Macro Theme:

Key dates ahead:

- 8/28 GDP, NVDA earnings

- 9/18 FOMC

- 9/20 OPEX

Index Vols are elevated due to upcoming NVDA earnings, which makes this a key directional trigger into September.

Key SG levels for the SPX are:

- Support: 5,600, 5,580, 5,550

- Resistance: 5,615, 5,650, 5,665, 5,700

- As of 8/28/24:

- Models are “risk off” with a break <=5,580, which implies a multi-day directional move lower. 5,500 is major support.

- Models are “risk on” while >5,620, with 5,700 the initial upside target if NVDA ER is bullish.

QQQ:

- Support: 475, 470

- Resistance: 480, 485

- As of 8/28/24:

- Post NVDA ER a multi-day directional move is likely signaled by a break <470 (bearish) or >480 (bullish)

IWM:

- Support: 210, 200

- Resistance: 220

- As of 8/28/24:

- Price will likely remain very fluid in either direction due to negative gamma. 200 is a long term support strike, and large positive gamma strike resistance is at 230.

Founder’s Note:

All eyes are obviously on NVDA today, which reports after the close. We’ve laid out our key Index views in “Macro Theme”, above.

Here, we want to dig into NVDA.

Why is this such a

pivot

al event for equities? Reiterating the importance: On August 8th we had a +2.3% move in the SPX as equities ripped from the JPY flash crash. The prior +2% move was over 110 trading days before, when NVDA posted massive results on Feb 22nd.

There are the obvious macro implications of chip demand and the AI story as the key US growth driver. But more structurally, there are a myriad of flows all built on the success of the chip/AI theme.

Consider the current weighting of NVDA in the SPX & NDX: 6.58% & 8.2% (!), respectively. Our earnings dashboard informs us that the options implied move for NVDA is 9%, and so should NVDA fill that move it alone would potentially move the SPY by 0.585% & QQQ by 0.738%. However, >=20% of these broad indicies are directly related to the AI/chip sector.

Should NVDA put up a great print, the equity upside seems fairly obvious, with SPX 5,700 & QQQ 480 on tap.

With an “in line” or “meh” type of earnings print, we would flip to a broad risk off position with a move <5,580, but maintain equity longs if the SPX is >=5,620.

The downside with a NVDA ER miss, though, is fraught with risk.

We spent much of this year flagging the risks of these high Index concentrations (i.e. top 3 stocks >=20% of the index), and the low equity correlations. These correlations broke back in April, and again most recently in August. Today’s broad positioning looks nearly the same as it did before those major risk-off moves, in which the SPX declined ~5% and these top stocks dropped <-10%.

You can see the relationship in the plot below, wherein correlation (COR1M, maroon) is back to lows, as is the VIX (purple). But both moved violently higher in April & August as NVDA (candles) and equities writ-large broke down.

Those April & August drawdowns did indeed recover very quickly as traders rooted back into these key AI-themes and trades. If NVDA misses we suspect that the related correlation/momentum trades may not return with the same force.

The TLDR here is that there may be a lot of “August 5th” style conversations if NVDA doesn’t put up big numbers.

