Macro Theme:

Short Term SPX Resistance: 5,460

Short Term SPX Support: 5,400

SPX Risk Pivot Level: 5,400

Major SPX Range High/Resistance: 5,500

Major SPX Range Low/Support: 5,000

- NVDA 10-1 split Friday night has the potential for relative top the week of 6/10

- Upside scenario:

- 5,460 is major resistance into Friday 6/14

- 5,500 is our target high for 6/21 OPEX, should CPI + FOMC meet expectations

- Downside scenario:

- A break of 5,400 likely leads to a test of 5,350

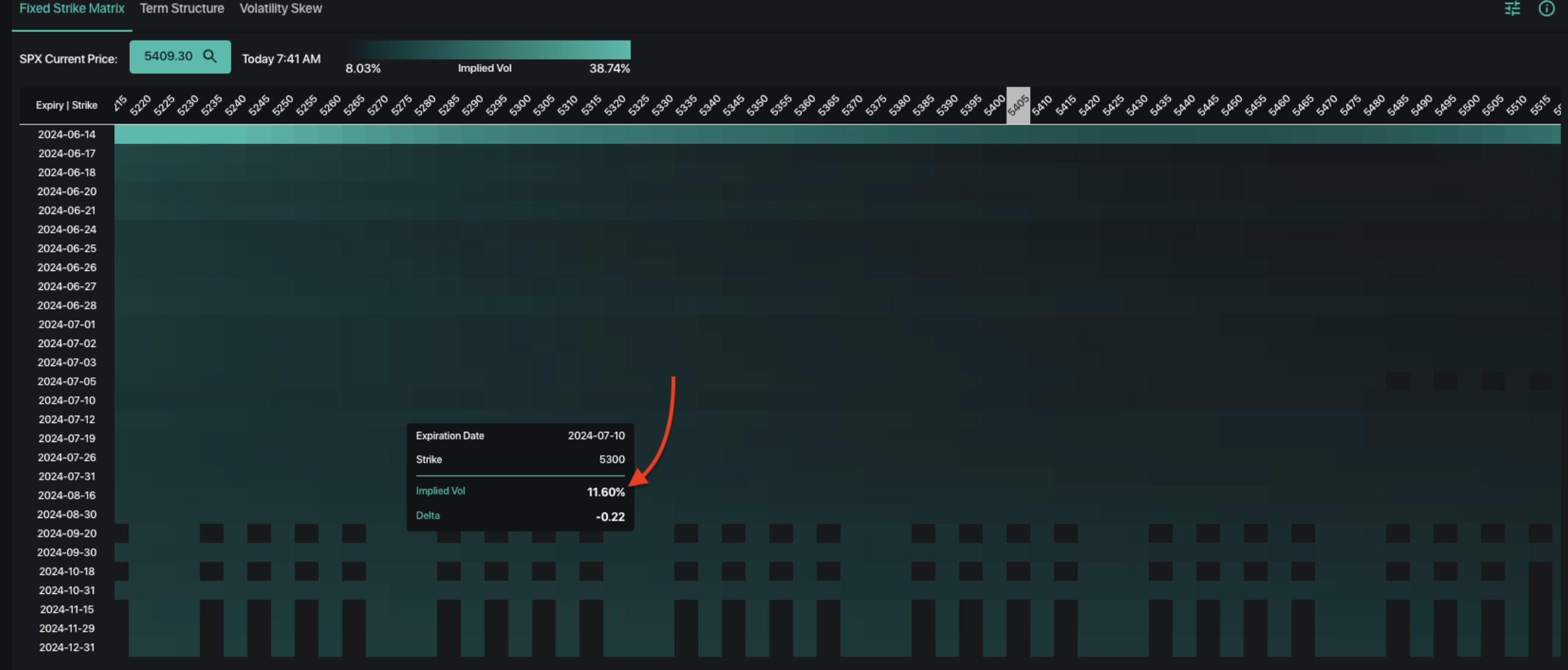

- <5,300 the market fully loses positive gamma support, allowing for higher implied volatility (i.e. VIX 20) and a move down into 5,000

- 5,000 is massive support into June OPEX 6/21 & June Quarterly OPEX 6/28

Founder’s Note:

ES futures are -60bps to 5,470. NQ futures are -35bps to 19,790.

Key SG levels for the SPX are:

- Support: 5,400, 5,360

- Resistance: 5,423, 5,450, 5,460, 5,475, 5,500

- 1 Day Implied Range: 0.57%

For QQQ:

- Support: 470, 465

- Resistance: 475, 480

IWM:

- Support: 200, 195

- Resistance: 204, 205, 210, 220

Mich Consumer Sentiment 10AM ET

Note: ES futures symbology has rolled to September.

