Macro Theme:

Short Term SPX Resistance: 5,500

Short Term SPX Support: 5,400

SPX Risk Pivot Level: 5,515

Major SPX Range High/Resistance: 5,600

Major SPX Range Low/Support: 5,300

Next week (7/29) is critical both on the earnings front (MSFT, AAPL, AMZN, AMD, INTC), and macro front (FOMC, PMI, NFP). We expect this data to trigger a large directional move into August OPEX.

When the SPX moves above the Vol Trigger area (currently 5,515), we look to hold a core equity long position.

If equities are weak (<5,400) out of next weeks events, we may look to hold a core short position with major SPX targets below at 5,300 & 5,000.

- Upside scenario:

- SPX 5,600 is the top of our upside range into 7/31 FOMC

- We are “risk on” if SPX moves back over 5,515 (SPY 550)

- Downside scenario:

- 5,500 is our major, long term support level

- A break <5,400 implies a test of 5,300

- A break <5,300 implies a test of 5,000

Founder’s Note:

Key SG levels for the SPX are:

- Support: 5,416, 5,400, 5,373, 5,350, 5,300

- Resistance: 5,500, 5,520, 5,550

- 1 Day Implied Range: 0.63%

For QQQ:

- Support: 460

- Resistance: 464, 470, 475

IWM:

- Support: 210

- Resistance: 220

8:30 AM PCE

Support today remains at 5,400, with resistance at 5,500, then 5,515 (SPY 550). The

Put Wall

did roll lower to 5,300 (from 5,400) as traders closed puts at 5,400 and rolled them lower. This put-roll signals short term relief, but should we revisit 5,400 again there may be less support. A break of 5,400 therefore implies a test of 5,300.

Additionally, we maintain a “risk off” stance until/unless the SPX recaptures SPY 550. This means we will be looking to make long trades only as a “day trades”, as rallies can be subject to violent reversals as seen yesterday. If the SPX moves >5,515 we will be more comfortable holding a core long equity/short vol position.

The major catalysts are all next week, on both the earnings side and macro side.

On June 18th, NVDA became the worlds largest company, surpassing MSFT. That lasted one week.

Since then, NVDA is down 20%, with the QQQ -5% & SPY -2%. Meanwhile, the DIA and IWM are both higher at +3% & +12%, respectively.

Through this lens, we are in the midst of an equity rotation – a “Correlation Spasm” as equity relationships normalize from “never seen before” levels.

