Macro Theme:

Short Term SPX Resistance: 5,150

Short Term SPX Support: 5,050

SPX Risk Pivot Level: 5,100

Major SPX Range High/Resistance: 5,200 SPX Call Wall

Major SPX Range Low/Support: 4,800

‣ 5,200 is the upside target.*

‣ 5,100 is critical support, up from 5,000 the week ending 3/1.*

‣ We look for index volatility to now contract (ref: 2/23, 1-month realized vol 14%, VIX 14.2).

‣ The week of 3/11 is the next major inflection point: 3/12 CPI & March Quarterly OPEX (3/15), followed by 3/20 VIX exp *

*updated 3/4

Founder’s Note:

ES futures are +25 bps to 5,100. NQ futures are +70 bps at 18,050.

Key SG levels for the SPX are:

- Support: 5,075, 5,050, 5,040

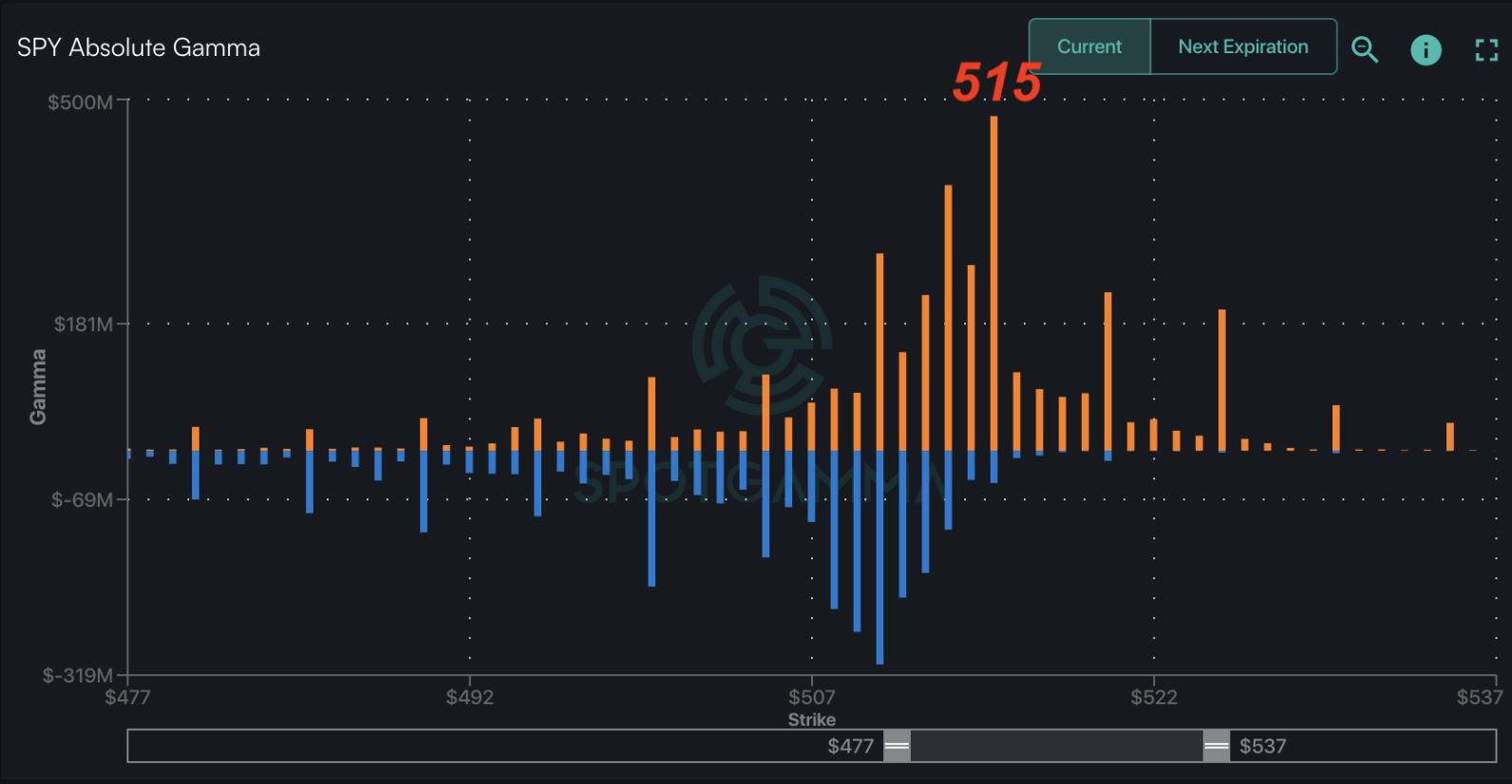

- Resistance: 5,100, 5,115 (SPY 510), 5,150, 5,160 (SPY 515

Call Wall

)

- 1 Day Implied Range: 0.67%

For QQQ:

- Support: 440, 437

- Resistance: 437, 440, 445

IWM:

- Support: 200, 195

- Resistance: 210

Call Wall

Powell is on deck today, with congressional testimony starting at 10AM ET. JOLTS data is out at that same 10AM time. Later in the day two Fed Speakers: Daly (12PM), Kashkari (3:15).

It was indeed “risk off” on the break of 5,100, yesterday, which led to a low near 5,055. That low was bought, likely due to hedging flows, as the SPX rallied 50bps to 5,078 in the last 30mins.

Markets are recovering this morning, looking to test the underbelly of 5,100. What strikes us as quite odd here, is that this mornings at-the-money 0DTE straddle is just $28, which is essentially pricing in a 55bps SPX move on the day (that move was made in just the last 30mins yesterday). We saw something similar to this yesterday in AAPL, wherein the 3/15 exp, 170 straddle (ATM) was $5.6 (3% requiring a ~3% stock move, 24% IV), despite the fact that AAPL was down $5 (~2.5%) on the day.

The histogram below is of SPX returns from the last year, and you can see yesterday’s -1% SPX return (red line) was something of a tail move. This move comes just 2 days after we had a right tail move of +1% last Friday. We’ve also seen the NQ swinging over 2% on 2 of the last 3 sessions.

In a normal, quiet environment we’d be flagging a 55bps 0DTE price as getting “too cheap”. However, we were just delivered two “tails” into Powell, JOLTS, State of the Union, NFP Friday…the list goes on. These data are triggers in that if they pass without event, it releases some event vol, which likely juices equities higher. If upcoming data/events are tail prints (or provocative statements from Powell), that could easily trigger a downside demand/long volatility positions which adds downside pressure.

