Futures are higher this morning to 3995. Key levels are for the most part unchanged, with resistance at 4000-4010 (SPY 400), then 4025 & 4048. Support shows at 3960 and 3900.

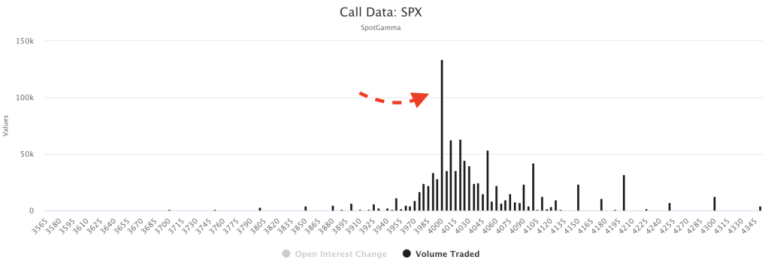

The 4000 strike continues to dominate both in terms of position sizing, and in volume. As shown below over 130k 4000 strike calls traded yesterday, vs 60k puts. We believe that the bulk of these calls are being sold which has helped maintain 4000 resistance.

As outlined the last several notes, we continue see markets revolving around the 4000 area into Fridays OPEX, wherein we see >35% of gamma expiring. This indicates a “release” of the 4000 area Friday, and an uptick in volatility for next week.

Zooming out, data continues to suggest a lack of downside put demand and we are starting to favor adding a bit of longer dated downside insurance here. The Vol Trigger (currently 3920) continues to slide higher, which is typically driven by call positions being added. As a reminder, our core model is to favor long positions while the S&P is above this Vol Trigger level, and give edge to shorts while the SPX is below the. Vol Trigger.

Whats interesting here is that the Put Wall has not shifted despite the large S&P rally. This suggests that there is little new put demand despite the +6% SPX rally over the last week. This, along with flat skew, leads us to view this market as “poorly hedged” as it may not take much to trigger a rather sharp market reversal. Again, we do not see a breakdown for this week, but we do see the potential for volatility being triggered with OPEX.

We would also highlight our concerns should the market decline into the start of December. There are extremely large options positions tied to December OPEX, and any slide lower post-Thanksgiving could energize those Dec puts which could serve to drag the market sharply lower (i.e. increased the vol-of-vol). We will certainly be tracking these positions closely, but note it now as markets are relatively calm which may present an opportunity for adding downside plays.

| SpotGamma Proprietary SPX Levels | Latest Data | SPX Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Ref Price: | 3957 | 3992 | 395 | 11700 | 285 |

| SG Implied 1-Day Move:: | 1.0%, | (±pts): 40.0 | VIX 1 Day Impl. Move:1.51% | ||

| SG Implied 5-Day Move: | 3.15% | 3900 (Monday Ref Price) | Range: 3778.0 | 4023.0 | ||

| SpotGamma Gamma Index™: | 0.47 | 1.1 | -0.07 | 0.03 | -0.02 |

| Volatility Trigger™: | 3920 | 3825 | 398 | 11000 | 285 |

| SpotGamma Absolute Gamma Strike: | 4000 | 4000 | 400 | 12000 | 290 |

| Gamma Notional(MM): | 81.0 | 357.0 | -392.0 | 5.0 | -144.0 |

| Put Wall: | 3600 | 3600 | 390 | 11000 | 260 |

| Call Wall : | 4100 | 4100 | 400 | 11050 | 290 |

| Additional Key Levels | Latest Data | Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Zero Gamma Level: | 3945 | 3920 | 397.0 | 10674.0 | 298 |

| CP Gam Tilt: | 1.13 | 1.2 | 0.88 | 1.45 | 0.91 |

| Delta Neutral Px: | 3866 | ||||

| Net Delta(MM): | $1,710,188 | $1,851,751 | $196,291 | $54,129 | $101,852 |

| 25D Risk Reversal | -0.04 | -0.05 | -0.04 | -0.03 | -0.03 |

| Call Volume | 571,977 | 725,222 | 1,971,191 | 9,329 | 830,361 |

| Put Volume | 841,364 | 1,148,016 | 2,644,548 | 7,391 | 859,673 |

| Call Open Interest | 7,074,617 | 6,907,865 | 8,349,876 | 71,338 | 5,298,406 |

| Put Open Interest | 11,495,855 | 11,873,666 | 14,261,572 | 62,747 | 7,200,891 |

| Key Support & Resistance Strikes: |

|---|

| SPX: [4100, 4000, 3950, 3900] |

| SPY: [400, 395, 390, 380] |

| QQQ: [290, 285, 280, 270] |

| NDX:[12500, 12000, 11500, 11050] |

| SPX Combo (strike, %ile): [(4151.0, 84.28), (4124.0, 73.94), (4100.0, 96.8), (4076.0, 79.2), (4048.0, 93.92), (4040.0, 77.79), (4025.0, 83.12), (4005.0, 79.82), (4001.0, 87.2), (3949.0, 74.82), (3902.0, 78.27), (3835.0, 77.15), (3799.0, 81.82)] |

| SPY Combo: [409.34, 404.21, 399.47, 414.48, 401.84] |

| NDX Combo: [11888.0, 11479.0] |