Macro Theme:

Short Term SPX Resistance: 5,200

Short Term SPX Support: 5,100

SPX Risk Pivot Level: 5,100

Major SPX Range High/Resistance: 5,200 SPX Call Wall – 5,211 (520 SPY Call Wall)

Major SPX Range Low/Support: 5,000

‣ 5,200 is the upside target.*

‣ 5,100 is critical support, up from 5,000 the week ending 3/1.*

‣ We look for index volatility to now contract (ref: 2/23, 1-month realized vol 14%, VIX 14.2).

‣ The week of 3/11 is the next major inflection point: 3/12 CPI, 3/14 PPI, March Quarterly OPEX (3/15), 3/18 NVDA Event, followed by 3/20 FOMC & VIX exp.*

*updated 3/4

Founder’s Note:

ES futures are +30bps to 5,250, NQ futures are +40bps at 18,405.

Key SG levels for the SPX are:

- Support: 5,160, 5,150, 5,115 (SPY 510), 5,100

- Resistance: 5,200 (SPX

Call Wall

), 5,211 (SPY 520

Call Wall

), 5,226

- 1 Day Implied Range: 0.59%

For QQQ:

- Support: 440, 437

- Resistance: 445, 450

Call Wall

IWM:

- Support: 204, 200, 194

- Resistance: 210

Call Wall

8:30AM ET is PPI, with a Treasury bill auction at 11:30 AM.

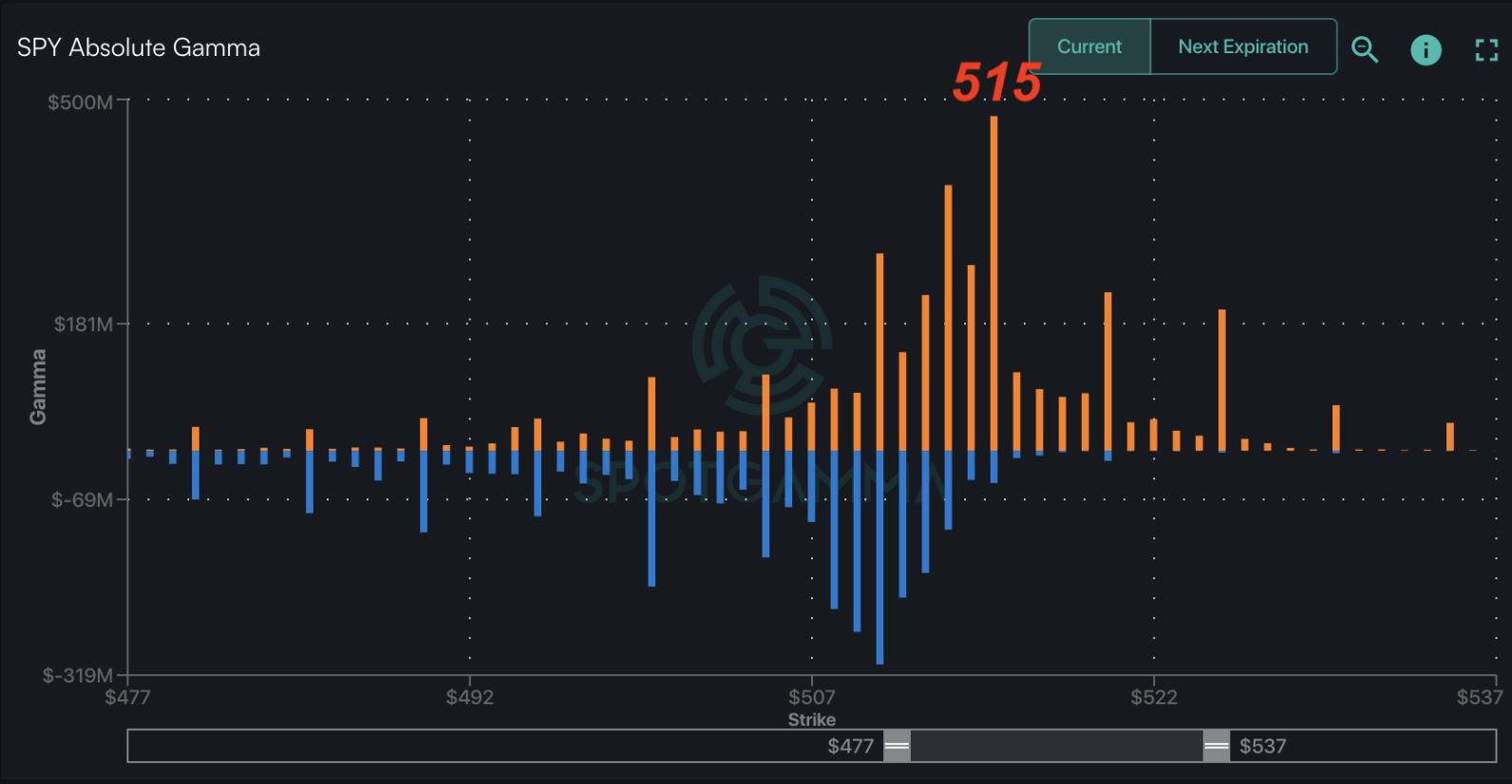

The market shows a lack of complete lack of concern for today’s PPI, with the ATM SPX straddle priced at just 45bps ($24, ref 5188, IV 17%). With that tight straddle the SPX is indicating an opening near 5190, placing it within striking distance of our major overhead resistance at the 5,200 – 5,210 SPX/SPY

Call Wall

range. As per our forecasts this week, we expect that

Call Wall

range to offer resistance into tomorrow’s close. We also highlight the 520 SPY

Call Wall

(SPX 5,210) is the largest gamma strike on the board, as shown below.

