Macro Theme:

Short Term SPX Resistance: 5,100

Short Term SPX Support: 5,050

SPX Risk Pivot Level: 5,000

Major SPX Range High/Resistance: 5,115 (SPY 510)

Major SPX Range Low/Support: 4,800

‣ We look for index volatility to now contract after hitting the 5,100 is the upside target.*

‣ 5,000 is critical support, up from 4,900 the week ending 2/16.*

‣ March Quarterly OPEX (3/15) is the next major inflection point.*

*updated 2/23

Founder’s Note:

ES futures are -30bps to 5,075. NQ futures are flat at 17,945.

Key SG levels for the SPX are:

- Support: 5,050

- Resistance: 5,065, 5,100, 5,115 (SPY 510)

Call Wall

- 1 Day Implied Range: 0.62%

For QQQ:

- Support: 435, 439

- Resistance: 440

Call Wall

IWM:

- Support: 195

- Resistance: 200, 210

Call Wall

This morning is a GDP print at 8:30 AM ET.

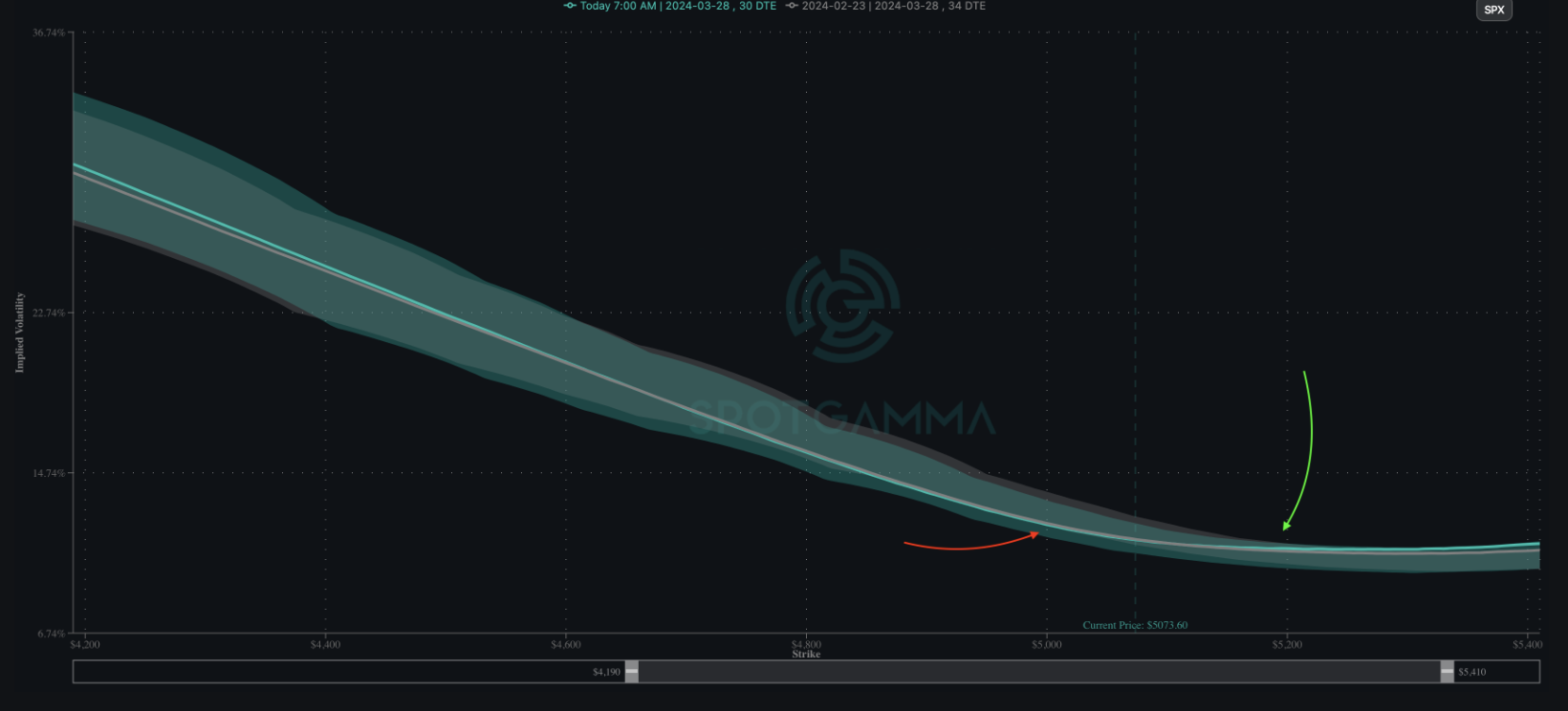

According to plan, there has been painfully little happening across the major indexes this week, as shown below. We see little reason for that to change today, with an SG 1-day implied move of 62bps, and big levels above (5,100) and below (5,050). The net effect of this should be a continued reduction in realized volatility, which will weight on forward/implied volatility (i.e. VIX). The 0DTE SPX straddle, which was at $20/39bps the last two days is now up to…$21/41bps (ref 5,065). This is interesting given futures are -30bps overnight. This implies we are seeing little more than drift in overnight futures action, and the passing of the GDP print, a likely non event, may bring mean reversion back above SPY 505/5,065.

