Macro Theme:

Short Term SPX Resistance: 5,590

Short Term SPX Support: 5,550

SPX Risk Pivot Level: 5,500

Major SPX Range High/Resistance: 5,600

Major SPX Range Low/Support: 5,300

- Upside scenario:

- 5,600 is now major resistance, after move to 5,565

- 5,600 is the target high into July OPEX

- Downside scenario:

- 5,500 is our major risk off level

- <5,500 the market loses positive gamma support, allowing for higher implied volatility (i.e. VIX 20) and a move down into 5,400

Founder’s Note:

ES futures are +25bps at 5,640, NQ futures are +35bps at 20,735.

Key SG levels for the SPX are:

- Support: 5,578, 5,565, 5,550, 5,500

- Resistance: 5,590, 5,600, 5,612

- 1 Day Implied Range: 0.57%

For QQQ:

- Support: 494, 490

- Resistance: 500

IWM:

- Support: 200, 190

- Resistance: 205, 210

Powell 10AM testimony to Congress.

Equities again today face massive amounts of positive gamma, which should continue to keep the SPX in a tight trading range. There are several big gamma levels above at 5,590, 5,600 & 5,612, which should keep a lid on the upside. To the downside the dynamic is similar, with large levels at SPY 555 (SPY 5,565) & 5,550. If we break <5,550 we’d anticipate a test of 5,500.

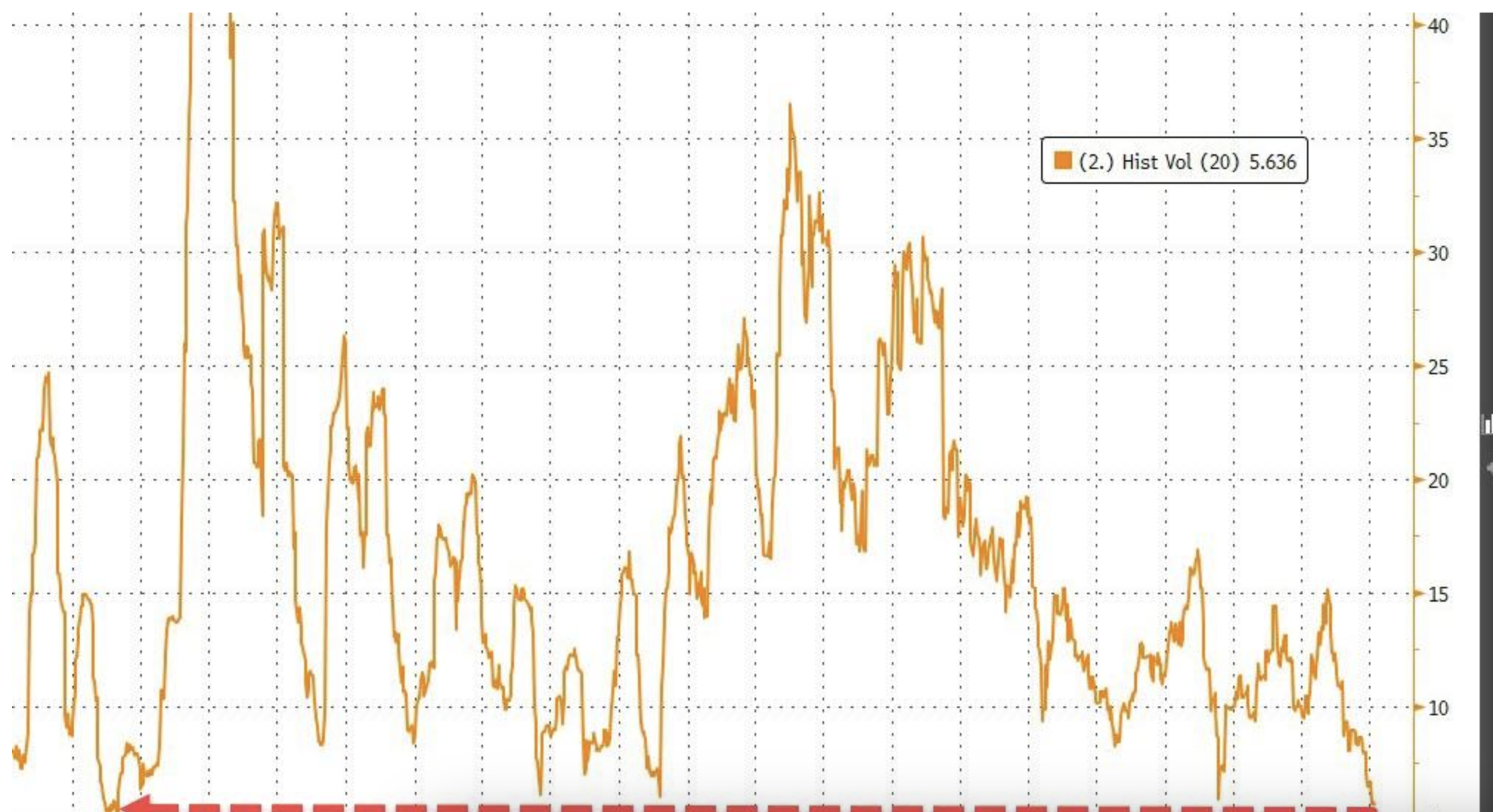

These tight trading ranges are evident in the collapse in realized volatility[RV] – a dynamic we have been covering extensively. This low volatility, we believe, is a function of dominant trading flows including: correlation trades, systematic derivatives selling (i.e. call selling programs), and 0DTE flow (see recent video content here & April’s “Vol Suppression” video here).

