Macro Theme:

Short Term SPX Resistance: 5,200

Short Term SPX Support: 5,100

SPX Risk Pivot Level: 5,100

Major SPX Range High/Resistance: 5,200 SPX Call Wall – 5,211 (520 SPY Call Wall)

Major SPX Range Low/Support: 5,000

‣ 5,200 is the upside target.*

‣ 5,100 is critical support, up from 5,000 the week ending 3/1.*

‣ We look for index volatility to now contract (ref: 2/23, 1-month realized vol 14%, VIX 14.2).

‣ The week of 3/11 is the next major inflection point: 3/12 CPI, 3/14 PPI, March Quarterly OPEX (3/15), 3/18 NVDA Event, followed by 3/20 FOMC & VIX exp.*

*updated 3/4

Founder’s Note:

ES futures are +35bps to 5,200. NQ futures are +70bps to 18,187.

Key SG levels for the SPX are:

- Support: 5,115 (SPY 510), 5,100

- Resistance: 5,150, 5,160, 5,200 (SPX

Call Wall

), 5,211 (SPY 520

Call Wall

), 5,226

- 1 Day Implied Range: 0.51%

For QQQ:

- Support: 439, 437

- Resistance: 440, 445, 450

Call Wall

IWM:

- Support: 200, 194

- Resistance: 210

Call Wall

There is a 3 month & 6 month Treasury Auction at 11:30AM ET.

NVDA’s GTC conference starts today with CEO speaking at 4PM EST.

