Macro Theme:

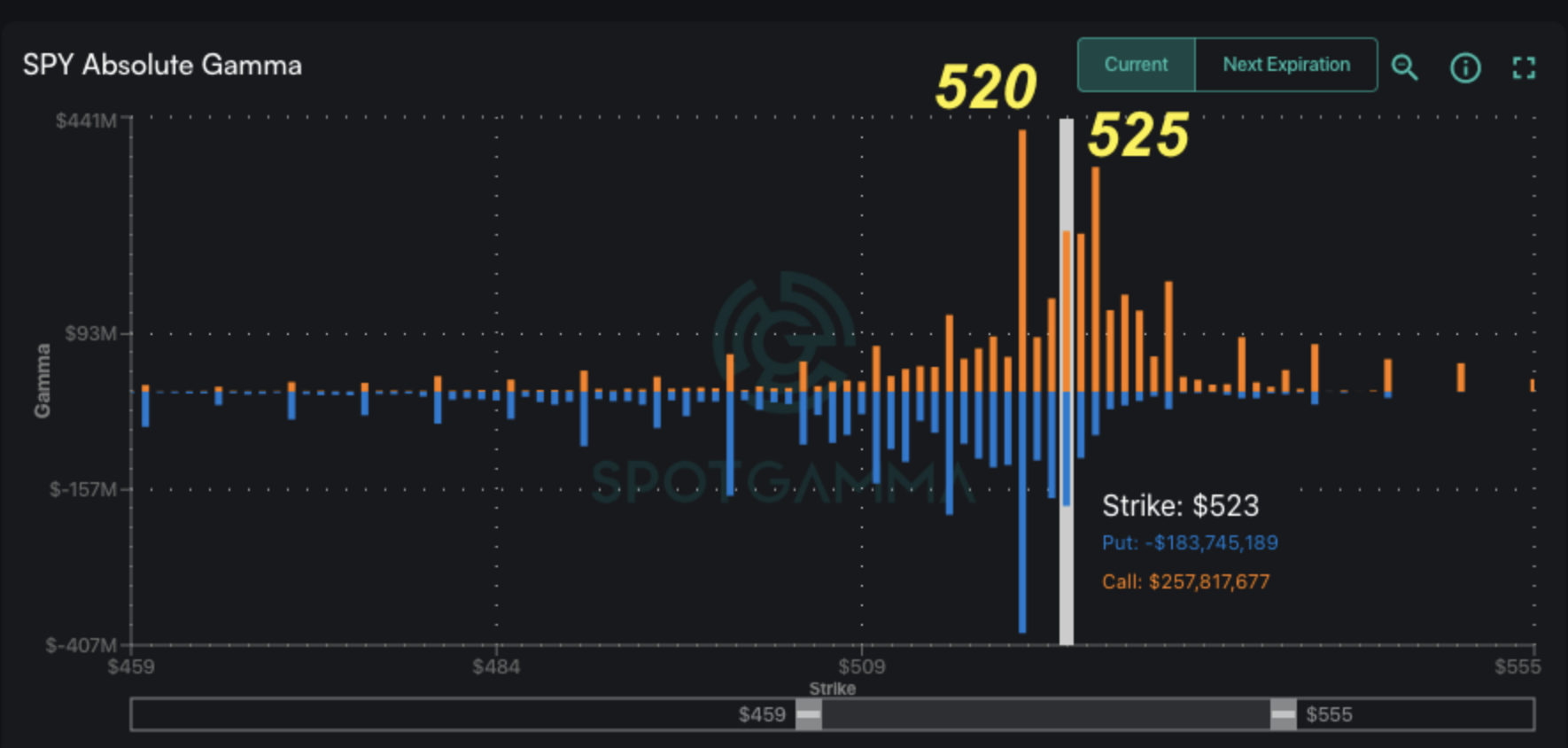

Short Term SPX Resistance: 5,265 (SPY 525)

Short Term SPX Support: 5,200

SPX Risk Pivot Level: 5,200

Major SPX Range High/Resistance: (5,265 SPY 525)

Major SPX Range Low/Support: 5,000

‣ 5,265 is the upside target.*

‣ 5,200 is critical support, up from 5,100 on 3/20. Below 5,200 is our risk off indicator.*

‣ 5,300 is our target into March month end.*

‣ NVDA’s event on 3/18 failed to renew the call bid in the chip sector, likely triggering longer term consolidation in the space (ref: 216 in SMH).**

*updated 3/22

**updated 3/19

Founder’s Note:

ES are up fractionally to 5,310. NQ futures are flat at 18,575.

Key SG levels for the SPX are:

- Support: 5,236, 5,226, 5,210, 5,200, 5,188

- Resistance: 5,250 (SPX

Call Wall

), 5,265

- 1 Day Implied Range: 0.74%

For QQQ:

- Support: 440, 435

- Resistance: 445, 447, 449, 450

IWM:

- Support: 200

- Resistance: 210

Call Wall

We saw

Call Walls

contract in both SPY & QQQ, to 523 & 449, respectively. These are small contractions, and speak to what appeared to be at-the-money call selling/overwriting into yesterday’s 5,250 -5,260 Call Wall area, and as AAPL’s antitrust headlines hit the tape. This call flow should function to create a supportive, but sticky gamma zone in the 5,200-5,250 area which should be slowly digested over the next week. With that, we still seem to be on path toward a move to 5,300 by the end of March, as upside vanna drift serves to nudge indexes higher. The idea of upside drift comes with realized volatility contacting due to the sticky gamma zone highlighted above, which allows implied volatility to decline. Tighter IV’s invoke that vanna tailwind of dealer stock buying.

