ES futures are -57bps to 5,293. NQ futures are -65bps to 18,814.

Key SG levels for the SPX are:

- Support: 5,275, 5,265, 5,250

- Resistance: 5,300, 5,311, 5,333, 5,350

- 1 Day Implied Range: 0.54%

For QQQ:

- Support: 450, 440

- Resistance: 460, 465

IWM:

- Support: 205, 200, 190

- Resistance: 210

7 Year auction at 1PM ET, Fed Williams 1:45PM

Equity futures are lower this morning, pushing into several layers of support at 5.275, 5,265 & 5,250. Below 5,250 would imply a test of the 5,200

Put Wall.

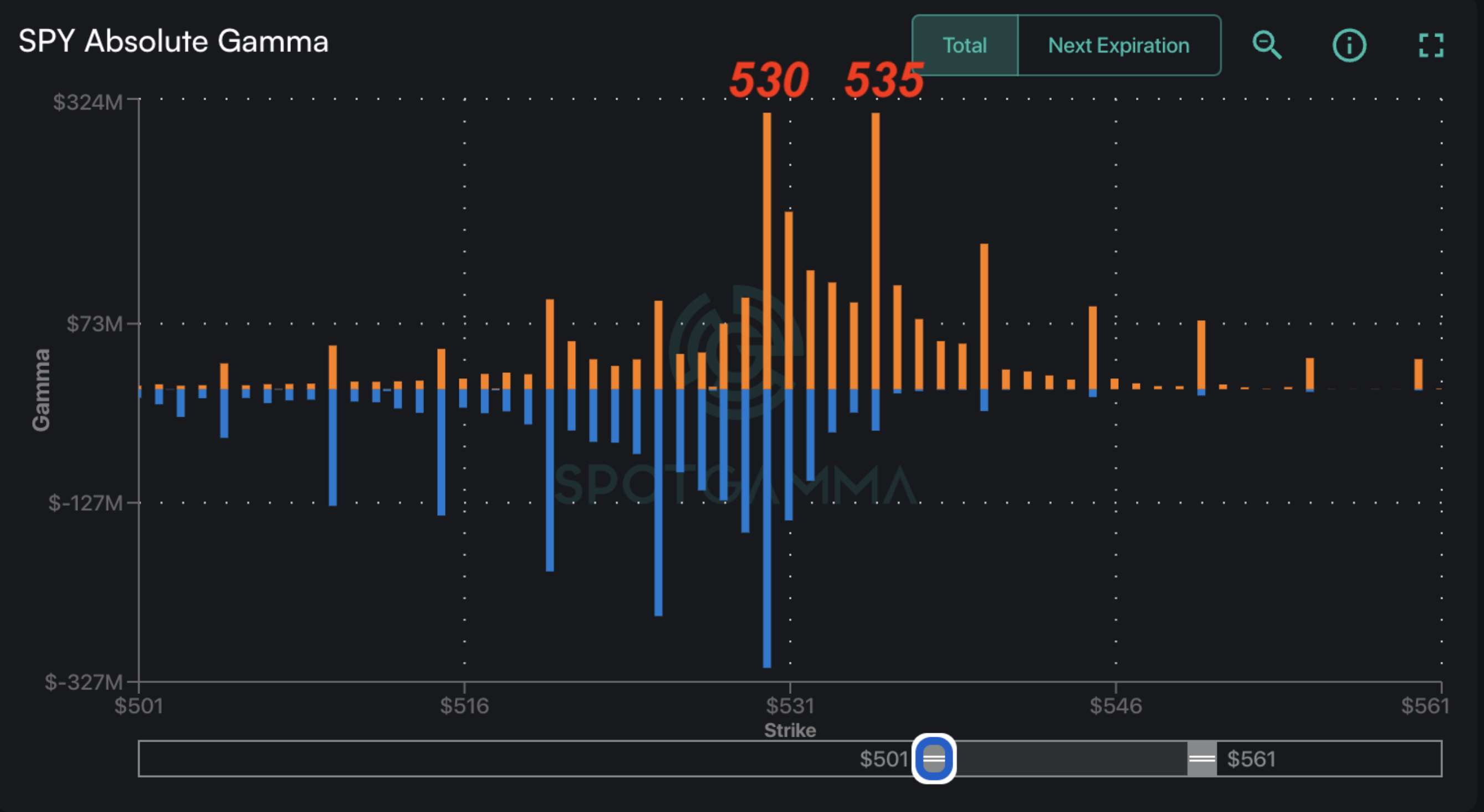

To the upside the large resistance range of 5,300-5.320 (SPY 530) is likely to hold for today – and likely into Friday.

This area of 5,250-5,320 is a “neutral zone”. A close >SPY 530 (SPX 5,320) would flip our long term view back to “risk on”. <5,250 is “risk off” as we’d look for hedging flows to pressure equities lower, and vol higher. <5,250 is important for longer term traders, as we think long put positions and/or long VIX calls as a portfolio hedge would be warranted.

