Macro Theme:

Key dates ahead:

- 9/18 FOMC/VIX Exp

- 9/20 Huge Quarterly OPEX

9/18 – 9/20 is a major inflection point for equities, due to VIX Exp & FOMC (9/18), followed by Triple-Witching-OPEX.

Key SG levels for the SPX are:

- Support: 5,600, 5,550

- Resistance: 5,600, 5,643

- As of 9/16/24:

- Models are risk-on in the positive-gamma zone >5,600, with resistance at 5,660.

- Risk off <5,500

QQQ:

- Support: 474, 470

- Resistance: 480

IWM:

- Support: 213, 210

- Resistance: 220

- As of 8/28/24:

- Price will likely remain very fluid in either direction due to negative gamma. 200 is a long term support strike, and large positive gamma strike resistance is at 230.

Founder’s Note:

Futures are flat ahead of a very big week, with VIX Exp/FOMC on 9/18 and Triple-Witching OPEX on 9/20. Currently there is $200 bn in single stock delta set to expire vs $50 bn in puts. This nearly 4:1 call:put ratio is an advantage for bears in our eyes, as the rolloff of these positions statistically signals lower equity markets next week. The giant, flaming curveball here is the uncertain FOMC.

In terms of equity positions, bulls have some stability to bank on with the SPX >5,600, but things get slippery <5,500. <5,500 we see some support at 5,560. A prolonged risk-off move shows if <5,500 is broken. This positioning is true for today, and likely for the rest of this week.

The recent rally off of equity lows has been driven by two things:

1) NVDA and chase into the chip/semi sector

2) Put/Vol selling

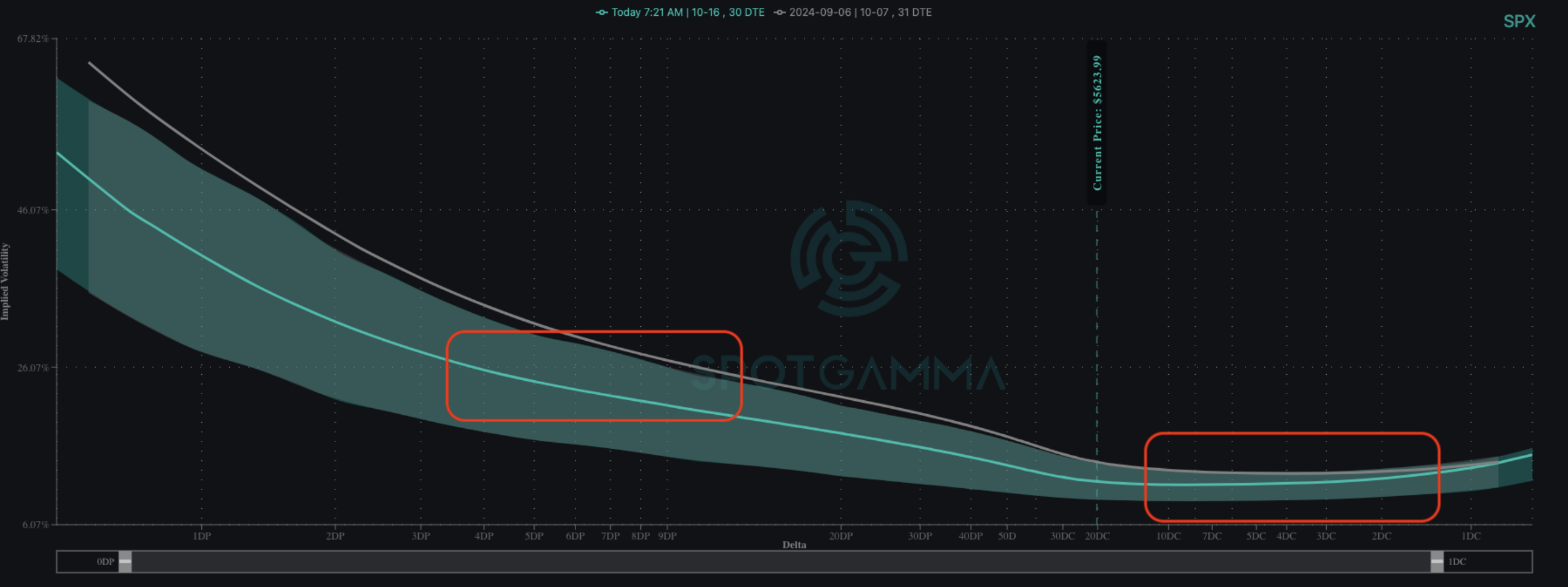

Starting with #2, you can see the collapse in 1-month SPX put skew, below (left red box) from earlier this month (9/6 exp). While the the call side (right red box) has remained fairly stable as the equity market has rallied, IV’s are being held to a premium here due to the upcoming FOMC. This signals vanna was a major driver of the recent rally, with traders having extracted max-vol premium into this major FOMC.

