Macro Theme:

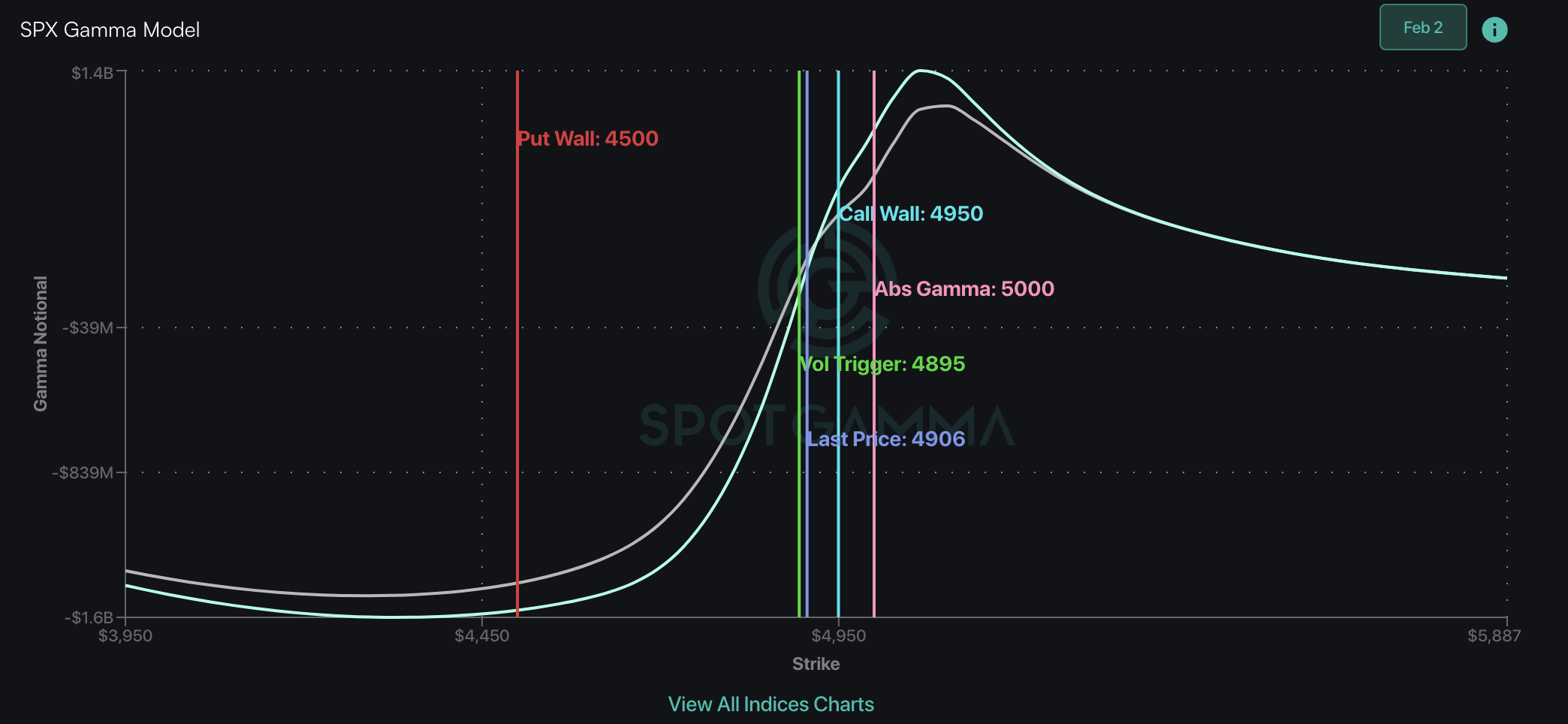

Short Term SPX Resistance: 5,000

Short Term SPX Support: 4,900

SPX Risk Pivot Level: 4,800

Major SPX Range High/Resistance: 5,000

Major SPX Range Low/Support: 4,800

‣ We look for a sharp directional move post-FOMC & into 2/16 expiration, with 5,000 the key upside strike. Major downside “risk-off” occurs on a break of 4,800, which is our first major support.*

*updated 2/1

Founder’s Note:

ES Futures are up 65bps to 4,960. NQ futures are up 107bps to 17,622.