For intrday/short term traders today, we think buying dips off of these large support zones is viable. To this point, we yesterday saw a flash down to 5,285, which violently reverted higher to 5,310 by the close.

The issue for asset prices, is rates. Shown here is the US10Y, which was +10bps yesterday, and has been trending higher over 2024 (10Y rate was ~3.8% on 12/31). This is, in the short term, counteracting NVDA’s massive gains higher (+20% since earnings on 5/22). That 20% is good for about 60 handles of positive S&P500 “push”, which is being counteracted by other, more negative forces.

The futures probe lower is starting to cause a lift in implied vols, as you can see in the SPX term structure change from yesterday (gray) to today (teal). While we think those traders focused on market action today/tomorrow will be looking to buy dips, longer dated or more macro focused traders are unlikely to want to enter short vol positions into the abundance of rate-related data coming from 5/31 Core PCE to 6/12 (FOMC). On this point, if you are interested in long equity hedges, positioning in +1-2 month S&P puts may carry a bit better due to these data points – most specifically FOMC.

|

|

/ES |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$5322.41 |

$5306 |

$529 |

$18869 |

$459 |

$2066 |

$205 |

|

SG Gamma Index™: |

|

0.420 |

-0.576 |

|

|

|

|

|

SG Implied 1-Day Move: |

0.54% |

0.54% |

0.54% |

|

|

|

|

|

SG Implied 5-Day Move: |

1.95% |

1.95% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

After open |

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

After open |

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$5311.41 |

$5295 |

$529 |

$18590 |

$459 |

$2090 |

$205 |

|

Absolute Gamma Strike: |

$5316.41 |

$5300 |

$530 |

$18600 |

$450 |

$2100 |

$200 |

|

Call Wall: |

$5416.41 |

$5400 |

$535 |

$18600 |

$465 |

$2200 |

$220 |

|

Put Wall: |

$5216.41 |

$5200 |

$525 |

$18880 |

$450 |

$2000 |

$200 |

|

Zero Gamma Level: |

$5291.41 |

$5275 |

$528 |

$18540 |

$455 |

$2077 |

$208 |

|

|

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Gamma Tilt: |

1.024 |

0.743 |

1.496 |

1.021 |

0.794 |

0.627 |

|

Gamma Notional (MM): |

$667.569M |

‑$312.993M |

$33.951M |

$977.836M |

‑$56.311M |

‑$1.139B |

|

25 Delta Risk Reversal: |

-0.033 |

0.00 |

-0.035 |

-0.018 |

-0.028 |

-0.018 |

|

Call Volume: |

4.48M |

2.378M |

17.03K |

5.324M |

51.52K |

383.28K |

|

Put Volume: |

8.734M |

3.265M |

19.58K |

6.096M |

95.108K |

557.644K |

|

Call Open Interest: |

14.15M |

11.70M |

118.738K |

7.817M |

638.656K |

7.939M |

|

Put Open Interest: |

28.536M |

27.295M |

167.568K |

13.411M |

1.115M |

16.398M |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [5300, 5000, 5200, 5250] |

|

SPY Levels: [530, 525, 520, 528] |

|

NDX Levels: [18600, 18700, 18900, 18500] |

|

QQQ Levels: [450, 460, 455, 465] |

|

SPX Combos: [(5550,95.43), (5524,87.14), (5508,86.65), (5502,99.82), (5481,73.39), (5476,88.62), (5471,81.66), (5460,88.89), (5449,99.45), (5439,78.42), (5428,77.86), (5423,94.80), (5417,91.86), (5412,79.38), (5407,88.06), (5402,99.98), (5396,76.69), (5391,89.10), (5386,88.33), (5380,95.91), (5375,97.82), (5370,94.69), (5364,87.75), (5359,98.23), (5354,79.12), (5348,99.24), (5343,90.71), (5338,97.77), (5333,99.15), (5327,89.93), (5322,95.89), (5317,90.71), (5311,97.68), (5306,91.73), (5301,97.54), (5295,94.85), (5290,96.99), (5285,94.87), (5280,91.55), (5274,97.48), (5269,95.51), (5264,87.56), (5258,97.66), (5253,88.30), (5248,94.56), (5242,92.38), (5237,89.01), (5232,79.95), (5226,93.25), (5221,79.62), (5216,80.87), (5211,79.53), (5205,96.18), (5200,98.47), (5195,72.23), (5189,88.85), (5173,91.09), (5168,74.77), (5157,93.91), (5152,95.87), (5142,76.50), (5126,93.12), (5110,87.33), (5099,97.25), (5073,89.74), (5051,93.04)] |

|

SPY Combos: [539.35, 549.41, 544.11, 534.05] |

|

NDX Combos: [19096, 18605, 19002, 19492] |

|

QQQ Combos: [465.2, 453.24, 462.9, 474.85] |

0 comentarios