Short Term SPX Resistance: 5,200

Short Term SPX Support: 5,100

SPX Risk Pivot Level: 5,100

Major SPX Range High/Resistance: 5,200 SPX Call Wall – 5,211 (520 SPY Call Wall)

Major SPX Range Low/Support: 5,000

‣ 5,200 is the upside target.*

‣ 5,100 is critical support, up from 5,000 the week ending 3/1.*

‣ We look for index volatility to now contract (ref: 2/23, 1-month realized vol 14%, VIX 14.2).

‣ The week of 3/11 is the next major inflection point: 3/12 CPI, 3/14 PPI, March Quarterly OPEX (3/15), 3/18 NVDA Event, followed by 3/20 FOMC & VIX exp.*

*updated 3/4

Founder’s Note:

ES futures are +10bps to 5,228, NQ futures are +20bps at 18,312.

Key SG levels for the SPX are:

- Support: 5,115 (SPY 510), 5,100

- Resistance: 5,150, 5,160, 5,200 (SPX

Call Wall

), 5,211 (SPY 520

Call Wall

), 5,226

- 1 Day Implied Range: 0.59%

For QQQ:

- Support: 439, 437

- Resistance: 440, 445, 450

Call Wall

IWM:

- Support: 200, 194

- Resistance: 210

Call Wall

ADBE -10% after earnings, to $505. Bitcoin -10% to ~$67k, from yesterday’s all time high at ~$74k. We view BTC as a proxy for risk assets.

Things continue in line with expectations, as single stocks consolidate into today’s large options expiration, and the SPX holds the 5,100-5,200 neutral zone. 5,100 remains critical support for today and into next week, with the 5,200

Call Wall

serving as major resistance into Monday (and/or until the

Call Wall

(s) roll higher). Contrary to the

Call Wall

‘s ability to shift up, our 5,100 risk-off level can only shift higher – not lower. Should 5,100 break we think it will lead to a swift test of 5,000, at which point we will be closely tracking IV’s as a signal of further downside risk (more on this below).

Putting some numbers on today’s OPEX, we see a massive $190bn in absolute

call delta

notional (purple) expiring across single stocks. As you can see below, the put position (teal), by contrast, is quite small. Outside of a few past January expirations, which were packed with long term leap call options, we think this is the largest single stock expiration on record. These are more shorter dated speculative positions, which we think has drawn larger hedging flows. As discussed in yesterday’s note, these call heavy expirations have been associated with periods of equity consolidation.

While there is indeed consolidation in leading single stocks, there were massive inflows into the SMH ETF this past week, as shown below (h/t BBG). We also flag Bloomberg strategist Eric Blachunas’ note that NVDA traded $100bn notional on 3/12, which he believes is the 2nd largest single stock volume notional day ever (2nd to TSLA into its 2021 stock split). The chip stocks are the leaders, which is why we are watching so closely.

What is fascinating about this is that these flows come in at a point when the call skews have been breaking apart – which signals options call buyers fading into all time highs. These flows also, in our view, reiterate how critical it is for NVDA to stoke more momentum on Monday (note here), and for Powell to stick to expectations on 3/20.

The question turning to many minds is related to current markets being in bubble territory. We’ve laid out the case that this is indeed in bubble territory (here, here), but the trick is that bubbles can expand. A feature of bubbles, particularly options-driven bubbles, are bouts of stocks rocketing higher which, in turn, means that stocks will inevitably, and violently, retrace.

The key signal that its a true risk-off vs simple correction will likely be seen in the implied vol reaction to equities moving lower. If traders are simple reducing call demand and/or selling puts, then we are likely just seeing a short term correction. However, if put demand starts to increase then we should be on alert for a wider & deeper equity correction. Not only should you be able to see this put demand for in higher IV’s at downside strikes, we should also see put positions forming at downside strikes.

For example in the SPX, a break of 5,100 is our risk off, and we think that leads to a quick test of 5,000. The question will be: at 5,000 do traders start to sell puts, which would result in IV’s decreasing? Or do traders continue to position for risk off? This year, during earlier selloffs, fixed strike vol decreases into equity drawdowns.