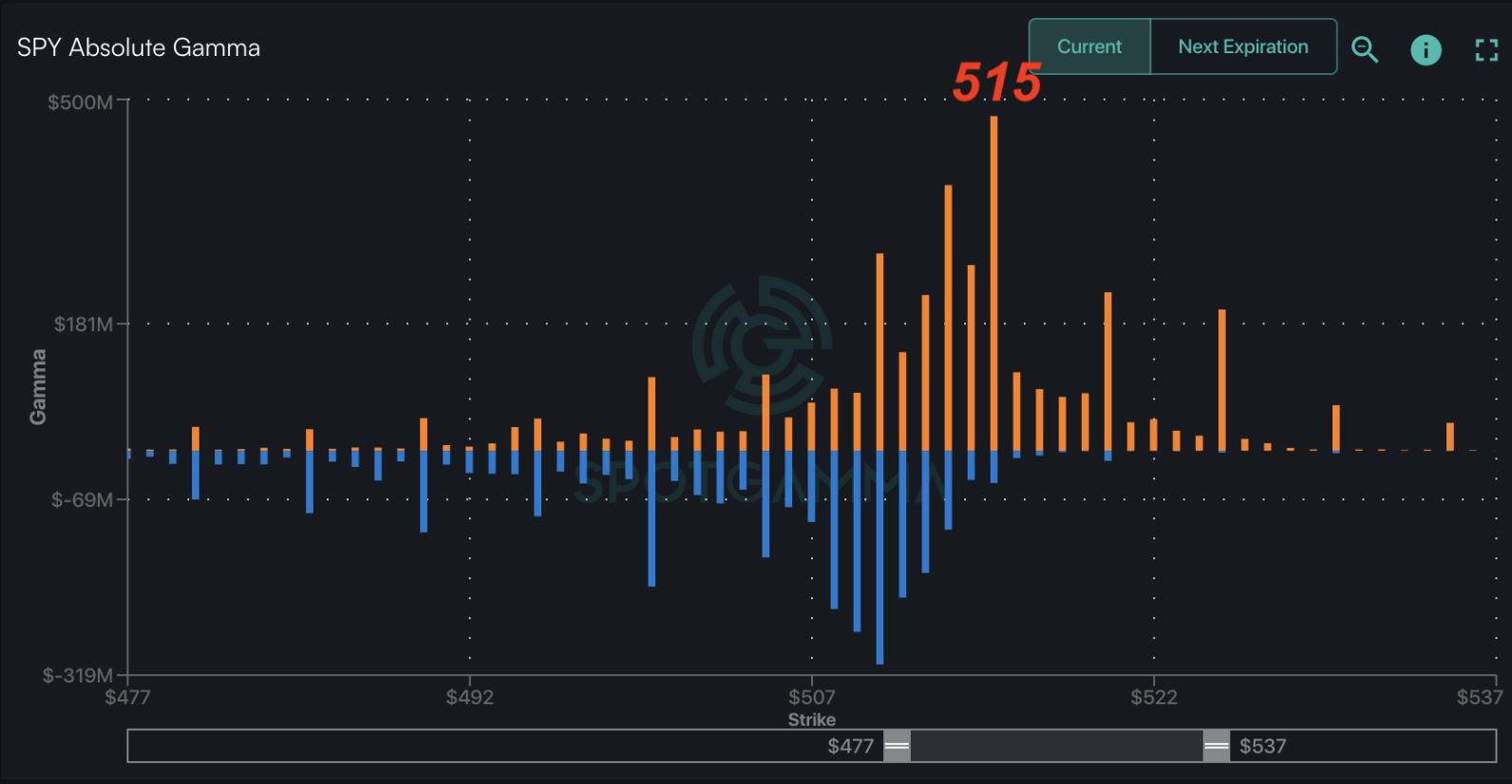

While OPEX reduced SPX gamma significantly, we still see the major levels as 5,100 support with initial resistance at 5,150 – 5,160 (SPY 515). 5,200 remains the

Call Wall

and longer term resistance. Our SG 1-day implied move is a very tight 51bps, and that corresponds with very low straddle prices. This makes sense as the two major headline catalysts this week, NVDA & FOMC, are after the close today and on Wednesday afternoon, respectively.

The catalyst that may not be on most traders radar is that of Wednesday AM’s VIX expiration. The last two VIX expirations have brought some rather large, gappy moves higher in the VIX as we’ve highlighted in black, below. These VIX moves corresponded with ~1% selloffs in the SPX – dips that were quickly bought. In this case, we think that traders need to be on watch for unusual moves tomorrow, too.

