Macro Theme:

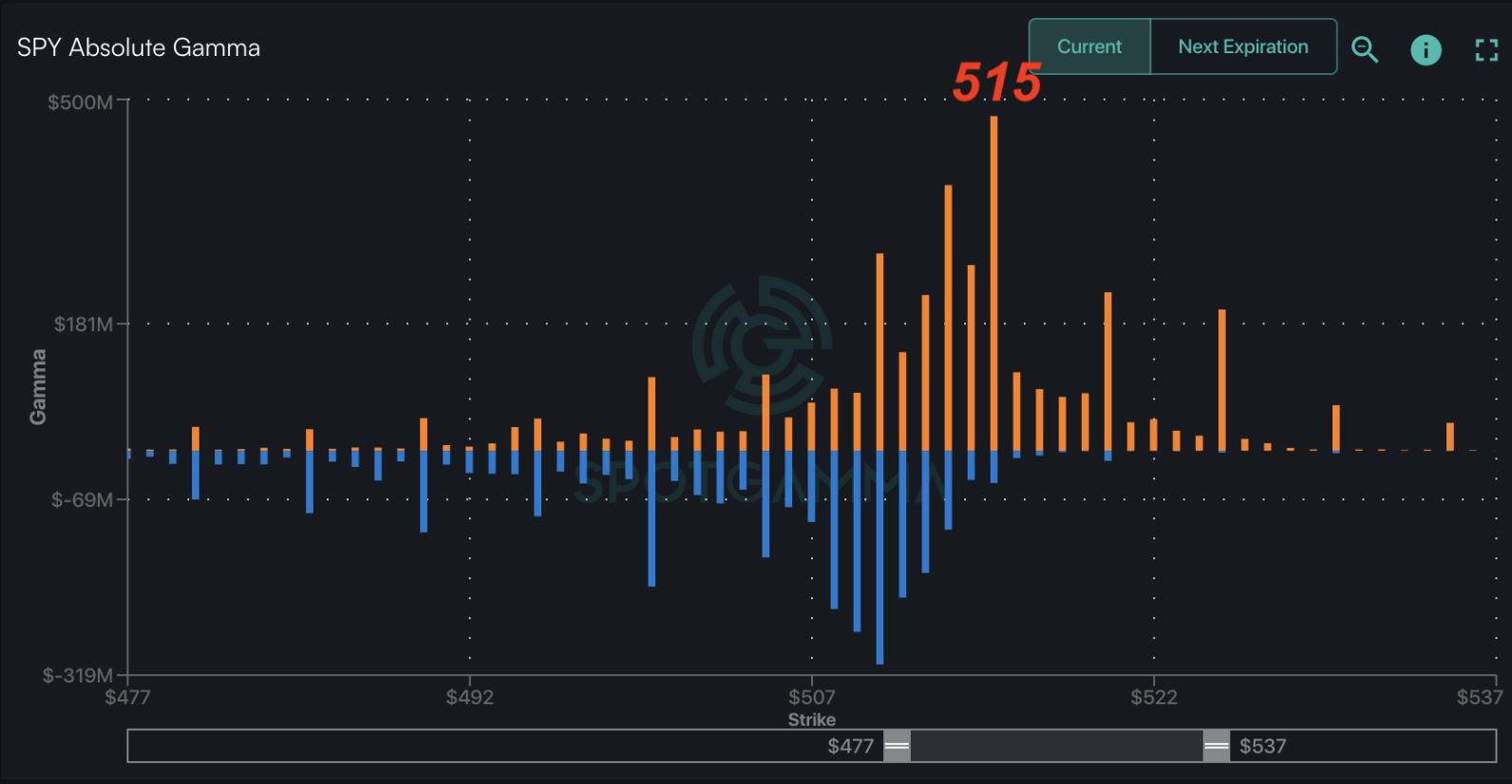

Short Term SPX Resistance: 5,160 (SPY 515 Call Wall)

Short Term SPX Support: 5,100

SPX Risk Pivot Level: 5,100

Major SPX Range High/Resistance: 5,200 SPX Call Wall

Major SPX Range Low/Support: 4,800

‣ 5,200 is the upside target.*

‣ 5,100 is critical support, up from 5,000 the week ending 3/1.*

‣ We look for index volatility to now contract (ref: 2/23, 1-month realized vol 14%, VIX 14.2).

‣ The week of 3/11 is the next major inflection point: 3/12 CPI & March Quarterly OPEX (3/15), followed by 3/20 VIX exp *

*updated 3/4

Founder’s Note:

ES futures are -20 bps to 5,125. NQ futures are -60 bps at 18,150.

Key SG levels for the SPX are:

- Support: 5,100, 5,115 (SPY 510)

- Resistance: 5,150, 5,160 (SPY 515

Call Wall

)

- 1 Day Implied Range: 0.67%

For QQQ:

- Support: 440, 437

- Resistance: 445, 450

Call Wall

IWM:

- Support: 200, 199

- Resistance: 210

Call Wall

The key SPX range for today, and likely tomorrow, is 5,100 to 5,160 (SPY 515). Today’s session, we believe, should be quiet on the Index side.

