Macro Theme:

Short Term SPX Resistance: 5,200

Short Term SPX Support: 5,100

SPX Risk Pivot Level: 5,100

Major SPX Range High/Resistance: 5,200 SPX Call Wall

Major SPX Range Low/Support: 5,000

‣ 5,200 is the upside target.*

‣ 5,100 is critical support, up from 5,000 the week ending 3/1.*

‣ We look for index volatility to now contract (ref: 2/23, 1-month realized vol 14%, VIX 14.2).

‣ The week of 3/11 is the next major inflection point: 3/12 CPI & March Quarterly OPEX (3/15), 3/18 NVDA Event, followed by 3/20 FOMC & VIX exp *

*updated 3/4

Founder’s Note:

Key SG levels for the SPX are:

- Support: 5,115 (SPY 510), 5,100

- Resistance: 5,150, 5,160 (SPY 515), 5,200 (SPX

Call Wall

)

- 1 Day Implied Range: 0.59%

For QQQ:

- Support: 438, 425

- Resistance: 440, 445, 450

Call Wall

IWM:

- Support: 204, 200, 198

- Resistance: 210

Call Wall

Its a big week with CPI tomorrow (3/12), then OPEX (3/15), Friday. That is followed by another big week: 3/18 NVDA launch, 3/20 FOMC & 3/20 VIX Exp. With CPI out tomorrow, we think today should be fairly quiet, with 5,100 large support and 5,160 resistance. A break of 5,100 is still considered to be our long term “risk off” signal.

We’ve been highlighting this week as a potential turning point, leading to a cooling in equity prices. One has to wonder if the first warning shot was fired on Friday, with a massive market reversal driven by very large call selling & put buying options flows. Many semi stocks saw negative

HIRO

signals at or near their lowest in the last 30 days, including: NVDA, AVGO, TXN, INTC, TSM and SMH.

NVDA flows were particularly noteworthy, as the day started with +$2bn

HIRO

signal, and ended with a -$2bn signal. That’s a -$4bn swing, which is quite large for the S&P500, much less a single stock.

The other flow to flag was in SPY, which posted its largest negative delta signal in at least 30 days. As you can see below, it was dominated by put buying (blue line) into the morning highs. The other thing to note about these flows, really across the board, was that they were largely longer dated options flows – not 0DTE (AKA Friday Exp). We spent a large part of the note from Friday AM flagging large 0DTE/Next Exp flows as inducing noise and “false flags”, and in line with that these longer dated options flows may offer signals of a longer term (i.e. >1 day) market pause at hand.

The equity market is really just a function of momentum in the chip stocks, which is providing some wild volatility readings in related names. Accordingly, we’ve been watching various volatility measures in SMH as a signal of market topping. Shown below is the fixed strike vol grid comparing Thursday’s close to Friday’s close, wherein the SMH dropped 4%. What we distinctly see here is brighter shades of green at strikes >225 (Friday’s close), and shades of red <=200. This implies puts were sold, and calls were bought into Friday’s weakness.

If you slice this a different way, and look at SMH term structure, you see very elevated vols highlighted by the current structure (green line) being so far above the shaded cone. That cone highlights the average 60 day range of term structure readings. This elevated structure is likely due to the 3/18 NVDA product showcase, which is adding event volatility premium to volatilized environment. On this topic we see that the 1-month implied volatility rank is at 100%, which signals this is the highest level of IV we’ve seen in the last year. The NVDA event will most certainly drain off some of these elevated IV’s – the question is will it flatten call skews. If that does happen its our bat signal that equities are due for a correction.

This highlights a very tricky environment over the next 1-2 weeks.

If CPI is in line, then stocks could buoy back up into the 5,150-5,200 area, but we think thats it until Monday.

If NVDA blows traders away with some new products, then we could potentially regain the bullish momentum seen in the last few weeks. However, that train runs directly into FOMC.

We are also clearing out a ton of call positions with March OPEX, on Friday, which is often related to short term equity weakness.

The net of all this is mapped out below. A clear “risk off” signal come from a break below 5,100, which likely invokes a test of 5,000.

The full “risk on” signal would be a break above 5,200 post-FOMC.

| SpotGamma Proprietary Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Reference Price: | $5123 | $511 | $18018 | $439 | $2082 | $206 |