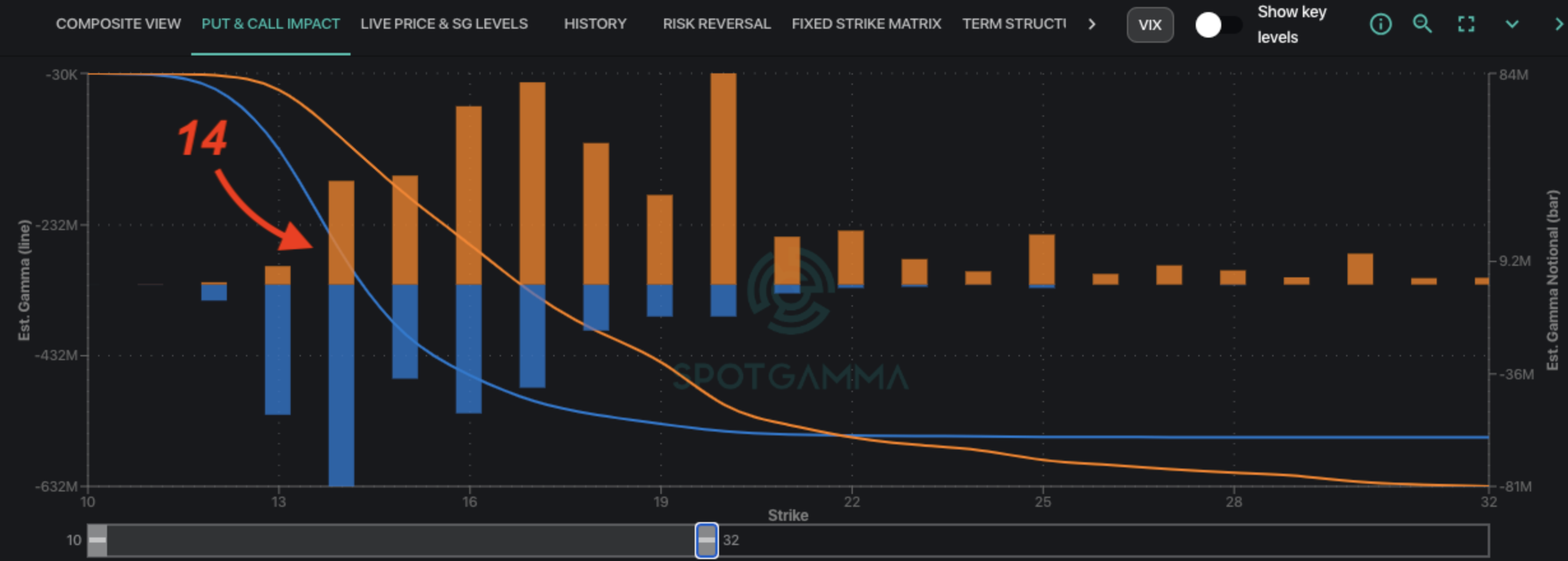

In this case the VIX exp, which is at the open on Wednesday, is playing into the prime catalyst of the FOMC, an Wednesday PM event which drives a volatility premium. This could inhibit some of the VIX related flow, but our gut here is that VIX could be driven lower tomorrow, which could result in the SPX ratcheting unexpectedly higher. As far as VIX positioning goes, 14 seems to be the large level and we often use the “max pain” theory as a guide here. A close below that levels wipes out nearly all of the VIX calls for Wednesdays expiration. Should the VIX push <14 it would signal a pop in equities.

That being said, it seems that the last two VIX spikes related to VIX expiration were due to large VIX call positions rolling, which added upside pressure. I can hear you all saying “great, so it could go up or down”, and the answer to that is “yes”.

The critical point is that volatility could expand (i.e. lots of movement up or down) Tuesday given the expiration dynamics, and other market participants would likely not see VIX exp as the key driver. Additionally, any related VIX/equity move on Tuesday could well be a head fake as it feeds into Powell on Wednesday (he could quickly unravel any move occurring into FOMC).

You also have to toss NVDA into the mix, as if there are some amazing new AI/chip developments it could stoke semi’s higher overnight.

