Macro Theme:

Short Term SPX Resistance: 5,510 (SPY 550)

Short Term SPX Support: 5,460

SPX Risk Pivot Level: 5,400

Major SPX Range High/Resistance: 5,510 (SPY 550)

Major SPX Range Low/Support: 5,000

- NVDA 10-1 split Friday night has the potential for relative top the week of 6/10. After OPEX, our prime catalyst (unwinding of long stock hedges) is gone, and we will be forced to take a “stop” on our NVDA short thesis.

- We like 1-month QQQ 90-95% put spreads into the close of 6/18, and holding them through next week, due to potential OPEX weakness.

- OPEX is supportive of equities into Wednesday’s Juneteenth Holiday, and then a window for weakness opens into early next week.

- Upside scenario:

- 5,460 is major resistance into Monday 6/17

- 5,500 is our target high for 6/21 OPEX, should CPI + FOMC meet expectations

- The major high level for SPX on 6/28 (end-of-quarter OPEX) is 5,570

- Downside scenario:

- A break of 5,400 likely leads to a test of 5,350

- <5,300 the market fully loses positive gamma support, allowing for higher implied volatility (i.e. VIX 20) and a move down into 5,000

- 5,000 is massive support into June OPEX 6/21 & June Quarterly OPEX 6/28

Founder’s Note:

ES futures are +40bps at 5,582. NQ futures are +60bps at 20,323

Key SG levels for the SPX are:

- Support: 5,493, 5,462, 5,450, 5400

- Resistance: 5,500, 5,510

- 1 Day Implied Range: 0.58%

For QQQ:

- Support: 485, 480, 469

- Resistance: 490

IWM:

- Support: 200, 195

- Resistance: 202, 205

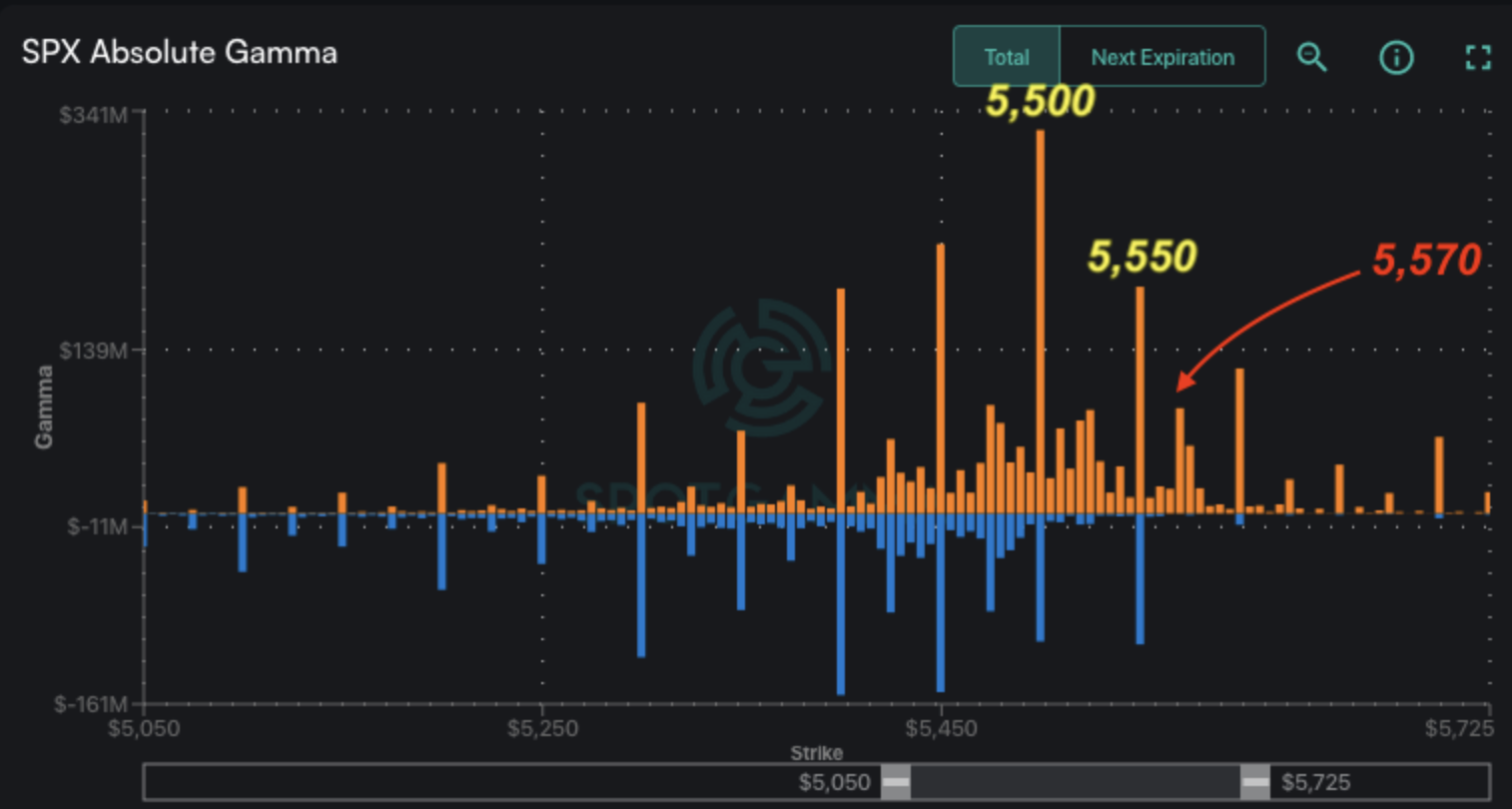

ES futures are indicating an SPX open just above our major resistance range of 5,500-5,510 (SPY 550

Call Wall

). We would anticipate that this range would remain sticky for today, as 5,500 is the largest gamma strike into tomorrow’s expiration.

