Macro Theme:

Short Term SPX Resistance: 5,510 (SPY 550)

Short Term SPX Support: 5,450

SPX Risk Pivot Level: 5,400

Major SPX Range High/Resistance: 5,510 (SPY 550)

Major SPX Range Low/Support: 5,000

- NVDA 10-1 split Friday night has the potential for relative top the week of 6/10. After OPEX, our prime catalyst (unwinding of long stock hedges) is gone, and we will be forced to take a “stop” on our NVDA short thesis.

- We like 1-month QQQ 90-95% put spreads into the close of 6/18, and holding them through next week, due to potential OPEX weakness.

- OPEX is supportive of equities into Wednesday’s Juneteenth Holiday, and then a window for weakness opens into early next week.

- Upside scenario:

- 5,500 is our target high for 6/21 OPEX, should CPI + FOMC meet expectations

- The major high level for SPX on 6/28 (end-of-quarter OPEX) is 5,570

- Downside scenario:

- A break of 5,400 likely leads to a test of 5,350

- <5,300 the market fully loses positive gamma support, allowing for higher implied volatility (i.e. VIX 20) and a move down into 5,000

- 5,000 is massive support into June OPEX 6/21 & June Quarterly OPEX 6/28

Founder’s Note:

ES futures are -10 bps to 5,539. NQ futures are -7 bps to 20,023

Key SG levels for the SPX are:

- Support: 5,462, 5,450, 5400

- Resistance: 5,484, 5,500, 5,510

- 1 Day Implied Range: 0.54%

For QQQ:

- Support: 480, 474

- Resistance: 483, 490

IWM:

- Support: 195

- Resistance: 200, 202, 205

Yesterday, the SPX opened over the 5,500

Call Wall,

but that rejected into our OPEX window of weakness, leading to a test of the key SPY 545 support level (SPX 5,460). 5,500 – 5,510 remains major resistance for today, with the 5,460-5,450 range as support. A break <5,450 indicates a test of 5,400 for early next week.

We are set to lose about $7.5bn (~1/3) of S&P positive gamma, + $35bn of single stock/ETF gamma, which is roughly equivalent to March OPEX.

Across the US options market, OPEX positioning remains extremely call-heavy at 9:1 (on a delta basis). This reading was 11:1 on Tuesday, and just 5:1 in March. This extreme call weighting is a prime reason we have been looking for a OPEX driven weakness in equities, as dealers likely have long stock hedges to unwind, along with a loss in index positive gamma.