US futures are down this morning due to politically-driven weakness in European markets (CAC 40 -2.6%). For the S&P500, this indicates an opening near the 5,400 support level, a level which we believe holds today, as it did yesterday. Why do we bet it holds? This is a market loaded up with positive gamma & 0DTE flows, into a weekend (traders don’t like paying weekend theta bills). However, should that level 5,400 break, we look for a quick test of 5,360.

While we are certainly not qualified to weigh in on European politics, we can tell you that the risk-barometer of SPX vol suggests this is not a major concern – at least yet. Below is fixed strike vol for the SPX, and you can see the vast field of dark colors which shows IV’s near 10%, which is about as low as SPX reasonably gets.

If the SPX breaks <5,400 then we’d anticipate a decent jump in IV’s (i.e. VIX to 15).

While we continue to look for some near term stability, a window of volatility opens next week with OPEX.

As we discussed in yesterday’s Q&A, the only way we can reduce this big positive gamma is if the SPX grinds lower for a few sessions to 5,300, or if these large June OPEX positions start to disappear (either closed, or expire). This big June OPEX is tracking to be about the same size as the March quarterly expiration, and is 8:1 in terms of call values: put values. This heavy call weighting is due to the demand for long calls & associated bullish equity moves, which have driven call values higher.

As we lose these call heavy positions with OPEX, we think it will likely lead to some equity consolidation – but probably not until next Thursday/Friday & into the week after. That timing may be a bit “too cute”, but those looking to buy puts stare down the short term decay of the weekend and the Wednesday market holiday (Juneteenth). Therefore we may not see hedging pressure on equities, yet.

We’ve been on record as stating that we felt NVDA’s equity outperformance was due to break starting this week, after the 10:1 split. The stock is +5% this week, testing the 130 level. As you can see below, the amount of call positions (orange bars) immediately >130 start to sharply dwindle. This signals a possible slowing in momentum.

What could additionally hit this stock is the size of its expiration for next week. On a delta basis it has the 3rd largest expiration of any US listed instrument – only behind the behemoths of SPX & SPY. So NVDA is bigger in the options space than: QQQ, NDX, MSFT, AAPL, etc. That strikes as very…bloated. We think the removal of these very large calls could lead to some hedging adjustments, and some consolidation in NVDA, and stocks more broadly.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5504.14 | $5433 | $542 | $19576 | $476 | $2038 | $201 |

| SG Gamma Index™: |

| 2.909 | 0.135 |

|

|

|

|

| SG Implied 1-Day Move: | 0.57% | 0.57% | 0.57% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5431.14 | $5360 | $541 | $18590 | $462 | $2070 | $205 |

| Absolute Gamma Strike: | $5471.14 | $5400 | $540 | $19500 | $475 | $2050 | $200 |

| Call Wall: | $5571.14 | $5500 | $545 | $19500 | $480 | $2100 | $210 |

| Put Wall: | $5271.14 | $5200 | $530 | $19630 | $473 | $2000 | $200 |

| Zero Gamma Level: | $5432.14 | $5361 | $537 | $19091 | $468 | $2065 | $204 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.434 | 1.147 | 1.777 | 1.461 | 0.788 | 0.537 |

| Gamma Notional (MM): | $1.086B | $741.432M | $15.692M | $815.964M | ‑$38.818M | ‑$1.132B |

| 25 Delta Risk Reversal: | -0.017 | -0.011 | -0.02 | -0.003 | -0.013 | 0.013 |

| Call Volume: | 544.474K | 1.295M | 8.299K | 685.119K | 13.294K | 469.355K |

| Put Volume: | 1.136M | 1.963M | 11.867K | 1.041M | 27.922K | 891.635K |

| Call Open Interest: | 7.672M | 6.033M | 63.219K | 4.249M | 350.308K | 4.456M |

| Put Open Interest: | 15.316M | 14.911M | 98.143K | 7.613M | 584.902K | 9.058M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5400, 5450, 5300, 5000] |

| SPY Levels: [540, 545, 542, 543] |

| NDX Levels: [19500, 19600, 20000, 19000] |

| QQQ Levels: [475, 470, 480, 465] |

| SPX Combos: [(5700,95.38), (5673,70.98), (5651,90.69), (5624,78.89), (5602,98.58), (5575,90.97), (5570,95.21), (5559,82.63), (5548,98.10), (5542,82.25), (5532,70.47), (5526,93.76), (5521,86.10), (5510,94.75), (5499,99.92), (5488,92.98), (5483,95.80), (5477,98.68), (5472,97.53), (5461,98.86), (5455,77.55), (5450,99.89), (5439,93.83), (5434,91.95), (5428,83.08), (5423,96.13), (5412,83.65), (5401,99.49), (5298,86.59), (5249,73.31), (5200,89.26)] |

| SPY Combos: [550.54, 545.11, 540.23, 560.3] |

| NDX Combos: [19499, 19714, 19910, 19303] |

| QQQ Combos: [477.66, 482.43, 472.42, 487.67] |

0 comentarios