Despite that 0DTE pricing, our models suggest that changes to longer dated vols (>1-2 weeks) are a possible driver of equity movement in this market. You can see this in the vanna model, wherein the purple, IV-adjusted delta reading is below that of the gray, IV-unadjusted model. This informs us that if vol drops there is some fuel to pull equities higher.

If 0DTE’s don’t show any volatility premium, what is the vanna model reflecting?

If we look at SPX term structure we can see that there is a lift from Friday, which is when we closed at record highs. This signals that longer dated IV’s are perking up just a bit, anticipating some volatility into the upcoming deluge in data (CPI next week, OPEX, etc). These ATM readings are stable (i.e term structure flattens out) around 13%, which is pricing in daily moves of 80bps.

The summary is that 0DTE’s prices are strange to us, but longer dated seem to be acting a bit more normal.

So, why is short dated vol pricing in, essentially no move?

Let’s say from the event side that traders are viewing today’s Powell testimony as a non-event, if for no other reason than its day 1 of 2 (Powell speaks again tomorrow), and that no policy is being set today. That could then suggest 0DTE options shouldn’t price in any significant IV premium.

However, that still does not account for any type of autocorrelated view of volatility – that is the (statically backed) idea that volatility tends to cluster. In other words: high volatility days tend to lead to other high volatility days, and vice versa. We are proponents of this theory, as we believe that large market moves create larger changes in options positions, which invokes more dealer hedging flows.

Our theory here is that the prices are related to supply, in that the liquidity providers (dealers/market makers) are full on long of short dated options positions, which may drive be driving the price of options lower. We also saw no significant demand for put hedges in the fixed strike vol data, below, which is shown via the lack of bright green at strikes <5,100 out past this week. One would think that if puts were being bought those downside strike IV’s would be higher – they really weren’t.