Key SG levels for the SPX are:

- Support: 4,900, 4,817, 4,800

- Resistance: 4,950, 4,965, 4,975, 5,000

- 1 Day Implied Range: 0.65%

For QQQ:

- Support: 420, 415

- Resistance: 430, 440

Call Wall

IWM:

- Support: 190

- Resistance: 196, 200

Call Wall

Major Post ER Moves: AMZN +7%, AAPL -2.6%, and META +17%!

Traders are watching NFP today at 8:30AM ET.

Today we see a futures reaction to new highs, led my a massive bullish earnings response in 2/3 Mag 7 names (AMZN, META). While traders are watching the 8:30AM ET NFP very closely, we’d posit that as long as its not some type of tail print, equities Indexes are set to pounce even higher.

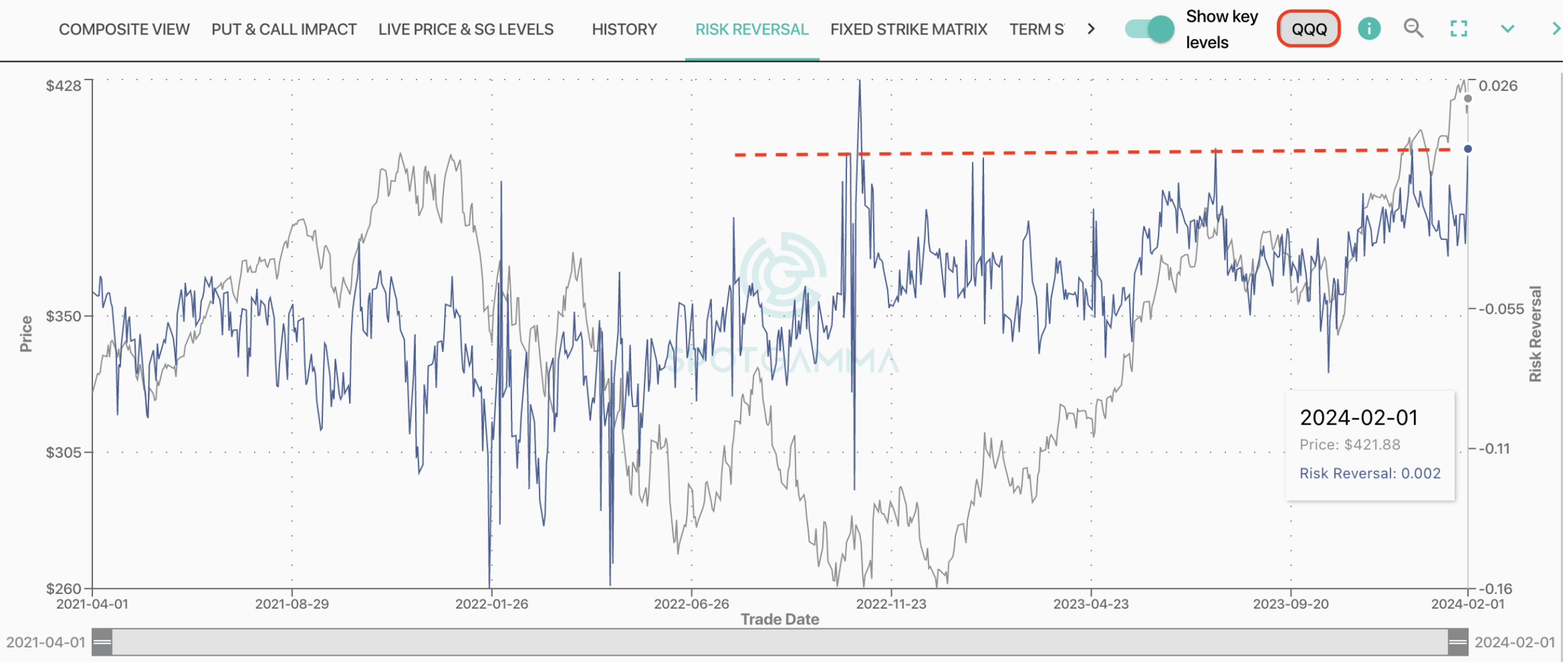

For that, we present exhibit one, our QQQ Risk Reversal.

