Macro Theme:

Short Term SPX Resistance: 5,200

Short Term SPX Support: 5,100

SPX Risk Pivot Level: 5,100

Major SPX Range High/Resistance: 5,200 SPX Call Wall

Major SPX Range Low/Support: 5,000

‣ 5,200 is the upside target.*

‣ 5,100 is critical support, up from 5,000 the week ending 3/1.*

‣ We look for index volatility to now contract (ref: 2/23, 1-month realized vol 14%, VIX 14.2).

‣ The week of 3/11 is the next major inflection point: 3/12 CPI & March Quarterly OPEX (3/15), 3/18 NVDA Event, followed by 3/20 FOMC & VIX exp*

*updated 3/4

Founder’s Note:

ES futures are +20bps to 5,195, NQ futures are +35bps to 18,280.

Key SG levels for the SPX are:

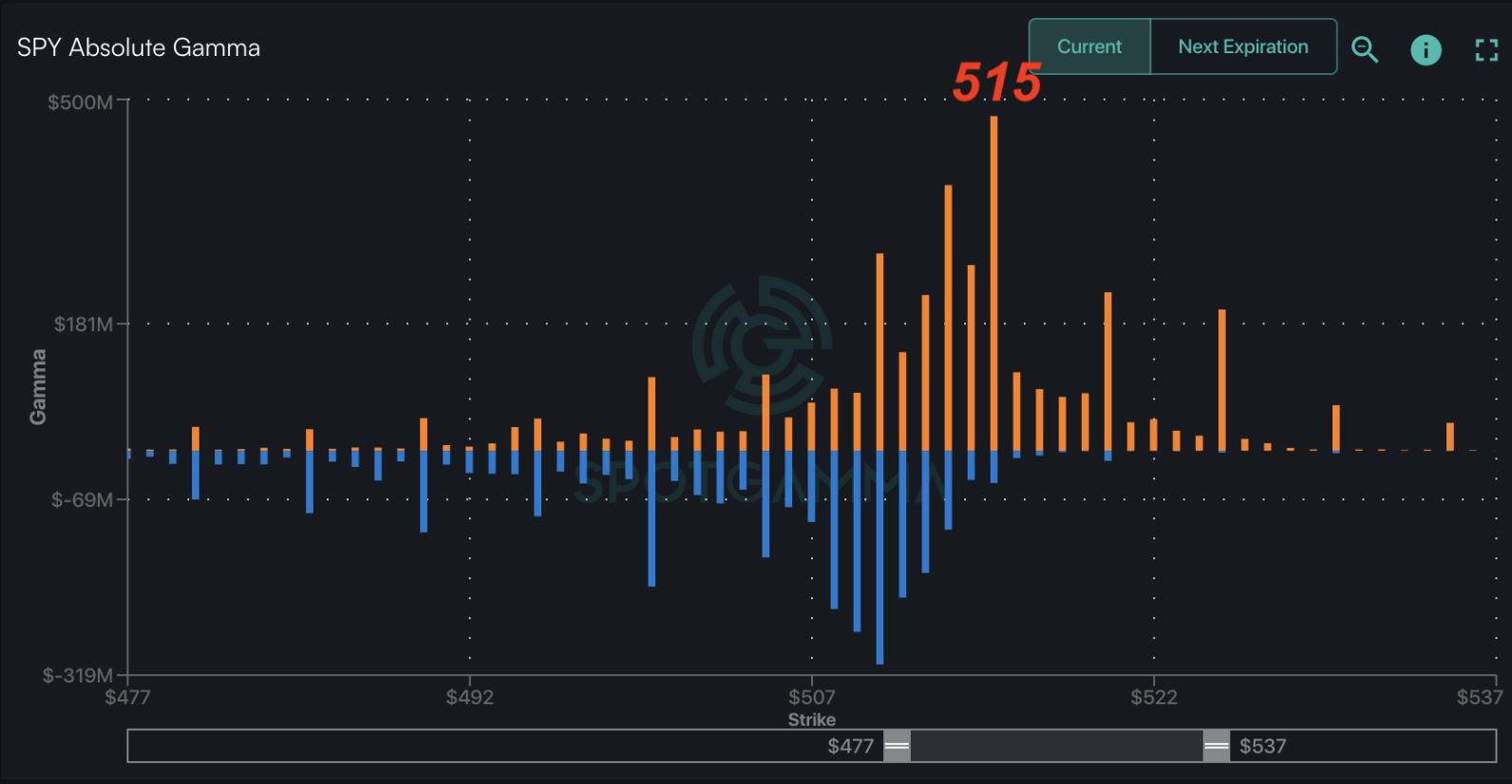

- Support: 5,115 (SPY 510), 5,100, 5,060

- Resistance: 5,150, 5,160 (SPY 515), 5,200 (SPX

Call Wall

)

- 1 Day Implied Range: 0.55%

For QQQ:

- Support: 437, 430

- Resistance: 440, 445, 450

Call Wall

IWM:

- Support: 204, 200, 194

- Resistance: 210

Call Wall

8:30AM ET is the CPI print. The 10 year treasury auction is at 1pm ET.

Tech is catching a bid today after ORCL posted positive results, sending the stock +13% premarket.

Things are mainly holding to plan, as the SPX found support at 5,100 yesterday, awaiting this mornings CPI. CPI is our first trigger point in a series of triggers over the next 10 days. Should today’s CPI come in <=expectations we think it could fuel a rally up into the 5,150-5,160 (SPY 515) area. A hot CPI could potentially break 5,100 support, which should open the door to a move down toward 5,000. Should 5,100 break traders should watch for a sustained increase in IV’s and/or persistent negative delta flows in

HIRO.

