Macro Theme:

Key dates ahead:

- 8/28 GDP, NVDA earnings

- 9/18 FOMC

- 9/20 OPEX

Index Vols are elevated due to upcoming NVDA earnings, which makes this a key directional trigger into September.

Key SG levels for the SPX are:

- Support: 5,600, 5,580, 5,550

- Resistance: 5,615, 5,650, 5,665, 5,700

- As of 8/27/24:

- We are neutral <5,580, meaning markets likely trend lower, but find initial support at 5,550 & 5,520.

- Models are “risk off” with a break <=5,500, which implies a multi-day directional move lower.

- Models are “risk on” while >5,620, with 5,700 the initial upside target if NVDA ER is bullish.

QQQ:

- Support: 475, 470

- Resistance: 480

- As of 8/27/24:

- Post NVDA ER a multi-day directional move is likely signaled by a break <470 (bearish) or >480 (bullish)

IWM:

- Support: 210, 200

- Resistance: 213, 215, 220

- As of 8/27/24:

- Price will likely remain very fluid in either direction due to negative gamma. 200 is a long term support strike, and large positive gamma strike resistance is at 230.

Founder’s Note:

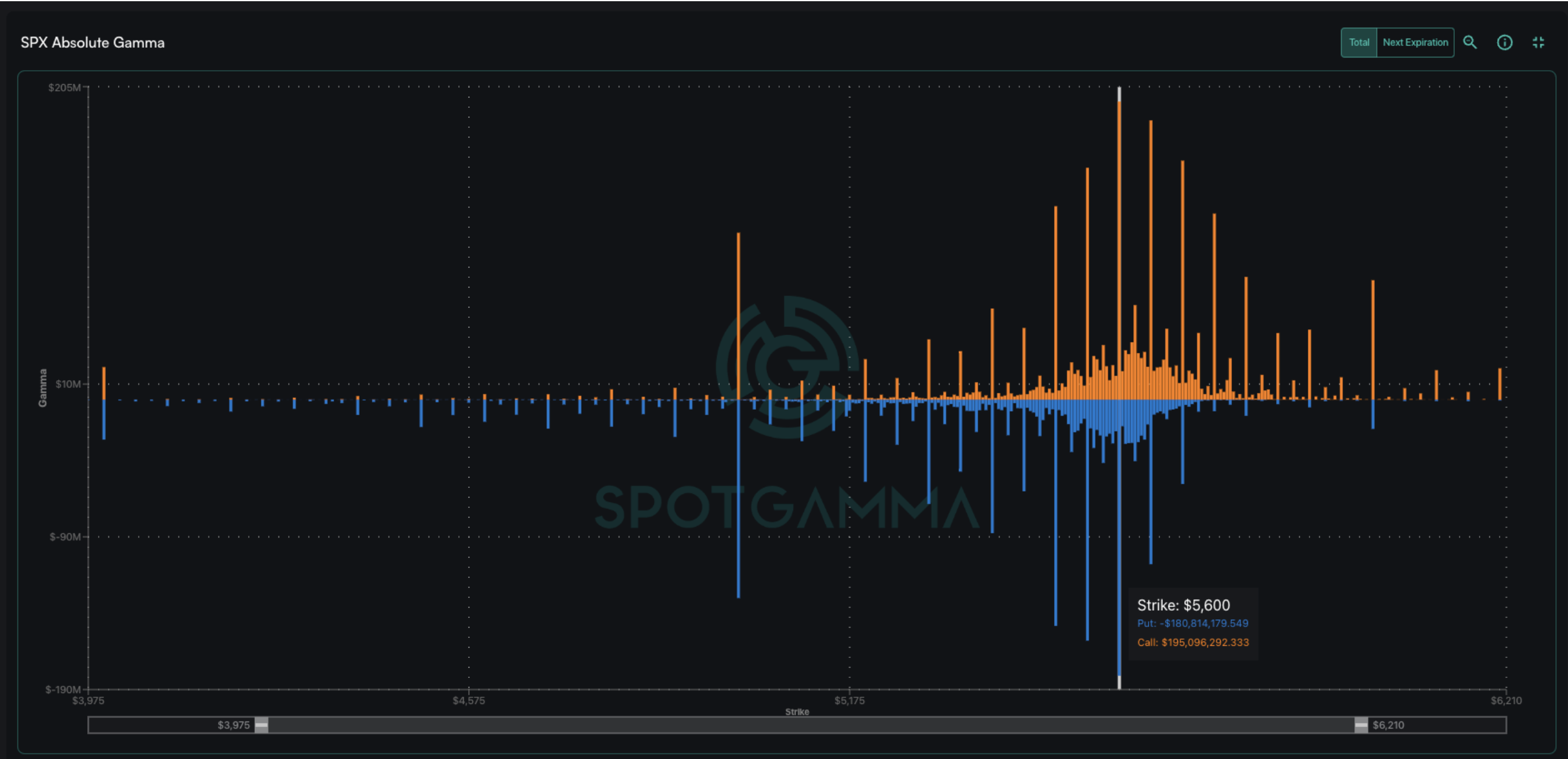

Futures are fractionally lower as the S&P500 wrestles with the large positive gamma strike of 5,600. And, while yesterday was framed by a large iron condor, the positions at 5,600 are tied to longer dated expirations (Sep, Dec) which should make this a significant strike going forward.

