Macro Theme:

Short Term SPX Resistance: 5,400

Short Term SPX Support: 5,300

SPX Risk Pivot Level: 5,312

Major SPX Range High/Resistance: 5,312

Major SPX Range Low/Support: 5,000

- NVDA 10-1 split Friday night has the potential for a blow-off top into early next week.

- Upside scenario:

- 5,400 is major resistance into FOMC 6/12

- Downside scenario:

- A break of 5,300 likely leads to a test of 5,200

- <5,300 the market fully loses positive gamma support, allowing for higher implied volatility (i.e. VIX 20) and a move down into 5,000

- 5,000 is massive support into June OPEX 6/21 & June Quarterly OPEX 6/28

Founder’s Note:

ES & NQ futures are both -20bps to 5,344 & 19,000, respectively.

Key SG levels for the SPX are:

- Support: 5,350, 5,311, 5,300

- Resistance: 5,374, 5,390, 5,400

- 1 Day Implied Range: 0.58%

For QQQ:

- Support: 455, 450

- Resistance: 460, 465, 470

IWM:

- Support: 200

- Resistance: 205, 210, 220

AAPL WWDC 1pm ET

Implied vols are low for today and tomorrow, ahead of the main event(s) on Wednesday. In addition to the 6/12 afternoon FOMC, we have CPI at 8:30AM ET. As you can see in the SPX term structure, there is a fairly large premium assigned to Wednesdays data points. That leaves options in control of markets today, with heavy price mean reversion likely around key SpotGamma levels (buy rips, sell dips).

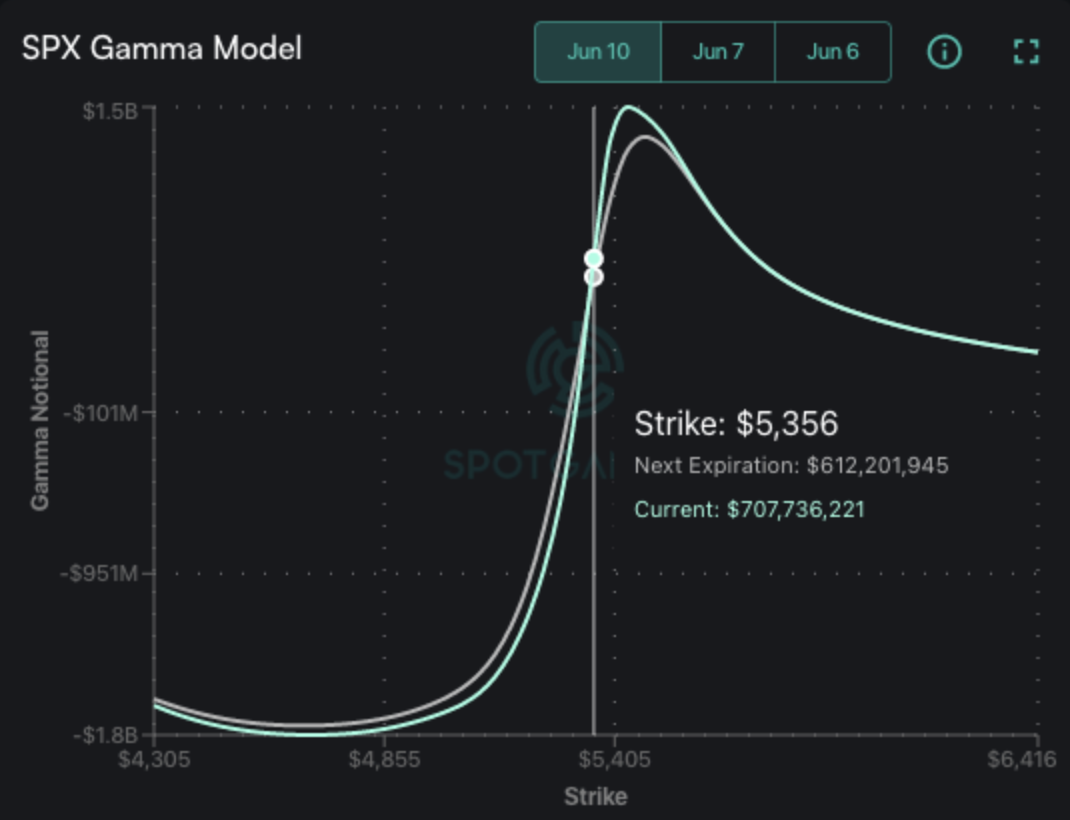

Options flows should bring tight trading ranges as the S&P500 is wrapped up in a large amount of vol-crushing positive gamma. Gamma currently peaks near 5,400, which is our heavy

Call Wall

resistance. We think that resistance holds into 6/12, with 5,300 functioning as major support.