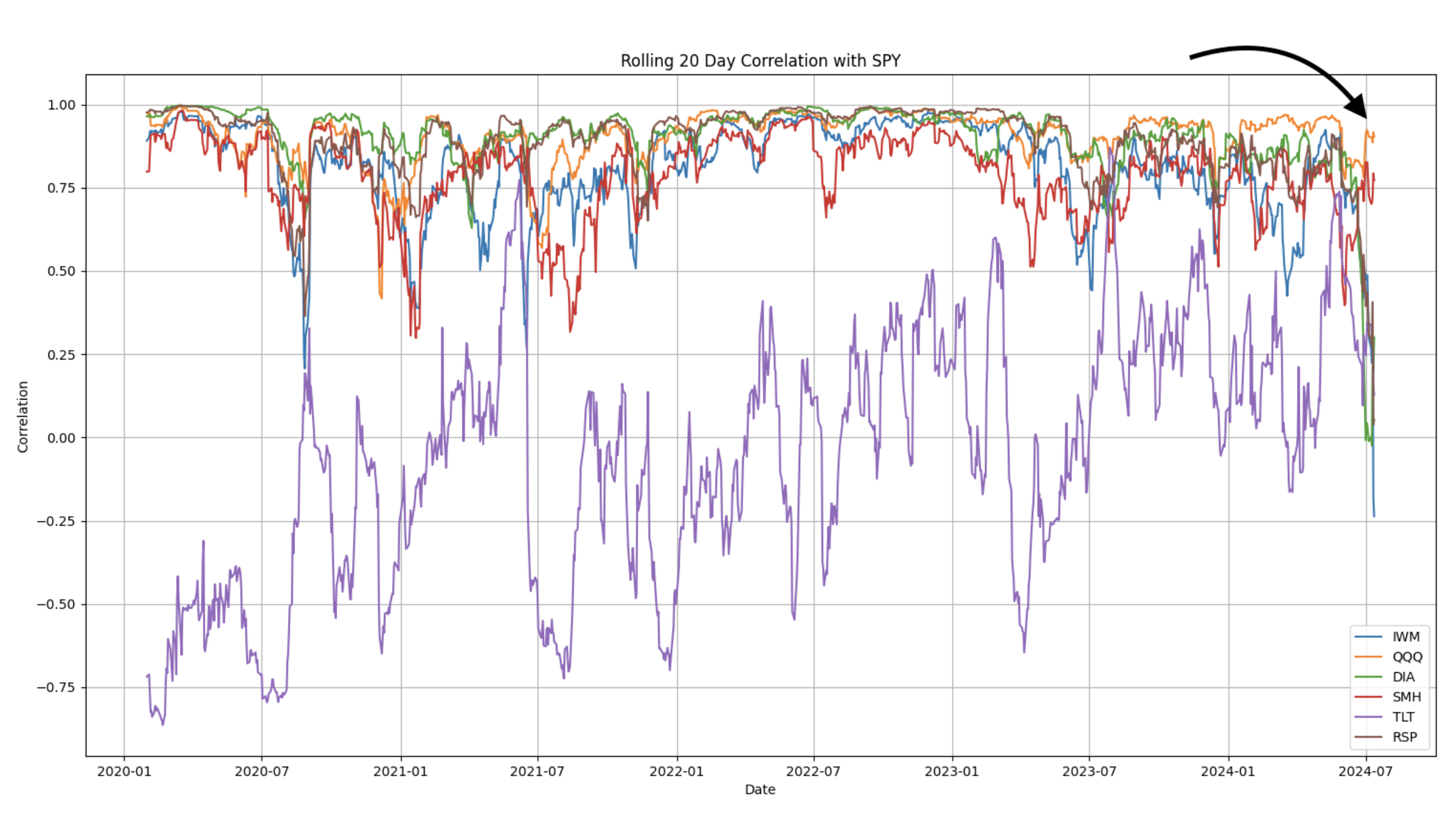

You can see these relationships in the plot below, which shows realized correlation of various ETF’s to SPY. The QQQ (orange) and semi-ETF SMH (red) are heavily correlated to the SPY, as they are all essentially the same trade: heavyweight tech (and that performed very well up into June).

Note here the DIA (green) and IWM (blue) are inversely correlated to SPY in ways not seen over the last 4 years, as DIA/IWM go up and tech declines.

This “internal” equity rotation (out of tech & into DIA/IWM) is a different from an “external” equity rotation, wherein traders dump stocks and move into bonds or other assets. The former is traders still liking equities, but finding better value in other equity sectors. The latter is a fear trade, generally associated with bad times (i.e. risk-off).

Why does all this matter?

First, just as megacap & semis overshot heavily to the upside, many seem to be overshooting to the downside. We think this is part of the “normalization” process, wherein all equity sectors eventually end up moving in better alignment (reference 2020-March 2024 in the chart above).

As a visualization, we plotted the SMH below with a basic trendline (we are certainly not CMT’s), to illustrate how over-extended the semi trade was, and how quickly its reverted. Now, is this equity-leading AI/semi story over, in which case we continue selling? That seems to be more of a fundamental question, and on that point we have: AMD, MSFT, AAPL, QCOM, INTC (& AMZN) all reporting next week.

Additionally next week are the leading macro events: FOMC, PMI & Jobless claims. These events are leading to a bump in index term structure, with IWM shown here, illustrating the importance traders place on this data.

Will we get a rate cut soon? We do not know, but we do believe that the IWM performance is banking on it.