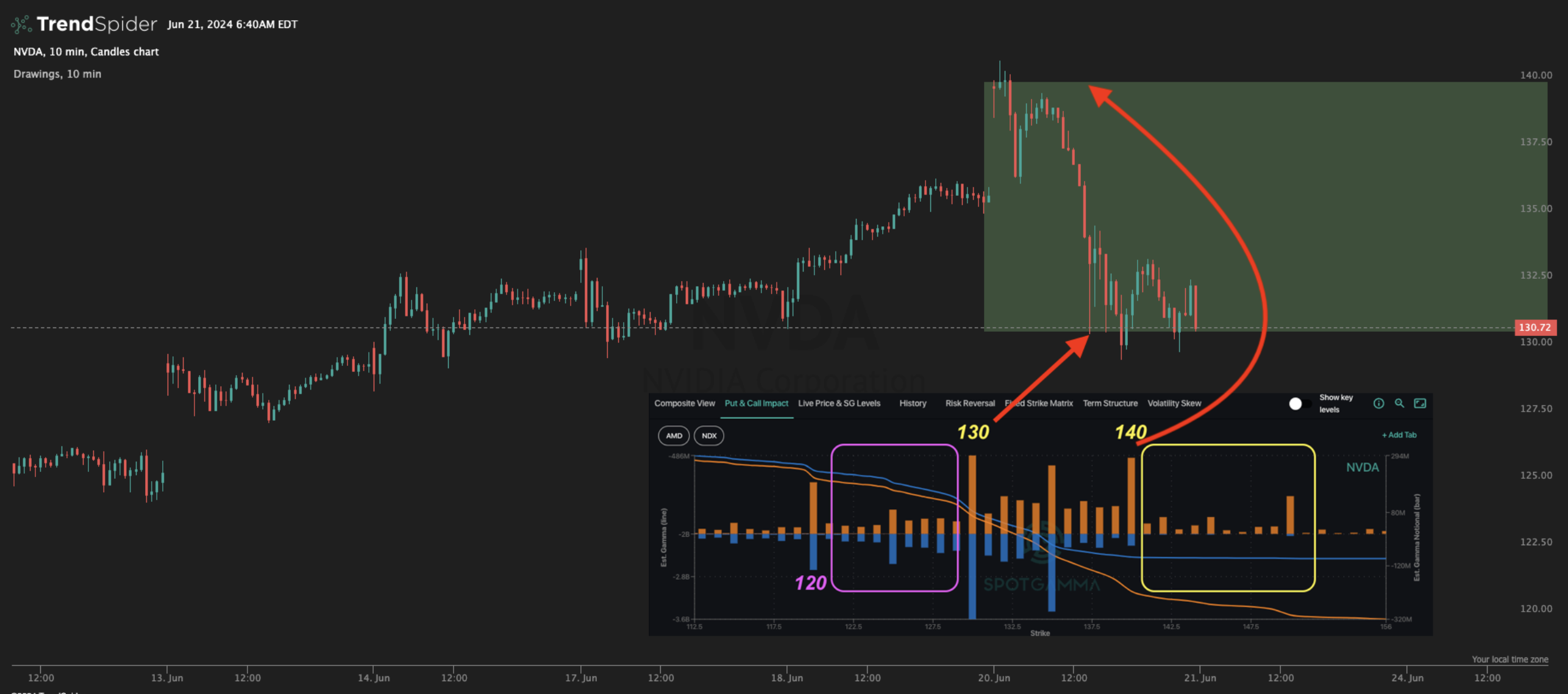

One of the topics most-discussed in markets today, is of the low correlation. This has been on display as single stocks, namely NVDA, blast higher in price, leaving broader equities in the dust. That “correlation move” was on display yesterday, just to the downside. NVDA yesterday rejected right at the 140 area highlighted in yesterday’s AM note, and lost 7% from that level to close at 130. In yesterday’s Member Q&A, we highlighted there were very few positions in NVDA <130, but today’s open interest update shows some large positions now at 120 – which is our new downside target.

This is a critical point: violent moves up in single stocks, relative to a grind-up in index, likely partially unwind with a violent move down in single stocks, and a grind-down. The “correlation trade” likely only fully breaks with some type of macro catalyst which pushes traders out of equities writ-large, and into cash or bonds. As far as we can tell there is no macro scare at the moment – just OPEX.

