Macro Theme:

Short Term SPX Resistance: 5,200

Short Term SPX Support: 5,100

SPX Risk Pivot Level: 5,100

Major SPX Range High/Resistance: 5,200 SPX Call Wall – 5,211 (520 SPY Call Wall)

Major SPX Range Low/Support: 5,000

‣ 5,200 is the upside target.*

‣ 5,100 is critical support, up from 5,000 the week ending 3/1.*

‣ We look for index volatility to now contract (ref: 2/23, 1-month realized vol 14%, VIX 14.2).*

‣ The week of 3/11 is the next major inflection point: 3/12 CPI, 3/14 PPI, March Quarterly OPEX (3/15), 3/18 NVDA Event, followed by 3/20 FOMC & VIX exp.*

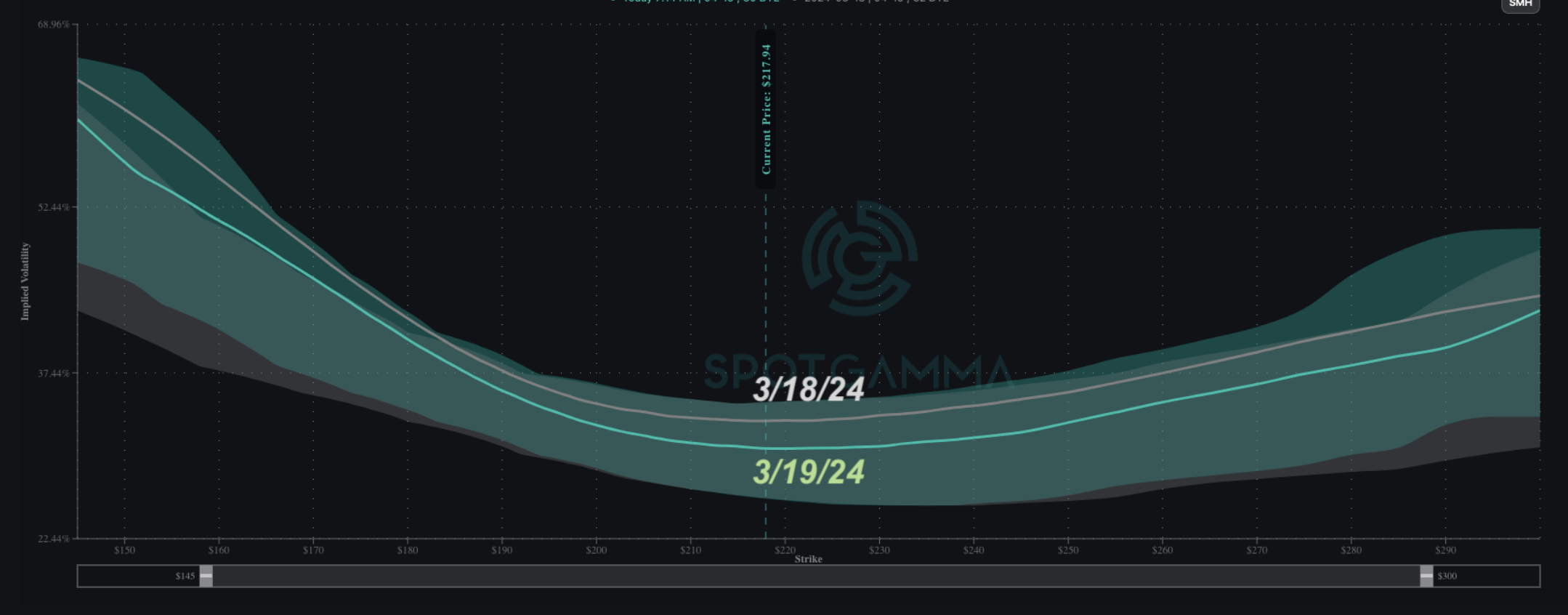

‣ NVDA’s event on 3/18 failed to renew the call bid in the chip sector, likely triggering longer term consolidation in the space (ref: 216 in SMH).**

‣ Mag7 ex-NVDA is our preferred way to play longs in the equities going forward, as their low call skews may attract bids, which could restart these stocks higher.**

*updated 3/4

**updated 3/19

Founder’s Note:

ES &. NQ futures are flat at 5,240 & 18,28, respectively.

Key SG levels for the SPX are:

- Support: 5,160, 5,150, 5,115 (SPY 510), 5,100, 5,082

- Resistance: 5,200 (SPX

Call Wall

), 5,211 (SPY 520

Call Wall

), 5,222

- 1 Day Implied Range: 0.73%

For QQQ:

- Support: 435, 430

- Resistance: 440, 445, 450

Call Wall

IWM:

- Support: 200

- Resistance: 210

Call Wall

VIX expiration is at 9:30AM ET, there is a 17 week TBILL auction at 11:30AM ET, and FOMC is at 2PM ET.

The VIX is primed to expire this morning <14, and we believe yesterday’s VIX slide was why equities pumped higher yesterday (see Mon & yesterday’s notes). With that, we saw the SPX close up at 5,175 – just a few handles shy of all time highs.