As you can see, this metric is at 1 year highs, only bested by some major dip-buying in Oct of 2022 (when the QQQ was at multi-year lows). This signals that traders have bid up calls more than relative puts – something that is pretty rare for major equity indices. This has the appearance of a frothy, aggressive long call position, which means dealers may have to chase to the upside. With that we also saw the QQQ

Call Wall

roll to 440 overnight.

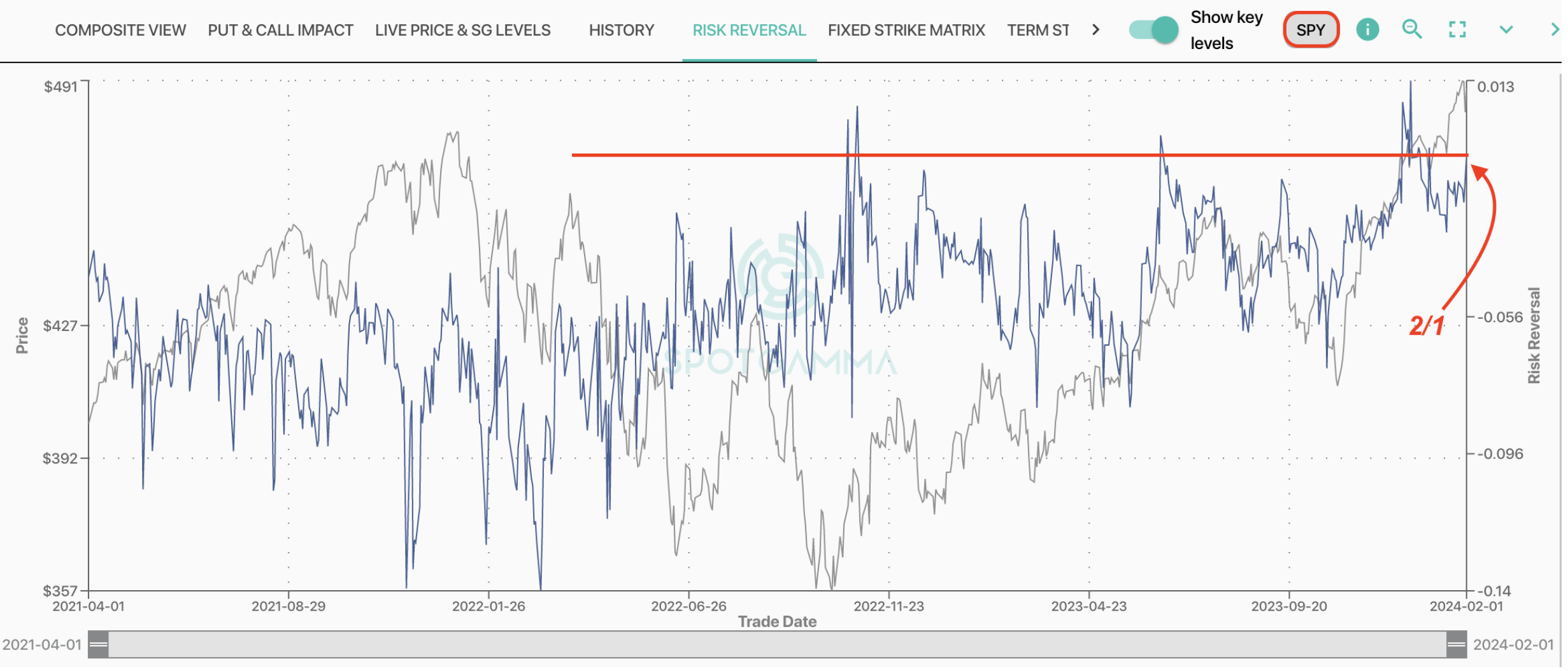

A similar position exists in the SPY, too.

