Macro Theme:

Short Term SPX Resistance: 5,200

Short Term SPX Support: 5,100

SPX Risk Pivot Level: 5,200

Major SPX Range High/Resistance: 5,300

Major SPX Range Low/Support: 5,000

‣ Monday & Tuesday flows could be supportive of equities based on charm + vanna flows. Accordingly, this may be an interesting place for call flies that profit on a move into +5200, as we’ve seen sneaky rallies on the Tuesday before VIX expiration (4/17), as vol could be shoved lower due to expiration mechanics.*

‣ A risk-off window then opens up on Wednesday AM with VIX expiration (4/17), and extends into the following Monday.

‣ 5,100 is critical support, down from 5,200 on 4/12. Below 5,200 remains long-term risk off level.*

‣ 5,300 is our max high target into April OPEX.*

*updated 4/15

Founder’s Note:

Both ES +54bps to 5,195. NQ futures +60bps to 18,289.

Key SG levels for the SPX are:

- Support: 5,123, 5,100

- Resistance: 5,150, 5,200, 5,220

- 1 Day Implied Range: 0.59%

For QQQ:

- Support: 435

- Resistance: 440, 445

IWM:

- Support: 195

- Resistance: 200, 205

3 & 6 month TBill auction at 11:30AM ET.

Equity futures are ~50bps higher this morning, and volatility is flat as shown both by the VIX, and by SPX fixed strike vol, shown below (change from Friday PM to current). In Friday’s AM note, we laid out that we were looking for equity market strength today into Tuesday PM, and that remains the case today. The amendment that we’d have to make to Friday’s view is that volatility is now more wound up due to Friday’s equity weakness/vol spike, which should give more energy to vanna flows, which in turn could lift equities. On this point we see a gap in major gamma levels from 5,150 to 5,200. Mind that gap.

To the downside, 5,100 remains first major support, as it held markets on Friday. The more significant, long term support level is 5,000.

The focus of this market is the situation in the Middle East, and we certainly hope things take a more positive tone. That being said, there are several additional factors at play which could be drivers of volatility:

1) Rate Vol: As we framed on Thursday there were massive shifts in rates, and rates remain at 6 month highs. This is not a worry for “today”, but likely is a risk factor out in time.

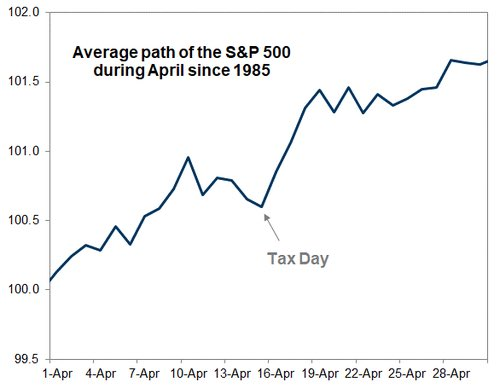

2) Tax Day: Seasonality strongly favors weakness into mid-April (h/t ZH). This chart suggests that seasonality shifts to a more positive stance, starting now.

3) “Put Cover” – Selling puts/vol has been a rewarding strategy for a year, leading to depressed put skews. Further, other systematic flows have shoved volatility into a box in unprecedented ways (see here), which provide stability in the short term, and in turn give the illusion of low volatility out in longer term time windows. One common narrative related to this is “the VIX is dead”, because 0DTE is where all the flows are.

The issue with this, as often discussed, is that when it comes time to hedge “known unknowns” you have to own longer dated options. If you are worried that conflict will shift higher over the coming days, you can’t hedge that with 0DTE. We saw this tenor shift during the March ’23 banking crisis, and are seeing a flavor of it now due to Middle East turmoil. VIX suddenly “matters” in these situations when vega is in demand.

While this vol bid shows in a 6-month VIX high, you can also see it in slightly longer dated skews. Shown here is 2-month SPX skew, comparing skew from 2 weeks ago (yellow) vs today (green). As you can see skew has traveled from statistically low (bottom of shaded cone) to well above highs from the several months. This likely sparks a trend of higher-for-longer IV’s in the longer dated space.

