Macro Theme:

Short Term SPX Resistance: 5,665

Short Term SPX Support: 5,600

SPX Risk Pivot Level: 5,600

Major SPX Range High/Resistance: 5,700

Major SPX Range Low/Support: 5,500

Positions changes for 7/17 VIX-exp and 7/19 OPEX open a window for volatility shifts, and a break from the extreme equity calm.

With 7/17-7/19 OPEX we are looking for a pullback in IWM to 210.

- Upside scenario:

- SPX 5,665 shows as a major high into 7/19 OPEX

- Downside scenario:

- 5,600 is our major risk off level as of 7/15

- A break of 5,600 likely leads to a test of 5,550.

- 5,500 is our major, long term support level.

Founder’s Note:

ES are -70 bps to 5,675, NQ futures are -115 bps to 20,356

Key SG levels for the SPX are:

- Support: 5,620, 5,600, 5,550

- Resistance: 5,665, 5,650, 5,665, 5,676

- 1 Day Implied Range: 0.60%

For QQQ:

- Support: 490

- Resistance: 496, 500

IWM:

- Support: 220, 210, 206, 200

- Resistance: 225

For today SPY 560 (SPX 5,620) & 5,600 are major support, and a break below 5,600 implies a test of 5,550. To the upside, heavy resistance remains at 5,650-5,665.

Futures are down sharply this morning, let by shares of NVDA & tech. Media outlets point to Biden’s export restrictions as the cause, but this weakness falls into the VIX Exp/OPEX “window of weakness”. As nearly all of you are additionally aware, we have been harping on the concentration risk inherent to this market (see last Thu note). Therefore with NVDA -3.5% premarket, it alone drags down the S&P ~25 bps and the NDX ~29bps. To dive into this idea more you can dive into this Member Q&A segment from Monday.

Its additionally apparent that flow has been leaving megacap/tech and pushing into smallcap (IWM). This is clear when you look at the relative Index ETF moves over the last several days: IWM (candles) are +12%, with QQQ -0.5%. The DIA & RSP (see our trade idea from yesterday) are up 4-5% the past week, too.

Back to our first point on the concentration risk – if you look at the premarket marks on “tech/megacap light” RSP (equal weighted SPY): – 20bps vs SPY -70bps.

Turning to blazing-hot IWM/Russell (R2k), it seems ripe for a pullback.

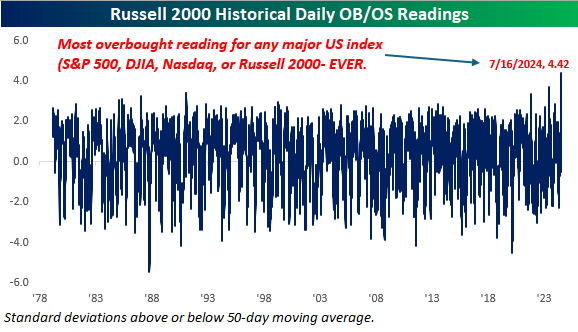

Starting with things we can toss onto the pile of “we’ve never seen this before”, Bespoke flags that IWM/R2k’s +12% over 4 days leads to IWM/R2k’s 2k as having “the most overbought reading for any majorUS Index EVER”.

We don’t think its a coincidence that week we saw the largest ever

call volume

in IWM’s, and on Monday we first noted the steep skew, and called for an OPEX-driven pullback into the 210 area. Options being bought add leverage/volatility, which magnify moves.

Since Monday, skew has only gotten steeper, as you can see in the plot of 1-month IV, below. This is evidence of this tremendous “stock up, vol up” move which is likely to resolve over the coming days with the Index moving sharply lower as that rich call skew flattens out (i.e. moves more toward the shaded green cone). That cone is the 90-day range for IWM 1-month skew. OPEX is a fantastic trigger for calls to be sold.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5717.76 | $5667 | $564 | $20398 | $496 | $2263 | $224 |

| SG Gamma Index™: |

| 2.419 | 0.017 |

|

|

|

|

| SG Implied 1-Day Move: | 0.60% | 0.60% | 0.60% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5645.76 | $5595 | $563 | $20290 | $496 | $2125 | $206 |

| Absolute Gamma Strike: | $5750.76 | $5700 | $565 | $20000 | $500 | $2200 | $220 |

| Call Wall: | $5750.76 | $5700 | $565 | $19750 | $500 | $2200 | $225 |

| Put Wall: | $5350.76 | $5300 | $540 | $17000 | $492 | $2125 | $200 |

| Zero Gamma Level: | $5642.76 | $5592 | $559 | $20194 | $495 | $2126 | $213 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.381 | 1.019 | 1.225 | 0.860 | 1.777 | 1.517 |

| Gamma Notional (MM): | $966.436M | $544.022M | $8.525M | ‑$109.807M | $48.777M | $674.289M |

| 25 Delta Risk Reversal: | -0.02 | 0.00 | -0.022 | 0.000 | 0.004 | 0.026 |

| Call Volume: | 493.833K | 1.431M | 12.476K | 731.264K | 70.307K | 2.10M |

| Put Volume: | 1.041M | 1.658M | 11.11K | 1.028M | 82.322K | 1.483M |

| Call Open Interest: | 6.899M | 5.011M | 64.647K | 3.427M | 332.477K | 4.952M |

| Put Open Interest: | 14.704M | 13.655M | 126.559K | 6.799M | 534.907K | 8.796M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5700, 5650, 5600, 5550] |

| SPY Levels: [565, 560, 564, 562] |

| NDX Levels: [20000, 20500, 19975, 20300] |

| QQQ Levels: [500, 490, 495, 492] |

| SPX Combos: [(5922,77.05), (5900,94.29), (5877,77.61), (5849,93.40), (5826,80.81), (5798,99.10), (5775,92.36), (5769,86.25), (5758,82.96), (5752,99.74), (5747,75.94), (5741,88.61), (5735,80.42), (5730,84.00), (5724,97.97), (5718,96.09), (5713,96.29), (5707,91.18), (5701,99.85), (5696,92.03), (5690,98.28), (5684,91.08), (5679,93.17), (5673,97.71), (5667,98.10), (5662,93.33), (5650,98.85), (5645,75.60), (5633,77.89), (5628,85.62), (5599,87.11), (5526,70.01), (5497,84.33), (5469,72.35), (5452,71.84), (5401,78.30)] |

| SPY Combos: [571.62, 566.54, 576.71, 581.79] |

| NDX Combos: [20215, 20541, 20745, 20133] |

| QQQ Combos: [492.42, 500.36, 490.43, 505.33] |

0 comentarios