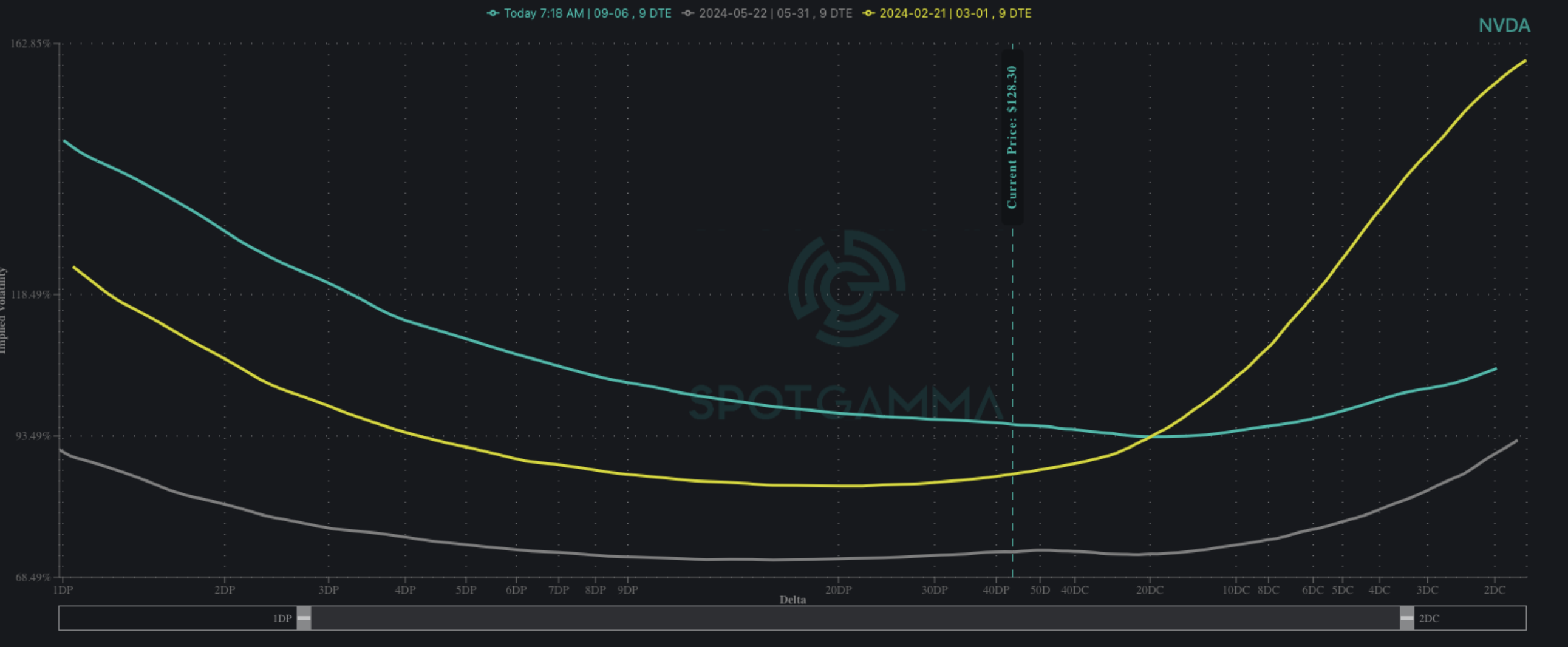

Looking at NVDA specifically, today we see that at-the-money IV (teal) is more elevated than into Feb & May earnings (9-day skew shown below). Skew currently reads much more like traders hedging downside risks, than worried about upside.

Compare today vs into Feb earnings (yellow), where there was a massive call skew, driven by FOMO & an upcoming NVDA product event. The same bullish expectations are clearly not in play, but traders are pricing in volatility.

The key boundaries for NVDA are 100 to the downside, and 150 to the upside. Outside of those bounds we read NVDA as overbought/oversold. We think that the 100-110 area is in play for tomorrow on a miss, as dealers appear to be in a negative gamma position down into that zone, with little positioned <=100 (which implies a loss of downside momentum <100).

To the upside, we read a bit of dealer positive gamma into 140, which would be the top of an initial reaction (i.e. tomorrow), with 150 into Friday.

Our big takeaway is that we think NVDA can move more than the 9% implied move given the dynamics listed above, and the fact that NVDA moved +14% in Feb ER and +9% in May. We think this is particularly true because so much of the flow is reflexive, meaning as NVDA jumps, it movement in the SPY/QQQ, which further pushes NVDA as its the 2nd largest index component.

So, how do you play this? Imran will be live today at 10AM ET to discuss some trade ideas, which will center on NVDA proxies like TSM and AVGO. I think something like QQQ Nov or Dec put spreads are a decent way to play an NVDA miss, as volatility may more broadly spike as outlined above.

Short dated QQQ IV’s are all jacked up due to the NVDA print, and so we look to post-election positions which should offer less decay if NVDA should have a positive report. Something like the 11/15 Exp 450/400 put spread at $5.6. You could pair this with short term upside play like tomorrows exp 1 x 480, -2x 485, 1 x 490 call fly in the QQQ’s, for around $0.75.

As an additional upside idea, something like Sep 25 delta calls/call spreads in TSM, which is a large NVDA supplier. As an example, the 9/20 exp 185/200 call spread is ~$1.7.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5642.49 | $5625 | $561 | $19581 | $476 | $2203 | $218 |

| SG Gamma Index™: |

| 1.281 | 0.004 |

|

|

|

|

| SG Implied 1-Day Move: | 0.59% | 0.59% | 0.59% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5612.49 | $5595 | $560 | $19440 | $476 | $2120 | $217 |

| Absolute Gamma Strike: | $5617.49 | $5600 | $550 | $19450 | $480 | $2250 | $220 |

| Call Wall: | $5767.49 | $5750 | $570 | $19450 | $485 | $2250 | $225 |

| Put Wall: | $5317.49 | $5300 | $540 | $20150 | $440 | $2120 | $200 |

| Zero Gamma Level: | $5568.49 | $5551 | $556 | $19385 | $476 | $2165 | $218 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.171 | 1.005 | 1.118 | 0.931 | 1.23 | 0.867 |

| Gamma Notional (MM): | $501.402M | $348.39M | $3.438M | ‑$6.753M | $22.284M | ‑$119.24M |

| 25 Delta Risk Reversal: | -0.042 | 0.00 | -0.042 | -0.027 | -0.022 | -0.01 |

| Call Volume: | 326.026K | 1.031M | 5.679K | 507.038K | 14.259K | 344.339K |

| Put Volume: | 636.964K | 1.155M | 5.355K | 524.999K | 15.441K | 471.352K |

| Call Open Interest: | 7.215M | 5.475M | 67.702K | 3.457M | 354.16K | 4.795M |

| Put Open Interest: | 13.861M | 14.663M | 87.381K | 6.259M | 562.942K | 8.843M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5600, 5650, 5550, 5500] |

| SPY Levels: [550, 560, 570, 555] |

| NDX Levels: [19450, 20000, 19500, 20500] |

| QQQ Levels: [480, 470, 475, 485] |

| SPX Combos: [(5901,94.34), (5873,76.75), (5851,94.35), (5828,86.25), (5800,98.22), (5778,88.20), (5772,76.26), (5761,79.96), (5750,99.67), (5738,81.86), (5733,78.61), (5727,93.22), (5721,84.21), (5716,77.87), (5710,93.45), (5699,99.49), (5693,90.60), (5688,81.87), (5682,88.66), (5676,93.56), (5671,90.83), (5665,77.65), (5660,89.84), (5654,78.81), (5648,99.21), (5643,75.96), (5603,71.36), (5558,75.30), (5508,73.31), (5502,89.45), (5451,75.43), (5423,76.50), (5412,79.25), (5401,89.70), (5378,72.95), (5350,78.24)] |

| SPY Combos: [575.01, 569.95, 564.9, 580.06] |

| NDX Combos: [19444, 19914, 19719, 18896] |

| QQQ Combos: [475.4, 486.37, 481.6, 471.58] |

0 comentarios