Macro Theme:

Key dates ahead:

- 9/11 CPI

- 9/18 FOMC/VIX Exp

- 9/20 Huge Quarterly OPEX

Key SG levels for the SPX are:

- Support: 5,400, 5,340

- Resistance: 5,500, 5,520

- As of 9/09/24:

- Models are now risk-neutral in the 5,400-5,500 range, due to the SPX testing 5,400 on 9/6

- We note SPX prices are very unstable <5,500, and so we’d currently return to a long term bullish stance only a move >5,520

- Into Sep 18th, major support shows at 5,340, a zone we’d look to play short term long positions

QQQ:

- Support: 450

- Resistance: 460

IWM:

- Support: 200

- Resistance: 210, 220

- As of 8/28/24:

- Price will likely remain very fluid in either direction due to negative gamma. 200 is a long term support strike, and large positive gamma strike resistance is at 230.

Founder’s Note:

Futures are flat, as traders eye tonights debate, and tomorrow’s CPI. Resistance is at 5,500 & 5,515. Support is at 5,430 & 5,400.

Price is expected to remain unstable in the 5,400 – 5,500 range, as we saw with yesterday’s large swings.

We note the re-appearance of the 0DTE Condor, wherein a trader has 9k contracts of:

- Short the 5,505/5.510 Call Spread

- Short the 5,430/5,425 Put Spread

Should the SPX be near (10-15 handles) one of these strikes into the close (after 3:30 pm ET), it could dictate market action as the PNL of that position becomes a dominant short term concern for a few traders.