Tomorrow is a very large quarterly expiration, which is completely dominated by call positions. Shown below is the delta for leading index/ETF’s, will

call deltas

(orange) growing in size due to the persistent gains in the major indicies. We tend to view call-heavy expirations as leading to contractions in stocks, for which there is strong evidence. In 2021, which was a similar, call heavy environment, the equity market was negative 9/12 weeks leading into OPEX, but closed higher 1 week after OPEX 8/9 of those times.

The OPEX effect does appear to be at work currently, as the major indicies having stalled out and the market-leading semi sector contracting. Over the past few months, any contraction or small decline in equities has been bought (with both hands!). It was a similar situation back into Feb OPEX, which featured some equity consolidation the days into & after OPEX, with NVDA’s earnings on 2/22 igniting another major market rally.

In this case, the bulls are watching the upcoming NVDA event on 3/18 with bated breath. This can clearly be seen in the NVDA skew, with 4/12 expiration (1 month to exp) shown here. As you can see, OTM calls have higher relative IV’s then they’ve had over the past 3 months (green shaded cone). Further, our stats show this is a 99th %’ile skew rank – and that seems fairly exceptional given the incredible performance of NVDA’s stock over the last several months (+90% YTD).

The point here is that if NVDA delivers, it can spark a chase not only in NVDA, but likely across the chip sector.

The other side of that coin is NVDA not offering anything novel, which likely leads to a flattening of call skews across the chip sector, which would signal a longer term equity correction. Added into this, of course, is 3/20 VIX exp + FOMC.

| SpotGamma Proprietary Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Reference Price: | $5165 | $515 | $18068 | $440 | $2071 | $205 |

| SpotGamma Implied 1-Day Move: | 0.59% | 0.59% |

|

|

|

|

| SpotGamma Implied 5-Day Move: | 1.95% |

|

|

|

|

|

| SpotGamma Volatility Trigger™: | $5095 | $514 | $17675 | $438 | $2030 | $204 |

| Absolute Gamma Strike: | $5150 | $520 | $18000 | $440 | $2050 | $205 |

| SpotGamma Call Wall: | $5200 | $520 | $17750 | $445 | $2050 | $210 |

| SpotGamma Put Wall: | $5000 | $500 | $18000 | $425 | $2000 | $200 |

| Additional Key Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Zero Gamma Level: | $5096 | $511 | $17620 | $439 | $2066 | $202 |

| Gamma Tilt: | 1.236 | 1.203 | 1.283 | 1.096 | 1.049 | 1.195 |

| SpotGamma Gamma Index™: | 1.553 | 0.202 | 0.067 | 0.044 | 0.006 | 0.034 |

| Gamma Notional (MM): | $468.74M | $1.03B | $8.38M | $141.586M | ‑$620.099K | $293.317M |

| 25 Delta Risk Reversal: | 0.00 | -0.019 | -0.017 | -0.021 | -0.006 | -0.009 |

| Call Volume: | 360.881K | 1.44M | 7.125K | 789.889K | 27.935K | 328.382K |

| Put Volume: | 816.694K | 1.62M | 8.849K | 916.117K | 39.317K | 420.862K |

| Call Open Interest: | 7.385M | 7.041M | 59.787K | 4.603M | 301.46K | 4.496M |

| Put Open Interest: | 14.732M | 17.066M | 81.059K | 8.796M | 530.389K | 6.67M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5150, 5200, 5000, 5100] |

| SPY Levels: [520, 515, 516, 517] |

| NDX Levels: [18000, 17750, 17850, 18150] |

| QQQ Levels: [440, 439, 444, 435] |

| SPX Combos: [(5398,97.50), (5377,72.05), (5351,90.82), (5325,73.80), (5305,73.82), (5300,97.97), (5274,88.43), (5258,87.17), (5248,98.37), (5238,74.25), (5232,79.14), (5227,97.98), (5222,78.11), (5217,77.64), (5212,87.86), (5207,98.02), (5201,99.90), (5196,88.47), (5191,73.75), (5186,88.76), (5181,82.29), (5176,97.91), (5170,88.38), (5165,81.10), (5155,83.59), (5139,90.29), (5129,72.45), (5103,72.96), (5098,88.04), (5016,81.09), (5005,71.93), (5000,90.54), (4948,71.97)] |

| SPY Combos: [518.57, 519.09, 521.15, 523.21] |

| NDX Combos: [18267, 18231, 18466, 17436] |

| QQQ Combos: [441.54, 446.38, 440.66, 451.67] |

SPX Gamma Model

View All Indices Charts

0 comentarios