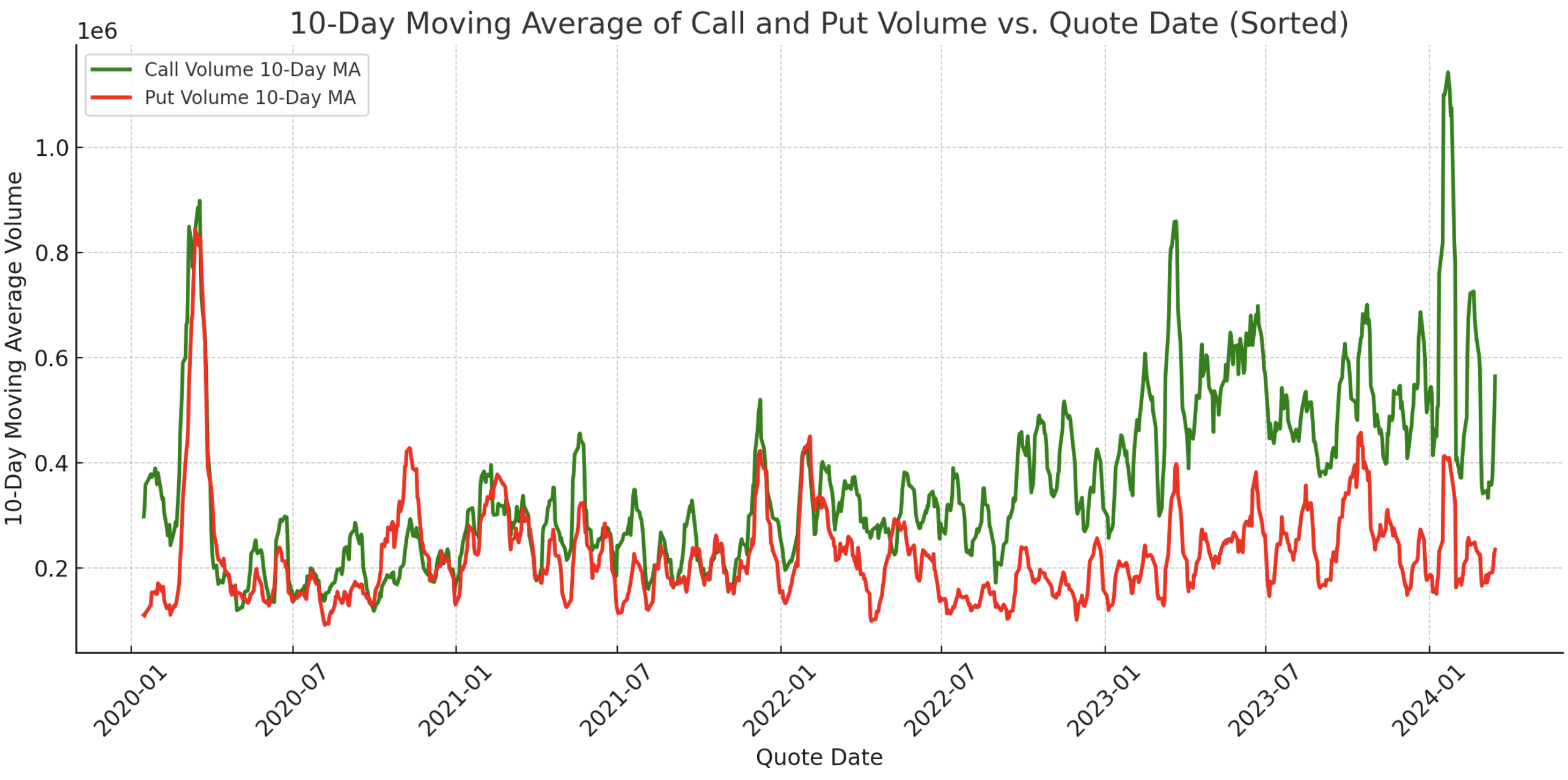

A quick side note on VIX

call volume

(green) – it has been tapering off some, after being near record highs. As a point of reference, Goldman has been out suggesting VIX as the way to hedge risk into April. We would join their call if the SPX breaks <5,100.

Shifting back to equities, we have been following the SPX map below over the past week, focused on the SPX holding 5,100 – 5,200 range. With OPEX behind us, and several catalysts just ahead, we are now watching for a close >5,200 as “risk on” or <5,100 as “risk off” into the end of March.