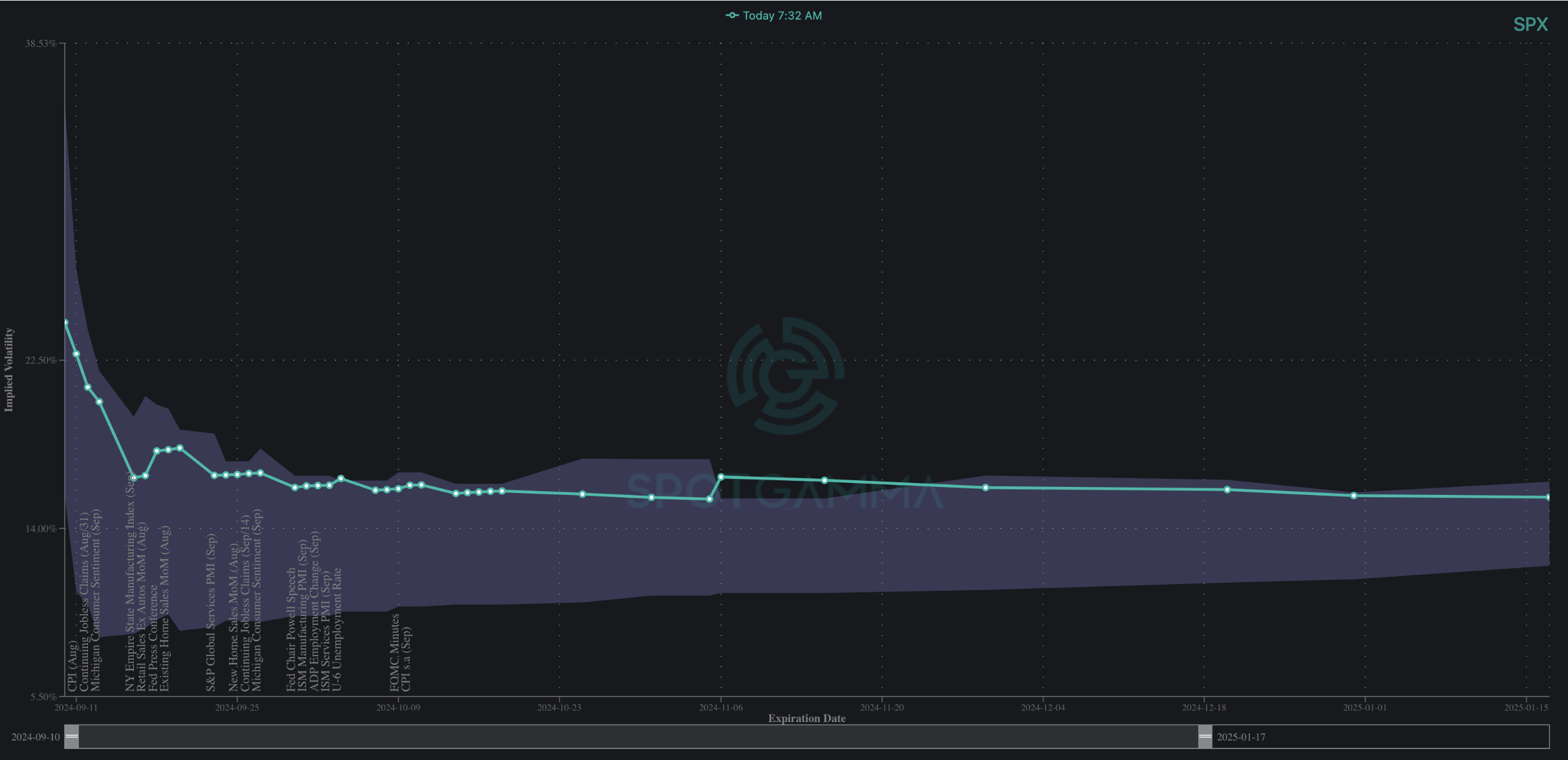

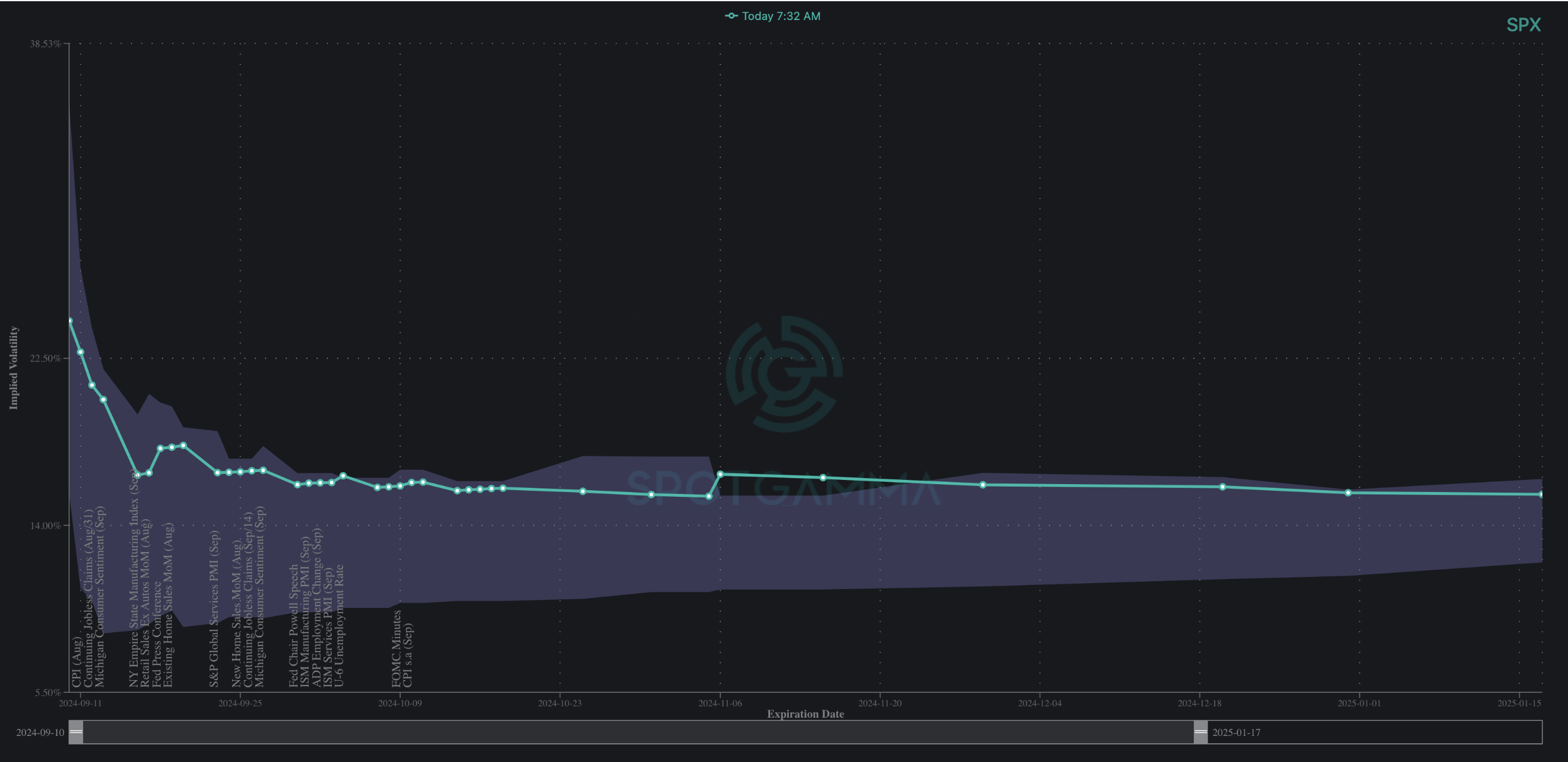

Diving into the vol space, we see that SPX IV remains amplified across the term structure. 1-month realized volatility is at 15%, which somewhat justifies this elevated IV. Further, we are likely to see some IV event-vol premium remain over the next few months due to rolling events ahead: tomorrows’s CPI focus immediately flips to FOMC mid-Sep, and then the elections on Nov 5.

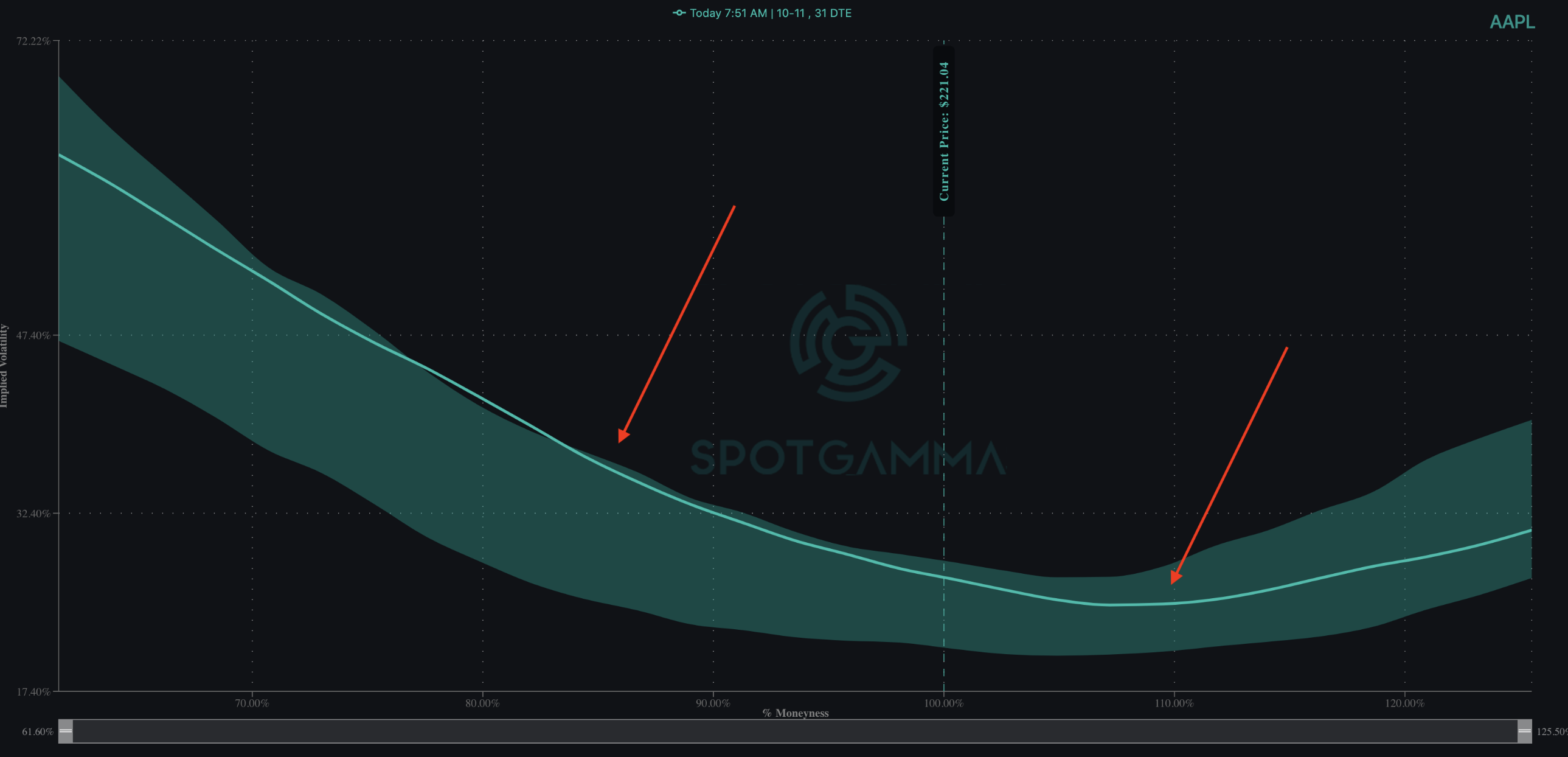

Equities here have a real lack of leadership, as we see with AAPL’s 1-month skew, below. Here, we find a statistically low call skew (right arrow) vs elevated put skew (left arrow). This signals as traders “short calls” in this elevated volatility environment, which is interesting given that AAPL had their big product announcements last night (spoiler alert: a new iPhone with better camera). Note, too, the stock is -1% premarket with pressure being added by a $16bn EU back-tax ruling.

