Macro Theme:

Short Term SPX Resistance: 5,590

Short Term SPX Support: 5,550

SPX Risk Pivot Level: 5,500

Major SPX Range High/Resistance: 5,600

Major SPX Range Low/Support: 5,300

- Upside scenario:

- 5,600 is now major resistance, after move to 5,565

- 5,600 is the target high into July OPEX

- Downside scenario:

- 5,500 is our major risk off level

- <5,500 the market loses positive gamma support, allowing for higher implied volatility (i.e. VIX 20) and a move down into 5,400

Founder’s Note:

ES futures are flat at 5,620, NQ futures are flat at 20,615.

Key SG levels for the SPX are:

- Support: 5,550, 5,500

- Resistance: 5,565, 5,585, 5,600

- 1 Day Implied Range: 0.62%

For QQQ:

- Support: 494, 490

- Resistance: 500

IWM:

- Support: 200, 190

- Resistance: 205, 210

For today there is little on the economic front, leaving the equity market to primarily grapple with dealer gamma.

Tomorrow Powell testifies before Congress tomorrow, and earnings kick off with banks on Friday.

Most notably for SPX is a customer short large condor position expiring today, with ~30k each of a 5,585/5,590 call spread & 5,550/5,545 put spread. There was a similar position on Friday, with a customer short 10k of the 5,560/5,565 call spread & 5,510/5,505 puts, and the SPX closed right above that spread position at 5,566, which was a max loss for customer.

We’d note today’s condor position seems to be why the SPX

Call Wall

has contracted to 5,585. Following today’s OPEX we’d expect to see the SPX

Call Wall

revert back to 5,600 – which is our major upside target into July OPEX (7/19).

To the downside we see other large 5,550 positions forming for 7/19 OPEX, but little below there until 5,500. As a result, we are cautious on a break of 5,550, with a lack of support levels below 5,550 until 5,510 – 5,500.

Zooming out, we have major concerns that this market is getting too stretched. Accordingly, we are leaning on 5,500 as our major “risk off level”, as we think a break below there could trigger a strong volatility response.

The risk is that the imbalance of flows dedicated to suppressing SPX/Index vol vs expanding single stock vol has hit extremes. This can be seen in things like correlation metrics (i.e. COR1M at record lows), and index concentration metrics (top 10 stocks are 18% of S&P500, that’s the 2nd highest ever).

