Macro Theme:

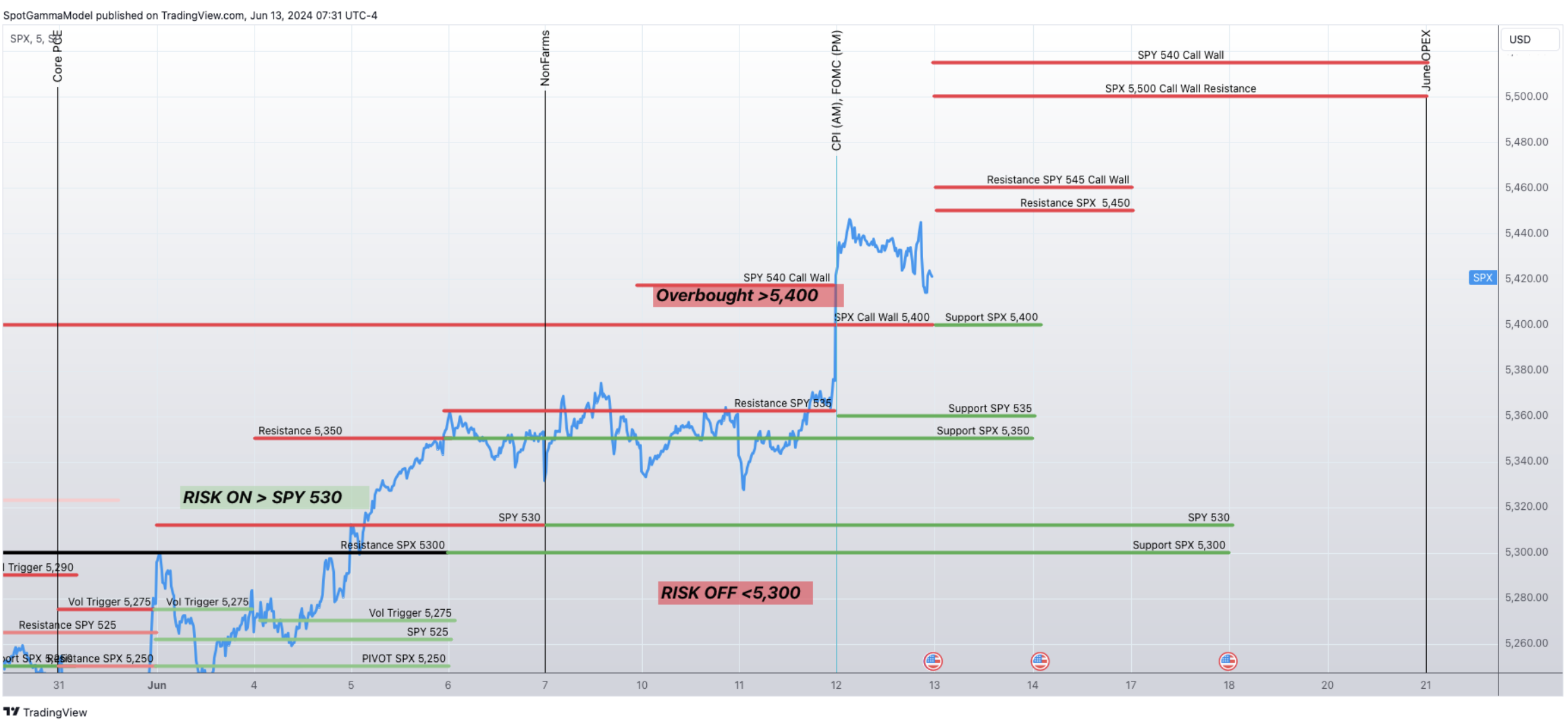

Short Term SPX Resistance: 5,460

Short Term SPX Support: 5,400

SPX Risk Pivot Level: 5,400

Major SPX Range High/Resistance: 5,500

Major SPX Range Low/Support: 5,000

- NVDA 10-1 split Friday night has the potential for relative top the week of 6/10

- Upside scenario:

- 5,460 is major resistance into Friday 6/14

- 5,500 is our target high for 6/21 OPEX, should CPI + FOMC meet expectations

- Downside scenario:

- A break of 5,400 likely leads to a test of 5,350

- <5,300 the market fully loses positive gamma support, allowing for higher implied volatility (i.e. VIX 20) and a move down into 5,000

- 5,000 is massive support into June OPEX 6/21 & June Quarterly OPEX 6/28

Founder’s Note:

ES futures are flat at 5,430. NQ futures are +55bps to 19,600.

Key SG levels for the SPX are:

- Support: 5,426, 5,400, 5,360

- Resistance: 5,450, 5,460, 5,475, 5,500

- 1 Day Implied Range: 0.58%

For QQQ:

- Support: 470, 465, 462, 460

- Resistance: 475

IWM:

- Support: 200, 195

- Resistance: 205, 210, 220

PPI 8:30AM ET.

With yesterday’s thrust higher, the S&P

Call Walls

rolled to 5,500 SPX & 545 SPY (5,460 SPX). 5,460 is now the big overhead resistance level for today, with 5,500 our max upside target into next weeks OPEX 6/21.

The 475

Call Wall

did not roll higher for QQQ, with but we see a likely flipping to 480, should QQQ hold above 475, today.

On net these are bullish shifts, and we anticipate an equity grind-higher into these new

Call Walls

for Friday and likely into next week’s very large OPEX.

