Macro Theme:

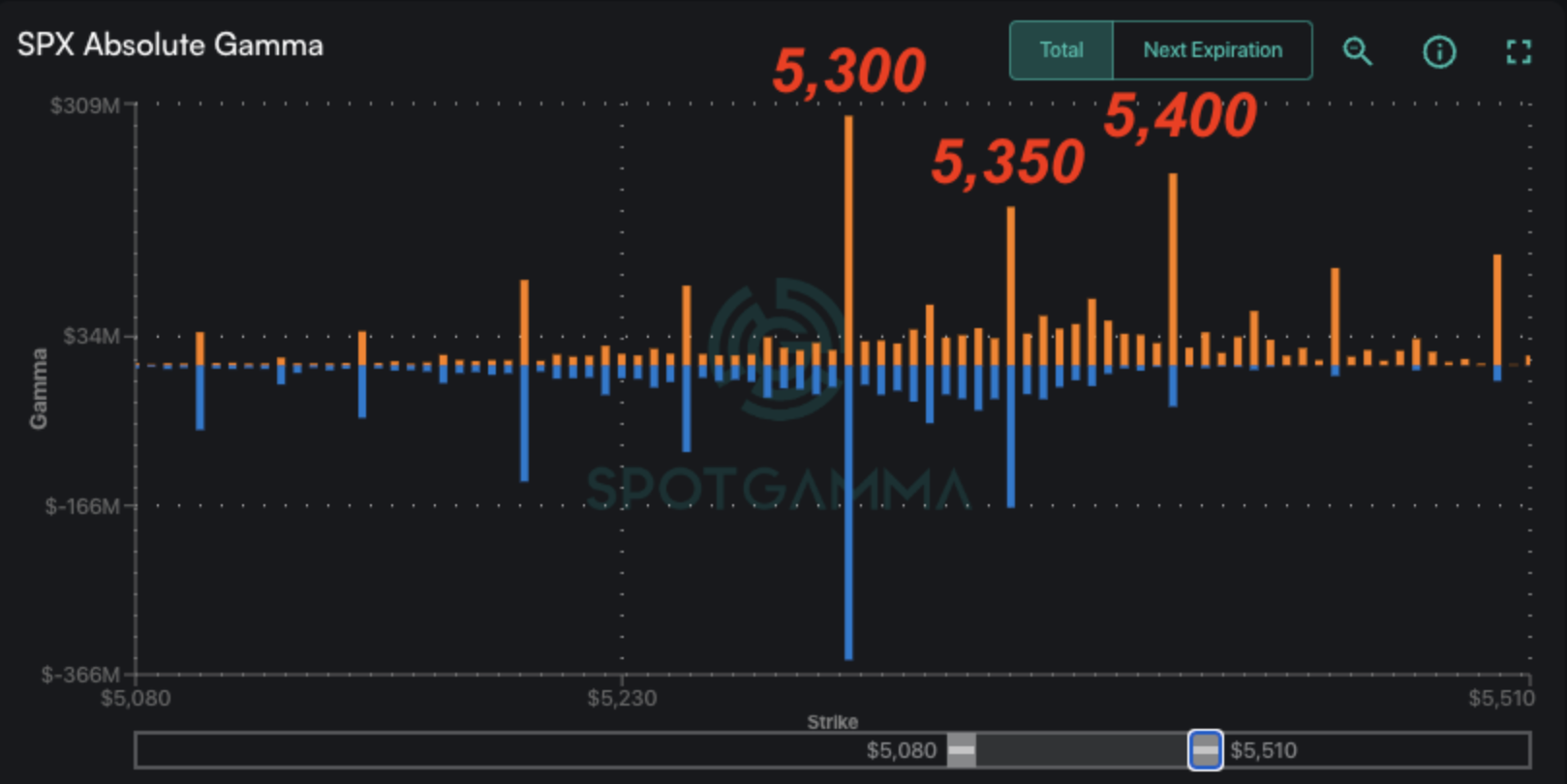

Short Term SPX Resistance: 5,400

Short Term SPX Support: 5,300

SPX Risk Pivot Level: 5,312

Major SPX Range High/Resistance: 5,312

Major SPX Range Low/Support: 5,000

- NVDA 10-1 split Friday night has the potential for a blow-off top into early next week.

- Upside scenario:

- 5,400 is major resistance into FOMC 6/12

- Downside scenario:

- A break of 5,300 likely leads to a test of 5,200

- <5,300 the market fully loses positive gamma support, allowing for higher implied volatility (i.e. VIX 20) and a move down into 5,000

- 5,000 is massive support into June OPEX 6/21 & June Quarterly OPEX 6/28

Founder’s Note:

ES futures are down 25bps to 5,357. NQ futures are -30bps to 19,055.

Key SG levels for the SPX are:

- Support: 5,350, 5,311, 5,300

- Resistance: 5,362, 5,377, 5,388, 5,400

- 1 Day Implied Range: 0.57%

For QQQ:

- Support: 464, 455, 450

- Resistance: 465, 470

IWM:

- Support: 200

- Resistance: 205, 210, 220

52 Week Bill auction 11:30 AM ET.

Like yesterday, there is little on the news front today, leaving the options market in control. 5,350 SPX to 535 SPY (5,360 SPX) is the center, sticky range for today. 5,400 is resistance into tomorrows big events (CPI, FOMC), with 5,300 major support. <5,300 our models flip to “risk off”, as it suggests a quick test of a sharp, high volatility move to 5,200.

Back to today, the options market is pricing in a lowly 37bps of market movement (5,350 0DTE straddle $20 IV 14.4%). As you can see in the map below, the SPX has stuck to the 5,350-5,360 range over the last several sessions, and we see little reason for that to deviate, today.