This RV dynamic is now receiving attention from the big banks, as per Goldman’s recent note & plot below: “1 month realized S&P vol is 6 (1st percentile rank on 5y lookback)”

Said another way – you have to go pre-Covid to see a market with as little SPX volatility as this current market.

The lowest 1-month realized vol on record was ~3.5% in October of ’17, and with the barrage of “we’ve never seen this before” mechanics happening these days, a revisit of 3.5% RV isn’t out of the question.

What is interesting about this is that implied volatility is not plunging in the same manor.

Shown below is 1-month SPX IV (blue) vs RV (gray), and as you can see RV is plunging but IV is not following suit. You can also look at this through the lens of the VIX, wherein the spread between 1-month SPX RV and VIX is, on average, 3.5pts. This indicates a current “fair value” for the VIX at ~9.5 – 10 vs the live VIX price of 12.5.

The punchline, per CBOE’s Mandy Xu: “Despite low absolute levels of implied volatility, the even lower levels of realized means that the SPX volatility risk premium is near the highest in a year. In other words, while implied vol is low, it’s not “cheap” as cost of carry remains extremely expensive.”

Yes, SPX 1-month IV of 10% seems pretty cheap, but now when you are realizing 5%.

This 10% IV is not that strange, as back in ’19 when RV was last at 5-6%, 1-month SPX IV hit a low of ~9%. We do note that in ’17 when RV moved <4%, 1-month IV had a 6-handle.

Getting to the point, whereas a few months ago you could see these vol-suppressing dynamics at play, with “room to run” in the aforementioned dynamics. We’re now hitting boundaries in the realm of whats possible. Framed most simply: when you are realizing 5% SPX IV – that’s ~35bps of daily movement in the SPX. You can’t realize <0.

And, yes, IV isn’t “cheap”, but its pricing in daily moves of ~63 bps. Do you really want to short that vol expectation?

This low vol situation can of course persist, and there is indeed a pain trade in not being long an equity market which persistently drives higher. Further, we’d need 1-2 days to likely wear away the positive gamma blanket which is supporting equities. Therefore if Powell is a little “triggering” today, and/or if CPI comes in a bit hot tomorrow, initial weakness can likely be absorbed and all is well >5,550.

However, when price jumps, we believe it will do so rather violently, which is why we are very mindful of downside risk trigger. Specifically this is “head’s up” on a break of 5,550, and looking to get short equities/long vol <5,500.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5626.73 | $5572 | $555 | $20439 | $497 | $2038 | $202 |

| SG Gamma Index™: |

| 2.017 | -0.06 |

|

|

|

|

| SG Implied 1-Day Move: | 0.57% | 0.57% | 0.57% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5599.73 | $5545 | $554 | $19740 | $494 | $2050 | $202 |

| Absolute Gamma Strike: | $5604.73 | $5550 | $555 | $20000 | $490 | $2050 | $200 |

| Call Wall: | $5654.73 | $5600 | $557 | $19750 | $500 | $2020 | $210 |

| Put Wall: | $5354.73 | $5300 | $530 | $20480 | $492 | $2000 | $197 |

| Zero Gamma Level: | $5553.73 | $5499 | $554 | $20083 | $492 | $2049 | $203 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.332 | 0.933 | 1.53 | 1.034 | 0.793 | 0.672 |

| Gamma Notional (MM): | $871.246M | $343.018M | $14.689M | $251.143M | ‑$25.523M | ‑$497.751M |

| 25 Delta Risk Reversal: | -0.023 | 0.004 | -0.019 | 0.003 | 0.00 | 0.013 |

| Call Volume: | 434.998K | 1.066M | 9.174K | 533.31K | 20.854K | 417.472K |

| Put Volume: | 910.86K | 1.383M | 15.313K | 806.695K | 26.75K | 475.774K |

| Call Open Interest: | 6.453M | 4.656M | 56.289K | 3.005M | 279.336K | 3.891M |

| Put Open Interest: | 13.564M | 12.573M | 114.736K | 6.34M | 478.773K | 7.451M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5550, 5500, 5600, 5000] |

| SPY Levels: [555, 550, 557, 556] |

| NDX Levels: [20000, 20500, 19750, 19975] |

| QQQ Levels: [490, 500, 495, 485] |

| SPX Combos: [(5801,95.82), (5773,86.65), (5751,98.89), (5723,89.70), (5701,98.94), (5673,94.59), (5668,74.22), (5662,84.68), (5651,98.90), (5640,86.73), (5629,92.71), (5623,98.44), (5617,92.40), (5612,96.57), (5606,94.41), (5601,99.87), (5595,87.91), (5590,97.52), (5584,92.36), (5578,99.52), (5573,91.28), (5567,83.08), (5551,85.57), (5545,81.11), (5528,73.09), (5517,75.12), (5467,74.75), (5450,85.18), (5428,74.69), (5417,74.61), (5378,71.76), (5350,74.75), (5316,70.42), (5300,91.63)] |

| SPY Combos: [557.01, 555.9, 557.56, 553.12] |

| NDX Combos: [20542, 20501, 20746, 19745] |

| QQQ Combos: [501.37, 481.97, 506.34, 496.4] |

0 comentarios