Macro Theme:

Short Term SPX Resistance: 5,200 (SPX Call Wall)

Short Term SPX Support: 5,150

SPX Risk Pivot Level: 5,100

Major SPX Range High/Resistance: 5,200 (SPX Call Wall)

Major SPX Range Low/Support: 4,800

- For the week of 5/5 we see few catalysts, which should lead to contracting volatility, and upside equity drift.

- 5,200 – 5,215 is major resistance into OPEX week.

- 5,165 (SPY 515) likely remains a key pivot level (support/resistance area) through 5/10

- On a larger time frame, 5,100 is short term support. A break <5,100 pushes the S&P into a more fluid zone, wherein 5,000 is major, long term support.

- 5/22 NVDA earnings, which follows 5/17 OPEX, should be a major turning point for equities.

*updated 5/7

Founder’s Note:

ES futures are +35 bps to 5,257. NQ futures are +43bps to 18,292.

Key SG levels for the SPX are:

- Support: 5,150, 5,100

- Resistance: 5,165, 5,175 5,200, 5,208

- 1 Day Implied Range: 0.57%

For QQQ:

- Support: 440, 437, 435

- Resistance: 445

IWM:

- Support: 202, 200

- Resistance: 210

ES futures are 35bps higher, however the S&P

Call Walls

have held at 520 SPY/5,200 SPX. Higher S&P futures imply that the S&P is opening into overbought territory this morning, and the overbought condition remains until/unless the

Call Walls

roll higher. The QQQ & IWM Walls remain unchanged, too, at 445 & 210, respectively.

For this reason we are calling for consolidation of AM highs in ES futures, back to the 5,200-5,215 (SPY 520) range.

Zooming out, the S&P is now +4% from the SPY 500 lows on 5/1 FOMC.

We also note that higher equities are not just in the US, as European equities are markedly higher, too. Shown here are the Euro STOXX futures (candles) which just hit all-time highs vs ES Futures (teal). These equity indexes both

pivot

ed higher as interest rates (US 10Y as a benchmark, orange) moved sharply lower.

The point here is that the theme of higher equities, with bonds lower, is global as major central banks indicate lower rates ahead.