As per usual, higher

Call Walls

are the signal for another leg up in equities. Our new risk-off level is 5,200. Below that level we see likely see marked increase in negative gamma, and a spike in IV.

This point on IV, and the related VIX, is an interesting one. 1-month realized SPX volatility is around 11%, which has been sustained primarily by markets moving higher (stock up, vol up). The plot below compares the VIX vs 1-month SPX realized vol, and as you can see the long term mean is 3pts (red line), which infers that an SPX RV of 11% = fair value of ~14 VIX. Above the red line the VIX has arguably too much premium, below that red line the premium may be too small.

To get the VIX, and slightly longer dated SPX IV’s to contract, we need realized vol to come in. That seems to be a reasonable belief for the SPX, but less less likely on the singe stock side.

That theme of SPX vs single stock performance suggests that correlation should be low, as the “winning stocks keep winning”, leaving other stocks behind. With that, we can see the CBOE 1 month correlation index back at recent lows. This matters to investors as it means this should continue to be a “stock pickers” market. If you are long the right stocks you are crushing it, while broader indexes….your doing “just ok” (read more about correlation here). This could be a problem for fund managers, if investors complain their diversified stock portfolios are falling behind chips or other leading sectors (like XLF, XLI).

This turns us to the final topic, and that of the Mag7’s. We have recently favored these mega-cap names now leading the market higher, picking up pace against the chip sector. Yesterday’s AAPL DOJ news certainly puts a damper on that idea, and we saw huge call selling (orange) in AAPL, suggesting that investors are throwing in the towel on the name. This makes some sense, as the stock was already struggling to keep pace, and now carries this added drag. We can’t help but wonder if this regulatory spotlight may be a drag on other (non semi) Mag7’s, too…thinking back to the idea of correlation, the question is why bother with the stocks which may now have extra hair on them (ex: TSLA).

| SpotGamma Proprietary Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Reference Price: | $5241 | $522 | $18320 | $445 | $2098 | $207 |

| SpotGamma Implied 1-Day Move: | 0.74% | 0.74% |

|

|

|

|

| SpotGamma Implied 5-Day Move: | 1.24% |

|

|

|

|

|

| SpotGamma Volatility Trigger™: | $5240 | $522 | $17850 | $446 | $2025 | $204 |

| Absolute Gamma Strike: | $5250 | $520 | $17900 | $447 | $2100 | $210 |

| SpotGamma Call Wall: | $5250 | $523 | $17900 | $449 | $2200 | $210 |

| SpotGamma Put Wall: | $5240 | $522 | $17500 | $446 | $1700 | $198 |

| Additional Key Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Zero Gamma Level: | $5172 | $521 | $17732 | $445 | $2062 | $206 |

| Gamma Tilt: | 1.702 | 1.042 | 1.612 | 0.990 | 1.038 | 1.21 |

| SpotGamma Gamma Index™: | 3.93 | 0.046 | 0.052 | -0.005 | 0.002 | 0.032 |

| Gamma Notional (MM): | $624.705M | ‑$71.429M | $3.062M | $5.916M | $40.141M | $354.831M |

| 25 Delta Risk Reversal: | 0.006 | 0.010 | 0.016 | 0.009 | 0.016 | 0.028 |

| Call Volume: | 1.259M | 3.381M | 28.049K | 1.726M | 34.752K | 746.349K |

| Put Volume: | 1.767M | 4.26M | 24.109K | 2.172M | 43.62K | 827.746K |

| Call Open Interest: | 6.147M | 5.857M | 37.926K | 3.713M | 204.50K | 4.029M |

| Put Open Interest: | 12.705M | 15.012M | 56.207K | 7.257M | 374.923K | 7.352M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5250, 5000, 5200, 5255] |

| SPY Levels: [520, 523, 522, 524] |

| NDX Levels: [17900, 18000, 18500, 17500] |

| QQQ Levels: [447, 445, 448, 440] |

| SPX Combos: [(5493,96.36), (5441,87.31), (5415,81.24), (5394,99.10), (5367,88.58), (5341,94.62), (5320,74.63), (5315,94.02), (5310,72.13), (5304,86.82), (5294,99.80), (5289,76.74), (5283,94.50), (5278,92.66), (5273,93.51), (5268,99.73), (5262,97.44), (5257,98.67), (5252,98.90), (5247,100.00), (5242,100.00), (5236,99.73), (5231,96.08), (5226,93.09), (5221,85.71), (5210,73.44), (5205,82.84), (5194,96.71), (5142,85.20), (5116,80.75), (5016,81.34), (4990,87.29)] |

| SPY Combos: [529.42, 534.12, 544.56, 518.46] |

| NDX Combos: [17881, 18430, 18394, 18467] |

| QQQ Combos: [442.96, 437.16, 427.34, 442.51] |

0 comentarios