Vols are perking up a bit this morning, with ISM PMI out today at 10AM, and Fed Barr at 12PM. Then tomorrow attention shifts to Powell’s semiannual congressional testimony, which goes through Thursday. There is also the State of the Union on Thursday night, the 7th.

We think there is some event-vol premium around all of these points, and the odds-on bet is that they pass as non-events. Should that happen, the event vol premium (i.e. higher IV tied to the event(s)) gets drained away, which should provide a short term boost for equities.

The signal of risk-off, and larger, longer term selling is imminent is if the S&P500 breaks below 5,100.

For additional signs of topping, we are heavily focused on the semi sector. and SMH (semi ETF). We think that trading regimes like we have now highlight the value of volatility tools, because shifts in the volatility surface could help to flag signs of major market highs & lows.

In this case, the SMH has been on a rocket higher, and is +33% in ’24.

In the plot below we show 1 month skew from last night (green) and 1 week ago (gray). Note that the SMH is up 7% over just this past week!

Most of the semi stock earnings are now behind us, which should generally lead to a lower level of implied volatility in SMH. However, what we see here is a higher level of IV across the skew. This is seen by the green line being above the green line. Intuitively this makes sense, as the SMH is up 7% over this time frame. That’s some volatility, you could frame it as “crashing higher”. This, we believe, is reflective of a “blow off top” – at least a short term one.

Why do we say that? What catches our eye here is that, on a fixed strike basis (x axis), the call skew appears to be flattening. This can be see in the red box, where the gap between the gray and green lines is shrinking, which could be a signal of waning relative long call demand. Compare this to the downside strikes in the yellow box wherein the gap between the two lines is increasing – a sign of relative demand for downside puts.

If we continue to see current skew readings rotate towards puts, it may be a significant signal of equities topping. This is what we will be carefully monitoring for over the next week as we move toward CPI/OPEX/VIX Exp.

| SpotGamma Proprietary Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Reference Price: | $5130 | $512 | $18226 | $444 | $2074 | $205 |

| SpotGamma Implied 1-Day Move: | 0.75% | 0.75% |

|

|

|

|

| SpotGamma Implied 5-Day Move: | 2.02% |

|

|

|

|

|

| SpotGamma Volatility Trigger™: | $5095 | $511 | $17640 | $442 | $2000 | $201 |

| Absolute Gamma Strike: | $5000 | $512 | $17750 | $440 | $2050 | $200 |

| SpotGamma Call Wall: | $5200 | $515 | $17750 | $450 | $2050 | $210 |

| SpotGamma Put Wall: | $4800 | $509 | $16000 | $420 | $1900 | $195 |

| Additional Key Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Zero Gamma Level: | $5063 | $511 | $17247 | $440 | $2053 | $202 |

| Gamma Tilt: | 1.222 | 0.976 | 1.654 | 1.152 | 1.07 | 1.246 |

| SpotGamma Gamma Index™: | 1.288 | -0.025 | 0.083 | 0.060 | 0.006 | 0.037 |

| Gamma Notional (MM): | $525.054M | ‑$14.903M | $9.249M | $288.334M | $5.466M | $390.989M |

| 25 Delta Risk Reversal: | -0.024 | -0.02 | -0.019 | -0.021 | -0.006 | -0.007 |

| Call Volume: | 452.685K | 1.52M | 9.791K | 661.125K | 16.155K | 387.713K |

| Put Volume: | 971.611K | 2.027M | 14.839K | 1.054M | 57.469K | 383.789K |

| Call Open Interest: | 6.981M | 6.263M | 55.168K | 4.251M | 275.303K | 4.667M |

| Put Open Interest: | 13.966M | 16.014M | 70.812K | 8.194M | 496.86K | 8.263M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5000, 5100, 5200, 5150] |

| SPY Levels: [512, 510, 515, 513] |

| NDX Levels: [17750, 18000, 17600, 17625] |

| QQQ Levels: [440, 445, 444, 435] |

| SPX Combos: [(5352,87.02), (5300,97.77), (5275,82.17), (5259,86.13), (5249,97.01), (5239,71.77), (5228,76.63), (5223,91.35), (5218,76.63), (5208,89.94), (5198,99.87), (5193,89.28), (5187,76.25), (5182,83.28), (5177,95.95), (5172,90.55), (5167,79.44), (5162,77.80), (5157,94.44), (5151,96.77), (5146,79.24), (5136,72.99), (5121,75.42), (5116,74.00), (5100,94.97), (5090,89.14), (5085,82.15), (5075,84.32), (5049,72.20), (5039,82.23), (5013,90.28), (4951,72.54), (4900,85.09)] |

| SPY Combos: [520.14, 515.51, 510.37, 530.42] |

| NDX Combos: [17753, 18463, 18682, 18627] |

| QQQ Combos: [432.44, 450.27, 449.38, 448.04] |

0 comentarios