Futures are off slightly to 3985 after a quiet overnight session. 4000 remains the large resistance/pin area, and is likely in play until 11/18 OPEX. Above that level we note 4024 and 4040 resistance. Support shows at 3976 ad 3948.

On Friday we talked about how this week should bring a change in volatility regimes from large directional swings, to more pining/grinding around the large 4000 strike. We view this market setup like that of August, which was the last time our models calculated material positive gamma. We highlighted August OPEX week in the chart below (left, red box), and you can see the price action stabilize after an explosive move higher.

With that, we note the vol shift comes from:

- The destruction of put values below (due to market higher/delta and implied vol declining/vanna)

- Building of call positions just overhead – the short term bulk of these positions we believe are trader short calls (dealer long call vs short futures).

This call position brings a dealer positive gamma position wherein dealers may be able to buy back short futures hedges on declines below 4000 and sell futures on rallies above. Further, the decay of these calls into 11/18 adds a market tailwind. This is because long call decay leads to a general requirement to buy back short hedges – this is charm.

This hedging stance is picked up in our vanna model, which has a left skew (tilt down to the left). This skew infers dealers are in a position to suppress volatility as they short into strength above 4000. This is because the notional delta exposure increases (y axis) as the market rises and/or IV comes down (see here for a “volatility inducing” stance on 9/13).

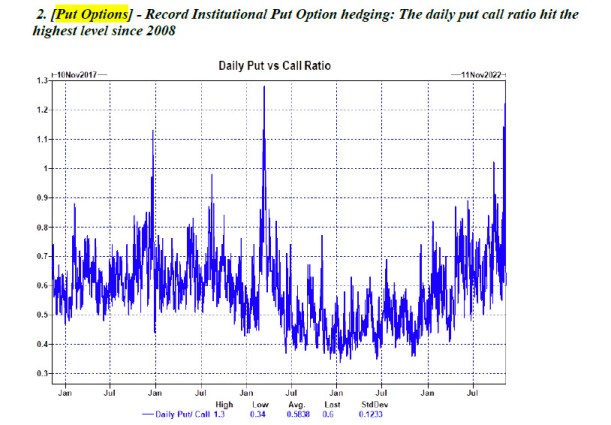

One quick note on some “record put” data being passed around. There are two flavors of this data – some showing record put/call ratios and others showing “historic levels of put premiums“.

First, if you look at the OCC data, you see extreme levels of put premiums both to open & close (top left and top right). However, you do not see record levels of put contracts trading (bottom right). The balanced buy/sell premium and “normal” contract volume all suggests some type of corporate action, like a takeover/spinoff. It does not read like traders going full “shock and awe” into puts for directional purposes.

In regards to the large put/call ratios (like the chart below shown in Fridays note), we would argue that the most effective way to play longs in this market was through the sale of puts – and all the suppressed skew readings suggest that this is a popular trading strategy. Selling puts generates positive delta exposure, but also benefits from a decline in IV. These short puts are then closed on market rallies, which creates an air pocket underneath for equity prices to decline into.

Extreme long put demand, we believe, would correspond with a capitulatory type move in equities and a large spike in IV (i.e. VIX new highs).

| SpotGamma Proprietary SPX Levels | Latest Data | SPX Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Ref Price: | 3992 | 3999 | 398 | 11817 | 287 |

| SG Implied 1-Day Move:: | 1.0%, | (±pts): 40.0 | VIX 1 Day Impl. Move:1.42% | ||

| SG Implied 5-Day Move: | 3.15% | 3900 (Monday Ref Price) | Range: 3778.0 | 4023.0 | ||

| SpotGamma Gamma Index™: | 1.10 | 0.87 | 0.06 | 0.02 | -0.00 |

| Volatility Trigger™: | 3825 | 3820 | 393 | 11040 | 280 |

| SpotGamma Absolute Gamma Strike: | 4000 | 4000 | 400 | 12000 | 290 |

| Gamma Notional(MM): | 357.0 | 432.0 | 223.0 | 4.0 | -4.0 |

| Put Wall: | 3600 | 3600 | 380 | 11000 | 260 |

| Call Wall : | 4100 | 4100 | 400 | 11050 | 290 |

| Additional Key Levels | Latest Data | Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Zero Gamma Level: | 3920 | 3898 | 395.0 | 0 | 298 |

| CP Gam Tilt: | 1.34 | 1.27 | 1.08 | 1.3 | 1.0 |

| Delta Neutral Px: | 3929 | ||||

| Net Delta(MM): | $1,851,751 | $1,755,718 | $198,120 | $62,043 | $103,842 |

| 25D Risk Reversal | -0.05 | -0.04 | -0.04 | -0.04 | -0.04 |

| Call Volume | 725,222 | 752,068 | 2,445,285 | 11,897 | 1,175,043 |

| Put Volume | 1,148,016 | 1,279,664 | 2,997,000 | 9,289 | 1,224,561 |

| Call Open Interest | 6,907,865 | 6,847,872 | 8,266,613 | 70,109 | 5,232,043 |

| Put Open Interest | 11,873,666 | 11,626,387 | 14,033,395 | 68,372 | 7,165,085 |

| Key Support & Resistance Strikes: |

|---|

| SPX: [4100, 4000, 3950, 3900] |

| SPY: [400, 395, 390, 380] |

| QQQ: [300, 290, 285, 280] |

| NDX:[12500, 12000, 11500, 11050] |

| SPX Combo (strike, %ile): [(4148.0, 86.04), (4100.0, 97.99), (4088.0, 85.82), (4076.0, 81.22), (4060.0, 82.71), (4048.0, 95.71), (4040.0, 87.84), (4024.0, 86.66), (4008.0, 92.59), (4000.0, 97.79), (3976.0, 77.52), (3948.0, 90.75), (3900.0, 74.67), (3833.0, 78.89), (3801.0, 80.93)] |

| SPY Combo: [409.27, 399.31, 404.09, 400.1, 394.13] |

| NDX Combo: [11900.0] |