Macro Theme:

Short Term SPX Resistance: 5,665

Short Term SPX Support: 5,600

SPX Risk Pivot Level: 5,600

Major SPX Range High/Resistance: 5,700

Major SPX Range Low/Support: 5,400

Key dates ahead: 8/28 NVDA earnings

- Upside scenario:

- 5,665 is major short term resistance, due to large positive dealer gamma

- 5,700 is currently our max upside level in the end of August

- Downside scenario:

- <5,600 we are risk off. Below there is negative gamma territory, and a lack of price stability.

Founder’s Note:

Key SG levels for the SPX are:

- Support: 5,615, 5,600

- Resistance: 5,650, 5,665, 5,700

For QQQ:

- Support: 470

- Resistance: 480, 485

IWM:

- Support: 210, 200

- Resistance: 213, 215, 220

Futures are flat today, after Powell paved the way for rate cuts on Friday. This sparked a broad move higher in equities, with small caps strongly outperforming (IWM, red). All eyes are now on Wed PM NVDA earnings.

For today, we see a fair amount of positive gamma for the SPX, which should offer support below at 5,615 then 5,600. Resistance builds into the 5,665 area (a key strike for today), and persists up into 5,700. We think this positive gamma position persists as long as the SPX holds > 5,600. Should the SPX break <5,590 we would flip back to a “risk off” stance.

We watch 5,590 for today, not 5,600, due to a key 0DTE position.

In regards to these key 5,665 & 5,600 strike zones, there is a 0DTE iron condor position on today which has been shown to pin the market in the past. Currently this position shows as a buyside fund holding ~8k contracts of each leg:

- short 5,660 vs long 5,665

- short 5,600 and long 5,595

This works out to be dealers long a 5 pt call spread at 5,660 x 5,665, and long a put spread at 5,600 x 5,595. If the SPX is near either of these areas >3PM, expect the relevant position to be a strong magnet. Dealers in theory get “max profit” by forcing the market to close at >=5,665 or <=5,595.