On the point of FOMC, it reads to us like the market has a lot of uncertainty around an upcoming rate cut of 25 bps vs 50 bps.

Last week it was 70/30 in favor of a 25 bps cut, not its 60/40 in favor of a 50 bps cut. This is uncertainty, which is likely to keep an extra bid to equity implied vol. Trying to wade through the markets reaction to any given rate outcome here seems like a a roll of the dice, at best.

Second, in regards to NVDA, we’ve covered its impact at great lengths (ex: Friday). Below is a chart of major equtiy ETF’s over the last 5 days, and you can see how much SMH (semi-ETF, blue) outperforms. Semis & related names are +25% of the SPY/QQQ, and so they are the major driver of US market performance. The chip-lighter IWM/DIA did also bounce strongly off of 9/11 lows, with IWM benefitting from the hope of larger cuts.

The other thing this recent performance shows us is that equity correlation is again falling, with dispersion increasing. This signals a partial return into the major dynamic for most of ’24, as chips & NVDA bust(ed) higher (& linked call demand) while other sectors flounder(ed).

The problem with this correlation dynamic is that we’ve seen rapid, violent moves lower when “risk off” markets snap correlation & implied volatility higher (see: April, July/August, Sep and our “Correlation Spasms“).

Accordingly, correlation unwinds see 0DTE flows disappear in favor of long vol demand (ex: VIX spikes) – which is a liquidity evaporation (ex: Aug 5th). The point here is that we do not see any type of “soft landing” for a negative reaction out of FOMC due to these related positions. This does not mean the market has to go down after FOMC, but it does signal that the left tail is the one to watch. We think the market is likely underpricing vol if equities break lower, as traders may not figure in the correlation spasm dynamics.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5691.69 | $5626 | $562 | $19514 | $475 | $2182 | $216 |

| SG Gamma Index™: |

| 1.318 | 0.013 |

|

|

|

|

| SG Implied 1-Day Move: | 0.57% | 0.57% | 0.57% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5655.69 | $5590 | $560 | $19190 | $474 | $2120 | $213 |

| Absolute Gamma Strike: | $5665.69 | $5600 | $560 | $19450 | $480 | $2200 | $220 |

| Call Wall: | $5815.69 | $5750 | $570 | $19450 | $480 | $2200 | $220 |

| Put Wall: | $5565.69 | $5500 | $540 | $18500 | $440 | $2000 | $205 |

| Zero Gamma Level: | $5616.69 | $5551 | $556 | $18887 | $471 | $2161 | $216 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.145 | 1.014 | 1.63 | 1.056 | 1.021 | 0.865 |

| Gamma Notional (MM): | $577.923M | $432.069M | $16.684M | $193.548M | $7.374M | ‑$55.276M |

| 25 Delta Risk Reversal: | -0.043 | 0.00 | -0.049 | 0.00 | 0.00 | -0.018 |

| Call Volume: | 568.934K | 1.485M | 8.894K | 614.046K | 35.752K | 816.934K |

| Put Volume: | 1.087M | 2.16M | 9.62K | 807.936K | 65.891K | 906.821K |

| Call Open Interest: | 7.728M | 5.655M | 68.478K | 3.661M | 354.03K | 5.078M |

| Put Open Interest: | 14.832M | 14.759M | 86.616K | 6.65M | 553.063K | 9.377M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5600, 5550, 5500, 5650] |

| SPY Levels: [560, 550, 570, 555] |

| NDX Levels: [19450, 20000, 19500, 19700] |

| QQQ Levels: [480, 475, 470, 465] |

| SPX Combos: [(5902,94.11), (5874,71.09), (5851,92.42), (5823,81.84), (5800,97.54), (5778,92.62), (5772,74.58), (5755,76.02), (5750,99.65), (5739,83.26), (5733,73.49), (5727,97.21), (5722,73.38), (5716,74.54), (5710,80.19), (5705,93.62), (5699,99.51), (5694,72.59), (5688,91.12), (5682,85.40), (5677,97.22), (5671,80.62), (5665,87.94), (5660,94.42), (5654,98.02), (5649,99.07), (5643,91.93), (5637,89.35), (5632,75.52), (5626,89.95), (5598,91.26), (5592,92.55), (5587,91.13), (5553,76.70), (5508,75.42), (5502,95.11), (5474,80.02), (5452,81.94), (5423,76.13), (5407,81.28), (5401,93.57), (5373,78.48), (5350,87.70)] |

| SPY Combos: [577.12, 567.01, 572.07, 562.51] |

| NDX Combos: [19456, 19710, 19905, 19495] |

| QQQ Combos: [475.86, 482.04, 477.28, 487.26] |

0 comentarios