This “short call” is something that has been at play for a while with tech leadership. The AI/chip growth story is clearly not more inspiring than macro angst. Accordingly, we’ve seen equity correlation snap higher, as a result of September stock weakness wherein all stocks declined (ex: IWM, QQQ, SPY). What is outperforming is bonds, as shown by TLT (purple), which plays into this theme of the “60/40” portfolio, and there now being a viable alternative to stocks (vs the TINA environment of 2022/23).

What’s the point? Equity upside is being driven by relief rallies as traders opportunistically sell short dated puts & swing at quick day-trade longs.

For a longer term bull move, we want to see some long call demand develop, along with deflation in volatility across the SPX surface. Given the shifting rate expectations into 9/18 FOMC & upcoming elections, we’re likely waiting on a bullish macro thesis that has to form (vs NVDA/AI will save us), that makes stocks more attractive than bonds (or volatility-linked positions). For now, the earliest opportunity for this to play out is >5,520, wherein dealers offer a bit of equity stability. From our lens until/unless >5,520 happens then equities remain vulnerable to some slippery downside.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5480.25 | $5471 | $546 | $18660 | $454 | $2097 | $208 |

| SG Gamma Index™: |

| -1.599 | -0.415 |

|

|

|

|

| SG Implied 1-Day Move: | 0.60% | 0.60% | 0.60% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5509.25 | $5500 | $550 | $18900 | $460 | $2130 | $213 |

| Absolute Gamma Strike: | $5509.25 | $5500 | $550 | $19450 | $460 | $2100 | $210 |

| Call Wall: | $5709.25 | $5700 | $570 | $19450 | $480 | $2135 | $230 |

| Put Wall: | $5409.25 | $5400 | $540 | $18500 | $440 | $2070 | $205 |

| Zero Gamma Level: | $5489.25 | $5480 | $549 | $18613 | $467 | $2156 | $218 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.830 | 0.608 | 0.876 | 0.595 | 0.684 | 0.492 |

| Gamma Notional (MM): | ‑$485.063M | ‑$1.162B | ‑$2.112M | ‑$678.86M | ‑$47.475M | ‑$1.155B |

| 25 Delta Risk Reversal: | -0.061 | 0.00 | -0.056 | 0.00 | -0.038 | -0.031 |

| Call Volume: | 509.485K | 1.223M | 9.291K | 705.253K | 15.54K | 295.416K |

| Put Volume: | 931.852K | 1.904M | 10.679K | 928.181K | 21.162K | 428.791K |

| Call Open Interest: | 7.412M | 5.66M | 65.641K | 3.567M | 343.417K | 4.759M |

| Put Open Interest: | 14.268M | 14.202M | 84.985K | 6.499M | 549.777K | 9.097M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5500, 5550, 5000, 5600] |

| SPY Levels: [550, 540, 545, 530] |

| NDX Levels: [19450, 18500, 19000, 18000] |

| QQQ Levels: [460, 450, 440, 470] |

| SPX Combos: [(5723,78.62), (5701,94.61), (5673,74.51), (5652,91.81), (5624,70.73), (5602,91.45), (5548,79.42), (5537,74.03), (5526,79.34), (5520,71.68), (5509,89.94), (5504,91.85), (5498,90.38), (5477,84.02), (5449,90.03), (5438,73.74), (5427,98.83), (5422,72.47), (5416,71.44), (5405,90.80), (5400,98.04), (5389,76.32), (5373,91.34), (5367,70.76), (5356,80.37), (5351,92.63), (5323,90.78), (5312,74.57), (5307,81.30), (5301,97.16), (5274,84.18), (5258,77.65), (5252,91.86), (5225,82.15), (5208,79.18)] |

| SPY Combos: [535.5, 545.34, 525.12, 540.42] |

| NDX Combos: [18064, 18474, 19445, 18269] |

| QQQ Combos: [445.42, 455.87, 450.42, 435.42] |

0 comentarios