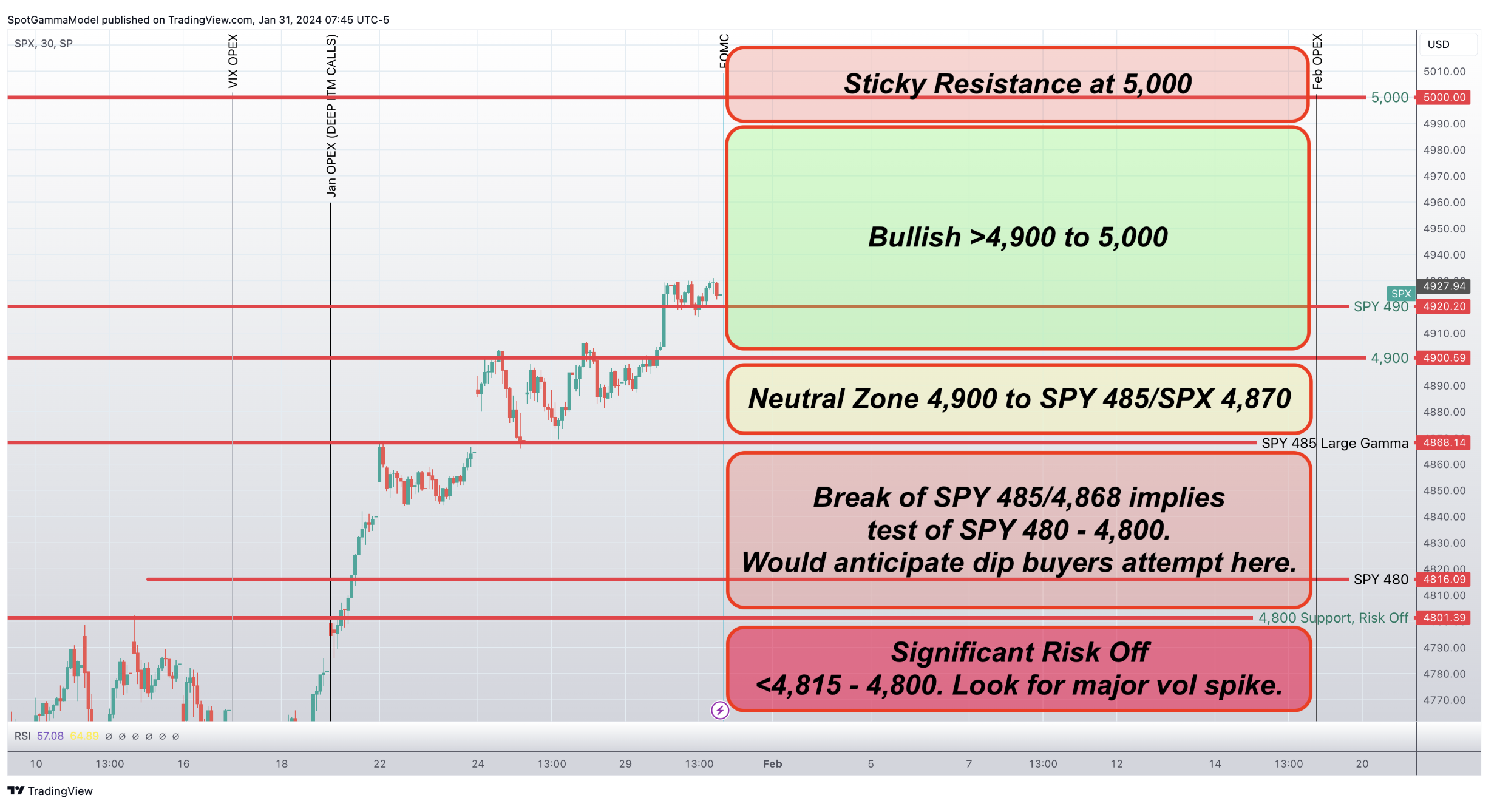

On Wednesday we posted the map below, with those major landmarks of 5,000 to the upside and 4,800 to the downside. While that 5,000 strike seemed improbably yesterday, it feels more tangible today and that is due to this “spot up, vol up” market. Things can move more than you expect, particularly to the upside.