This move is now playing into an OPEX time window which could result in some equity contraction, after a period of significant strength. We’re set to lose about 1/3 of the SPX positive gamma with OPEX.

We do note a lot of positions building up at 5,550, as marked below. At a high level, this suggests that the SPX

Call Wall

could roll higher, which would raise the top end of our trading range (from 5,500, currently). This gamma-strike growth above results from the cadence of the SPX grinding higher each day, with new positions being added above. Additionally, we have the incredible moves in major single stocks, which serve to pull the index higher.

A chunk of this large gamma at 5,550 is likely to remain post-OPEX, which is awfully close to the big end-of-quarter (6/28) gamma held at the 5,570 JPM collar strike. This area is one to highlight for the SPX into the end of June.

While we are looking for weakness and a test of 5,400 post-OPEX, we need to present all sides.

These positions near 5,550-5,570 may put a short term kink in our plan for OPEX consolidation. The idea is that if we remain >5,500 these end-of-month positions keep the SPX positive gamma stability in place, and the attention on the JPM collar may keep attention up in that price area. Additionally, if we were to rally up to that 5,550 area today & tomorrow, it likely leads to a stronger SPX support over the next week, into month-end.

The blistering move in single stocks is led by NVDA, “the King”, in front of tomorrow’s XLK rebalance. This rebalance, adds ~$10bn of XLK buying for NVDA, and ~ -$10bn of selling for AAPL. While traders think this is a major boon for NVDA this week (+10% last 5 days), it doesn’t appear to be stopping AAPL’s stock (+3.5% last 5 days). Interestingly that $10bn in volume is about 1 day of volume for AAPL, but only 1/4 of a day’s volume for NVDA.

While the XLK is clearly going to add some NVDA buying pressure, that buying is feeding into a nasty negative gamma complex in NVDA that leads to dealers having to buy more stock as the stock goes higher (gamma squeeze). Consider Tuesday’s NVDA 38 million

call volume

– it was the largest daily

call volume

in the US options market. That is more

call volume

than SPY, AAPL, TSLA & SPX combined.

NVDA is set to lose about 1/2 its gamma with tomorrows expiration, which could serve to stall its momentum. Further, we see very little in the way of open interest >140.

This single stock volatility breeds instability. In our view, you cannot have an extremely volatility “stock up, vol up” move which settles into a “stock flat, vol down” move. Its more likely a “stock down, vol stays up” scenario.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5558.8 | $5487 | $548 | $19908 | $485 | $2025 | $200 |

| SG Gamma Index™: |

| 3.005 | 0.217 |

|

|

|

|

| SG Implied 1-Day Move: | 0.58% | 0.58% | 0.58% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5466.8 | $5395 | $544 | $19690 | $469 | $2030 | $202 |

| Absolute Gamma Strike: | $5571.8 | $5500 | $548 | $20000 | $480 | $2050 | $200 |

| Call Wall: | $5571.8 | $5500 | $550 | $20000 | $490 | $2200 | $210 |

| Put Wall: | $5371.8 | $5300 | $520 | $19625 | $424 | $2000 | $200 |

| Zero Gamma Level: | $5485.8 | $5414 | $543 | $19561 | $477 | $2051 | $203 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.436 | 1.262 | 1.552 | 1.398 | 0.807 | 0.546 |

| Gamma Notional (MM): | $1.144B | $1.194B | $12.497M | $689.711M | ‑$41.235M | ‑$1.211B |

| 25 Delta Risk Reversal: | -0.02 | 0.00 | -0.021 | -0.007 | -0.015 | 0.008 |

| Call Volume: | 700.617K | 1.181M | 9.44K | 580.393K | 16.298K | 401.527K |

| Put Volume: | 1.329M | 1.384M | 13.327K | 816.43K | 19.515K | 401.025K |

| Call Open Interest: | 8.03M | 5.914M | 65.058K | 4.313M | 372.634K | 4.606M |

| Put Open Interest: | 16.239M | 15.074M | 103.621K | 7.838M | 603.692K | 9.367M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5500, 5450, 5400, 5550] |

| SPY Levels: [548, 550, 545, 547] |

| NDX Levels: [20000, 19500, 19950, 19900] |

| QQQ Levels: [480, 485, 475, 470] |

| SPX Combos: [(5750,93.41), (5723,81.93), (5701,97.62), (5674,80.03), (5652,94.76), (5624,89.31), (5608,73.20), (5602,99.63), (5580,85.41), (5575,96.82), (5569,98.93), (5564,86.03), (5558,84.49), (5553,99.32), (5547,71.99), (5542,94.71), (5536,79.47), (5531,95.45), (5525,98.55), (5520,98.55), (5514,95.77), (5509,97.53), (5503,97.85), (5498,99.97), (5493,98.60), (5487,72.54), (5482,97.62), (5471,89.02), (5460,76.58), (5449,98.44), (5427,85.00), (5399,92.82), (5377,80.33), (5350,81.79), (5328,82.09), (5300,92.65), (5251,77.19)] |

| SPY Combos: [551.23, 553.43, 561.11, 556.17] |

| NDX Combos: [20108, 20506, 19909, 20008] |

| QQQ Combos: [490.08, 500.27, 485.23, 494.93] |

0 comentarios