Macro Theme:

Short Term SPX Resistance: 5,200

Short Term SPX Support: 5,100

SPX Risk Pivot Level: 5,100

Major SPX Range High/Resistance: 5,200 SPX Call Wall – 5,211 (520 SPY Call Wall)

Major SPX Range Low/Support: 5,000

‣ 5,200 is the upside target.*

‣ 5,100 is critical support, up from 5,000 the week ending 3/1.*

‣ We look for index volatility to now contract (ref: 2/23, 1-month realized vol 14%, VIX 14.2).*

‣ The week of 3/11 is the next major inflection point: 3/12 CPI, 3/14 PPI, March Quarterly OPEX (3/15), 3/18 NVDA Event, followed by 3/20 FOMC & VIX exp.*

‣ NVDA’s event on 3/18 failed to renew the call bid in the chip sector, likely triggering longer term consolidation in the space (ref: 216 in SMH).**

‣ Mag7 ex-NVDA is our preferred way to play longs in the equities going forward, as their low call skews may attract bids, which could restart these stocks higher.**

*updated 3/4

**updated 3/19

Founder’s Note:

ES futures are -15bps to 5,205. NQ futures are -40bps to 18,185.

Key SG levels for the SPX are:

- Support: 5,115 (SPY 510), 5,100, 5,082

- Resistance: 5,150, 5,160, 5,200 (SPX

Call Wall

), 5,211 (SPY 520

Call Wall

), 5,226

- 1 Day Implied Range: 0.73%

For QQQ:

- Support: 435, 430

- Resistance: 440, 445, 450

Call Wall

IWM:

- Support: 200

- Resistance: 210

Call Wall

There is a 52 week TBIll auction at 11:30AM ET, and a 20 year auction at 1PM.

NVDA is -100 bps to 875 after the CEO’s keynote last night.

Bitcoin, which we consider a leading indicator of speculative risk, is -6% today to $63k, and -15% since its ATH near $73k last week.

Tomorrow AM is VIX expiration and as per our note yesterday, traders should today be on the lookout for unusual swings in both VIX & equities. We had favored VIX shifting lower today <=14, which could in turn buoy the SPX up toward 5,175-5,200. However, we need to take this in the context of a few more triggers, outlined below. Regardless, any move related to VIX flows today should be viewed as a “day trade”, and not an indicative signal of what may happen out of tomorrow’s FOMC. Out of FOMC we continue to mark an SPX close >5,200 as “risk on” and <5,100 as “risk off”.

Onto the triggers, first with NVDA. Based on the pre-market action (-1% to 875) traders are not terribly impressed by NVDA’s offering. Based on last nights close, traders were pricing in a ~4% move around the event. With no material bid after-hours, it appears that event-IV is set to come down, which would also likely mean a flattening of call skews not just for NVDA, but across the sector. This is a bearish development for the chip sector, as it signals that buyside long call positions will decay, leading dealers (short calls) to sell long semi stock hedges. You can also look at it as all those flows that were present in the recent stock-up, vol-up move need to unwind.