Major support is now at 5,400 SPX & 475 QQQ. A break <5,400 SPX implies a test of 5,350, with solid support at that level. It would take a break <5,300 for a serious, sustained jump in volatility.

You can hear it on fintwit this AM: “We need today’s PPI to rate guidance!” Well, the 0DTE straddle is just $25 this morning, vs $50 yesterday. This means there is a very small hedge around a PPI tail print, and little more stress that than. So, unless we get a major PPI miss, we assume the equity drift-up is back on as the last bid of event-vol contracts.

Yesterday’s sharp rejection of 5,450 left some traders concerned about the veracity of the new equity highs. The PM 5,450 rejection led to a quick drop in the S&P to SPY 541 which is just a shade above yesterday’s

Call Wall

resistance band (5,400-5,420), which, in a way, just meant we went from over-bought at 5,450 to in-line at the SPY ~540

Call Wall

. Don’t forget, this is a very large positive gamma environment, which brings mean-reverting order flow (buy the dip, sell the rip!).

With the

Call Wall’

s rolling up today, those higher strikes near 5,450-5,460 are more sticky. As noted above, we think that is the major resistance into tomorrow & Friday.

Second, our beta-data suggests there were large 0DTE flows yesterday. 5,450 was a big dealer long-gamma strike, with 0DTE short gamma at nearly all strikes <5,450 – a lot of which was traders long 0DTE calls into yesterdays CPI/FOMC. For traders, that PM SPX price drop seemed to have flipped all those 0DTE calls from “all-day winners” to “last-minute losers”. Or, for MM’s, they appear to have won the day (or at least the afternoon).

You can this in

HIRO,

where the SPX top was just at 5,450, which seemed to trigger a big delta-flush lower. Those 0DTE flows (teal) registered at ~$1bn – which generally isn’t massive except for the fact that it was over just 8 minutes. You have to consider, too, that HIRO is monitoring the delta activity – there is also a lot of gamma on these positions (particularly at >3pm ET), which adds to hedging-induced volatility.

The point here is that there were a lot of “positional flows” moving markets yesterday afternoon, and that shouldn’t be extrapolated as a fundamental signal (i.e. fade-the-Fed highs).

For some “truth” around equity market anxiety, we turn to the vol space. No matter how you slice it, IV went lower. You can see this in the term structure from Tuesday night (gray) vs this morning (teal). Note how current IV’s have sunk to 90 day lows (gray shaded cone). There is a slight bump for today due to PPI, and if that fades then you will likely see a drop in the 0-5 day expiration IV to lows, too.

If we get passed today’s CPI, the next likely spot for a volatility spike would be >=6/21 OPEX.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5427.72 | $5421 | $541 | $19465 | $474 | $2057 | $203 |

| SG Gamma Index™: |

| 2.623 | 0.034 |

|

|

|

|

| SG Implied 1-Day Move: | 0.58% | 0.58% | 0.58% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5371.72 | $5365 | $539 | $18590 | $462 | $2070 | $205 |

| Absolute Gamma Strike: | $5306.72 | $5300 | $540 | $19500 | $475 | $2050 | $200 |

| Call Wall: | $5506.72 | $5500 | $545 | $19500 | $475 | $2100 | $210 |

| Put Wall: | $5206.72 | $5200 | $520 | $19540 | $460 | $2000 | $200 |

| Zero Gamma Level: | $5315.72 | $5309 | $536 | $18698 | $462 | $2067 | $205 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.388 | 1.037 | 1.888 | 1.443 | 0.863 | 0.633 |

| Gamma Notional (MM): | $1.119B | $701.134M | $18.172M | $912.946M | ‑$18.961M | ‑$624.717M |

| 25 Delta Risk Reversal: | -0.018 | -0.008 | -0.021 | -0.004 | -0.009 | 0.016 |

| Call Volume: | 829.005K | 2.102M | 9.918K | 885.375K | 32.088K | 774.261K |

| Put Volume: | 1.286M | 2.521M | 11.585K | 1.124M | 41.347K | 832.912K |

| Call Open Interest: | 7.585M | 6.002M | 61.848K | 4.193M | 348.094K | 4.338M |

| Put Open Interest: | 15.064M | 14.709M | 94.874K | 7.398M | 579.715K | 8.961M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5300, 5400, 5350, 5000] |

| SPY Levels: [540, 535, 545, 530] |

| NDX Levels: [19500, 18600, 19000, 19300] |

| QQQ Levels: [475, 470, 465, 460] |

| SPX Combos: [(5649,88.97), (5627,76.60), (5600,98.24), (5573,89.07), (5567,95.46), (5551,97.26), (5540,70.78), (5524,90.42), (5519,81.40), (5508,93.54), (5502,99.86), (5492,79.55), (5486,85.11), (5481,91.46), (5475,97.05), (5470,95.42), (5459,97.90), (5454,78.99), (5448,99.85), (5443,78.06), (5437,96.64), (5432,92.74), (5426,96.69), (5421,84.89), (5410,94.85), (5399,99.74), (5372,84.78), (5307,71.22), (5302,83.65), (5199,90.18)] |

| SPY Combos: [543.51, 548.92, 553.79, 546.21] |

| NDX Combos: [19504, 19699, 19290, 19913] |

| QQQ Combos: [481.25, 476.04, 458.97, 470.82] |

0 comentarios