The market is pricing in a bit of volatility ahead of the CPI, with the 0DTE straddle marked at $43 or 83bps (ref 5,130, IV 29.9%). This is a up from last weeks 50-60bps straddle, but we do not think today’s CPI print will offer much longer term relief. This is because traders are likely to immediately shift attention to PPI (3/14), OPEX (3/15), NVDA (3/18), then VIX exp + FOMC (3/20).

You can see this trepidation reflected in the SPX term structure, which shows that ATM IV’s are above the range we’ve seen over the last several months. Therefore the 0DTE crowd can pop out and trade off of the CPI today, but vols are unlikely to meaningfully contract. As a result, price action is unlikely to remain stable (i.e. rallies can fade, selloffs can recover). For more on the major levels over the next few sessions see Monday AM’s note.

We’ve been receiving many questions on NVDA and its price action over the last several days. The semi sector is the most critical element to this bull rally, and we are watching closely for a signal that the call bid is set to fade. We do not anticipate seeing a signal in this space until NVDA’s event on Monday, and this seems to line up with the IV action shown in NVDA the last few days.

To this point, NVDA yesterday was -2% yesterday, and -12% off of its Friday intraday high, but fixed strike volatility was down across the board (seen via the block of red across all strikes & expirations). This was a signal that traders were not adding puts into recent weakness, and more a sign that vols are simply deflating after a wild few days.

If we flip to the NVDA term structure you can see the impact of the 3/18 event, which is not as meaningful as an earnings report, but is enough to kink the NVDA term structure. In all likelihood the event deflates NVDA IV and flattens out call skews, which could serve to stall some of the price momentum across the chip sector we’ve seen over the last few weeks. This flow, of course, lines up with several other macro triggers and a very large options expiration.

The major upside level for NVDA is 1000, which is a massive gamma strike with little in the way of positioning above there. The 1000 area was sold very hard on Friday, with massive call sellers and put buying. To the downside it seems that major positions dwindle <800, particularly <750.

| SpotGamma Proprietary Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Reference Price: | $5117 | $511 | $17951 | $437 | $2065 | $205 |

| SpotGamma Implied 1-Day Move: | 0.55% | 0.55% |

|

|

|

|

| SpotGamma Implied 5-Day Move: | 1.95% |

|

|

|

|

|

| SpotGamma Volatility Trigger™: | $5095 | $510 | $17740 | $437 | $2040 | $204 |

| Absolute Gamma Strike: | $5000 | $510 | $17750 | $440 | $2050 | $200 |

| SpotGamma Call Wall: | $5200 | $520 | $17750 | $439 | $2050 | $210 |

| SpotGamma Put Wall: | $4900 | $500 | $17500 | $430 | $1950 | $196 |

| Additional Key Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Zero Gamma Level: | $5088 | $510 | $17506 | $436 | $2061 | $203 |

| Gamma Tilt: | 1.118 | 0.996 | 1.314 | 0.994 | 1.052 | 1.104 |

| SpotGamma Gamma Index™: | 0.885 | -0.004 | 0.065 | -0.002 | 0.005 | 0.017 |

| Gamma Notional (MM): | $223.839M | $114.149M | $6.484M | $32.346M | $159.827K | $172.185M |

| 25 Delta Risk Reversal: | -0.024 | -0.026 | -0.02 | 0.00 | -0.007 | -0.009 |

| Call Volume: | 488.154K | 1.581M | 14.172K | 559.053K | 28.422K | 326.706K |

| Put Volume: | 1.001M | 2.023M | 21.761K | 783.566K | 30.383K | 549.582K |

| Call Open Interest: | 7.461M | 6.913M | 58.004K | 1.761M | 292.643K | 4.732M |

| Put Open Interest: | 14.751M | 16.697M | 77.69K | 2.594M | 516.679K | 8.554M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5000, 5150, 5100, 5200] |

| SPY Levels: [510, 515, 500, 520] |

| NDX Levels: [17750, 18000, 17600, 17625] |

| QQQ Levels: [440, 429, 434, 439] |

| SPX Combos: [(5348,87.49), (5302,97.39), (5277,85.53), (5256,81.06), (5251,97.25), (5231,76.27), (5225,96.20), (5220,77.13), (5215,71.75), (5210,83.94), (5205,93.15), (5200,99.73), (5195,85.10), (5190,75.13), (5184,84.84), (5179,78.95), (5174,96.39), (5169,88.15), (5164,80.73), (5159,77.45), (5154,88.07), (5149,91.55), (5128,73.45), (5123,79.77), (5108,84.82), (5097,90.27), (5087,73.07), (5067,81.55), (5057,73.30), (5046,74.56), (5036,77.23), (5016,80.65), (5005,77.53), (5000,80.95), (4995,77.56), (4975,73.26), (4954,75.74), (4949,82.78), (4923,76.66), (4898,90.26), (4877,77.82)] |

| SPY Combos: [518.92, 528.63, 516.36, 524.03] |

| NDX Combos: [17754, 18023, 17647, 18257] |

| QQQ Combos: [430.72, 423.29, 448.21, 418.48] |

SPX Gamma Model

Strike: $5,783

- Next Expiration: $365,105,697

- Current: $365,071,042

View All Indices Charts

0 comentarios