We are careful to specify “longer dated space” above, because VIX expiration is this week. Further, 0DTE players, whom assume war isn’t going to happen before today’s market close, will likely step in express that view today given elevated ultra-short-dated IV’s.

In regards to VIX expiration, there are a lot of calls now in-the-money from 16-20 (orange). This, we think, could influence a move back toward 15 for VIX as all of those VIX calls get crushed before Wednesday AM.

These are the flows that could support equities over the next few days.

|

SpotGamma Proprietary Levels |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Reference Price: |

$5123 |

$510 |

$18003 |

$438 |

$2003 |

$198 |

|

SpotGamma Implied 1-Day Move: |

0.59% |

0.59% |

|

|

|

|

|

SpotGamma Implied 5-Day Move: |

1.95% |

|

|

|

|

|

|

SpotGamma Volatility Trigger™: |

$5165 |

$512 |

$17890 |

$440 |

$2030 |

$205 |

|

Absolute Gamma Strike: |

$5000 |

$500 |

$17900 |

$440 |

$2050 |

$200 |

|

SpotGamma Call Wall: |

$5300 |

$525 |

$17900 |

$450 |

$2040 |

$210 |

|

SpotGamma Put Wall: |

$5000 |

$500 |

$17500 |

$435 |

$2000 |

$195 |

|

Additional Key Levels |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Zero Gamma Level: |

$5171 |

$513 |

$17823 |

$440 |

$2075 |

$206 |

|

Gamma Tilt: |

0.787 |

0.616 |

1.148 |

0.723 |

0.548 |

0.443 |

|

SpotGamma Gamma Index™: |

-1.758 |

-0.51 |

0.039 |

-0.136 |

-0.07 |

-0.147 |

|

Gamma Notional (MM): |

‑$619.372M |

‑$1.572B |

$4.392M |

‑$469.775M |

‑$67.679M |

‑$1.30B |

|

25 Delta Risk Reversal: |

-0.042 |

0.00 |

-0.044 |

-0.022 |

0.00 |

-0.02 |

|

Call Volume: |

679.154K |

2.669M |

19.61K |

1.029M |

86.726K |

928.548K |

|

Put Volume: |

1.365M |

3.44M |

28.154K |

1.217M |

120.176K |

2.285M |

|

Call Open Interest: |

7.095M |

7.037M |

57.205K |

3.877M |

296.186K |

4.344M |

|

Put Open Interest: |

14.178M |

15.557M |

81.484K |

6.698M |

550.613K |

8.255M |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [5000, 5200, 5100, 5150] |

|

SPY Levels: [500, 510, 520, 515] |

|

NDX Levels: [17900, 18000, 18500, 17850] |

|

QQQ Levels: [440, 435, 430, 420] |

|

SPX Combos: [(5349,92.72), (5323,76.33), (5298,96.96), (5277,89.32), (5267,72.27), (5251,92.04), (5226,75.82), (5200,91.61), (5175,88.18), (5149,90.31), (5123,92.89), (5118,75.73), (5113,81.35), (5103,74.21), (5098,95.87), (5093,86.57), (5088,89.76), (5082,84.80), (5077,94.92), (5072,81.71), (5067,93.80), (5062,76.48), (5052,97.30), (5047,77.18), (5041,72.92), (5036,74.13), (5026,92.58), (5021,78.48), (5016,95.52), (5000,97.40), (4985,72.36), (4975,93.20), (4965,80.44), (4949,93.28), (4924,79.94), (4913,78.61), (4898,94.23), (4877,91.33)] |

|

SPY Combos: [520.53, 515.93, 530.74, 525.63] |

|

NDX Combos: [17895, 17877, 17661, 17247] |

|

QQQ Combos: [442.69, 428.67, 428.23, 422.97] |

SPX Gamma Model

Strike: $5,617

- Next Expiration: $635,264,430

- Current: $642,164,550

View All Indices Charts

0 comentarios