For tomorrow we see the market staging at 5,400 or 5,300, with a larger directional break into 6/21 OPEX.

Playing the upside out of FOMC is rather clean. If

Call Walls

roll up, our range high rolls up, too. In the upside scenario, vol would likely contract sharply after FOMC, which would lead to a real grind into June 21st OPEX (next Friday).

To the downside, we view 5,000 as a major market low into June OPEX (21st + quarter end on 28th). Below is 1-month SPX skew, which remains at the bottom of its statistical range. This suggests puts are pretty cheap, and there are various put structures you could enter for a cheap downside hedge.

The intersting aspect to tomorrows vol picture is tomorrow’s pre-open CPI (8:30AM ET), which risks “pulling forward” the FOMC move. A calm CPI likely sparks an early move to 5,400, while a hot CPI would stage us down at 5,300. The odds-on bet is that these events are not eventful, which leads to some vol contraction. This is why traders would likely want to enter options spreads, to help offset that event-vol tax.

Outside of some elevated short term hedges, the market is pricing in a big “nothing” out of tomorrow. You can see this in SPX term structure, as well as in implied correlation. Shown below is 3 month correlation, which looks at 3 month options implied vol (so its forward looking), and this metric is at all-time lows. This suggests that no one is really seeing an environment wherein we flip out of equities. Instead, this environment is about picking the hottest stocks (a la NVDA/”AI”).

When macro risks flare up (rates, geopolitics), then investors hedge with index puts, and or flip out of equities and into bonds/cash. This spikes equity correlation, as all stocks move in the same direction: down. This is what happened in April, as highlighted. Correlation at lows is suggesting that CPI comes in in-line, and this FOMC is benign. If that is true, then we see VIX/IV dropping to 10-11, and a 2017 style summer ahead (a very dull grind).

A hot CPI or hawkish FOMC would likely flip traders back into a higher rate stance, which would spike correlation. In that scenario, all of the leading stocks (NVDA/”AI”) decline asymmetrically to the SPX. Consider in April the SPX was -5% for the month, while NVDA was -20%.

Based on this, we think that traders can take a “wait and see approach” to tomorrows data, as its likely a trigger to a larger setup with these leading names.

Lastly, we wanted to touch on AAPL, which we had hope for yesterday AM. We can say confidently the options market was totally underwhelmed, and that nice call skew that was forming got smoked. The stock likely now performs “with beta”, but we now see no reason for upside stock outperformance.

|

|

/ES |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$5369.57 |

$5360 |

$535 |

$19074 |

$464 |

$2031 |

$201 |

|

SG Gamma Index™: |

|

1.672 |

-0.08 |

|

|

|

|

|

SG Implied 1-Day Move: |

0.57% |

0.57% |

0.57% |

|

|

|

|

|

SG Implied 5-Day Move: |

1.95% |

1.95% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

After open |

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

After open |

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$5354.57 |

$5345 |

$534 |

$18590 |

$464 |

$2090 |

$201 |

|

Absolute Gamma Strike: |

$5309.57 |

$5300 |

$535 |

$18600 |

$465 |

$2050 |

$200 |

|

Call Wall: |

$5409.57 |

$5400 |

$540 |

$18600 |

$470 |

$2100 |

$220 |

|

Put Wall: |

$5309.57 |

$5300 |

$520 |

$18690 |

$455 |

$2000 |

$200 |

|

Zero Gamma Level: |

$5298.57 |

$5289 |

$534 |

$18601 |

$460 |

$2073 |

$206 |

|

|

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Gamma Tilt: |

1.219 |

0.915 |

1.608 |

1.151 |

0.737 |

0.594 |

|

Gamma Notional (MM): |

$681.74M |

$217.188M |

$14.80M |

$436.931M |

‑$46.715M |

‑$836.867M |

|

25 Delta Risk Reversal: |

-0.022 |

0.00 |

-0.024 |

0.00 |

-0.015 |

-0.003 |

|

Call Volume: |

429.945K |

997.401K |

6.487K |

486.254K |

11.877K |

684.284K |

|

Put Volume: |

720.326K |

1.661M |

9.12K |

718.219K |

20.931K |

600.073K |

|

Call Open Interest: |

7.395M |

5.834M |

60.922K |

4.058M |

328.893K |

4.103M |

|

Put Open Interest: |

14.783M |

14.344M |

93.03K |

7.098M |

561.129K |

8.703M |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [5300, 5000, 5350, 5400] |

|

SPY Levels: [535, 530, 534, 540] |

|

NDX Levels: [18600, 19000, 18500, 19100] |

|

QQQ Levels: [465, 460, 470, 450] |

|

SPX Combos: [(5602,96.98), (5575,78.44), (5570,84.53), (5548,92.88), (5527,83.83), (5500,99.47), (5479,78.07), (5473,89.05), (5468,79.93), (5463,87.21), (5452,99.50), (5441,83.01), (5436,77.89), (5430,89.19), (5425,97.47), (5420,90.73), (5414,82.61), (5409,92.35), (5404,94.25), (5398,99.91), (5393,90.84), (5388,97.26), (5382,95.94), (5377,97.36), (5372,90.63), (5366,87.75), (5361,81.81), (5350,82.50), (5345,80.86), (5334,74.20), (5313,77.38), (5302,97.38), (5296,74.87), (5286,78.75), (5237,71.56), (5227,72.73), (5205,75.51), (5200,92.75), (5152,90.31), (5125,78.47), (5098,92.89)] |

|

SPY Combos: [541.02, 551.19, 545.84, 538.34] |

|

NDX Combos: [19494, 19284, 18598, 19208] |

|

QQQ Combos: [476.87, 471.76, 455.03, 466.65] |

0 comentarios