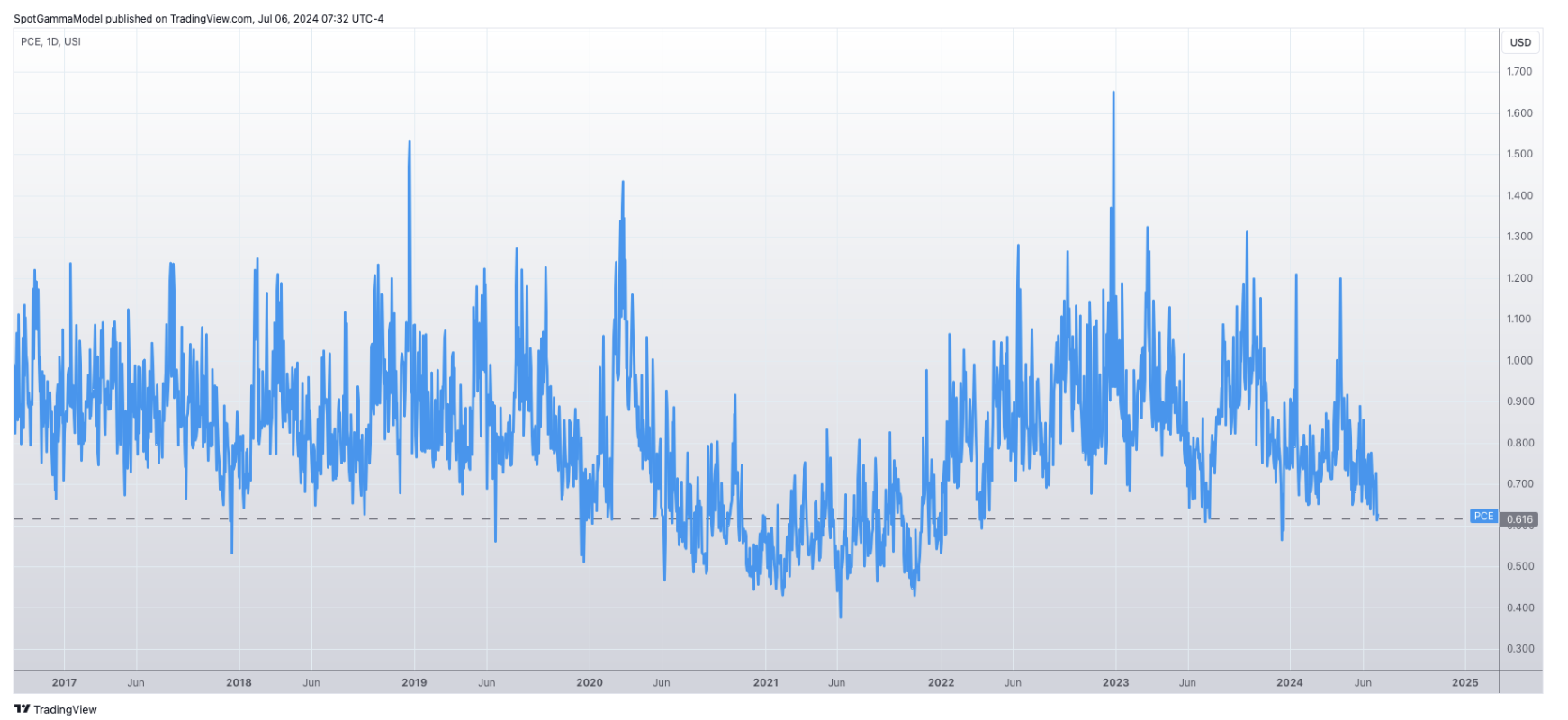

Let’s toss put/call ratios into the mix, too. Shown here is the US equity put/call ratio, which is at recent lows. This was only really bested by ’20/’21 which was a much more broad based rally (coming off of Covid lows), and meme mania.

These imbalances have been in place for a while, and could of course continue. This is why we continue to assume market strength until our risk flags fly with either SPX<5,500, or when large positions shift, like 7/19 OPEX.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5622.27 | $5567 | $554 | $20391 | $496 | $2026 | $200 |

| SG Gamma Index™: |

| 5.604 | -0.117 |

|

|

|

|

| SG Implied 1-Day Move: | 0.62% | 0.62% | 0.62% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5610.27 | $5555 | $553 | $19725 | $494 | $2015 | $201 |

| Absolute Gamma Strike: | $5605.27 | $5550 | $555 | $20000 | $490 | $2000 | $200 |

| Call Wall: | $5640.27 | $5585 | $557 | $19750 | $500 | $2020 | $210 |

| Put Wall: | $5600.27 | $5545 | $530 | $17000 | $490 | $2000 | $190 |

| Zero Gamma Level: | $5548.27 | $5493 | $553 | $19886 | $491 | $2037 | $203 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.42 | 0.933 | 1.617 | 1.058 | 0.690 | 0.617 |

| Gamma Notional (MM): | $2.351B | $426.913M | $28.356M | $378.744M | ‑$70.83M | ‑$1.237B |

| 25 Delta Risk Reversal: | -0.023 | 0.000 | -0.02 | 0.002 | -0.011 | 0.010 |

| Call Volume: | 1.076M | 2.354M | 21.896K | 1.392M | 33.134K | 723.016K |

| Put Volume: | 2.149M | 3.592M | 30.066K | 1.988M | 60.834K | 790.424K |

| Call Open Interest: | 12.91M | 9.109M | 110.496K | 5.889M | 544.786K | 7.529M |

| Put Open Interest: | 26.841M | 24.817M | 219.778K | 12.339M | 945.236K | 14.491M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5550, 5500, 5585, 5600] |

| SPY Levels: [555, 550, 554, 553] |

| NDX Levels: [20000, 19750, 20500, 19975] |

| QQQ Levels: [490, 500, 495, 485] |

| SPX Combos: [(5823,84.54), (5801,99.32), (5773,94.85), (5768,72.23), (5751,99.91), (5723,97.45), (5701,99.90), (5690,81.93), (5679,71.57), (5673,98.80), (5667,85.42), (5662,91.38), (5651,99.92), (5640,93.11), (5634,73.45), (5628,97.96), (5623,99.84), (5617,98.44), (5612,99.65), (5606,97.24), (5601,100.00), (5595,93.54), (5589,100.00), (5584,100.00), (5578,99.90), (5573,100.00), (5567,90.19), (5562,97.76), (5550,99.99), (5545,100.00), (5523,72.93), (5512,70.45), (5500,92.15), (5495,71.05), (5489,71.80), (5478,81.24), (5473,77.21), (5461,73.54), (5456,79.54), (5450,83.05), (5439,84.06), (5428,71.73), (5422,94.61), (5372,94.61), (5350,90.32), (5322,89.81), (5300,97.89)] |

| SPY Combos: [560.8, 555.81, 556.92, 558.58] |

| NDX Combos: [20555, 19760, 20759, 20351] |

| QQQ Combos: [505.17, 500.21, 485.32, 495.25] |

0 comentarios