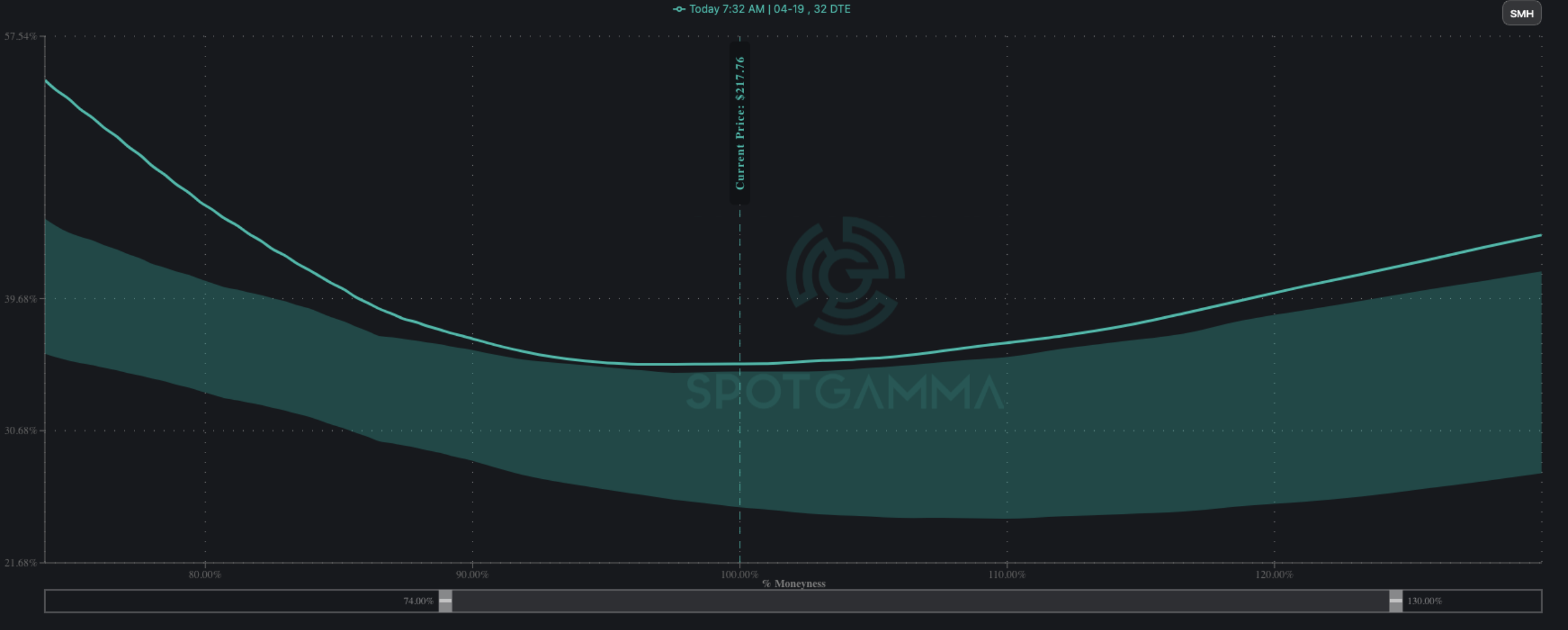

OPEX week did bring some consolidation across the chip sector, with SMH -3.5% on the week. With OPEX now over, eyes turn squarely to the NVDA event tonight. We can see the anticipation of the event in chip-related IV’s, with elevated IV’s and a call skew in the SMH, shown below. This informs us that should semis start to rally, dealers should be buying into the move. Conversely, we look for a flattening of these semi call skews as a core, long term “risk off” signal. This skew something we will be closely monitoring tomorrow as the market digests NVDA’s announcements.

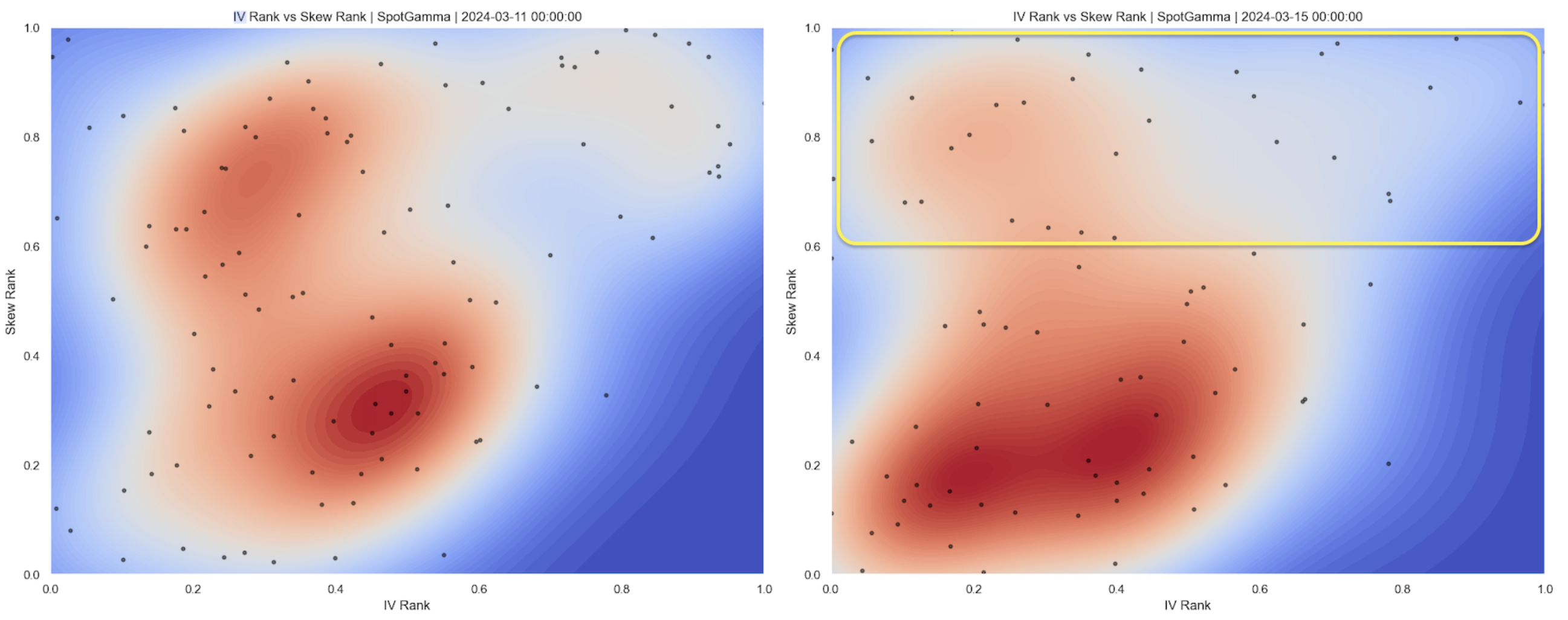

On this final topic of skew, we’ve been tracking the dying call bid across equities. You can see this over the past week, wherein the bulk of top stocks have moved away from high Skew Ranks (which indicated a strong call bid), and are now toward the bottom of their rankings (neutral call bid). We look at 1-month options to derive Skew Rank, and so this is not a measure of shorter term, speculative behavior. Further, the only names that are really holding onto their high Skew Ranks are related to semi’s and crypto, which highlights the importance of the NVDA event.