Below 5,300

gamma flips

to the negative, which infers volatility should pick up substantially. This likely leads to a quick test of 5,250.

For AAPL, we see the major upside level at 200 (which would be all-time highs & +2% from pre-market $197 levels), with gamma positioning very light above that. There is a noticeable call skew (1-month skew, below) ahead of today’s WWDC, as traders hedge out the right tail risk of AAPL mentioning “AI” several times today (we’re slightly joking). While there is likely some event-vol lost today after this afternoons keynote (i.e. a long call “tax”), we think calls would have to be rolled or added >200, which could create a gamma-led move to 205 – 210. In other words, >200 we think things could get a bit chase-y.

To the downside 190 is first support. There are almost no put positions <180, suggesting that is a major short term low.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5355.57 | $5346 | $534 | $19000 | $462 | $2026 | $201 |

| SG Gamma Index™: |

| 1.588 | -0.065 |

|

|

|

|

| SG Implied 1-Day Move: | 0.58% | 0.58% | 0.58% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5354.57 | $5345 | $534 | $18590 | $462 | $2090 | $205 |

| Absolute Gamma Strike: | $5309.57 | $5300 | $535 | $18600 | $465 | $2050 | $200 |

| Call Wall: | $5409.57 | $5400 | $540 | $18600 | $470 | $2100 | $220 |

| Put Wall: | $5309.57 | $5300 | $520 | $19050 | $455 | $2000 | $200 |

| Zero Gamma Level: | $5325.57 | $5316 | $533 | $18669 | $458 | $2068 | $207 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.209 | 0.930 | 1.508 | 1.122 | 0.697 | 0.504 |

| Gamma Notional (MM): | $535.006M | $37.941M | $11.997M | $320.324M | ‑$52.814M | ‑$1.078B |

| 25 Delta Risk Reversal: | -0.021 | -0.017 | -0.025 | -0.01 | 0.00 | -0.009 |

| Call Volume: | 513.296K | 1.462M | 7.465K | 519.439K | 31.797K | 417.419K |

| Put Volume: | 901.541K | 2.021M | 11.049K | 896.139K | 55.718K | 583.828K |

| Call Open Interest: | 7.331M | 5.851M | 60.224K | 4.013M | 325.784K | 4.151M |

| Put Open Interest: | 14.664M | 14.186M | 91.84K | 6.995M | 558.329K | 8.602M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5300, 5000, 5350, 5400] |

| SPY Levels: [535, 530, 540, 534] |

| NDX Levels: [18600, 19000, 18500, 18700] |

| QQQ Levels: [465, 450, 460, 470] |

| SPX Combos: [(5598,96.71), (5577,78.24), (5572,84.19), (5550,92.80), (5523,82.75), (5502,99.37), (5481,76.53), (5475,87.85), (5470,79.70), (5459,87.84), (5449,99.20), (5443,85.48), (5438,72.04), (5433,88.44), (5427,96.60), (5422,88.40), (5417,83.23), (5411,91.64), (5406,94.01), (5400,99.89), (5395,91.83), (5390,93.00), (5384,89.14), (5379,94.70), (5374,97.25), (5368,94.44), (5363,92.62), (5358,85.73), (5352,97.09), (5336,73.73), (5326,78.46), (5315,73.21), (5310,72.96), (5299,95.62), (5288,89.16), (5277,71.94), (5224,73.42), (5208,76.17), (5203,92.80), (5149,89.14), (5128,77.38), (5101,93.40)] |

| SPY Combos: [538.79, 548.4, 543.59, 536.12] |

| NDX Combos: [19495, 19286, 18602, 19077] |

| QQQ Combos: [474.55, 469.46, 459.74, 464.83] |

0 comentarios