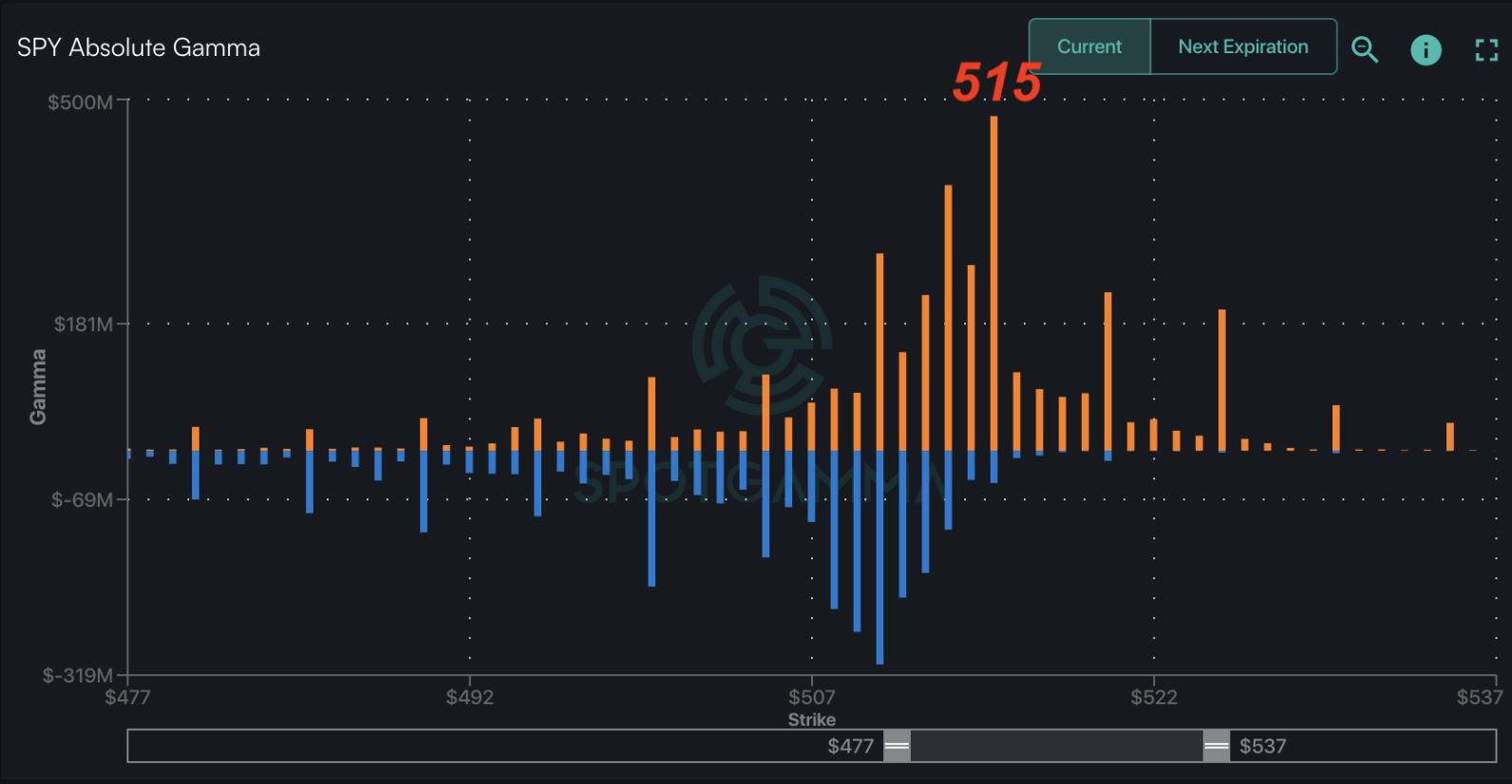

As an example of increasing put positions, consider our gamma impact plot of NVDA, below. Note how puts (blue) are the same notional size as calls (orange). Should puts start to increase relative to those calls its an indication of put buying below.

| SpotGamma Proprietary Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Reference Price: | $5150 | $514 | $18014 | $439 | $2031 | $202 |

| SpotGamma Implied 1-Day Move: | 0.59% | 0.59% |

|

|

|

|

| SpotGamma Implied 5-Day Move: | 1.95% |

|

|

|

|

|

| SpotGamma Volatility Trigger™: | $5155 | $512 | $18010 | $437 | $2030 | $203 |

| Absolute Gamma Strike: | $5150 | $515 | $18000 | $439 | $2050 | $200 |

| SpotGamma Call Wall: | $5200 | $515 | $18150 | $439 | $2050 | $210 |

| SpotGamma Put Wall: | $5150 | $510 | $18000 | $425 | $2030 | $198 |

| Additional Key Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Zero Gamma Level: | $5120 | $510 | $17969 | $441 | $2041 | $205 |

| Gamma Tilt: | 1.142 | 1.276 | 0.993 | 1.000 | 0.967 | 0.823 |

| SpotGamma Gamma Index™: | 1.221 | 0.258 | -0.002 | -0.00 | -0.004 | -0.043 |

| Gamma Notional (MM): | $119.478M | $863.84M | ‑$2.292M | ‑$288.992M | ‑$9.565M | ‑$349.388M |

| 25 Delta Risk Reversal: | -0.027 | -0.03 | -0.027 | -0.034 | -0.005 | -0.018 |

| Call Volume: | 821.768K | 4.307M | 16.812K | 967.677K | 45.054K | 690.339K |

| Put Volume: | 1.378M | 2.93M | 13.078K | 1.469M | 76.16K | 1.334M |

| Call Open Interest: | 7.841M | 5.986M | 59.784K | 4.166M | 309.098K | 5.00M |

| Put Open Interest: | 15.467M | 17.355M | 86.47K | 8.986M | 536.083K | 9.011M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5150, 5000, 5100, 5200] |

| SPY Levels: [515, 516, 514, 517] |

| NDX Levels: [18000, 17850, 18025, 18150] |

| QQQ Levels: [439, 440, 435, 438] |

| SPX Combos: [(5398,97.54), (5377,71.70), (5351,92.43), (5326,74.19), (5300,98.89), (5274,89.88), (5269,73.64), (5259,73.05), (5253,82.14), (5248,98.26), (5228,78.49), (5223,95.72), (5217,89.39), (5212,88.55), (5207,86.91), (5202,99.99), (5197,83.87), (5192,90.12), (5187,88.09), (5181,95.76), (5176,98.60), (5171,97.21), (5161,96.21), (5145,83.84), (5140,92.98), (5135,75.34), (5125,86.79), (5120,80.34), (5099,97.94), (5022,74.93), (5001,96.54), (4950,85.96), (4924,71.42), (4898,87.94)] |

| SPY Combos: [518.54, 523.18, 519.06, 521.12] |

| NDX Combos: [17997, 18015, 17438, 17636] |

| QQQ Combos: [443.58, 442.7, 448.4, 423.39] |

SPX Gamma Model

View All Indices Charts

0 comentarios