The key quote from our Monday AM note is/was this (emphasis added):

The critical point is that volatility could expand (i.e. lots of movement up or down) Tuesday given the expiration dynamics, and other market participants would likely not see VIX exp as the key driver [see this clip]. Additionally, any related VIX/equity move on Tuesday could well be a head fake as it feeds into Powell on Wednesday (he could quickly unravel any move occurring into FOMC).

That leads us to the map we’ve been following, wherein we’ve arrived at the critical junction of price (5,200) & time (FOMC event). The SPX is currently poised up near 5,175, which is in clear striking distance of the long-held 5,200 -5,210 SPX/SPY

Call Walls

, and a close today above that zone is our “risk on” indicator. Accordingly we’d look for a move to 5,300 by end of month.

To the downside, the SPX now has some distance to our major, first support line at 5,100. We think a gap down to that area would today be easy to fill, and it will be critical to monitor shifts in IV to determine if that 5,100 level will hold as future support. While we don’t think that 5,100 will break today, should we close near that level and see IV increase at lower SPX strikes, it will be an indicator that a move to 5,000 is in the cards.

Further, we believe monitoring

HIRO

flows around the 2:30PM ET time frame will offer great clues into how traders are adjusting positions into Powell’s statements. Watch in particular the longer dated flows (i.e. non-0DTE), for call and/or put buying.

Turning to the semis, our view has been that the NVDA event would lead to a drop in sector IV’s, and a flattening of call skews that would be a headwind for semi stocks. IV’s down clearly happened, as shown in the 1-month SMH skew plot, below. Most other semi sector stocks, including NVDA, saw a similar shift down after the NVDA event. The IV of upside strikes have not yet lost relative to at-the-money strikes (i.e. call skew flattening), but we continue to believe they will. As a result we favor some of the Mag 7 names being the leader in any type of refreshed equity breakout (per yesterday).

On this point of lower IV’s we saw most sector stocks close down yesterday, some quite lower, but they did indeed rally from much weaker AM levels. The mid-day rally in these names corresponded with the strong index bid, and because NVDA is the 3rd largest component of both the SPX & NDX, its going to asymmetrically benefit from broader market strength.

| SpotGamma Proprietary Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Reference Price: | $5149 | $512 | $17985 | $437 | $2024 | $201 |

| SpotGamma Implied 1-Day Move: | 0.73% | 0.73% |

|

|

|

|

| SpotGamma Implied 5-Day Move: | 1.24% |

|

|

|

|

|

| SpotGamma Volatility Trigger™: | $5145 | $513 | $17750 | $440 | $2025 | $201 |

| Absolute Gamma Strike: | $5000 | $515 | $17900 | $440 | $2100 | $200 |

| SpotGamma Call Wall: | $5200 | $520 | $17900 | $450 | $2040 | $210 |

| SpotGamma Put Wall: | $5000 | $510 | $16000 | $430 | $1900 | $200 |

| Additional Key Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Zero Gamma Level: | $5119 | $515 | $17276 | $440 | $2097 | $204 |

| Gamma Tilt: | 1.117 | 0.750 | 1.428 | 0.737 | 0.734 | 0.739 |

| SpotGamma Gamma Index™: | 0.670 | -0.265 | 0.036 | -0.109 | -0.019 | -0.043 |

| Gamma Notional (MM): | $104.499M | ‑$983.976M | $3.472M | ‑$408.116M | ‑$16.657M | ‑$364.53M |

| 25 Delta Risk Reversal: | -0.024 | -0.009 | -0.029 | -0.02 | -0.005 | -0.018 |

| Call Volume: | 448.953K | 1.249M | 11.158K | 810.658K | 19.57K | 305.153K |

| Put Volume: | 871.188K | 2.139M | 12.402K | 1.236M | 39.761K | 408.663K |

| Call Open Interest: | 5.92M | 5.568M | 36.906K | 3.372M | 199.06K | 3.684M |

| Put Open Interest: | 12.261M | 13.868M | 53.645K | 6.342M | 369.905K | 6.753M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5000, 5200, 5150, 5100] |

| SPY Levels: [515, 510, 512, 520] |

| NDX Levels: [17900, 18000, 18500, 16000] |

| QQQ Levels: [440, 430, 435, 420] |

| SPX Combos: [(5402,97.29), (5376,71.70), (5350,91.32), (5325,73.83), (5319,73.03), (5299,98.47), (5273,94.60), (5258,79.98), (5252,98.73), (5242,77.77), (5232,80.29), (5227,94.21), (5222,93.86), (5211,86.52), (5206,71.74), (5201,99.53), (5196,77.95), (5191,87.30), (5185,92.53), (5180,95.36), (5175,91.40), (5170,92.42), (5149,82.06), (5139,89.58), (5129,89.94), (5119,96.63), (5113,87.21), (5108,91.29), (5103,82.81), (5098,73.80), (5093,74.31), (5088,75.57), (5082,89.06), (5077,78.38), (5072,76.84), (5062,76.22), (5052,80.72), (5041,78.50), (5021,84.98), (5016,79.92), (5000,94.27), (4990,74.58), (4949,85.25), (4902,89.94)] |

| SPY Combos: [521.08, 531.33, 526.2, 514.41] |

| NDX Combos: [17895, 17679, 17266, 17463] |

| QQQ Combos: [439.66, 423.47, 433.53, 428.28] |

0 comentarios