Something needs to happy to reinvigorate the equity bid, and so the market needs NVDA and/or Powell to come through.

| SpotGamma Proprietary Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Reference Price: | $5117 | $509 | $17808 | $433 | $2039 | $202 |

| SpotGamma Implied 1-Day Move: | 0.51% | 0.51% |

|

|

|

|

| SpotGamma Implied 5-Day Move: | 1.24% |

|

|

|

|

|

| SpotGamma Volatility Trigger™: | $5130 | $510 | $17750 | $435 | $2025 | $204 |

| Absolute Gamma Strike: | $5000 | $510 | $17900 | $430 | $2100 | $200 |

| SpotGamma Call Wall: | $5200 | $520 | $17900 | $450 | $2040 | $210 |

| SpotGamma Put Wall: | $5130 | $500 | $17500 | $420 | $1700 | $200 |

| Additional Key Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Zero Gamma Level: | $5126 | $512 | $17366 | $439 | $2096 | $205 |

| Gamma Tilt: | 0.985 | 0.711 | 1.276 | 0.724 | 0.792 | 0.750 |

| SpotGamma Gamma Index™: | -0.09 | -0.299 | 0.025 | -0.108 | -0.014 | -0.04 |

| Gamma Notional (MM): | ‑$187.043M | ‑$935.849M | $2.226M | ‑$429.981M | ‑$11.658M | ‑$319.983M |

| 25 Delta Risk Reversal: | -0.026 | -0.012 | -0.028 | -0.026 | -0.007 | -0.009 |

| Call Volume: | 604.045K | 1.682M | 21.187K | 1.082M | 46.016K | 266.436K |

| Put Volume: | 1.21M | 2.348M | 18.564K | 1.303M | 51.652K | 509.505K |

| Call Open Interest: | 5.87M | 5.576M | 36.504K | 3.234M | 197.897K | 3.611M |

| Put Open Interest: | 12.183M | 13.402M | 53.004K | 6.003M | 361.017K | 6.722M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5000, 5100, 5150, 5200] |

| SPY Levels: [510, 515, 500, 505] |

| NDX Levels: [17900, 18000, 18500, 17500] |

| QQQ Levels: [430, 435, 440, 420] |

| SPX Combos: [(5352,89.46), (5301,97.85), (5276,86.02), (5271,83.65), (5250,97.68), (5230,71.81), (5225,91.11), (5219,89.86), (5209,78.78), (5199,99.20), (5189,78.70), (5178,79.01), (5173,91.45), (5168,91.19), (5158,86.26), (5148,92.62), (5143,79.31), (5132,97.61), (5122,79.64), (5112,87.97), (5102,77.64), (5092,91.34), (5086,86.19), (5081,83.28), (5076,85.91), (5071,83.43), (5061,79.39), (5051,86.50), (5040,87.33), (5030,81.03), (5025,79.63), (5020,88.61), (5015,76.37), (4999,95.56), (4989,74.20), (4974,72.13), (4969,73.29), (4958,71.23), (4948,88.71), (4923,72.50), (4918,77.47), (4902,91.52), (4877,74.07)] |

| SPY Combos: [514.84, 524.52, 512.29, 519.43] |

| NDX Combos: [17897, 17238, 17648, 17434] |

| QQQ Combos: [433.35, 433.78, 419.9, 424.68] |

SPX Gamma Model

$4,120$4,670$5,220$6,141Strike-$1.5B-$876M-$226M$1BGamma NotionalPut Wall: 5130Call Wall: 5200Abs Gamma: 5000Vol Trigger: 5130Last Price: 5117

Strike: $5,568

- Next Expiration: $527,028,861

- Current: $528,055,865

View All Indices Charts

0 comentarios