And, if you consider what happened post-Powell, it was “spot down, vol down”. We had to break 4,800 to get the normal “spot down, vol up” (i.e. SPX declines and IV goes up), which would be driven by covering of the heretofore successful volatility short/put selling flows.

The takeaway here is that this we need to watch for sneaky extended upside into that big 5,000 strike, with QQQ arguably poised to continue upside outpeformance. The downside support area will remain that SPY487 area, and a retreat to that level likely removes this “spot up, vol up” dynamic.

| SpotGamma Proprietary Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Reference Price: | $4906 | $492 | $17344 | $421 | $1974 | $195 |

| SpotGamma Implied 1-Day Move: | 0.65% | 1.00% |

|

|

|

|

| SpotGamma Implied 5-Day Move: | 2.06% |

|

|

|

|

|

| SpotGamma Volatility Trigger™: | $4895 | $488 | $17080 | $423 | $1915 | $194 |

| Absolute Gamma Strike: | $5000 | $487 | $17100 | $420 | $2000 | $195 |

| SpotGamma Call Wall: | $4950 | $495 | $17100 | $440 | $1920 | $200 |

| SpotGamma Put Wall: | $4500 | $482 | $17070 | $420 | $1800 | $190 |

| Additional Key Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Zero Gamma Level: | $4877 | $488 | $16536 | $427 | $1999 | $196 |

| Gamma Tilt: | 1.233 | 0.993 | 1.78 | 0.733 | 0.875 | 0.874 |

| SpotGamma Gamma Index™: | 1.472 | -0.007 | 0.084 | -0.171 | -0.011 | -0.027 |

| Gamma Notional (MM): | $283.818M | $658.587M | $7.406M | ‑$973.194M | ‑$7.692M | ‑$289.015M |

| 25 Delta Risk Reversal: | -0.014 | -0.009 | 0.00 | 0.002 | -0.029 | -0.027 |

| Call Volume: | 613.339K | 2.384M | 7.227K | 1.197M | 19.759K | 734.691K |

| Put Volume: | 969.728K | 3.092M | 10.297K | 1.575M | 30.181K | 1.186M |

| Call Open Interest: | 6.534M | 6.494M | 51.864K | 4.176M | 241.63K | 4.545M |

| Put Open Interest: | 12.789M | 14.387M | 65.67K | 8.214M | 433.624K | 8.204M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5000, 4900, 4800, 4850] |

| SPY Levels: [487, 490, 489, 480] |

| NDX Levels: [17100, 17000, 17600, 17625] |

| QQQ Levels: [420, 422, 415, 424] |

| SPX Combos: [(5117,73.83), (5102,98.10), (5073,85.16), (5048,95.12), (5024,92.20), (5014,96.79), (4999,99.14), (4990,82.20), (4985,83.01), (4980,80.31), (4975,97.10), (4970,89.86), (4965,94.85), (4960,89.18), (4955,90.52), (4950,99.40), (4945,95.54), (4941,91.63), (4936,90.28), (4931,82.21), (4926,96.55), (4916,86.00), (4911,74.16), (4901,86.05), (4896,86.69), (4887,81.29), (4882,82.50), (4872,85.76), (4867,83.39), (4862,77.30), (4833,85.65), (4823,73.02), (4813,78.65), (4798,76.33), (4774,85.68), (4715,74.88), (4700,75.32)] |

| SPY Combos: [493.6, 498.49, 508.77, 496.05] |

| NDX Combos: [17275, 17102, 17137, 17067] |

| QQQ Combos: [420.19, 415.97, 416.82, 415.13] |

0 comentarios