With that, our view here is that a move, certainly intraday at a minimum, of >55bps is possible today. With the SPX <5,100 we don’t see major support until down into the 5,000 area. To the upside, 5,150 – 5,160 saw a lot of call selling last week, and this is the major resistance area in the short term. You can see that upside selling reflected in the change to fixed strike vols from Friday to today, with the subtle shade of red at strikes >=5,100. We also note this 5,150-5,200 area should be the high range into next weeks OPEX.

The lurking longer term risk here, that has been a risk for some time, is that something invokes downside put demand which would accelerate the downside movement. We’ve not seen anything like this for many months, and we think the risk of increased put demand is higher from now through next weeks OPEX. A bid to downside strike vols (i.e. shades of brighter green) would be a major indicator that risk is increasing.

| SpotGamma Proprietary Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Reference Price: | $5078 | $507 | $17897 | $436 | $2053 | $203 |

| SpotGamma Implied 1-Day Move: | 0.67% | 0.67% |

|

|

|

|

| SpotGamma Implied 5-Day Move: | 2.02% |

|

|

|

|

|

| SpotGamma Volatility Trigger™: | $5095 | $509 | $17570 | $437 | $2010 | $204 |

| Absolute Gamma Strike: | $5000 | $510 | $17750 | $440 | $2000 | $200 |

| SpotGamma Call Wall: | $5200 | $515 | $17750 | $439 | $2050 | $210 |

| SpotGamma Put Wall: | $5040 | $500 | $16000 | $425 | $1950 | $195 |

| Additional Key Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Zero Gamma Level: | $5049 | $510 | $17453 | $435 | $2048 | $202 |

| Gamma Tilt: | 1.061 | 0.802 | 1.381 | 0.875 | 0.992 | 1.023 |

| SpotGamma Gamma Index™: | 0.473 | -0.235 | 0.067 | -0.063 | -0.001 | 0.004 |

| Gamma Notional (MM): | $33.673M | ‑$711.907M | $5.397M | ‑$194.28M | ‑$401.549K | $97.782M |

| 25 Delta Risk Reversal: | -0.022 | -0.019 | -0.01 | -0.013 | -0.004 | -0.001 |

| Call Volume: | 705.988K | 2.309M | 11.458K | 1.248M | 16.135K | 343.236K |

| Put Volume: | 1.246M | 3.041M | 14.467K | 1.56M | 36.512K | 582.16K |

| Call Open Interest: | 7.189M | 6.533M | 55.743K | 4.469M | 278.727K | 4.721M |

| Put Open Interest: | 14.185M | 16.093M | 72.186K | 8.282M | 501.023K | 8.371M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5000, 5100, 5050, 5075] |

| SPY Levels: [510, 500, 505, 508] |

| NDX Levels: [17750, 18000, 17600, 17625] |

| QQQ Levels: [440, 435, 434, 430] |

| SPX Combos: [(5302,96.88), (5277,77.86), (5256,76.18), (5251,95.20), (5226,89.25), (5206,80.96), (5201,99.53), (5195,76.95), (5185,71.27), (5180,74.75), (5175,95.64), (5170,87.48), (5165,75.90), (5160,77.43), (5155,92.02), (5150,98.43), (5145,78.09), (5140,79.61), (5135,80.83), (5129,91.38), (5124,86.31), (5114,85.02), (5109,84.89), (5099,97.54), (5089,78.28), (5084,72.14), (5068,90.85), (5058,89.17), (5053,72.97), (5048,88.09), (5043,82.48), (5038,96.16), (5033,82.03), (5028,85.70), (5023,79.29), (5018,85.59), (5013,88.64), (5008,93.97), (5002,74.76), (4997,84.49), (4977,83.45), (4957,80.60), (4952,82.15), (4901,85.51), (4876,73.28), (4850,84.64)] |

| SPY Combos: [512.04, 522.15, 517.09, 507.49] |

| NDX Combos: [17755, 17450, 17647, 17039] |

| QQQ Combos: [422.98, 439.92, 445.13, 443.82] |

0 comentarios