| SpotGamma Implied 1-Day Move: | 0.66% | 0.66% |

|

|

|

|

| SpotGamma Implied 5-Day Move: | 1.95% |

|

|

|

|

|

| SpotGamma Volatility Trigger™: | $5145 | $512 | $17740 | $441 | $2040 | $204 |

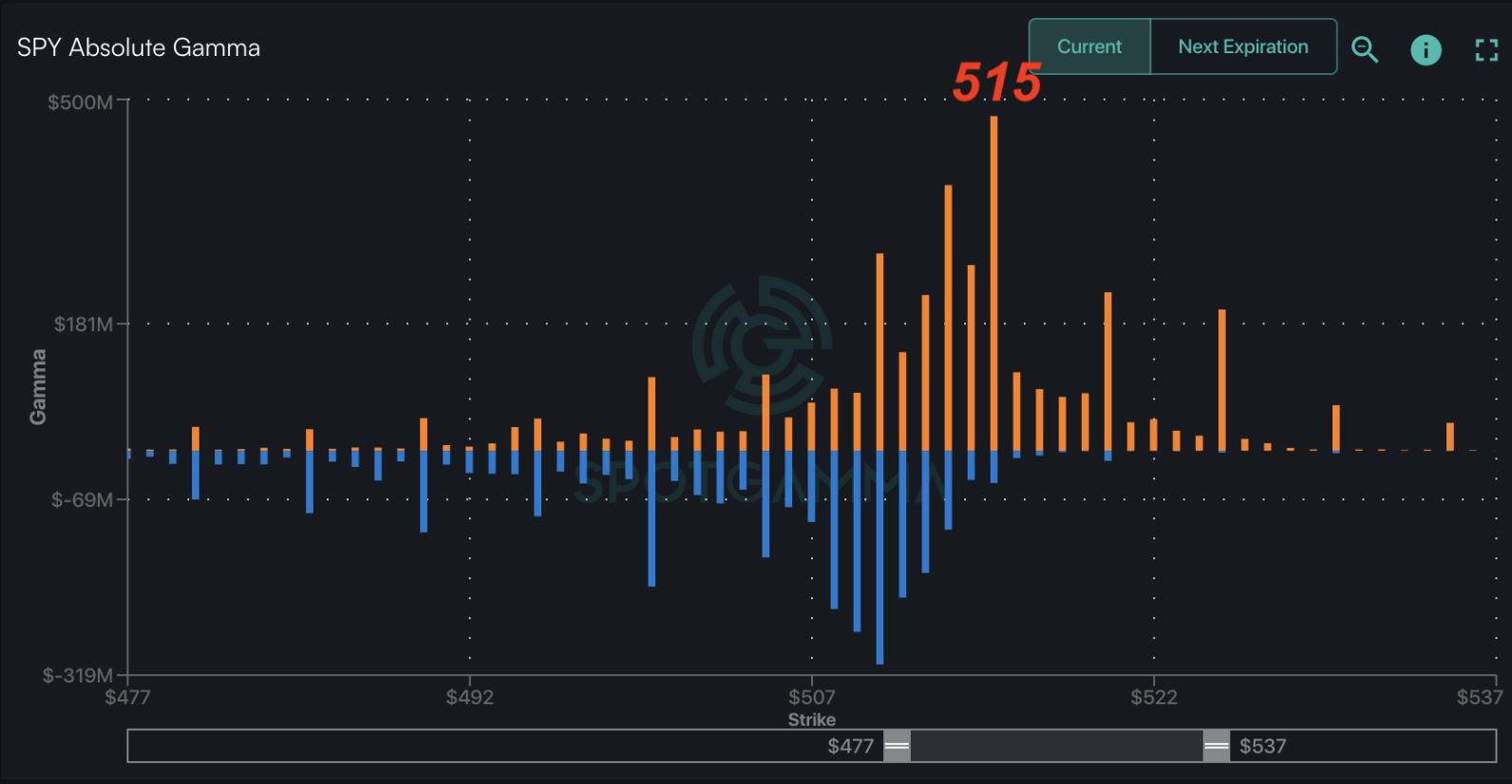

| Absolute Gamma Strike: | $5000 | $515 | $17750 | $440 | $2050 | $200 |

| SpotGamma Call Wall: | $5200 | $520 | $17750 | $450 | $2050 | $210 |

| SpotGamma Put Wall: | $5110 | $500 | $17500 | $425 | $1950 | $198 |

| Additional Key Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Zero Gamma Level: | $5094 | $510 | $17571 | $438 | $2077 | $205 |

| Gamma Tilt: | 1.108 | 0.949 | 1.236 | 0.841 | 1.152 | 1.184 |

| SpotGamma Gamma Index™: | 0.793 | -0.051 | 0.046 | -0.078 | 0.013 | 0.029 |

| Gamma Notional (MM): | $172.266M | $48.763M | $5.629M | ‑$225.483M | $1.875M | $314.485M |

| 25 Delta Risk Reversal: | -0.022 | -0.019 | -0.024 | -0.019 | -0.012 | -0.002 |

| Call Volume: | 705.724K | 3.158M | 10.199K | 1.294M | 33.161K | 471.649K |

| Put Volume: | 1.308M | 3.546M | 15.691K | 1.743M | 63.993K | 686.29K |

| Call Open Interest: | 7.403M | 6.774M | 57.489K | 4.455M | 272.101K | 4.696M |

| Put Open Interest: | 14.586M | 16.469M | 76.04K | 8.569M | 459.575K | 8.561M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5000, 5100, 5150, 5200] |

| SPY Levels: [515, 510, 512, 520] |

| NDX Levels: [17750, 18000, 17600, 17625] |

| QQQ Levels: [440, 435, 439, 429] |

| SPX Combos: [(5349,87.49), (5308,76.02), (5298,97.75), (5277,85.18), (5257,81.11), (5252,97.33), (5231,77.88), (5226,96.75), (5221,79.37), (5211,77.96), (5206,92.48), (5201,99.76), (5195,83.24), (5190,79.35), (5185,85.64), (5180,83.36), (5175,97.60), (5170,91.24), (5165,86.42), (5160,79.43), (5154,90.45), (5149,91.80), (5124,75.67), (5108,94.21), (5093,72.83), (5088,85.30), (5067,79.92), (5057,71.95), (5042,72.56), (5037,72.81), (5016,87.30), (4955,73.81), (4949,77.95), (4924,71.29), (4898,89.72)] |

| SPY Combos: [518.93, 514.3, 529.22, 516.35] |

| NDX Combos: [17748, 17442, 18469, 17244] |

| QQQ Combos: [449.9, 446.79, 444.11, 424.96] |

SPX Gamma Model

View All Indices Charts

0 comentarios