Macro Theme:

Short Term SPX Resistance: 5,665

Short Term SPX Support: 5,600

SPX Risk Pivot Level: 5,600

Major SPX Range High/Resistance: 5,700

Major SPX Range Low/Support: 5,300

Positions changes for 7/17 VIX-exp and 7/19 OPEX open a window for volatility shifts, and a break from the extreme equity calm.

- Upside scenario:

- On 5/10 we marked 5,600 – 5,625 (SPY 560) is the target high into July OPEX. This is still a key zone into 7/12

- On 5/11 the Call Wall did roll from 5,600 to 5,700, removing the overbought condition and setting our new model high at 5,700

- Downside scenario:

- 5,600 is our major risk off level as of 7/11

- <5,600 the market loses positive gamma support, allowing for a quick move down into 5,550

Founder’s Note:

ES futures are -10 bps to 5,682. NQ futures are -10 bps to 20,880.

Key SG levels for the SPX are:

- Support: 5,628, 5,600

- Resistance: 5,640, 5,650, 5,662

- 1 Day Implied Range: 0.62%

For QQQ:

- Support: 500, 499, 490

- Resistance: 505, 510

IWM:

- Support: 203, 200, 190

- Resistance: 205, 210

CPI 8:30AM ET

Call Walls

have leapt higher across the board. The SPX shifted from 5,600 to 5,700, SPY from 557 to 565, and QQQ to 510 from 500. This validates these higher equity prices, which were driven by an influx of call activity.

We were on record yesterday looking for an equity top into SPY 560 only after CPI (today) and PPI (tomorrow) cleared. So, why did equity markets yesterday jump?

From our seat, it looks like TSM’s reported +40% revenue boost triggered more upside chip-sector demand. As TSM (+3.5% y’day) is a big supplier to NVDA (+2.7%) & AAPL(+1.8%), those mega-cap names jumped.

When these ultra-concentrated names jump, it drags the S&P500 & Nasdaq higher. Below we calculated yesterday’s single stock impact to the SPX, and as you can see there is a huge +43bps of SPX impact just from the move in NVDA, AAPL & MSFT. Those 3 stocks are 21% of the weight of the S&P500, and 25% of the Nasdaq! These top 3-4 stocks are the index(es).

Conversely, the rest of the names are a tiny weight, and so even if they crash their impact to the SPX is diminished. Consider MA was -2.6% yesterday, which was only a 2 bps impact to SPX.

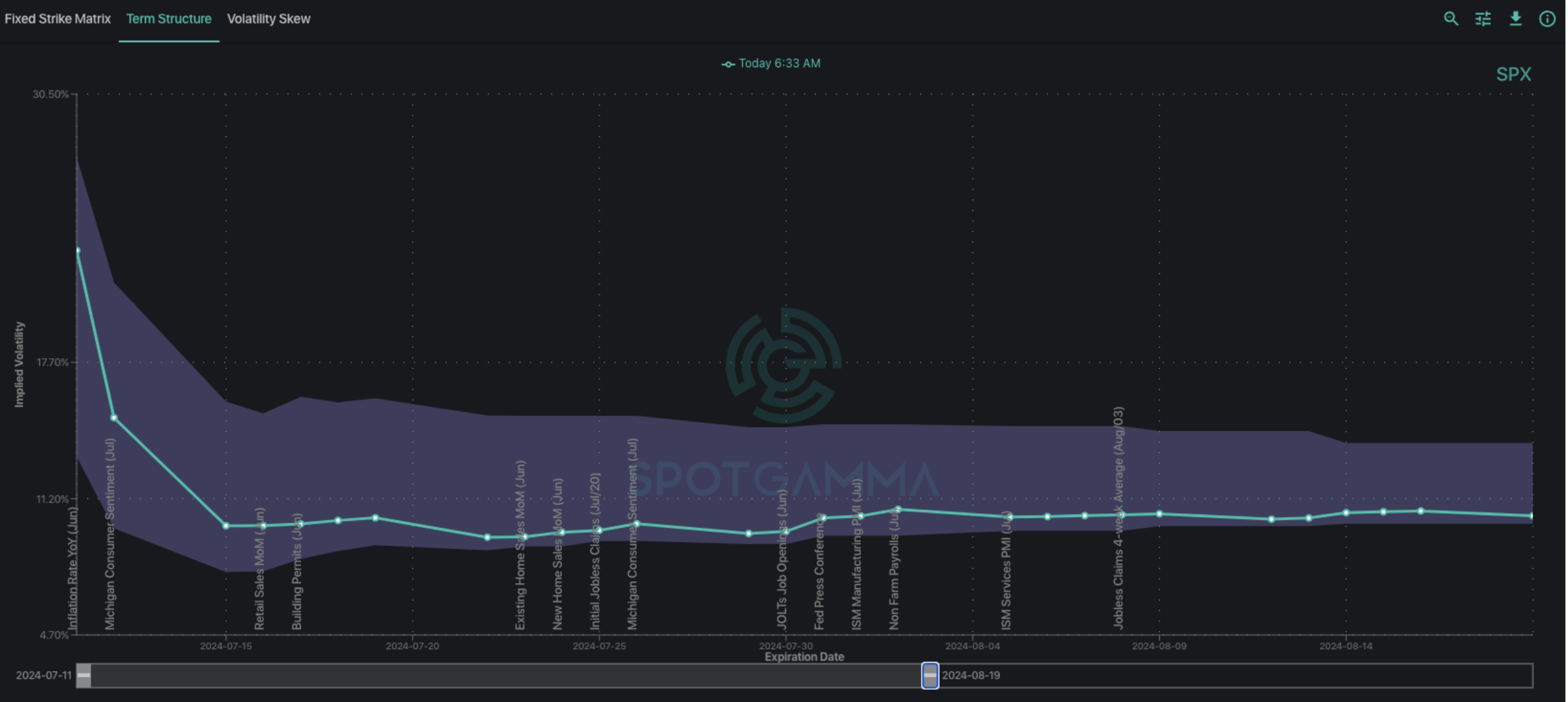

Turning to today, we see a mild lift in IV due to today’s CPI & Friday PPI. Longer dated IVs are at or near 90 day lows (bottom of gray shaded cone), and today’s 0DTE straddle is a bit elevated at $35, or 62bps with an IV of 22% (ref 5,630).