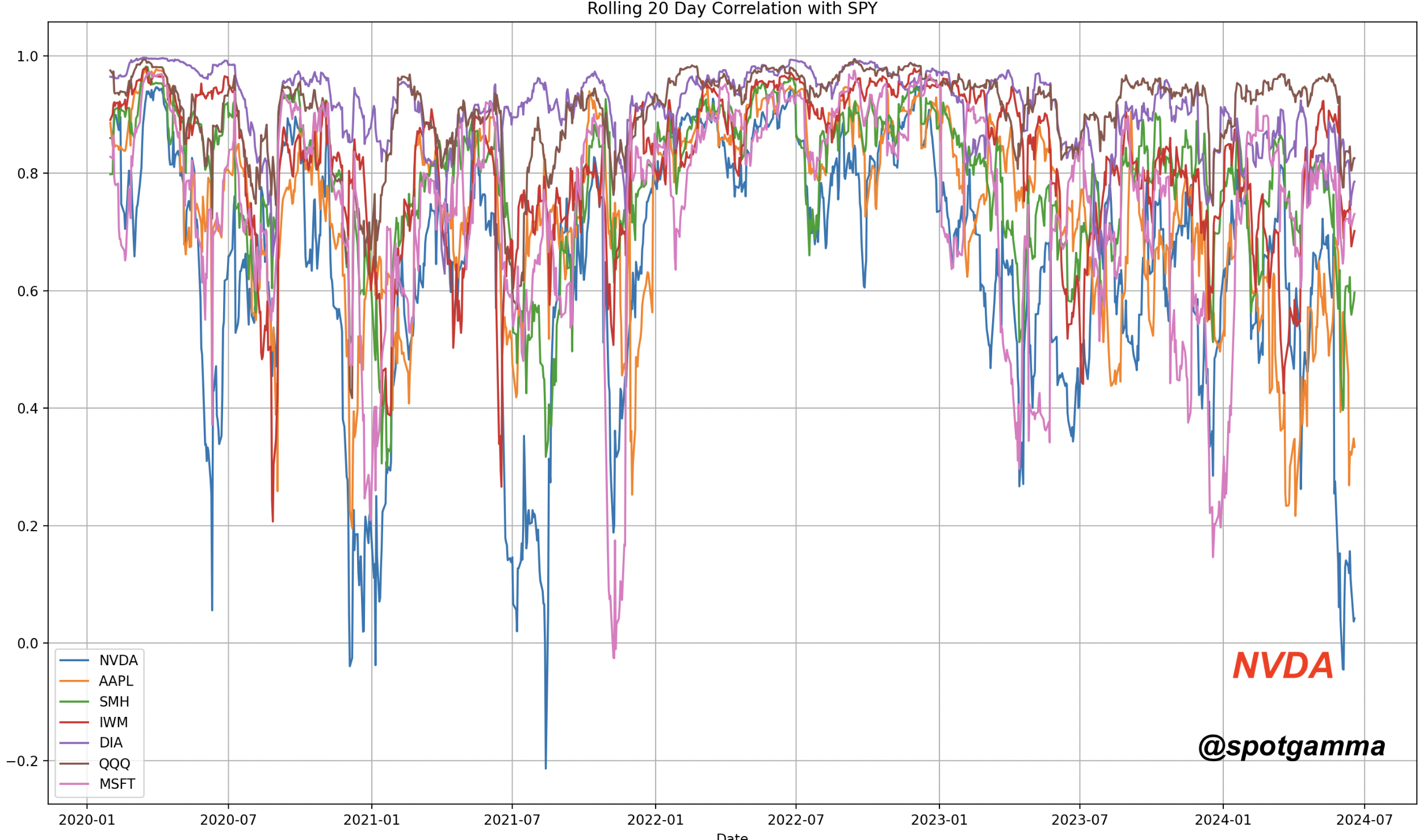

To highlight how unusual this period is, we plotted the rolling 1-month (20 day) correlation of NVDA (dark blue) vs major ETFs. As you can see, its wholly unto itself, in a way that is reminiscent of 2021. Whats key here, is that ’21 correlation had a few peaks and valleys, before NVDA finally fell back in line. Therefore, we could see some OPEX-driven mean reversion here, before the stock re-bases and moves back higher into the summer. This is our overall game plan: looking to buy equity market dips next week as long as the SPX holds >5,300.