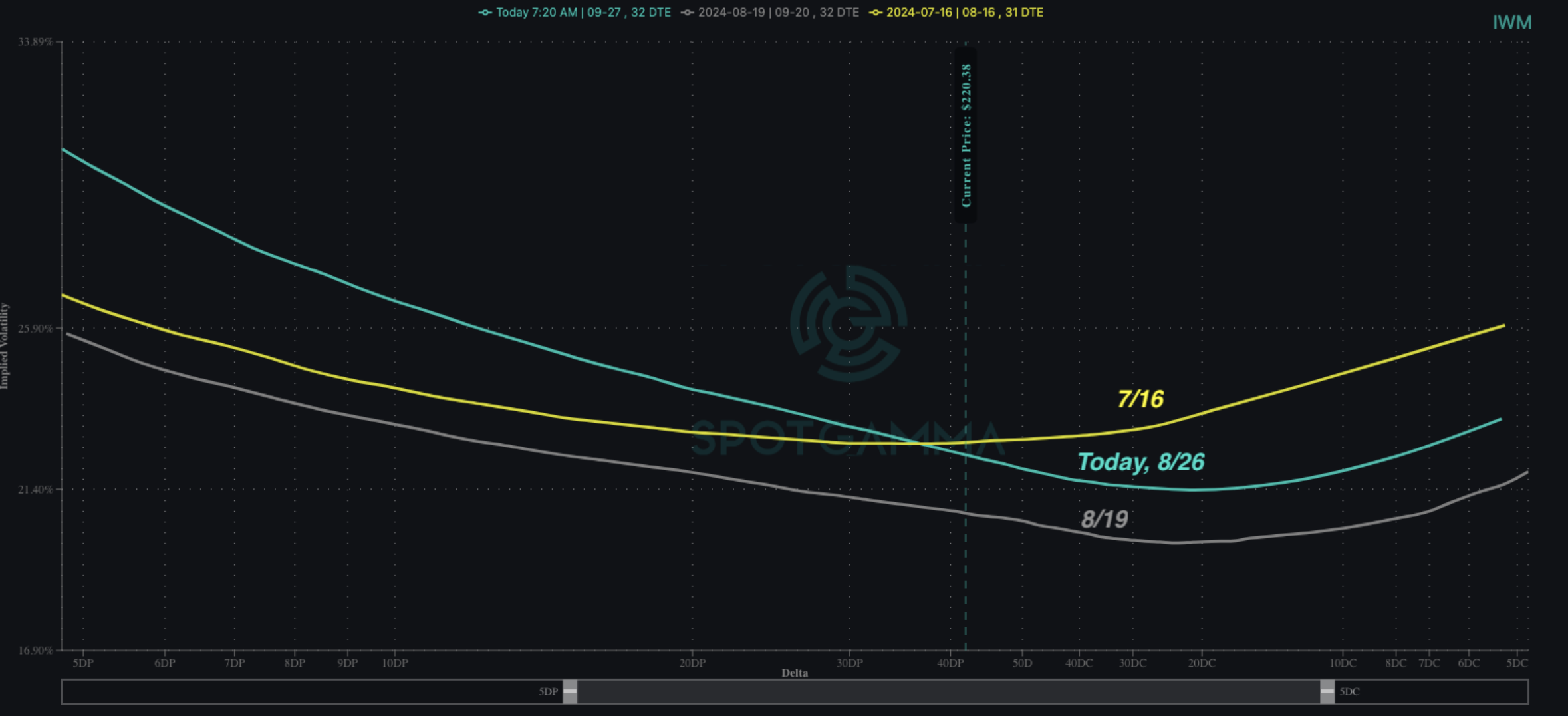

Turning to the strong performance of small caps, IWM is back to 220, which is just 2% from July highs and 6% from all-time highs near 233. (Nov ’21). What’s interesting from our perspective is that there is a lift in IV over the past week, but this has not transformed into a strong call skew like it did in mid-July.

Below, you can see 1-month skew from last week (gray) vs today (teal). This actually shows a relative increase in downside IV (i.e. puts) has built up as IWM’s rallied 4% last week. You can also see that the shape of skew today looks nothing like the “small cap summer” fervor & raving call demand of mid-July (yellow), which noticeably pumped upside strike IV’s. If you recall back to this July period, we were flagging those very rich IWM call IV’s as a major headwind for more IWM upside. Here, things are not the same.

While today’s more moderate call IV’s are no guarantee of higher underlying IWM prices, those looking to play further upside may want to look at IWM calls due to the potential of increasing call IV’s along with higher IWM stock prices.

Finally, in regards to NVDA what we notice is a bump in SPX implied vols on that date. GDP data does come out on Wednesday AM, but we suspect there is an additional event-vol premium due to NVDA’s ER report on Wed PM. These higher SPX IV’s seems to back the importance of this event from a broad equity perspective.

NVDA implied vols themselves are fairly standard into earnings, and we will cover them more in depth on Wednesday. Additionally we covered a few interesting proxy plays (TSM, AVGO) in a recent video, here.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5653.72 | $5634 | $562 | $19720 | $480 | $2218 | $220 |

| SG Gamma Index™: |

| 1.348 | -0.002 |

|

|

|

|

| SG Implied 1-Day Move: | 0.59% | 0.59% | 0.59% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5624.72 | $5605 | $560 | $19440 | $480 | $2120 | $216 |

| Absolute Gamma Strike: | $5619.72 | $5600 | $560 | $20000 | $480 | $2250 | $220 |

| Call Wall: | $5769.72 | $5750 | $565 | $19450 | $485 | $2250 | $225 |

| Put Wall: | $5614.72 | $5595 | $540 | $20150 | $480 | $2120 | $200 |

| Zero Gamma Level: | $5579.72 | $5560 | $556 | $19523 | $479 | $2147 | $218 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.186 | 0.997 | 1.159 | 0.884 | 1.407 | 0.991 |

| Gamma Notional (MM): | $681.293M | $525.397M | $5.377M | ‑$17.863M | $40.74M | $176.735M |

| 25 Delta Risk Reversal: | -0.04 | -0.028 | -0.041 | -0.019 | 0.00 | 0.002 |

| Call Volume: | 531.317K | 1.735M | 14.617K | 903.149K | 44.027K | 828.60K |

| Put Volume: | 853.846K | 2.686M | 10.028K | 1.044M | 65.492K | 1.061M |

| Call Open Interest: | 7.163M | 5.353M | 66.591K | 3.447M | 350.417K | 4.757M |

| Put Open Interest: | 13.636M | 14.292M | 86.518K | 6.219M | 553.06K | 8.647M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5600, 5550, 5500, 5650] |

| SPY Levels: [560, 550, 565, 562] |

| NDX Levels: [20000, 19450, 19500, 20200] |

| QQQ Levels: [480, 470, 485, 475] |

| SPX Combos: [(5899,93.90), (5877,73.37), (5849,94.35), (5826,80.78), (5798,98.15), (5775,87.37), (5770,73.97), (5764,76.85), (5747,99.57), (5742,70.68), (5725,93.09), (5719,72.69), (5713,88.32), (5708,77.69), (5702,99.60), (5691,86.32), (5685,82.91), (5680,85.33), (5674,94.13), (5668,87.97), (5663,99.50), (5652,99.22), (5646,82.04), (5635,73.86), (5623,84.13), (5601,74.98), (5595,93.91), (5511,71.28), (5499,82.84), (5449,71.16), (5426,72.22), (5415,82.29), (5398,89.09), (5375,70.48)] |

| SPY Combos: [580.64, 575.58, 570.52, 585.7] |

| NDX Combos: [19445, 19918, 19721, 20549] |

| QQQ Combos: [479.06, 490.1, 485.3, 465.14] |

0 comentarios