Because the “main event” is with tomorrow’s NVDA earnings, we anticipate today being fairly quiet, and mean reverting around the 5,600 to 5,620 (SPY 560) zone & QQQ 475.

While the overall SPX position is fairly balanced in respect to call vs put positions, there is a larger QQQ put position (blue bars) building <475. In gamma terms, generally the Q’s are only a fraction of SPX/SPY positions, but here they are of comparable size.

This larger put complex was flagged in yesterday’s Q&A (h/t Hassan), and suggests that if QQQ’s push <475 the negative gamma increases rather sharply, which should draw negative dealer gamma hedging (i.e. selling pressure).

Looking at QQQ skew, we see the wings are bid, likely in anticipation of NVDA earnings. Taking sizable gamma + elevated vols together, QQQ’s are poised to move, with <=470 signaling a longer term drawdown and >=480 a longer term rally toward Sep OPEX & FOMC (9/18-20). These vols are rich enough to invoke vanna as a key driver of forward price action in either direction.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5634.53 | $5616 | $560 | $19516 | $475 | $2217 | $220 |

| SG Gamma Index™: |

| 1.024 | -0.005 |

|

|

|

|

| SG Implied 1-Day Move: | 0.58% | 0.58% | 0.58% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | $5655.67 | $5637.14 | $562.71 |

|

|

|

|

| SG Implied 1-Day Move Low: | $5590.66 | $5572.12 | $556.23 |

|

|

|

|

| SG Volatility Trigger™: | $5613.53 | $5595 | $560 | $19440 | $474 | $2120 | $216 |

| Absolute Gamma Strike: | $5618.53 | $5600 | $560 | $19450 | $470 | $2250 | $220 |

| Call Wall: | $5768.53 | $5750 | $565 | $19450 | $480 | $2250 | $225 |

| Put Wall: | $5318.53 | $5300 | $540 | $20150 | $440 | $2120 | $200 |

| Zero Gamma Level: | $5560.53 | $5542 | $559 | $19467 | $474 | $2163 | $218 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.137 | 0.994 | 1.033 | 0.909 | 1.31 | 0.986 |

| Gamma Notional (MM): | $418.447M | $398.216M | $1.357M | $8.684M | $27.303M | $75.777M |

| 25 Delta Risk Reversal: | -0.04 | 0.00 | -0.043 | -0.026 | -0.02 | -0.008 |

| Call Volume: | 393.387K | 1.422M | 8.441K | 775.653K | 18.113K | 467.574K |

| Put Volume: | 591.986K | 1.733M | 8.318K | 729.833K | 22.893K | 479.828K |

| Call Open Interest: | 7.185M | 5.443M | 67.458K | 3.499M | 349.853K | 4.799M |

| Put Open Interest: | 13.692M | 14.548M | 87.80K | 6.253M | 560.621K | 8.806M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5600, 5550, 5650, 5500] |

| SPY Levels: [560, 550, 565, 555] |

| NDX Levels: [19450, 20000, 19500, 20500] |

| QQQ Levels: [470, 480, 475, 460] |

| SPX Combos: [(5875,71.34), (5853,93.92), (5825,78.80), (5802,98.10), (5774,87.14), (5768,75.32), (5757,82.47), (5752,99.54), (5740,70.04), (5729,72.28), (5724,92.55), (5718,82.42), (5712,94.44), (5701,99.36), (5690,84.95), (5679,86.96), (5673,91.87), (5667,93.04), (5662,90.86), (5651,98.76), (5639,77.71), (5628,73.86), (5622,90.81), (5600,71.61), (5561,73.66), (5527,73.60), (5510,70.88), (5499,86.08), (5448,76.40), (5426,73.35), (5409,79.39), (5398,90.86), (5347,82.45)] |

| SPY Combos: [567.46, 571.94, 563.53, 562.41] |

| NDX Combos: [19458, 19907, 19712, 19302] |

| QQQ Combos: [468.68, 480.08, 475.33, 495.29] |

0 comentarios