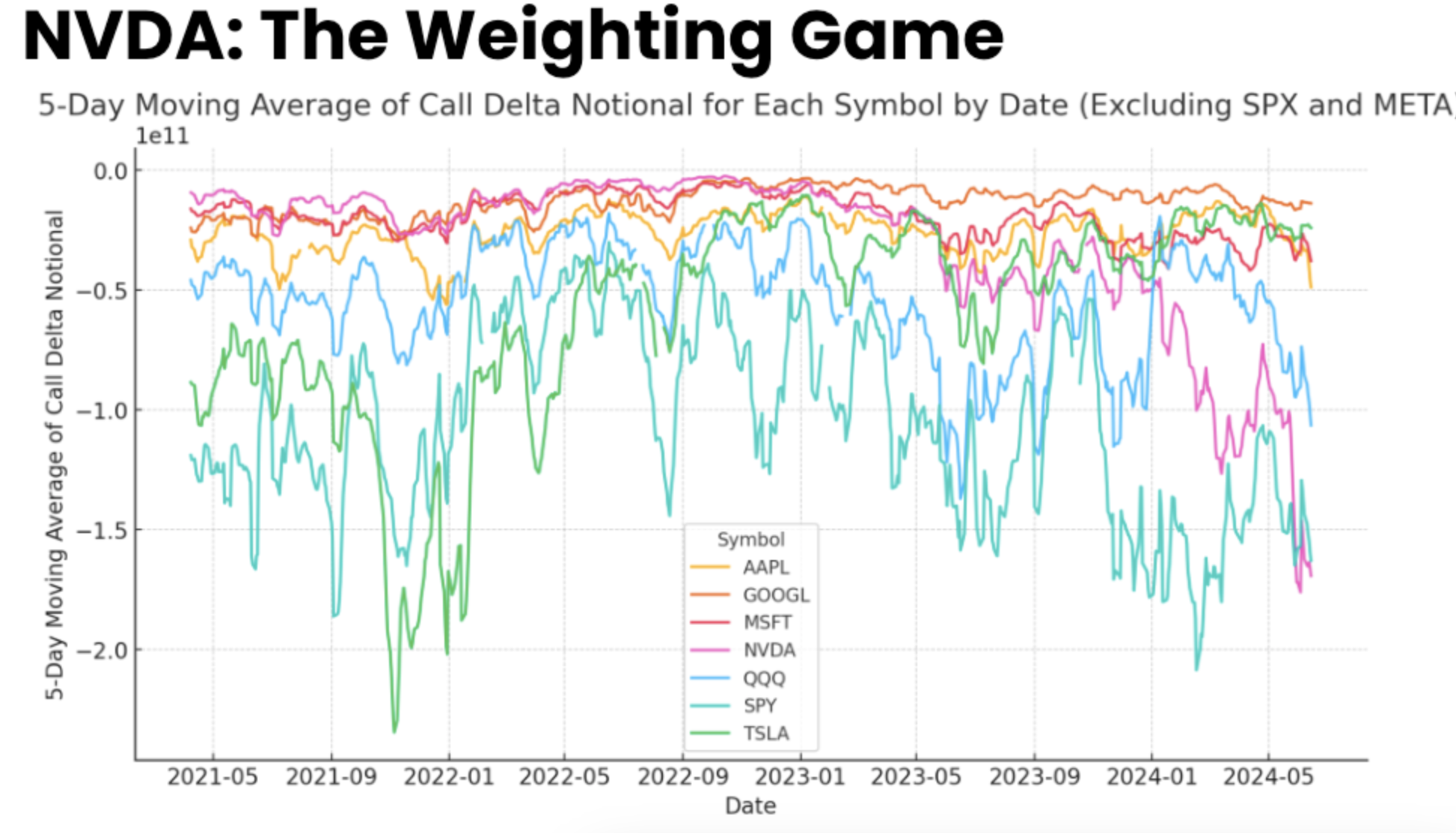

The other thing that is really interesting here is that this correlation chart looks an awful lot like the

call delta

chart we discussed in our OPEX review(s). See how NVDA’s

call delta

(pink) has eclipsed SPY (teal)? This implies to us that options are a driver in this extreme correlation, and through this line of thinking a large call expiration could serve to reign in that NVDA un-correlation.

Obviously NVDA & its lofty peers retreating would be a drag on the S&P/QQQ, which, when combined with a decrease in positive Index gamma, leads to an overall equity market correction.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5543.34 | $5473 | $547 | $19752 | $481 | $2017 | $199 |

| SG Gamma Index™: |

| 3.734 | 0.235 |

|

|

|

|

| SG Implied 1-Day Move: | 0.54% | 0.54% | 0.54% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5515.34 | $5445 | $545 | $19840 | $483 | $2030 | $201 |

| Absolute Gamma Strike: | $5520.34 | $5450 | $550 | $20000 | $480 | $2000 | $200 |

| Call Wall: | $5570.34 | $5500 | $550 | $20000 | $485 | $2200 | $210 |

| Put Wall: | $5370.34 | $5300 | $530 | $19625 | $474 | $2000 | $200 |

| Zero Gamma Level: | $5470.34 | $5400 | $542 | $19702 | $480 | $2043 | $202 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.238 | 1.134 | 1.064 | 0.968 | 0.740 | 0.503 |

| Gamma Notional (MM): | $1.298B | $1.439B | $2.882M | $104.67M | ‑$94.429M | ‑$2.824B |

| 25 Delta Risk Reversal: | -0.024 | -0.016 | -0.026 | -0.014 | -0.018 | 0.004 |

| Call Volume: | 1.413M | 4.368M | 39.844K | 1.538M | 31.328K | 810.538K |

| Put Volume: | 2.596M | 4.331M | 84.612K | 3.091M | 58.092K | 1.013M |

| Call Open Interest: | 16.247M | 9.401M | 130.648K | 8.67M | 753.966K | 9.482M |

| Put Open Interest: | 33.13M | 30.775M | 260.768K | 16.386M | 1.23M | 18.738M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5450, 5500, 5400, 5550] |

| SPY Levels: [550, 548, 547, 540] |

| NDX Levels: [20000, 19800, 19500, 19900] |

| QQQ Levels: [480, 475, 470, 485] |

| SPX Combos: [(5725,91.88), (5703,70.23), (5698,99.57), (5676,90.59), (5648,98.45), (5626,95.48), (5621,79.81), (5610,73.62), (5605,88.72), (5599,99.95), (5588,77.55), (5583,96.87), (5577,99.20), (5572,99.82), (5566,92.89), (5561,93.72), (5555,92.67), (5550,99.85), (5544,89.72), (5539,97.73), (5533,94.58), (5528,97.81), (5522,99.95), (5517,95.03), (5511,99.61), (5506,94.69), (5501,100.00), (5495,98.53), (5490,95.46), (5484,99.18), (5479,97.03), (5473,85.64), (5468,71.45), (5462,71.84), (5451,99.63), (5446,93.34), (5435,81.39), (5424,98.82), (5413,86.07), (5407,72.59), (5402,93.16), (5397,72.60), (5391,82.53), (5386,83.74), (5375,96.40), (5364,72.35), (5353,86.32), (5347,96.32), (5342,71.31), (5336,82.53), (5325,92.03), (5304,87.19), (5298,98.20), (5293,84.68), (5276,75.85), (5271,70.50), (5254,71.59), (5249,90.25), (5227,85.34), (5205,88.91)] |

| SPY Combos: [549.73, 551.92, 559.58, 554.66] |

| NDX Combos: [19891, 20503, 20108, 19436] |

| QQQ Combos: [484.84, 499.77, 490.14, 473.77] |

0 comentarios