 |

| SpotGamma Put Wall: | $4775 | $480 | $17070 | $415 | $1800 | $190 |

| Additional Key Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Zero Gamma Level: | $4817 | $485 | $16462 | $425 | $2002 | $198 |

| Gamma Tilt: | 1.025 | 0.658 | 1.696 | 0.623 | 0.793 | 0.596 |

| SpotGamma Gamma Index™: | 0.174 | -0.43 | 0.078 | -0.249 | -0.018 | -0.098 |

| Gamma Notional (MM): | ‑$93.171M | ‑$1.506B | $6.988M | ‑$1.042B | ‑$17.151M | ‑$913.60M |

| 25 Delta Risk Reversal: | -0.03 | -0.016 | -0.017 | -0.017 | -0.022 | 0.002 |

| Call Volume: | 623.684K | 2.375M | 15.171K | 1.183M | 16.586K | 789.959K |

| Put Volume: | 1.054M | 2.945M | 16.057K | 1.892M | 33.20K | 964.617K |

| Call Open Interest: | 6.434M | 6.368M | 51.244K | 3.842M | 236.681K | 4.428M |

| Put Open Interest: | 12.614M | 13.913M | 65.098K | 7.751M | 425.072K | 8.041M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5000, 4800, 4900, 4850] |

| SPY Levels: [480, 482, 485, 490] |

| NDX Levels: [17100, 17000, 17600, 17625] |

| QQQ Levels: [415, 410, 420, 417] |

| SPX Combos: [(5073,75.08), (5049,91.46), (5025,86.11), (5015,93.90), (5001,99.27), (4976,91.51), (4972,77.35), (4967,84.01), (4962,73.72), (4957,77.60), (4952,97.95), (4947,76.74), (4938,76.37), (4928,76.90), (4923,91.29), (4918,87.10), (4909,88.17), (4899,98.78), (4875,83.20), (4865,74.90), (4855,76.81), (4846,90.78), (4841,89.96), (4836,93.82), (4831,75.19), (4826,89.75), (4821,75.65), (4817,95.36), (4807,79.19), (4802,92.07), (4797,83.97), (4792,75.19), (4788,71.62), (4778,79.43), (4773,94.19), (4768,79.24), (4758,80.07), (4749,86.19), (4744,73.47), (4725,83.38), (4715,76.34), (4700,88.34), (4676,71.54), (4652,92.17)] |

| SPY Combos: [491.7, 482.01, 486.85, 484.43] |

| NDX Combos: [17052, 17103, 17137, 16846] |

| QQQ Combos: [412.02, 425.92, 411.18, 401.07] |

0 comentarios