This all reinforces two critical points at this juncture:

- Tech may be oversold as a trade (vol too high to downside) – with next weeks earnings updates critical to the story going forward. Great earnings likely re-inflates megacap/semi holdings. Or, bad earnings break things.

- IWM needs a rate cut amongst a soft landing narrative. Small cap calls are expensive (vol too high to upside), and we worry about a “sell the news” rate cut event in the short term.

Further, while we do not cover the fundamental/macro side of things here, we do feel pretty confident that you don’t want to own small caps into a recession. The risk here is that if things get ugly on the macro side, then we are going to see that “external” equity rotation, which means tech & small caps (and all other equities) drop in unison. That would be correlation shifting higher into macro risk-off events.

Our stance remains pretty simple – tactically trading intraday around key levels, and not looking to hold a core equity long position until/unless we are above the Vol Trigger area (currently 5,515). These levels shift as markets move, and options positions change.

Things are also setting up for a clear directional trade out of next week and into August OPEX, such that if equities are weak out of next weeks events, we may look to hold a core short position with major targets below at 5,300 & 5,000.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5440.71 | $5399 | $538 | $18830 | $458 | $2222 | $220 |

| SG Gamma Index™: |

| -2.526 | -0.524 |

|

|

|

|

| SG Implied 1-Day Move: | 0.61% | 0.61% | 0.61% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5536.71 | $5495 | $545 | $19400 | $462 | $2160 | $219 |

| Absolute Gamma Strike: | $5041.71 | $5000 | $540 | $19650 | $470 | $2200 | $220 |

| Call Wall: | $5791.71 | $5750 | $565 | $19650 | $463 | $2200 | $225 |

| Put Wall: | $5341.71 | $5300 | $540 | $17000 | $440 | $2155 | $210 |

| Zero Gamma Level: | $5531.71 | $5490 | $549 | $19357 | $471 | $2168 | $220 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.697 | 0.532 | 0.565 | 0.687 | 1.371 | 1.009 |

| Gamma Notional (MM): | ‑$1.191B | ‑$2.11B | ‑$20.433M | ‑$643.345M | $28.379M | $56.03M |

| 25 Delta Risk Reversal: | -0.038 | -0.013 | -0.047 | -0.024 | -0.007 | 0.019 |

| Call Volume: | 683.862K | 2.186M | 11.975K | 1.401M | 82.496K | 797.813K |

| Put Volume: | 1.141M | 2.332M | 15.62K | 1.507M | 23.216K | 958.852K |

| Call Open Interest: | 6.728M | 5.334M | 65.501K | 3.865M | 356.275K | 5.165M |

| Put Open Interest: | 13.875M | 12.213M | 114.635K | 6.003M | 534.891K | 8.935M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5000, 5500, 5550, 5400] |

| SPY Levels: [540, 545, 530, 550] |

| NDX Levels: [19650, 17000, 20000, 16900] |

| QQQ Levels: [470, 460, 465, 480] |

| SPX Combos: [(5648,81.75), (5626,69.68), (5599,91.06), (5577,81.46), (5464,83.83), (5448,93.19), (5442,84.94), (5437,87.73), (5426,92.52), (5421,88.75), (5415,93.58), (5410,74.69), (5405,80.21), (5399,98.67), (5394,77.62), (5388,86.81), (5383,81.80), (5378,97.55), (5372,80.99), (5367,90.19), (5356,70.26), (5351,95.34), (5345,72.31), (5340,79.33), (5329,70.39), (5324,84.28), (5313,89.92), (5307,77.73), (5302,98.85), (5275,94.28), (5264,76.95), (5248,91.76), (5226,81.26), (5216,80.44), (5199,96.80), (5172,93.92), (5151,85.58)] |

| SPY Combos: [535.64, 537.79, 525.41, 540.48] |

| NDX Combos: [18492, 19659, 18906, 18077] |

| QQQ Combos: [472.91, 455.04, 444.96, 450] |

0 comentarios