When we check the “fair value” of VIX, we actually see its a bit low, as shown by the chart below. This chart measures the VIX vs 1-month realized SPX volatility, and as you can see we are pushing down near the 10th %ile lows. This is suggesting the VIX is fairly low compared to where 1-month realized volatility is, however if realized vol comes down, which is what we forecast into March OPEX, then it may pave the way for VIX/>=2 week SPX IV’s to deflate.

While the SPY/QQQ are sleeping, IWM’s are threatening to break out to new highs, with 210 the

Call Wall

resistance point. We also see bitcoin over $59k – levels last seen in Nov ’21 (large BTC moves are linked to positive forward SPX returns). We also note that both XBI (biotech ETF’s) & XLF (financials ETF) showed up on some volatility scanning tools, which are flagging due to upside volatility (stock up, vol up). This informs us that there is still appetite our there for speculative upside risk.

| SpotGamma Proprietary Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Reference Price: | $5078 | $506 | $17971 | $437 | $2056 | $204 |

| SpotGamma Implied 1-Day Move: | 0.62% | 0.62% |

|

|

|

|

| SpotGamma Implied 5-Day Move: | 2.02% |

|

|

|

|

|

| SpotGamma Volatility Trigger™: | $5065 | $506 | $17675 | $437 | $2000 | $199 |

| Absolute Gamma Strike: | $5000 | $500 | $17750 | $437 | $2000 | $200 |

| SpotGamma Call Wall: | $5100 | $508 | $17750 | $440 | $2050 | $210 |

| SpotGamma Put Wall: | $4500 | $505 | $16000 | $430 | $1950 | $190 |

| Additional Key Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Zero Gamma Level: | $5011 | $506 | $17133 | $436 | $2051 | $200 |

| Gamma Tilt: | 1.30 | 1.049 | 1.57 | 1.048 | 0.981 | 1.299 |

| SpotGamma Gamma Index™: | 1.935 | 0.053 | 0.076 | 0.021 | -0.002 | 0.046 |

| Gamma Notional (MM): | $591.93M | $204.609M | $8.529M | $140.59M | $1.276M | $439.689M |

| 25 Delta Risk Reversal: | -0.019 | -0.018 | -0.013 | -0.014 | -0.002 | -0.008 |

| Call Volume: | 471.757K | 1.249M | 8.963K | 623.653K | 22.15K | 675.807K |

| Put Volume: | 833.743K | 1.909M | 8.665K | 1.009M | 42.818K | 752.664K |

| Call Open Interest: | 6.966M | 6.352M | 52.919K | 4.158M | 264.46K | 4.699M |

| Put Open Interest: | 13.859M | 16.086M | 67.665K | 7.993M | 481.693K | 8.053M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5000, 5100, 5050, 5075] |

| SPY Levels: [500, 505, 508, 506] |

| NDX Levels: [17750, 18000, 17600, 17625] |

| QQQ Levels: [437, 440, 434, 435] |

| SPX Combos: [(5302,96.67), (5276,75.89), (5251,94.52), (5225,85.07), (5210,78.98), (5200,99.34), (5180,73.44), (5175,90.40), (5170,85.06), (5159,90.92), (5149,99.07), (5144,74.50), (5139,89.59), (5134,72.36), (5129,95.55), (5124,97.56), (5119,94.38), (5114,92.04), (5109,98.08), (5104,88.05), (5098,99.90), (5093,80.80), (5088,95.90), (5078,87.93), (5073,94.02), (5058,89.21), (5053,77.50), (5038,91.91), (5032,84.12), (5017,89.85), (5002,75.03), (4977,72.01), (4956,73.41), (4900,85.05), (4860,72.95), (4850,83.64)] |

| SPY Combos: [509.53, 519.66, 514.6, 529.29] |

| NDX Combos: [17755, 18061, 18025, 18151] |

| QQQ Combos: [433.42, 441.3, 431.23, 440.43] |

0 comentarios