With that we watch SPY 565 (SPX 5,662) as resistance, with 5,600 as support. Interestingly, that straddle price of ~$35 lines up with a premarket SPX move to those major support and resistance lines (i.e. premarket SPX = 5,630 + 35 = 5,665 / 5,630-35 = 5,595). Critically, below 5,600 we shift to a risk-off stance.

What’s even more interesting, is the “stock up, vol up” scenario that has been unfolding over the last several days. Below we can see that the VIX (yellow) is higher this month, in correlation with higher S&P prices. Over these first 10 days of July, the S&P is now up 3%, which is the culmination of persistent daily “grinds” higher.

We’ve recently highlighted the record lows in realized volatility (here) – a signal that the S&P500 is barely moving. Well, just over the last few days we are seeing a slight increase in S&P500 realized vol because the market is breaking higher. This suggests a recent spate of SPX long call demand is entering the fray, as traders chase more upside in equities. “SPX up, SPX vol up” is unusual, and often a sign of a short term bubble/overextension.

George Soros famously said: “When I see a bubble forming, I rush in to buy, adding fuel to the fire…”

While we aren’t making a statement that equities are historically overvalued, we have been flagging the bizarre behaviors of equities that speak to short term risk, as elements like record low correlation and multi-year lows in realized vol must, at some point, normalize.

At the same time, we fully recognize that things can get more irrational, and large gains can come from these odd time periods.

Therefore we watch for the rolling of

Call Walls

higher as a signal for that more upside is available, while leaning on the major support levels below as a trigger for “risk-off”. Currently, both

Call Walls

and risk-off levels keep sliding higher. To this point we were only yesterday watching 5,600 as the top, with 5,550 as the risk off.

Today we now see 5,700 as our new top, with 5,600 as our risk off. Enjoy the upside, but respect that a violent reversion will likely rear up, and we feel that becomes more likely as things get more stretched to the upside.

A break <5,600 is to be respected as a possible trigger for sharp equity downside, and a jump in vol.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5686.84 | $5633 | $561 | $20675 | $502 | $2051 | $203 |

| SG Gamma Index™: |

| 2.601 | 0.011 |

|

|

|

|

| SG Implied 1-Day Move: | 0.62% | 0.62% | 0.62% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | $5723.99 | $5670.15 | $564.92 |

|

|

|

|

| SG Implied 1-Day Move Low: | $5654.12 | $5600.27 | $557.96 |

|

|

|

|

| SG Volatility Trigger™: | $5598.84 | $5545 | $559 | $19740 | $499 | $2060 | $202 |

| Absolute Gamma Strike: | $5603.84 | $5550 | $560 | $20000 | $500 | $2050 | $200 |

| Call Wall: | $5753.84 | $5700 | $565 | $19750 | $510 | $2200 | $205 |

| Put Wall: | $5353.84 | $5300 | $545 | $17000 | $490 | $2000 | $200 |

| Zero Gamma Level: | $5570.84 | $5517 | $556 | $20162 | $498 | $2047 | $203 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.467 | 1.012 | 1.602 | 1.222 | 0.854 | 0.846 |

| Gamma Notional (MM): | $1.09B | $658.407M | $12.887M | $445.807M | ‑$9.949M | $15.232M |

| 25 Delta Risk Reversal: | -0.022 | -0.00 | -0.022 | 0.002 | -0.011 | 0.012 |

| Call Volume: | 587.453K | 1.472M | 9.308K | 778.475K | 22.071K | 732.98K |

| Put Volume: | 1.015M | 2.017M | 12.704K | 980.124K | 20.81K | 278.597K |

| Call Open Interest: | 6.60M | 4.935M | 58.373K | 3.251M | 291.935K | 4.224M |

| Put Open Interest: | 14.058M | 13.276M | 118.89K | 6.58M | 491.524K | 7.536M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5550, 5600, 5650, 5500] |

| SPY Levels: [560, 555, 565, 557] |

| NDX Levels: [20000, 20500, 21000, 19750] |

| QQQ Levels: [500, 490, 495, 505] |

| SPX Combos: [(5899,91.96), (5876,76.10), (5854,92.57), (5825,71.92), (5803,98.01), (5775,87.73), (5769,77.79), (5763,70.77), (5752,99.52), (5741,74.29), (5724,96.48), (5718,73.67), (5713,71.13), (5702,99.78), (5690,93.91), (5679,94.27), (5673,99.82), (5668,87.51), (5662,96.78), (5656,72.62), (5651,99.68), (5640,96.45), (5634,86.56), (5628,99.24), (5623,92.32), (5617,82.04), (5611,77.56), (5606,85.14), (5600,99.11), (5594,71.13), (5578,82.28), (5499,80.21), (5471,73.75), (5454,80.16), (5420,73.21)] |

| SPY Combos: [563.5, 573.6, 568.55, 578.65] |

| NDX Combos: [20758, 20965, 20551, 20882] |

| QQQ Combos: [504.98, 510.51, 506.49, 515.54] |

0 comentarios