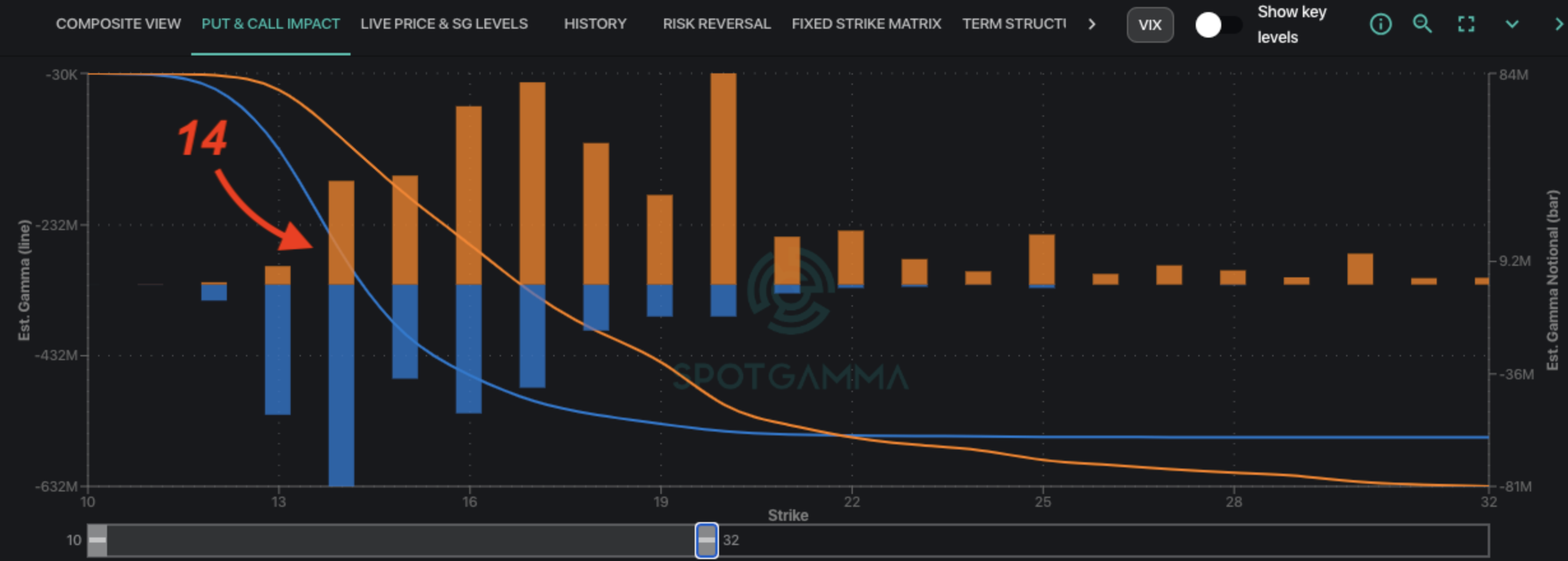

To this point, in the premarket we see the leading semi’s down sharply: AMD -2%, SMCI -4%, ARM -1.25%. Below is the SMH (semi ETF), wherein we see a lot of gamma positions (inset, orange & blue bars) down to 200, but very little under that. This indicates a target support area.

The second trigger is FOMC.

There are two ways to view this market into Powell. 1) If Powell is overtly hawkish, it likely means a larger selloff in the equity space. Our view is a break of 5,100 leads to a quick test of 5,000, but at 5,000 we’ll have to see a real bid to puts/vol in order trigger a larger, longer term drawdown. So far this year, all dips have been bought (via calls and or short puts), and so we will be monitoring fixed strike vol closely for a directional signal at the major 5,000 strike.

2) Conversely, should Powell come in in line we think equities are broadly likely to resume their bid. This would be an opportunity for the broader tech sector, particularly Mag 7 (ex NVDA) to close their performance gap vs chips which have just had their call skews zapped. You can see this gap in the AAPL+GOOGL+MSFT+AMZN+META (candlestick) vs SMH (orange). Again, SPX >5,200 is the risk on trigger. Our skew ranks in these top market cap names are already quite low (20-30% Rank) suggesting they have “been cleansed” vs semis which are likely to fight dropping call skews.

| SpotGamma Proprietary Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Reference Price: | $5149 | $512 | $17985 | $437 | $2024 | $201 |

| SpotGamma Implied 1-Day Move: | 0.73% | 0.73% |

|

|

|

|

| SpotGamma Implied 5-Day Move: | 1.24% |

|

|

|

|

|

| SpotGamma Volatility Trigger™: | $5145 | $513 | $17750 | $440 | $2025 | $201 |

| Absolute Gamma Strike: | $5000 | $515 | $17900 | $440 | $2100 | $200 |

| SpotGamma Call Wall: | $5200 | $520 | $17900 | $450 | $2040 | $210 |

| SpotGamma Put Wall: | $5000 | $510 | $16000 | $430 | $1900 | $200 |

| Additional Key Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Zero Gamma Level: | $5119 | $515 | $17276 | $440 | $2097 | $204 |

| Gamma Tilt: | 1.117 | 0.750 | 1.428 | 0.737 | 0.734 | 0.739 |

| SpotGamma Gamma Index™: | 0.670 | -0.265 | 0.036 | -0.109 | -0.019 | -0.043 |

| Gamma Notional (MM): | $104.499M | ‑$983.976M | $3.472M | ‑$408.116M | ‑$16.657M | ‑$364.53M |

| 25 Delta Risk Reversal: | -0.024 | -0.009 | -0.029 | -0.02 | -0.005 | -0.018 |

| Call Volume: | 448.953K | 1.249M | 11.158K | 810.658K | 19.57K | 305.153K |

| Put Volume: | 871.188K | 2.139M | 12.402K | 1.236M | 39.761K | 408.663K |

| Call Open Interest: | 5.92M | 5.568M | 36.906K | 3.372M | 199.06K | 3.684M |

| Put Open Interest: | 12.261M | 13.868M | 53.645K | 6.342M | 369.905K | 6.753M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5000, 5200, 5150, 5100] |

| SPY Levels: [515, 510, 512, 520] |

| NDX Levels: [17900, 18000, 18500, 16000] |

| QQQ Levels: [440, 430, 435, 420] |

| SPX Combos: [(5402,97.29), (5376,71.70), (5350,91.32), (5325,73.83), (5319,73.03), (5299,98.47), (5273,94.60), (5258,79.98), (5252,98.73), (5242,77.77), (5232,80.29), (5227,94.21), (5222,93.86), (5211,86.52), (5206,71.74), (5201,99.53), (5196,77.95), (5191,87.30), (5185,92.53), (5180,95.36), (5175,91.40), (5170,92.42), (5149,82.06), (5139,89.58), (5129,89.94), (5119,96.63), (5113,87.21), (5108,91.29), (5103,82.81), (5098,73.80), (5093,74.31), (5088,75.57), (5082,89.06), (5077,78.38), (5072,76.84), (5062,76.22), (5052,80.72), (5041,78.50), (5021,84.98), (5016,79.92), (5000,94.27), (4990,74.58), (4949,85.25), (4902,89.94)] |

| SPY Combos: [521.08, 531.33, 526.2, 514.41] |

| NDX Combos: [17895, 17679, 17266, 17463] |

| QQQ Combos: [439.66, 423.47, 433.53, 428.28] |

SPX Gamma Model

Strike: $5,478

- Next Expiration: $642,768,642

- Current: $645,859,811

View All Indices Charts

0 comentarios