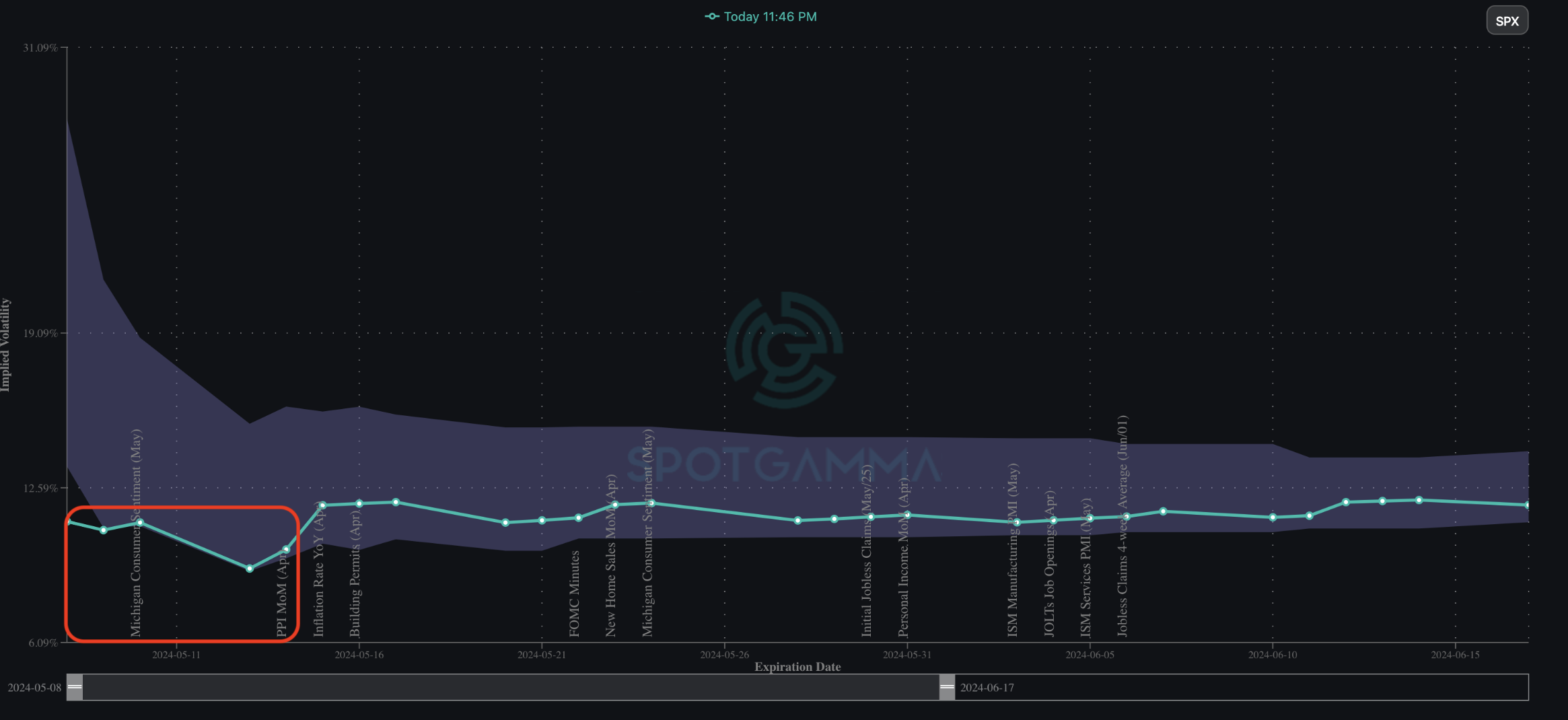

As we have been outlining, this equity resistance range in the 5,200 area lines up with implied vol nearing lows, and upcoming catalysts of data (inflation print(s) next week), OPEX (5/17), & NVDA ER (5/22). Therefore, both today and Monday serve as ‘freebies’ for 0DTE traders to engage freely, unaffected by the influences of longer-dated flows. You get a sense for this by looking at Monday’s SPX IV (the day before PPI/CPI data) – it is a measly 7%, which implies an SPX move of just 44bps!

Looking past that incredibly low single IV point, you can see that longer dated IV’s are skidding along 90-day lows, too, which suggests traders do not have much concern for the catalysts outlined above. This suggests that while there are some reasons for consolidation next week, traders see little major risk out in time.

On this point of the 0DTE traders being the only game in town, yesterday’s SPX options volume was absolutely anemic. Shown here is the CBOE Index Options volume, which includes SPX, VIX, etc. As you can see it was one of the lowest volume days since the full launch of 0DTE SPX options in late ’22. This backs the idea that its now short dated traders playing around and creating noise, as the bigger, longer dated flows now await next weeks data. Backing this is the failure of

Call Walls

to shift despite being tested, as there is little material OI changing with this low volume.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5238.03 | $5214 | $520 | $18113 | $441 | $2073 | $205 |

| SG Gamma Index™: |

| 1.824 | -0.049 |

|

|

|

|

| SG Implied 1-Day Move: | 0.58% | 0.58% | 0.58% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Volatility Trigger™: | $5189.03 | $5165 | $518 | $17940 | $439 | $2050 | $204 |

| Absolute Gamma Strike: | $5224.03 | $5200 | $520 | $18000 | $440 | $2050 | $200 |

| Call Wall: | $5224.03 | $5200 | $520 | $18200 | $445 | $2075 | $210 |

| Put Wall: | $5024.03 | $5000 | $510 | $17500 | $430 | $1900 | $200 |

| Zero Gamma Level: | $5169.03 | $5145 | $519 | $17797 | $437 | $2037 | $205 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.25 | 0.953 | 1.418 | 1.099 | 1.185 | 0.837 |

| Gamma Notional (MM): | $834.317M | $384.382M | $11.536M | $404.77M | $23.987M | ‑$84.235M |

| 25 Delta Risk Reversal: | -0.02 | 0.003 | -0.025 | -0.003 | -0.015 | 0.006 |

| Call Volume: | 454.184K | 1.485M | 8.104K | 1.447M | 35.364K | 219.431K |

| Put Volume: | 767.947K | 2.189M | 9.802K | 1.516M | 65.718K | 379.835K |

| Call Open Interest: | 7.058M | 6.111M | 63.624K | 4.231M | 338.66K | 4.221M |

| Put Open Interest: | 13.94M | 14.364M | 82.891K | 6.808M | 554.458K | 8.839M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5200, 5000, 5300, 5250] |

| SPY Levels: [520, 519, 515, 510] |

| NDX Levels: [18000, 18100, 18200, 18500] |

| QQQ Levels: [440, 435, 438, 445] |

| SPX Combos: [(5449,91.07), (5423,71.66), (5402,98.24), (5376,76.40), (5350,96.03), (5324,93.36), (5318,72.89), (5313,71.17), (5298,99.36), (5292,82.46), (5282,87.11), (5277,96.23), (5271,87.48), (5266,80.80), (5261,94.59), (5256,84.30), (5251,99.43), (5245,85.37), (5240,96.78), (5235,96.52), (5230,93.99), (5225,99.23), (5219,91.17), (5214,91.49), (5209,90.23), (5198,99.53), (5193,84.99), (5178,81.62), (5162,84.79), (5110,87.25), (5099,77.87), (5073,76.18), (5052,85.40), (5011,79.50), (5000,93.36), (4974,88.41)] |

| SPY Combos: [521.18, 531.58, 526.38, 523.78] |

| NDX Combos: [18276, 18476, 18186, 18204] |

| QQQ Combos: [445.88, 451.17, 438.82, 430.89] |

0 comentarios